Dear Readers,

A few days back we released a detailed report (27 pages) on long/medium term investment recommendation for our Alpha and Alpha + members and would like to share with you details on the same especially if you like our research and our focus on high quality companies run by good management.

We believe some high quality stocks that can grow at 20-30% on annualized basis should be part of one’s long term core portfolio and as you will realize in the below details this Consumer durable stock (Name of the company – We*****y) is one of those companies.

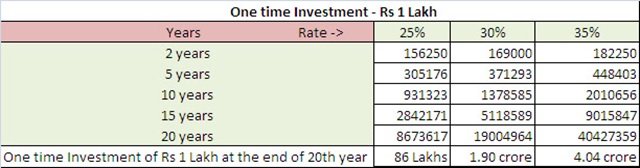

In the image below check how much your one time investment grows if the company you invest in grows at 25-35% on annualized basis. It pays to be long term investor in good companies.

Details on Consumer durable Alpha recommendation

The company that we have recommended to our members is the leading company in India in its area of operations. Yes, leading because it commands ~50% market share in the organized segment.

We like companies that have leadership position or are amongst top 3 in their respective industries as it is reflective of the quality of management, their ability to outgrow competition and with leadership position the companies also get advantages of scale, brand recognition, etc.

Consider this, while the company commands 50% market share, it accounts for ~70% of the profitability of the industry. Thus, as mentioned above, the company clearly has the advantage of scale and brand recognition enabling it to generate much higher profitability than its competitors.

Besides, the company is debt free with surplus cash to the tune of 150 crores (invested in various debt schemes) and only 80-90 crores has been employed in the core business with return in excess of 95% on the capital employed.

What makes the company so profitable? The company operates on an asset light strategy and has outsourced most of its manufacturing requirement; however it focuses extensively on design, quality and introduction of new models through continuous innovation. The working capital requirement is also very low as the sales to distributors are on cash basis.

Thus, the company is experiencing a very sweet combination of asset light business model with very good free cash flow.

What is the growth outlook for the company? As per the guidance shared by the management, they expect to maintain 25-30% annualized growth on the back of good growth in the industry, continuous shift towards branded products, steadily increasing exports and expansion of domestic dealer network from ~15,000 to more than 35,000 dealers in next few years.

Let’s also look at the key financial metrics of the company:

- 5 years Sales growth – 40% annualized

- 5 years profit growth – 40.5% annualized

- 5 years Avg. Cash flows from operations – In line with the reported net profit

- 5 years Avg. Return on Equity – Higher than 35%

- Debt equity ratio – 0

- Surplus cash – 10% of the current market cap of the company

- Dividend payout – >35% for the last 2 years

- Promoter holding – Higher than 50%

As mentioned above, we believe this Alpha stock is a very good company and should be part of one’s long term core portfolio. You can get a detailed report on the company by subscribing to either of Alpha or Alpha + services.

You can access some of our past reports (including the most recent Oct’13 Alpha stock) that have already been made public by clicking HERE

Best Regards,

Ekansh Mittal

https://www.katalystwealth.com/

Ph.: 0512-6050062, Mob: +91-9818866676

Email: [email protected]