Dear Sir,

Hope you are doing well.

We don’t often talk about Market Outlook; however, as we are going through truly interesting times, thought of looking at some data and sharing our inputs.

To begin with, frankly, I too don’t have a clear answer because there are a lot of mixed signals. Some of those are:

- NIFTY is 10-11% higher than pre Covid-19 highs of 12300-12400; however, the NIFTY MID CAP 100 is still 2-3% lower than the highs recorded in 2018 and the NIFTY SMALL CAP 100 is almost 26% lower than the highs recorded in 2018.

- The NIFTY 50 valuations (in terms of PE) are much higher than the peaks recorded in the past.

- In general, when the markets are rising and near their peak, the investor participation also tends to be extremely high; however, this time around the investors in general are cautious and the mutual fund data also suggests that the investors are taking money off the table.

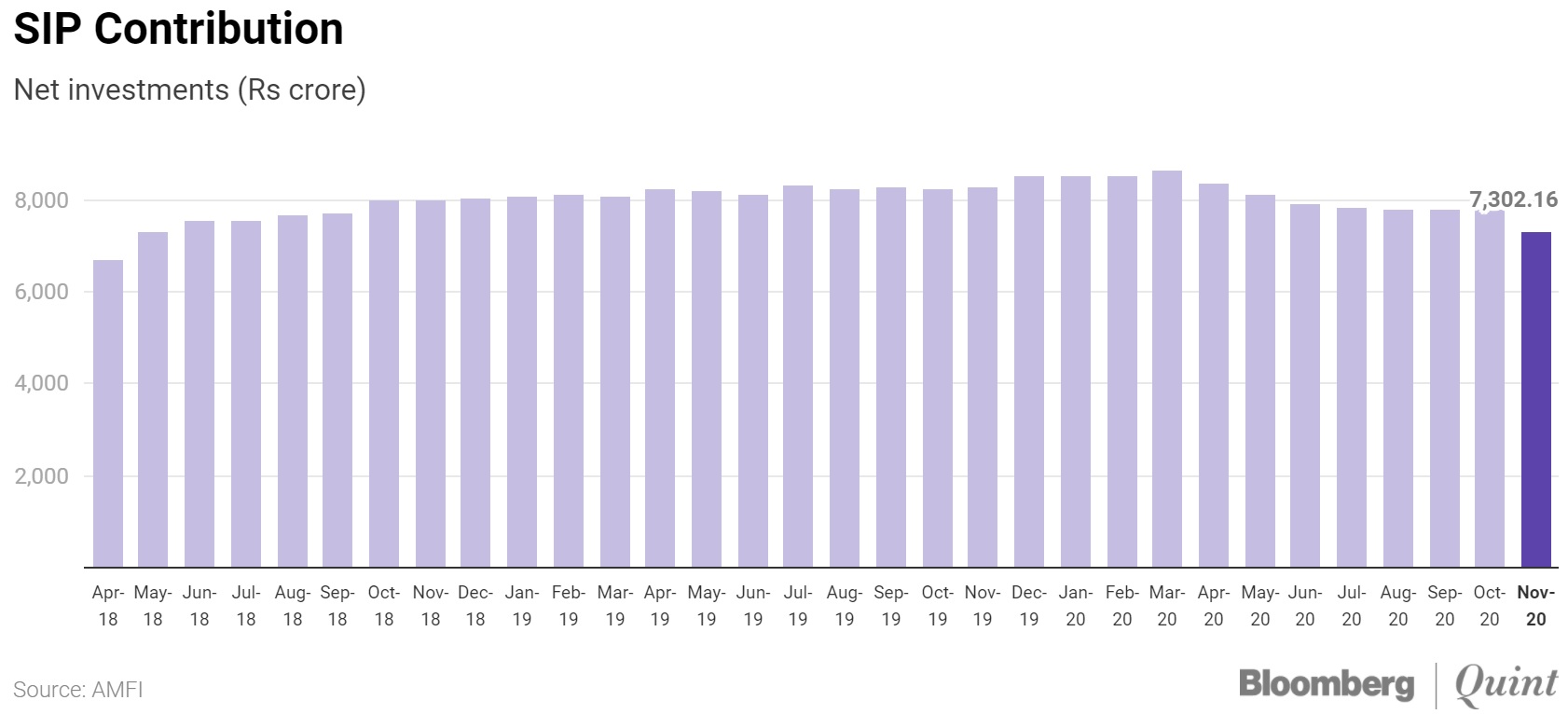

- Even the generally consistent SIPs have been steadily declining since Mar’20.

Source: Bloomberg Quint

Source: Bloomberg Quint

- While the peaks of the market cycle and the economic cycle may not necessarily coincide, they are generally in tandem; however, this time around the economic cycle is probably at its lowest and there are surely signs of strong recovery going forward.

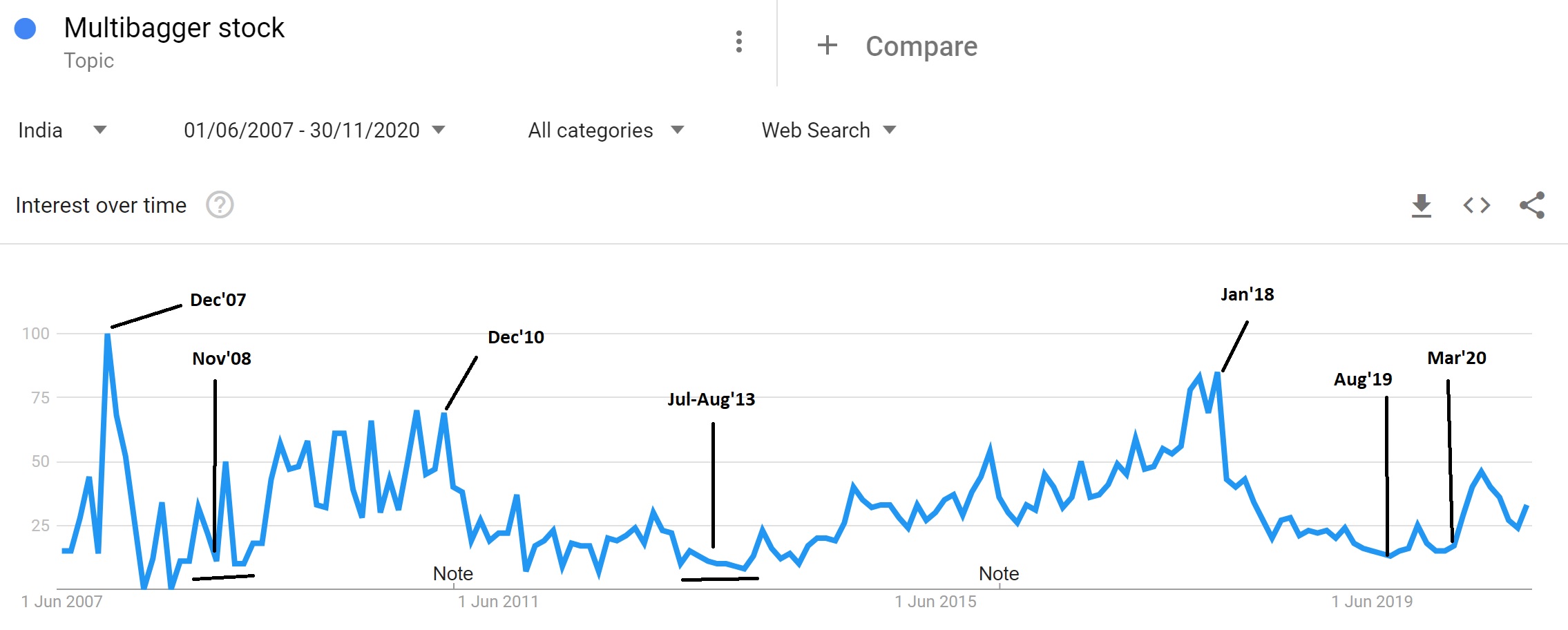

- Last, but not the least, since some time we have been using a Google chart that has proved to be extremely useful in knowing the pulse of the market and even that is not suggesting a market top

Source: Google Trends

To know more about the above graph and how it has proved to be helpful in the past, you can check the following LINK

As I said, there are a lot of mixed signals. This is probably one of those very few times when majority of the investors are actually hoping for some sort of a market correction or consolidation than the steady rise we have been witnessing.

New/Returning Member

In our list of recommendations, currently we have 12-13 stocks which are Investment worthy and in the buy-range at this point of time.

You can access latest Stock Reports, Special situations and Model Sheet in Premium Memberships HERE

Our View:

I am personally biased towards equity investments, so please take my views with a pinch of salt.

First and foremost, I don’t believe in the philosophy of timing the market to perfection i.e., being completely out or fully invested and if you still believe in it, there’s no better example than 2020 as to how futile the whole exercise can be.

I can think of several investors who were waiting on the side-lines in Mar’20 and waiting for 20,000 odd levels on SENSEX to invest fully and I am sure they would have lowered the benchmark for going all in had SENSEX reached 20,000 or lower.

Similarly, there are a set of investors who booked out completely in Jul-Aug 2020 and now desperately praying for a major market correction.

So, personally speaking, I have always found being 70-75% to 90-95% invested more comfortable than 0-100%.

Secondly, even though the NIFTY and the SENSEX are much higher than what they were in 2018, I believe the broader markets (the small and the mid-caps) are still better in terms of valuations and opportunities than what it was in 2018.

Surely, there are sectors/stocks which have witnessed a huge run up and one should tread them cautiously, but at the same time there are still a lot of beaten down decent companies trading at 0.3-0.5 times the highs recorded in 2017-18 and available at reasonable valuations.

Such companies may not necessarily be posting the best of numbers at this point of time and therefore also out of favour; however, if on deeper research one can see signs of improvement in balance sheet, margin profile, sales, etc, then there’s great value to be unlocked in such stocks.

To summarize, it’s difficult to foresee a very major market correction like we witnessed in Mar’20; however, I would be more than happy if there’s a 10-15% correction and consolidation, because such corrections and consolidations prove to be healthy in the medium to longer term.

On the front of portfolio management, I think it will be important to have some sort of profit protection strategy in place for stocks that have run up a lot and wherein the earnings growth or the recent expansion in margins may not seem sustainable.

Lastly, unlike 2018 till H1 of 2020, this time around the real wealth creating opportunities may emerge from out of favour beaten down stocks/sectors than the high-quality ones.

Wish you good health and wealth.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]