Dear Readers,

Suprajit Engineering (NSE Code – SUPRAJIT) is the world’s largest 2-wheeler cable maker. As per the company, they have recorded compounded annual growth of over 30% for the past 25 years and have one of the largest manufacturing capacities in world with 150 million cables per year.

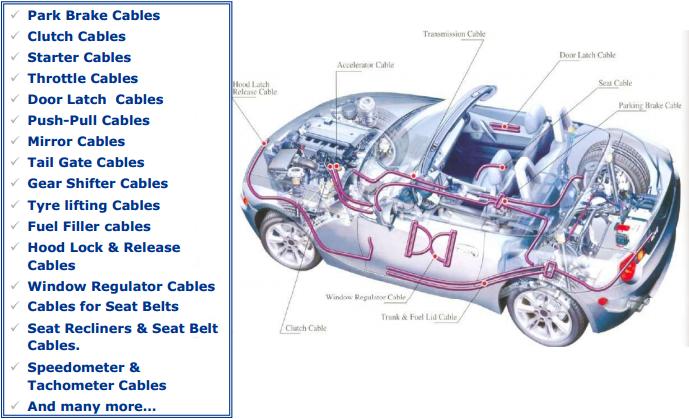

The company currently produces an exhaustive range of mechanical control cables for motorcycles, cars, commercial vehicles and various non-automotive cables. Besides, it also specializes in the production of instruments, speedometers and many other parts.

If, unlike batteries, tyres, etc you are unable to visualize cables and their presence in your 2&4-wheelers, please find below an illustration by the company indicating various kinds of cables used in a 4-wheeler.

The management is focusing on 3 distinct business divisions in the company: the first is the focused domestic cable division; the second is focused export business and third, an emerging new products/JV/inorganic space.

Domestic cable division is the mainstay of the company with ~90% revenue contribution while the two other divisions are likely to reap dividends in the coming years.

In order to tide over the current slowdown in the automotive industry, the company is focusing on new applications for cables/customers, commercial breakthroughs in new product developments, introduction of new outsourced products in the aftermarket to tap brand “Suprajit” and aggressive cable distribution on a Pan-India basis through company’s wide distribution network.

Performance Snapshot

Achieving leadership status in 2-wheeler cable industry is no mean achievement and we like companies that have leadership position or are amongst top 3 in their respective industries as it is reflective of the quality of management, their ability to outgrow competition and with leadership position the companies also get advantages of scale, brand recognition, etc.

As can be observed from the above illustration, the performance of Suprajit has been excellent over the years and the company has done well on all the parameters such as growth, margins, return on capital employed, etc and maintained a find balance of leverage and dividend payout.

What is good is that despite there being a slowdown in automotive OEM space, the company has managed to grow at reasonable rate and outperformed industry growth rate.

Huge wealth creation (more than 10x in less than 5 years)

For all the skeptics, who don’t believe in the wealth creating potential of equities, check the below illustration to find out how the stock has performed since Apr’09.

In the last 4.5 years or so, Suprajit has appreciated by more than 1,000% (1,272% to be precise) and has outperformed both BSE Auto Index and SENSEX by huge margin.

Valuations

In the past 2-3 months, small and mid cap space has witnessed lot of appreciation, especially the good companies.

On the same lines, Suprajit has appreciated from around Rs 35 to current levels of 48-50 i.e. a good 40% in just 3 months.

At around current price of 50, the market cap of the company is 600 crores and the company has net debt of around 70 crores. For FY 13, the company earned operating profit before tax of 69 crores. Thus, the valuations seem reasonable considering the operating performance of the company and the capability of the management; however at the same time it’s important to note that due to the recent appreciation in the stock, the valuations are higher than what the company has commanded historically.

Disclaimer: Please do not construe the above note as investment advice. In case you buy/sell Suprajit Engineering, please carry out your own due diligence.

Best Regards,

Ekansh Mittal

https://www.katalystwealth.com/

Ph.: 0512-6050062, Mob: +91-98188 66676

Email: [email protected]