Dear Readers,

We would like to bring to your notice an interesting arbitrage opportunity in the case of

UTV Software Communications Ltd (NSE Code: UTVSOF, BSE Code: 532619).

We believe one can expect annualized returns of 23-45% from investment operations in the arbitrage case of UTV Software.

Some insights into the Arbitrage opportunity in UTV Software

On 25th Jul’11, UTV Software in it’s letter to Stock Exchanges informed about the boards approval to a proposal from promoter Walt Disney Company, South East Asia to delist shares of the firm from all stock exchanges.

The Acquirer i.e. Walt Disney company expressed willingness to pay a price up to Rs 1,000 per share for acquiring all outstanding equity shares held by public shareholders in the company. The stock is currently hovering at Rs 945.

The company has received the following approvals

- Competition Commission of India (CCI) under the Competition Act, 2002.

- The company has received public shareholders approval to de-list the company’s shares from Indian bourses. 99.61% of valid votes cast by public shareholders were in favor of the resolution. (Note: This is important in the light of the fact that Astrazeneca Pharma’s de-listing offer was rejected by the public shareholders)

The de-listing offer should sail through smoothly

We believe the de-listing offer of the company should sail through smoothly. We derive our optimism from the following facts:

Before the de-listing proposal, the stock used to trade in a range of Rs 400-500, while the indicative offer price by the acquirers is substantially high at Rs 1000. So, the shareholders should most likely be happy about the offer price.

There was a thumping approval to the de-listing proposal with 48.96 lakh votes from public shareholders in favor of the same while only 1 lakh against it. (Note: The total public shareholding stands at 1.2 crore shares i.e. 29.74% with just 19 lakh shares in the hands of individual investors i.e. 4.75% stake while the remaining 1.01 crore shares in the hands of Institutional investors and Bodies corporate, who should most likely tender their shares given the pricing).

Investment Strategies

As the shareholder’s approval has been received, it should not take more than 3 months for the complete de-listing process i.e. starting from public announcement, fixing up the floor price, the Reverse Book building process (RBP), the price discovery and the exit price and the final receipt of the consideration from the tendering of shares.

We would suggest the following two strategies.

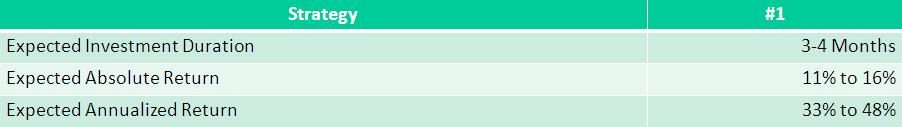

Strategy #1

- Buy in the current price range of Rs 940-950

- Tender your shares in the Reverse Book Building process at Rs 1000-1050. Your shares will be accepted at the exit price fixed by the company (in case they accept the discovered price) which could likely be Rs 1050-1100.

- In most of the Reverse Book Building processes, the shares are generally tendered at 5-10% premium to the indicative offer price by the acquirers. For example in the recent case of Atlas Copco, while the acquirers had indicated an offer price of Rs 2250/-, the exit price was finally set as Rs 2750/- per share i.e. 20% higher.

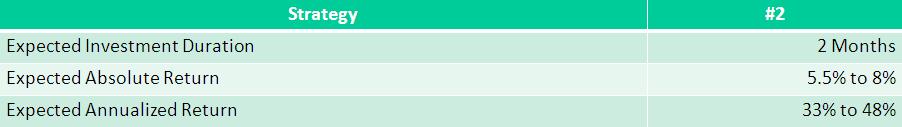

Strategy #2

- Buy in the current price range of Rs 940-950

- Book complete profit @ Rs 1000-1025 (in case the stock price attains the mentioned levels before the reverse book building process) by selling your shares in the open market.

Potential Risks

The rupee has depreciated against the dollar by more than 10% since the time the acquirers proposed a voluntary de-listing with an indicative offer price of Rs 1000. The rupee depreciation raises the cost of acquisition for the acquirers.

The shareholders may not tender the minimum required number of shares in the RBP for the de-listing process to sail through.

The acquirers may not be willing to pay the discovered price in case the same comes substantially higher than the indicative offer price.

Ekansh Mittal [[email protected]]