It’s a well known fact that markets are cyclical and similarly there’s cyclicality in credit markets as well and I believe there’s some correlation in the two.

Recently read a very good description of credit cycle in “The most important thing illuminated” by Howard Marks and tried applying the same to the Indian markets.

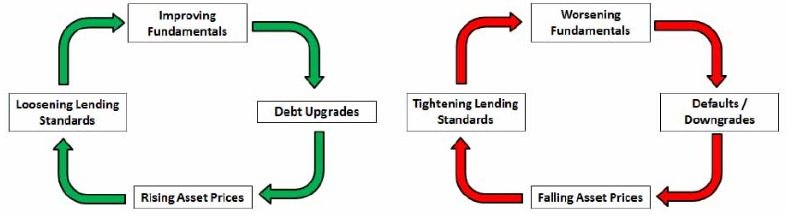

Before discussing further, let’s first look at the credit cycle itself:

Good times:

During good times the economy moves into a period of prosperity.

Providers of capital thrive, increasing their capital base.

Because bad news is scarce, the risks entailed in lending and investing seem to have shrunk.

Risk averseness disappears.

Financial institutions move to expand their businesses—that is, to provide more capital.

They compete for market share by lowering demanded returns e.g. lowering credit standards, providing more capital for a given transaction and easing covenants. At the extreme, providers of capital finance borrowers and projects that aren’t worthy of being financed.

As they say, “the worst loans are made at the best of times.”

This leads to capital destruction (case in point several infra, real estate, airlines, etc)—that is, to investment of capital in projects where the cost of capital exceeds the return on capital, and eventually to cases where there is no return of capital.

When this point is reached, the up-leg described above—the rising part of the cycle—is reversed.

Bad times:

Losses cause lenders to become discouraged and shy away.

Risk averseness rises, and along with it, interest rates, credit restrictions and covenant requirements.

Less capital is made available—and at the trough of the cycle, only to the most qualified of borrowers, if anyone.

Companies become starved for capital. Borrowers are unable to roll over their debts, leading to defaults and bankruptcies.

This process contributes to and reinforces the economic contraction. Of course, at the extreme the process is ready to be reversed again. Because the competition to make loans or investments is low, high returns can be demanded along with high creditworthiness.

Thus, one gets higher return and lower risk. Contrarians who commit capital at this point have a shot at high returns, and those tempting potential returns begin to draw in capital. In this way, a recovery begins to be fuelled.

As per my understanding and from reading of results of banks, credit rating agencies, etc. it seems we are towards the lower end of credit cycle and there could be reversal in the trend in the times ahead.

The loans made by PSU banks and even private banks (few years back) to companies in real estate, infra, capital goods, airlines and some other segments have gone bad and there’s been decent amount of capital destruction.

Now, both companies and banks seem starved of capital with lenders adopting cautious approach and seeking high creditworthiness. In fact, there are two completely different credit markets running in India. One is to businesses and other one to individuals. So while credit growth to businesses has been slow, consumer finance and housing finance has been doing well.

Thus, with lowering of interest rates and gradual passage of time, we believe there should be reversal in credit cycle and thereby recovery in performance of companies and overall economy. What is obviously not known is if there will be further deterioration before eventual recovery or if we have already bottomed out and when will the process reverse.

Just to add, I am no expert on economic matters and the above might be an oversimplification of Indian credit cycle.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-72-75050062, Mob: +91-9818866676

Email: [email protected]