Dear Readers,

Our Alpha/Alpha Plus recommendation for Jun’10 i.e. Arman Financial Services Ltd. (BSE Code 531179) announced its second quarter results for FY 2012, yesterday, post market hours.

The results recorded by the company are very good; rather we are very pleased with the sequential growth in revenue at 14%.

Considering the pace at which company is growing its operations and the extent of undervaluation, one can invest at current levels of Rs 26-28 (if you haven’t already made the allocation at the previously recommended levels of Rs 20-21.)

Highlights of Q2 FY 2012 and Half year (H1) ending FY 2012

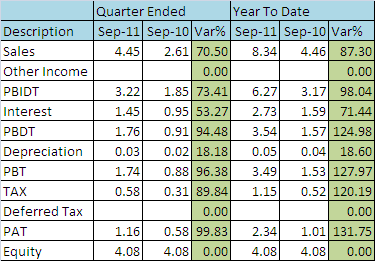

Total income Rs 4.44 crore. Higher by 70% on YOY basis. More importantly, the company has achieved a sequential growth (QOQ) of 14%.

Financial cost Rs 1.45 crore. At 32.65% of the total income, the financial cost is slightly higher than SE Investments 30.23%. However Arman has improved tremendously on the same as financial cost stood at 36.15% of the total income during the Sep’10 quarter. Financial cost is the major cost in the NBFC business and any savings on that front helps boost the profit margins.

Employee cost Rs 0.48 crore. Employee cost has gone up by 200% on YOY basis. Micro finance operations require higher work force in comparison to other NBFC operations. A jump of 200% points towards the increasing share of Micro finance in the overall operations of the company and the expanding operations of the company.

Profit after tax Rs 1.15 crore. PAT is higher by 101% on YOY basis against 70% expansion in total income.

H1 FY 2012 Profit after tax Rs 2.34 crore. For the half year ending Sep’12, company has already recorded a PAT of Rs 2.34 crore which is higher by 131% against the similar period for the last year.

Valuations and Risk arbitrage opportunity

The stock is currently quoting at a market cap of Rs 10 crore, while even by conservative estimates the company should be able to close FY 2012 with a PAT of Rs 4-4.2 crore. On the basis of the same, the stock is available relatively cheap at a P/E multiple of 2.5 and the P/B (Price to book value) of 0.75 on the basis of expected earnings for FY 2012.

Besides investment, we are hopeful of a Rights issue which may throw up a good Risk arbitrage opportunity for quick gains in the short term….. (Discussed below.)

Probable Risk arbitrage opportunity – Only if the company proceeds with the Rights issue

On 27th Oct’10, Arman Financial filed a draft letter of offer for the proposed Rights issue. As per the terms laid out, the synopsis of the Rights issue was as follows:

Rights entitlement 6 equity shares for every 5 shares held by the shareholders i.e. 6:5

Issue price per share Rs 15/- per share

Post their filing, the Micro finance business lost its sheen and got involved into regulatory issues on account of turmoil in Andhra Pradesh. Arman’s Rights issue offer too was put on hold by SEBI.

However, recently Arman received the approval from SEBI. Now they have a 1 year window within which they can proceed with the above proposed Rights issue.

Considering the pace at which company is growing and the amount of debt on books, we believe the company will soon have to infuse equity in order to maintain the growth rate and at the same time maintain Capital adequacy ratio.

Investment Operation

As mentioned above one can consider investing at Rs 26-27 as a part of investment portfolio. However, iff the company proceeds with the above proposed Rights issue, during the next 5-6 months, then we will probably have a very good arbitrage opportunity, as explained below.

We believe that downside from current levels is minimal and also expect the stock to trade higher from current levels.

As per the Rights issue, one will be entitled for 6 shares at a price of Rs 15/- per share for every 5 shares held.

Example: You purchase 1000 shares at Rs 27/- per share (inclusive of transaction cost). On ex-date, you may sell your 1000 shares. We expect the ex-date price to be somewhere around Rs 23-24 (explained in the Valuation Post Rights issue section).

You will be thus entitled for 1200 shares at Rs 15/- per share . The cost of investment will be Rs 18.00/- per share {3500 [(27-23.50)*1000] + 18000 = 21500. 21500/1200 = 17.91)

In case of Arman, out of a total of 26 lakh shares in the hands of the public shareholders, only 20 lakh shares are in the de-materialized form. The 6 lakh physical shares are mostly held by small individual shareholders and thus there’s a high probability that a large portion of the same may remain unsubscribed.

One would do well by subscribing over and above his entitlement of 1200 shares (based on the above example) after accounting both for the low liquidity of the stock and the individual portfolio allocation. Since the complete process of Rights issue gets completed in less than 2 months, one can apply for more number of shares only to sell off in the market in less than 2 months and un-block the amount. Also if one is very sure and has carried our proper due-diligence regarding the risks involved, even leverage can be employed.

For ex. in the case of Arman, one can apply for 3000 shares (against his entitlement of 1200 shares) and may sell either all the shares or book only partial profit based on one’s appraisal of the stock (this being a good case of investment cum arbitrage). In such a case the average cost of investment would further go down to Rs 16.50/- per share.

Valuation post Rights issue

Peter Bernstein once mentioned, The fundamental law of investing is the uncertainty of the future. Though, stock prices cannot be predicted and the future is always uncertain, however margin of safety plays a crucial role in all the investment decisions.

In case of Arman, we believe the current valuations lend adequate margin of safety to our investment operation.

Post rights issue, on expanded equity base, the various scenarios that may play out:

P/B ratio of 1-1.1 Very High probability case

- Book value – ~ Rs 21 crore

- No of issued shares 0.89 crore

- Stock price at a P/B of 1.1 Rs 23.50

- Stock price at a P/B of 1 Rs 25.75

P/B ratio of 1.5 – Low probability case

- Book value – ~ Rs 21 crore

- No of issued shares 0.89 crore

- Stock price at a P/B of 1.5 Rs 35.12

P/B ratio of 0.80 Moderate probability case

- Book value – ~ Rs 21 crore

- No. of issued shares 0.89 crore

- Stock price at a P/B of 0.80 Rs 18.75

Important Note:

We shall be updating and guiding the Alpha Plus members on the investment operation as and when the company makes an announcement regarding the rights issue. At present, we are happy with the 30% capital appreciation on our initial investment in the stock.

Best Regards,

Ekansh Mittal

https://www.katalystwealth.com/

B-47, 1st Floor, Dayanand Colony, Lajpat Nagar IV, New Delhi 110024 Ph.: 011-41730606, Mob: +91-9818866676

Email: [email protected]