Dear Readers,

These days there’s an abundance of Risk Arbitrage opportunities in the form of de-mergers, rights issue, open offer and de-listing. Somehow most of them go un-noticed irrespective of the fact that at times many are no brainers.

They are ignored completely on the grounds of avoiding the un-chartered territories. However as they say, it’s not the hard work but the smart work that pays off and the same goes with stock markets.

While on one hand market’s been in a state of decline since early Nov’10, Risk arbitrageurs have been making decent returns. One such case which we worked upon recently is the Rights issue of Atul Auto Ltd.

Important Note: The closing date for Rights issue has been extended to 14th Oct’11 from the earlier 29th Sep’11. So, there’s still a window of opportunity for the ones who can manage to get a hold on the Rights issue offer letter either through their brokers or acquaintances, apply and make sure the same reaches the registrar by 14th Oct’11.

Some background into the Rights Issue of Atul Auto

On 6th Jan’11, the Board of Directors of the Company approved the draft Letter of Offer for the proposed Right issue of equity shares of the Company. At that time, the stock was hovering aroung Rs 115/- per share.

Meanwhile the company had been performing exceedingly well and was witnessing very high positive cash flows from its operating activities. On going through the Annual report for 2010-11, we noticed some significant changes in important figures.

As on 31st March, 2011 the Company had Rs 3.37 crore as advances from dealers against just Rs 36 lacs in the previous year, a 10 fold jump. Also the company had Rs 1.67 crore as security deposits from dealers against Rs 0.88 crore in the previous year, pointing towards an almost 100% jump in dealer network and strong demand for company’s products.

The above was also corroborated by the fact that for FY 11 Atul Auto Ltd recorded total sales of 19398 vehicles as compared to 12329 vehicles in the previous year registering a growth of 57.33%.

Then on 31st May’11, the company recommended a dividend of Rs 4.00/- per share which was a 100% increase over their last years dividend of Rs 2.00/- per share.

All the above facts got us really interested into the company and it’s proposed Rights issue.

Investment Operation in Atul Auto Ltd

Finally on 19th Aug’11, the company informed BSE that the Board of Directors of the Company approved and adopted the Letter of Offer in respect of Proposed Rights Issue of Equity Shares of the Company aggregating to an amount of Rs. 4.38 crore.

BSE Link – https://www.bseindia.com/stockinfo/anndet.aspx?newsid=56b9ce52-ed97-4da0-a760-88ab42e7fb63¶m1=1

We got active with our stock purchases and luckily the massive correction of Aug’11, gave us ample opportunity to accumulate 400 shares (used for the ease of calculation) at an average of Rs 100.

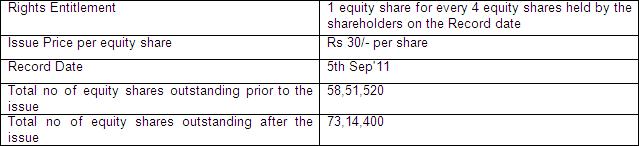

Meanwhile on 24th Aug’11, Atul Auto announced 5th Sep’11 as the Record date for the Right issue of shares. The synopsis of the Rights issue is as follows:

So, even after the Rights issue there’s not much equity dilution and with expanded equity the stock is still quoting at a PE multiple of 7.5-8 on a stock price of Rs 100.

Most importantly, the issue price announced by the company i.e. Rs 30/- per share is outstanding for both the long term investors and the arbitrageurs.

On 5th Sep’11 i.e. the record date, we managed to sell off all the 400 shares at an average of Rs 102 and thus pocket a minuscule gain of 2%.

So, what’s the big deal about 2% returns?

Well, we are yet to account for our Rights entitlement. As mentioned above, we are entitled for 1 equity share at an issue price of Rs 30/- per share for every 4 shares held by us on the record date.

So, based on our holding of 400 shares on the record date, we are entitled for 100 shares of Atul Auto at Rs 30/- per share while the current market price is Rs 99.

Now, as you all must be aware that in case of Rights issue one can apply for any number of shares over and above his entitlement (Only limit being the issue size i.e. 14.62 lakh shares in this case. We have applied for total 400 shares which blocks an amount of Rs 12000), though the allotment depends on the subscription.

So, in the worst case we will get our entitled Right of 100 shares while in the best case we may end up getting alloted 400 shares at Rs 30/- per share. The details regarding allotment will be available only after the closing date of Rights issue.

Considering the valuations and the bright prospects of the company, we may continue holding all the alloted shares or sell only above Rs 100/- per share (the CMP is Rs 99).

Worst Case Scenario

One gets allotted only 100 shares at a price of Rs 30/- and meanwhile the market’s correct sharply bringing Atul Auto down to Rs 70/- per share. Still a very good return, and we would suggest you to book complete profit.

Best Case Scenario

One gets allotted 400 shares at a price of Rs 30/- and the price does not correct beyond Rs 80/-. We would suggest complete profit booking in such a case with excellent returns.

Ekansh Mittal – [[email protected]]