Hello Sir,

Hope you are doing well.

Today, we will briefly discuss about - How do we select stocks for Investment?

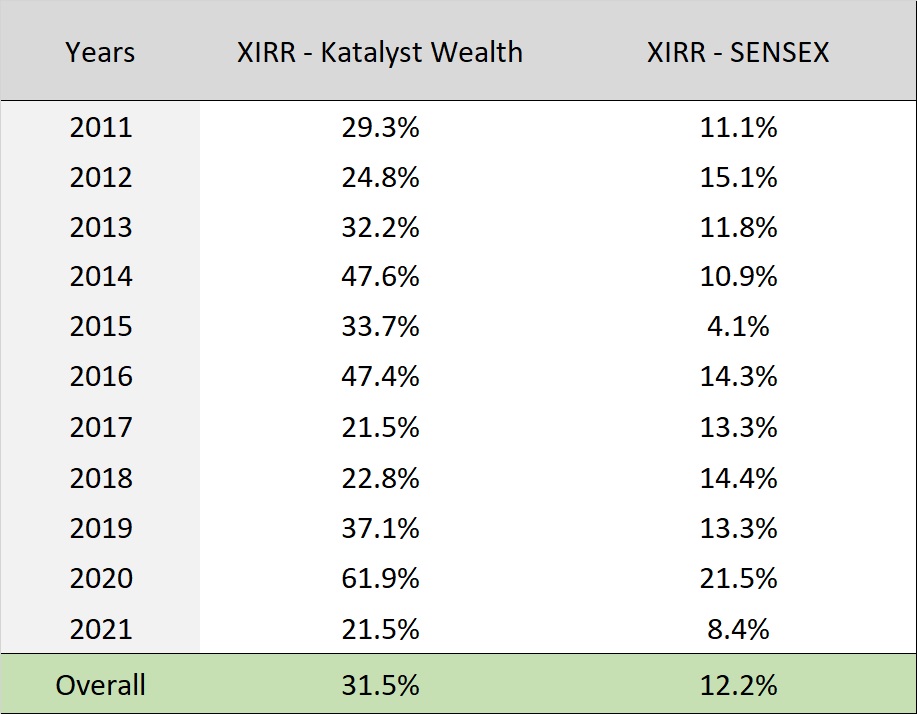

First of all, we have had our fair share of mistakes in stock selection. As we have been recommending stocks to members since 2011, there's a detailed track record and statistically 2-3 stock recommendations out of 10 have gone wrong in general.

You can access the complete list of stock recommendations by Clicking HERE

Nevertheless, the idea is to keep improving, make fewer mistakes, because the markets tend to be extremely rewarding in the long run. It's quite easy to understand, you may invest in 10 stocks, say 3 go wrong and you lose 20-30% on each; however, the upside potential on the remaining 7 can be anything from 0 to 10x-20x ad even more.

Below, we have shared a short note on the stock selection criteria. Hope you find the details useful for your own investments:

Stock selection criteria

- Growth stocks at reasonable valuations

- Here we look for companies that have been growing quite consistently across the years

- We focus largely on small and mid cap stocks because in this space it's relatively easier to get good growth opportunities at reasonable valuations

- For such stocks, important factors are - opportunity size, industry growth rate and whether the company seems capable enough to capitalize on the vast opportunity

- Unless there's a large opportunity size, the growth will soon plateau out and thus opportunity size is an important factor

- Examples -

- Acrysil - for report Click HERE

- Control Print - for report Click HERE

- Cyclical businesses -

- Largely commodity businesses like - Cement, Metals, Paper, etc

- Most investors make the mistake of investing in such businesses when the sales, profit numbers are extremely good and the valuations are cheap on the earnings based metrics

- However, most of the time, the best time to invest in such stocks/segments is when they are going through a bad phase

- To determine bad phase, look at commodity prices - have they corrected a lot from peak prices, or look at gross and operating margins - are they much lower than average margins of the company

- Similarly, the best time to sell is usually when the gross and operating margin numbers are significantly higher than average range

- Examples -

- Maithan Alloys - for report Click HERE

- National Aluminium - for report Click HERE

- Good businesses going through bad phase -

- There are companies which are overall quite good, but occasionally go through a lean phase

- A lean phase doesn't mean losses...it could simply mean a dip in the profitability of the company due to various issues

- There could be a slowdown in industry or the company may have done a major CAPEX after which it takes some years for the companies to realize the full benefit of the same

- In the interim the performance may hurt because of factors like lower capacity utilization, higher depreciation and interest cost, etc

- As an investor, it's important to determine if the problems are temporary and if the company can bounce back

- If yes, we get the advantage of both earnings and PE re-rating

- Examples -

- FIEM Industries - for report Click HERE

Recently, we released our new stock recommendation for our Premium Members. It's a leading Pharmaceutical company with global leadership in its product segment, net debt free and available at very reasonable valuations. Can read about the company HERE.

Disclaimer: I have personal investment in Acrysil, Control Print and FIEM Industries. This is not a recommendation to buy/sell the stock, but a way to showcase our research.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – Yes, in Acrysil, Control Print and FIEM Industries

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No