SUBSCRIPTION BENEFITS

WHAT DO YOU GET?

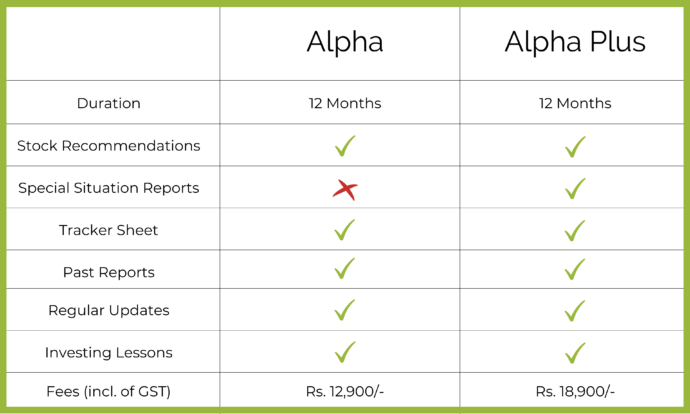

Stock Recommendations

We recommend growth stocks with potential for earnings and valuations re-rating. Idea is to identify opportunities with long runway for 20-25% CAGR potential. You get detailed reports with our recommendations so that you can learn how to select stocks and also understand the thought process behind stock selection.

Special Situation Opportunities

Markets are full of mispriced opportunities. Demergers, Delistings, Buybacks, Open Offers and many more such events if carefully studied can unlock good value in a short time span of 3-6 months. You get detailed reports and updates explaining the rationale and the procedure for participation in such opportunities.

Tracker Sheet

We maintain an excel sheet to determine performance of our research analysis on portfolio basis than on individual stock basis. It helps us to compare our performance against benchmark indices like NIFTY, SENSEX, etc. This will also help you know how we would act based on our own recommendations and updates.

Past Recommendations

You will also get access to all our past recommendations. These will also include many active recommendations that were given before you subscribed.

Stock Updates

If you invest in any business you would obviously want to know what is happening in the same. At Katalyst, we understand this well and so come up with important updates about out recommended stocks. These reports cover important developments with actionable insights including when to exit. Members are notified about updates through email and WhatsApp.

Investing Lessons

Learning and Investing should happen together. We share with you everything we know stock investing, equity research, etc. through our reports, blogs, mails.

ALPHA/ALPHA + DASHBOARD

Alpha/Alpha + members get access to Premium dashboard which consists of the following sections:

- Investment Reports

- Latest Updates

- Special Situations

- Alpha Tracker

- Alpha + Tracker

Check the video to understand how you can easily navigate the Premium Dashboard and make the most of the Stock recommendations, updates and tracker sheet.