Dear Readers,

It’s no surprise that while making outstanding stock purchases, a certain percentage of errors in purchasing are sure to occur. Also if someone tells you that all his investments went right, be rest assured that there couldn’t be a bigger lie.

Fortunately the long range profits from really good stocks should more than balance the losses from a normal percentage of errors in judgement. This is particularly true if the mistake is recognized quickly.

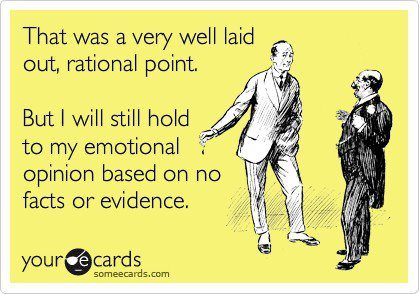

However here I would like to point out one very important aspect of behavioural finance which most of the people suffer from. There is a complicating factor that makes the handling of investment mistakes more difficult especially acknowledging errors in judgement. This is the ego in each of us which hampers rationality.

None of us likes to admit that we have been wrong. If we have made a mistake in buying a stock but can sell the stock at a small profit, we somehow lose any sense of having been wrong. On the other hand, if we sell at a small loss we are quite unhappy about the whole matter.

This reaction, while completely natural and normal, is probably one of the most dangerous in which we can indulge ourselves in the entire investment process.

More money has probably been lost by investors holding a stock they really did not want until they could “at least come out even” than from any other single reason.

If to these actual losses are added the profits that might have been made through the proper reinvestment of these funds if such reinvestment had been made when the mistake was first realized the cost of self-indulgence becomes truly tremendous.

Furthermore this dislike of taking a loss, even a small loss, is just as illogical as it is natural. If the real object of common stock investment is the making of a gain of a great many hundreds per cent over a period of years, the difference between, say, a 20 per cent loss or a 5 per cent profit becomes a comparatively insignificant matter.

Everyone makes bad investment decisions (even the likes of Buffett, Jhunjhunwala did), however it is important to acknowledge them to yourself and thus avoid riding on to your losses and this can only happen if you overcome your EGO.

Best Regards,

Ekansh Mittal

https://www.katalystwealth.com/

Ph.: +91-72-75050062, Mob: +91-9818866676

Email: [email protected]