Dear Readers,

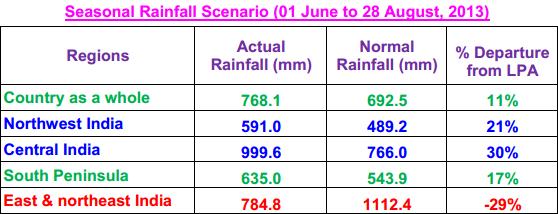

In all the gloom and doom surrounding the Indian economy, there’s been one major positive this year and that is above average rainfall in almost all the parts of India. The cumulative rainfall for the country as a whole till 28th Aug’13 was 11% above the average. The rainfall has been in excess of 15% in all the regions, except east and northeast India where it’s 29% below average.

We believe good monsoon augurs well for companies related directly/indirectly to the agriculture segment. While we already have VST Tillers Tractors under our coverage (for details click HERE – 10th report from the top), another company in the same segment that looks good is Swaraj Engines (NSE Code – SWARAJENG)

Swaraj Engines – Basic details

As the name suggests, Swaraj Engines (SEL) manufactures 20-50 horsepower (HP) engines for “Swaraj” tractors division of Mahindra and Mahindra Ltd (M&M). Besides, it also supplies hi-tech engine components to SML Isuzu Ltd for assembly of commercial vehicle engines; however this division’s contribution to the turnover is very low at about 4-5%. Since the start of commercial operations in 1989-90, SEL has supplied around 517,000 engines for fitment into “Swaraj” tractors.

Swaraj brand of tractors were originally promoted by Punjab Tractors Ltd (PTL). PTL also had 33.16% stake in Swaraj Engines along with Kirloskar Oil Engines 17.39% stake. In June 2007 PTL was acquired by Mahindra and Mahindra and thereby Mahindra ended up owning “Swaraj” brand of tractors and 33.22% stake in Swaraj Engines while Kirloskar continues to be the co-promoter with 17.39% stake.

Since the takeover of PTL by M&M, there’s been complete turnaround in the fate of “Swaraj” brand of tractors and the same has also rubbed off on Swaraj Engines (for more details on turnaround story of Swaraj Tractors, click HERE). While Swaraj tractors had slipped to 5th place with 9% market share before the acquisition by M&M in 2007, it now commands a market share of 13.1% and rank 3rd behind M&M tractors and TAFE.

Growth drivers for the tractors Industry

Coming back to Swaraj Engines, while good/bad monsoon is a key determinant of tractors sales in any particular year, we believe the long term prospects of the industry are bright on account of the following factors:

- Government’s focus on food security and high minimum support prices for farm produce

- India is still under-penetrated in terms of farm mechanization. The power productivity relationship shows that those states having higher farm power availability/ha have higher productivity and therefore the additional requirement of food grains in future is likely to be met through improving productivity by using more farm equipment.

- Increasing financing from Private Sector banks and NBFCs as the NPAs are low. Today 50-55% financing is done by NBFCs and Private Banks against almost 0% 7-8 years back.

- Schemes such as NREGA which are diverting people away from farm labor to government projects

- Shorter replacement cycle – As per the management of TAFE the average replacement cycle is now 4-5 years in comparison to 7-8 years in mid 2000

Performance Snapshot & Valuations

As can be observed from the below illustration, the company has reported good all-round performance in the last 6 years i.e. since the time Mahindra and Mahindra acquired Punjab Tractors Ltd and thereby majority stake in Swaraj Engines.

Besides good growth, the company has also done well on other metrics such as cash flow generation, return on equity, margins etc. Excluding the impact of other income, the cash flows from operations have been higher than the reported profits as there’s virtually immediate payment terms with M&M Swaraj division.

The company has recently enhanced its capacity of engines from 42,000 per annum at the end of Mar’11 to 75,000 engines per annum at the end of Mar’13. It incurred a sum of 95 crores on the above expansion and funded it entirely through internal accruals.

Despite the above expansion, Swaraj Engines still had ~110 crores surplus cash with it (after accounting for total dividend of Rs 33/- per share for FY 13 and other payables) at the end of Mar’13 which is ~20% of its current market cap of 550 crores.

Considering the surplus cash position with the company and no major fund requirement in the foreseeable future, the company recently paid a dividend of Rs 33/- per share (including Special dividend of Rs 20/- per share) to its shareholders and is thus reflective of management’s attitude towards minority shareholders.

At current price of 450-470, the stock is available at 10 times trailing twelve months earnings. To us, the valuations look reasonable considering the quality of operations, majority shareholding of M&M and considering the long term prospects of the industry.

However, it’s important to keep in mind that bad monsoon can play a spoilsport in any particular year and that should be used as an opportunity to increase allocation at lower prices.

Best Regards,

Ekansh Mittal

https://www.katalystwealth.com/

Ph.: 0120-4109766, Mob: +91-9818866676

Email: [email protected]