Dear Members,

We have released 23rd Jul’17: Manappuram Finance Ltd (NSE Code – MANAPPURAM) – Alpha/Alpha Plus stock for Jul’17. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Detailed pdf report on the company can be accessed at the following link – Manappuram Finance (NSE Code – MANAPPURAM) – Jul17 Katalyst Wealth Alpha Report

Date: 23rd Jul’17

CMP – 104.80 (BSE); 104.85 (NSE)

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation), the rating is only for indicative purpose and please take your own decision regarding the same.

Introduction

Manappuram Finance was incorporated in 1992 and is now the second largest gold loan NBFC in India. The company is promoted by Mr VP Nandakumar, MD & CEO, whose family has been involved in the gold loans business since 1949.

Till FY 14 the company was only focussed on gold loan business, however considering the challenges faced by the business during FY 12-FY14, the management decided to diversify into other lending products like Microfinance, housing finance, commercial vehicles finance, etc and from 0% in FY 14, the new products now account for more than 18% of the company’s AUM.

As far as gold loan business is concerned, post FY 14 the company has recalibrated the same in order to de-link it from fluctuations in gold prices by introducing lower tenure products and lower LTV (loan-to-value) for higher tenure products. In 2015 the company introduced online gold loan and became the first company in the industry to do so.

In the new businesses, the company has been growing at an exponential pace (low base effect); though demonetization did impact the microfinance business during the last two quarters of FY 17. However, we believe Manappuram is best placed to capitalize on the vast opportunities in microfinance business as it is not solely dependent on the same against other microfinance specific companies some of which might be finding it difficult to survive after the onslaught of de-monetization.

We believe with stable growth of more than 13-15% in gold loan business and strong growth in other verticals, company can sustain 18-20% growth momentum for the next few years. Further, its cost of borrowing has been coming down and there’s scope for expansion in net interest margins. Barring any unforeseen circumstances, we believe 18-20% growth should be sustainable.

Lastly, we find the valuations reasonable with Price to book value ratio of 2.60, trailing twelve months PE of 11.67 and dividend yield of around 2%.

Business

Manappuram’s AUM stood at Rs 13,657 crore as on 31st Mar’17. It has a pan-India presence, with 4,152 branches through which the company serves 33 lakh customers.

Since several years company has been involved in gold loan business and is now the second largest company in the gold loan business. Since FY 14 the company has diversified into other lending products and now offers a bouquet of gold loans, microfinance, housing finance, commercial vehicles finance, etc.

Gold loan business – During FY 12-15, Gold Loans market experienced a significant slowdown, with a marginal annual growth of 4% during the period. During this period, market was hit by series of adverse events which include stricter RBI regulations, funding constraints, exit of several new entrants from the market and a decline in gold prices.

During FY 12-14, Specialised Gold Loan NBFCs lost significant market share to public sector banks and the unorganised sector. The market share of Specialised Gold NBFCs came down to 31% in FY13 from a high of 36.5% in FY12 and further declined to 28.6% in FY14. The phase marked a turbulent period for Specialised Gold Loans NBFCs as they struggled to come to terms with the changed regulatory environment. The NBFCs focussed and spent their resources in consolidating their operations, diversifying their risks, improving productivity from their existing branch network and managing/retaining their employees. As a result, they could regain some of their lost ground in FY15 and FY16 with a market share of 30% and 31% respectively. Gold Loan NBFCs are now poised for a healthy growth as they enter into a stable regulatory regime.

As far as Manappuram is concerned, post the FY 12-14 period, when the gold loan business faced regulatory challenges coupled with steep decline in gold prices, Manappuram realigned its business model to de-risk it from volatility in gold prices.

The company has made an attempt at De-Linking the Gold Business from Gold Prices with introduction of shorter tenure (3-6 months) products against the previous scenario of only 12 months product and recalibration of LTV to link it to product tenure, i.e. lower LTV for higher tenure product and vice-versa.

Source: Manappuram May 2017 Investor Presentation

Thus, with the above two changes, if the customer does not pay or close the loan, there is ample margin of safety for the company to recover Principal as well as interest cost.

Besides, in Oct 2015 the company launched Online Gold loan (OGL) and became the first company to do so. At the end of Mar’17, OGL accounted for 12% of company’s total gold loan portfolio.

With the stable regulatory regime and the steps taken by the company, the gold loan business of the company is again on the path of growth with 10.9% CAGR in Gold loan AUM from FY 14-17 against a decline of 29% in AUM from FY 12-14. As for the near term prospects, the general expectation now is that growth in AUM will stabilise at around 13%-15% over the next couple of years. The overall regulatory environment is currently neutral for Specialised Gold Loan NBFCs and expected to continue to be stable.

Introduction of new lending products – Having established itself firmly in the gold loan business and to de-risk the company from over concentration on gold loan book, the company decided to diversify and add new asset classes that were complementary to its mainstay gold loan business. As a result, since FY 15 the company is now engaged in 3 new business segments – Microfinance, Housing Loans and Commercial Vehicle (CV) Loans.

The objectives behind this diversification are to:

- Reduce dependence on gold loan business

- Capitalise on its proven operational capability to process large volume, small ticket transactions with semi-urban and rural customers

- Leverage the Strong Brand Equity, Existing Retail Customer Base and wide branch network

- Utilize surplus capital to build new products relevant to the existing customer base

- Low gearing levels and high capital adequacy leaving ample scope for increase in leverage

Source: Manappuram May 2017 Investor Presentation

Source: Manappuram May 2017 Investor Presentation

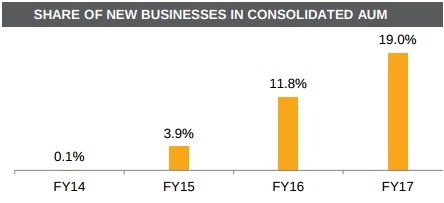

The new businesses built/acquired by the company have done well in terms of growth as their contribution has increased from 0.1% to AUM in FY 14 to 19% by the end of FY 17.

Housing finance – Manappuram Home Finance Pvt. Ltd. (MAHOFIN), a wholly own subsidiary of Manappuram Finance, was incorporated as Milestone Home Finance Company Pvt. Ltd. (Milestone). Manappuram Finance acquired Milestone in 2014 and renamed it. The company started operations in January 2015 and operates in the affordable housing finance segment in Tier-II and Tier-III cities. It had an AUM of Rs 310 crore as on March 31, 2017 (Rs 130 crore as on Mar’16 and Rs 2.2 crore as on Mar’15). Currently, there are 35 branches across 6 states: Maharashtra, Gujarat, Tamil Nadu, Kerala, Andhra Pradesh, and Karnataka.

Commercial Vehicle finance – Manappuram entered into commercial vehicle financing activity in FY 15 primarily in Southern & Western Regions and has recently launched operations in the Northern markets. The vehicle finance portfolio is about Rs 306 crore (Rs 129.8 crore as on Mar’16 and Rs 15.4 crore as on Mar’15) spreading across 43 hubs in 10 States as on Mar’17. The portfolio comprises of approximately 65% pre-owned vehicles and balance new vehicles.

Microfinance – Asirvad, an NBFC operating as a micro finance institution (NBFCMFI), is a majority-owned subsidiary of Manappuram Finance. The company was set up by its present managing director, Mr. S V Raja Vaidyanathan, in 2007. In February 2015, Manappuram Finance acquired an 85% stake in Asirvad and subsequently increased it to 90%. Asirvad had 763 branches in 252 districts across 17 states as on March 31, 2017. The Assets under Management of the company have grown exponentially from Rs 322 crore as on Mar’15 to Rs 1796 crore as on Mar’17. It was among the very few microfinance companies to have grown its AUM during Q3 and Q4 FY 17.

As per the management their aim is to grow its AUM at a CAGR of 18-20% over the next three-five years. Current, high levels of capital adequacy should help achieve its aim without the need for fresh equity infusion leading to higher return on equity in the medium term. The Company aims to continue its robust growth in the new businesses and increase the share of new businesses from current 19% to ~25% by 2020 and 50% by 2025.

Promoters/Management

Promoters, Mr VP Nandakumar and family hold 34.45% in the company.

Mr. V.P. Nandakumar holds a post graduate degree in Science, with additional qualifications in Banking & Foreign Trade. He began his career with the erstwhile Nedungadi Bank Limited but in 1986, he resigned from the Bank to take over the family business upon the demise of his father, V.C. Padmanabhan. In 1992, he promoted Manappuram Finance Ltd. and since then has led the Company initially as Chairman & Managing Director and since 2012 as Managing Director & CEO.

Mr. Nandakumar is ably supported by a professional team including Mr. Raveendrababu (Executive Director), Mr. Kapil Krishnan (Executive Vice President) and others.

In small/mid cap companies, it’s important as an investor that the promoters hold reasonably high stake and in the case of Manappuram, promoters hold 34.45% stake in the company. Generally, we like promoter holding of 50% or more; however in the case of Manappuram there’s some comfort from the fact that promoters increased their stake by around 1% in FY 17 through market purchases.

Further, what is interesting to note is that CFO of the company and one of the directors increased their stake in the company through market purchases.

Promoters, Directors and CFO making market purchases is a big positive in our view as they are ones running the company and know it better than anyone else.

On the front of rationality and transparency, we find the management good as we have found the annual reports/presentations of the company to be very detailed.

Operating Performance

Manappuram’s performance can be divided into three phases: FY 08-FY 12, FY 12-FY14 and from FY 14 onwards.

FY 08-FY 12 was the golden period for the company as it witnessed exponential growth in the business. Its AUM grew from Rs 800 crore to Rs 11,600 crore thus recording 95% CAGR in AUM. During this period the profitability also grew at a very brisk pace as the company offered better LTV (up to 85%), lower interest rates (cost of borrowing was low due to priority sector lending), prompt disbursement in comparison to banks, etc.

FY 12 is when things started turning sour for the company with RBI bringing in regulatory changes. In 2012, RBI removed gold loan lending from priority sector lending status and this resulted in increased borrowing cost for the company. Then, RBI put cap on LTV at 60% which weakened the competitive positioning of the company vis-a-vis banks and moneylenders. What further accentuated troubles for the company was the fall in gold prices. As the peak LTV was 85% and company was offering long tenure products, it faced significant under recoveries during auctions. The AUM of the company declined by ~30% from FY 12 to FY 14 and thus with higher provisioning and negative operating leverage the profitability of the company declined.

Since FY 14, the regulatory environment has been stable with RBI increasing the LTV ratio for gold loans to 75%. Further, the company’s exercise of de-linking gold loan business from gold price fluctuations has reduced the risk of under recoveries considerably. Also, with banks facing the pressure of bad loans they seem to have backed off a bit from the gold loan business and therefore companies like Manappuram have again been able to increase their market share. Thus, after a decline of 30% in AUM till FY 14, the company has witnessed 10.9% CAGR in gold loan AUM and the same is expected to improve going forward to around 13-15%.

Further, with the launch of new products the consolidated AUM has reported 18.7% CAGR with net profit reporting 49% CAGR and ROE improving to 24.7% at the end of FY 17. Higher growth in net profit is on account of positive operating leverage and expansion in net interest margins on account of declining cost of borrowing.

The company’s asset profile had also started improving with GNPA reducing to 1% at the end of FY 16 from 1.2% in FY 14 and NNPA reducing to 0.7% from 1%; however demonetization has de-railed the asset profile improvement as GNPA increased to 2.3% at the end of Q3 FY 17 from 0.9% at the end of Q2 FY 17. There’s been reduction in GNPA to 2% at the end of Q4 FY 17 and hopefully there should be continuous improvement going forward as the cash available in the country has improved.

Company’s capital adequacy ratio continues to be high at 26% against the regulatory requirement of 15% and with very low leverage of 2.7 there’s ample scope for the company to increase its asset base without going for equity dilution.

Valuations

At around current price of 104-105 the market capitalization of the company is Rs 8,823 crore.

As far as valuations are concerned, we find them reasonable with Price to book value ratio of 2.60, trailing twelve months PE of 11.67 and dividend yield of around 2%. In fact, looking at the valuations of other NBFCs, we believe there’s scope for re-rating in valuations of Manappuram; however for the same the key factors will be asset quality (especially in the wake of increasing contribution of microfinance), regulatory environment, growth in AUM and profitability, etc.

Risks and Concerns

Gold loans constitute about 81 percent of the total advances of the company. A sharp decline in price of gold within a short period may adversely affect repayments and also growth prospects of the business.

Business is highly regulated and it may be adversely affected by future regulatory changes.

Possibility of a squeeze on the use of cash in the business can adversely affect future business prospects given the general preference for cash by small ticket borrowers.

Financial performance is particularly vulnerable to interest rate risk as the bulk of funding is raised from banking channels.

AUM growth remains a key factor as gold price fluctuations could impact negatively.

Disclosure: I don’t have any investment in Manappuram Finance and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

Ekansh Mittal or its associates including its relatives/analyst do not hold beneficial ownership of more than 1% in the company covered by Analyst as of the last day of the month preceding the publication of the research report.

Ekansh Mittal or its associates/analyst has not received any compensation from the company/third party covered by Analyst ever.

Ekansh Mittal/Mittal Consulting/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market-making activity of the company covered by Analyst.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

A graph of daily closing prices of securities is available at www.bseindia.com

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.