Dear Members,

Wimplast Limited is one of the group company of ‘Cello’ group. Though many may not be aware of Wimplast as a brand name, however “Cello” is a hugely popular brand, especially in the segments of Pens, Stationery, and cookware.

Basic details

The company has been in existence since 1994 and though it initially started with Plastic Moulded furniture’s with a unit at Daman, it later on diversified into Bubble Guard Extrusion Sheets in 2005 with a unit at Baddi, Himachal Pradesh. The bubble guard extrusion sheets have multiple applications such as: Packaging, False ceiling, Door Panels, Partioning etc.

Presently the company has manufacturing units at Daman, Baddi and Chennai (started in Apr’11), while the company had already embarked upon the following expansion projects in Jun’11:

- Acquired land of 8092 sq. mt. at Haridwar, for setting up of manufacturing unit of Plastic Moulded Products. The commercial production from the unit was expected to start by late Mar’12.

- New extrusion plant at Daman for manufacturing of Flutted & S-flutted polypropylene sheets. The Commercial production from the unit was expected to start by Oct’11.

Performance over the last decade

Over the last 3-4 years the performance of Wimplast has been excellent with sales increasing from Rs 54 crores in FY 07 to Rs 160 crores for FY 11. For the same period, the net profit of the company has also grown multi-fold from 1.66 crores to Rs 18 crores.

However, if we go deeper into the past, one realizes that performance isn’t as great as the above numbers reflect. This is because for FY 03, Wimplast recorded sales of Rs 93 crores and a net profit of Rs 3 crores.

So, what brought about a drop in sales and profitability from FY 03 to FY 07? Similarly, what brought about expansion in sales and margins FY 07 onwards?

A look at the past Annual reports of the company suggests the below:

During early 2000, Wimplast sales constituted Manufacturing & Trading sales with almost equal contribution from both. This also explains why the margins were low during that period. Over the subsequent years, i.e. FY 04-07, the management took a conscious decision of closing down its unviable trading depots and curtailing cost at all levels. Consider this, the sales from the trading unit of the company declined from ~ Rs 45 crores for FY 03 to Rs 11-12 crores for FY 07.

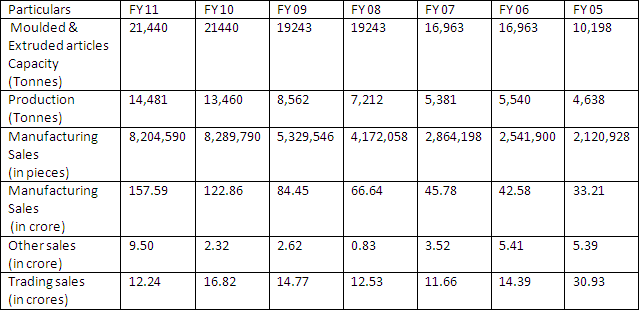

While on one hand the company was closing down its trading depots, the manufacturing capacity for the Plastic Moulded and Extruded articles was being expanded at a gradual pace. Initially the capacity utilization was low as the company had expanded rapidly and thus the cost of operation was also high. However, over the last few years the capacity utilization has improved from sub 35% levels to ~70% (refer the below image for details).

A combination of factors like increase in contribution from manufacturing sales, improvement in capacity utilization and thus operating leverage explains the expansion of sales and profit margins of the company FY 07 onwards.

Balance Sheet

In order for shareholders to realize gains from their investments, it is important for the company to grow, however what is even more important is the quality of growth. Its been observed in a lot many cases, that the managements are hell bent upon conjuring higher sales and profitability at the cost of sacrificing the quality of their balance sheet and cash flows. Over a period of time, such companies end up in debt traps with abysmal returns for the shareholders.

In the case of Wimplast, as can be observed above, the management has been able to grow the intrinsic value, while retaining debt free status. Like other companies, they too have resorted to debt for carrying out expansion (refer FY 06 when the debt increased from 0.22 crores to 13 crores and the net block increased from 12 crores to 32 crores), however their strong cash flows from operations have not only enabled them to repay all the debt, but also carry out gradual expansion.

Valuations

Wimplast is currently available at a market cap of 120 crores. As illustrated above, the company is debt free and has been recording steady 20% growth YOY for the last few years. For FY 11, the company closed the year with a net profit of Rs 18 crores, while this year they are expected to record a net profit of Rs 21-22 crores as they have already achieved 16 crore net profit for the nine months ending Dec’11. Thus, we believe that valuations are low at 5-6 times earnings, considering its debt free status and ROE in excess of 20%.

The two other positives that add to our comfort while buying at current valuations is the fact that Promoters added 2% to their stake during the last 1 year and thus reached the maximum permissible limit of 75% for the listed entities. Though, they may not be able to add further to their existing holding, it just highlights the confidence of the Promoters in the company.

Secondly, the company has been very consistent with dividend payouts, even during bad runs.

Risks

As with all the businesses, there are certain risks associated with Wimplast such as: no major entry barriers, very competitive business with numerous players in the organized segment. Also, it came to our notice that promoters of Wimplast have a link with Akruti group which was under the scanner of SEBI w.r.t. Sanjay Dangi case. We therefore suggest using adequate diversification for protection against above risks/negatives.

Best Regards

Ekansh Mittal [[email protected]]