WHY KATALYST WEALTH?

‘Because Financial Independence is Important’

Dear Reader,

I was lucky to have been born in the family where stock investing was a common discussion at the dinner table.

My father has been actively investing in stocks since 1980s and that exposed me to several cases of 10-20-100x appreciation in stocks at a very early age. It also made me realize the true potential of long term investing and wealth creation through stock markets.

Thus, out of my interest, I started investing when I was 21 and pursuing B. Tech and spent countless hours on researching businesses, understanding the principles of value investing and identifying great investment opportunities from the small and mid cap space.

After a few successful years of investing my own money, I began helping people with my research and stock picking skills and thus, Katalyst Wealth was born in 2011.

At Katalyst, we believe everybody should aim for financial independence. Not because we want you to leave your job and do nothing. Rather, so that you can have the freedom to pursue what you enjoy the most and achieve excellence in the same.

Today, I welcome you to the community and hope that we are able to fast track you on your journey towards a wealthy future.

Best Regards,

Ekansh

WANT FINANCIAL FREEDOM?

Focus on these 3 simple concepts

Time

Time is the most important factor for an Investor.

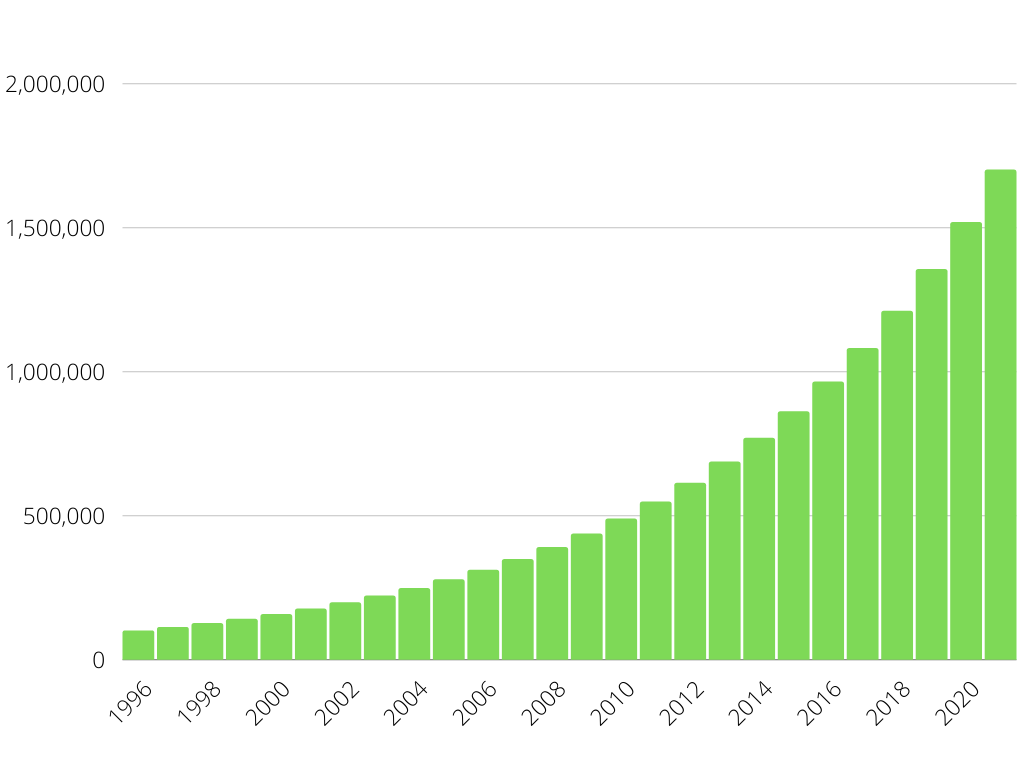

If you wish to compound your wealth then you must let it grow for as long as possible. As you can see in the chart here that the real wealth accumulation happens over a considerable period of time.

Did you know that Warren Buffett, one of the greatest investors in the world became the greatest because he started investing when he was just 11. Morgan Housel said it better than I ever could, 'Warren Buffett's skill is investing, but his secret is time.'

Begin today and get the most important component (time) of the world's strongest force (compound interest) on your side.

Amount Invested

Saving and Investing regularly are by far the most important habits that one should build as early as possible in life.

You will not meet a single wealthy person who spends more than he/she saves. Keep track of your money and invest as much as you can in appreciating assets so that your hard earned money can work harder to make you even more money.

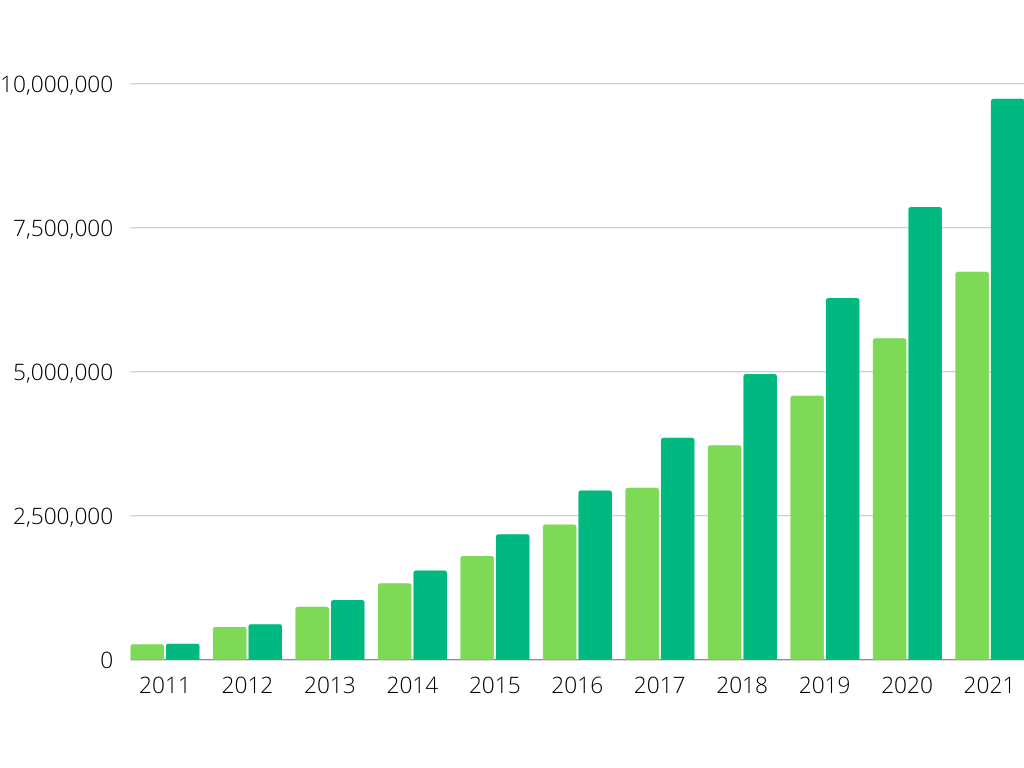

In the chart on the left, the light green bar represents a person who does a fixed monthly SIP and the dark green bar represents a person who increases the SIP amount by just 10% every year. You can see the vast difference that this 10% increase can make in your overall wealth.

Returns

While starting early and investing as much as possible are the two key things required, things get a lot better if you can grow your money at a faster pace.

Inflation is constantly eating up our savings and it is important to invest in assets that can deliver higher returns than inflation.

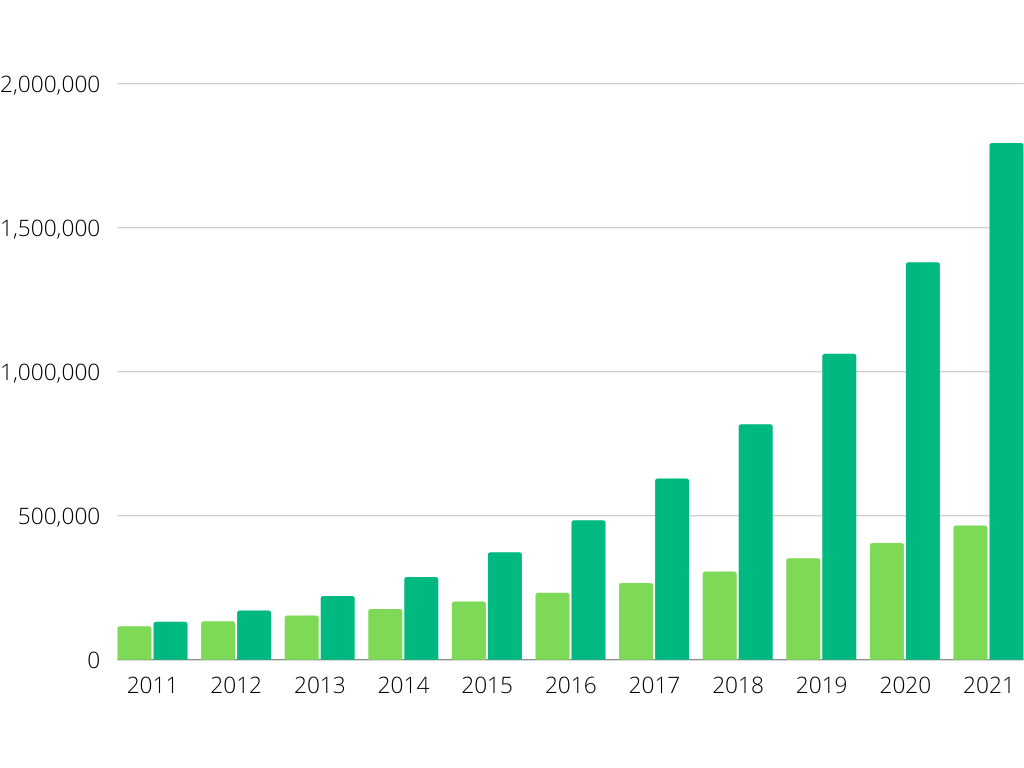

In the chart on the right, the light green bar represents a 15% return annually while the dark green bar represents a 30% return annually. You can see the vast amount of difference that these returns can cause in your overall wealth over a period of time.

HOW WE DO IT?

Our Investments are only as good as our Investment Philosophy

Honest Management

Buying a stock is no different than partnering with a company and if you are partnering with someone then you would want them to be honest and trustworthy. Clean accounting practices and good corporate governance are a must for us.

High ROCE

For companies to grow sustainably over long periods of time, it is important for them to have a strong moat and the skills to employ their earnings to generate even more profits.

Growth Potential

Stock prices sooner or later follow the company's growth path. We are always on the hunt for companies that are in growing industries with multiple tailwinds.

Operating Cash Flow

Companies do not go bankrupt because they do not have earnings, they go bankrupt because they do not have cash. Operating cash flow is one of the most important factors that we look at in a company.

Under Valued

Investing in good companies is great, what is even better is investing in them at a low valuation. When investing, we are always on the hunt for a good bargain. Markets are inefficient and hence always full of opportunities that if caught well can potentially give fantastic returns.

PE Growth Potential

We prefer investing in the small and mid caps which are not widely researched and are still out of the tracking list of the larger investing community. The idea here is to invest in companies that have the potential to get rerated significantly. A 4 times increase in PE along with a 5 times increase in earnings leads to a 20 bagger stock.