Dear Readers,

This could be an interesting investment opportunity for you if you are a High Net worth individual (explained later on). Well, even if you are not, you may still consider buying the stock as such value buys do not remain a value buy for long. As Charlie Munger says, the markets are quite efficient, if not completely efficient as suggested by efficient market theory.

(Note: This is not a recommendation to buy or sell. We are just sharing some of our findings. Please carry out your own due diligence or seek advice from your financial advisor before carrying out an investment operation)

The stock we are referring to is Lakshmi Electrical Control Systems Ltd (LECS) – (BSE Code – 504258). Without going much deeper into the business of the company, LECS is involved in the manufacturing of LV Switchgear products, control panels and power management systems aimed primarily at Textile Machinery. As far as the management is concerned, they look over a group with a market capitalization in excess of Rs 2000 crore.

Now, what really got us interested and why do we believe that a Control Value investor with some crores in his bank can make a deal out of the same?

Here are a few important facts about the company:

- Market capitalization – Rs 63 crore

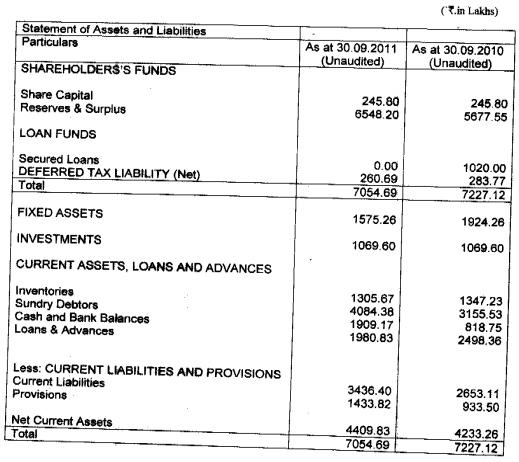

- Debt free company

- Cash and Bank balances – Rs 19 crore (as per the latest filing for Sep’11)

- Investments – Rs 10 crore in non-listed entity + ~Rs 8-10 crore in listed entity (10 crore investment in un-listed company so we won’t consider this, however the company also holds 88,800 shares of Lakshmi Machine Works which is a listed entity with the CMP of Rs 1700. At the CMP, the value of the same comes at Rs 15 crore)

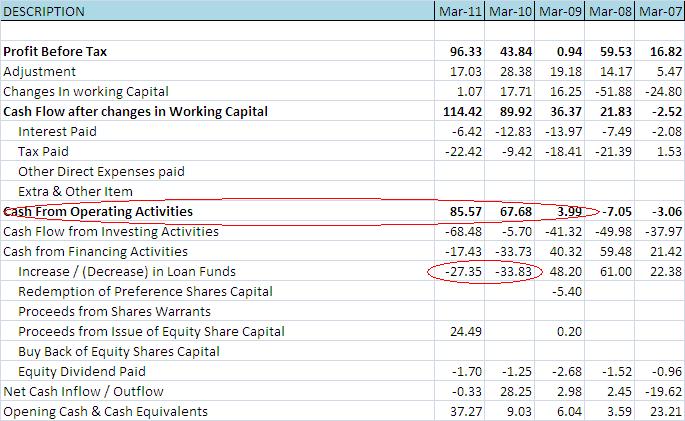

- Average operating cash flow from operations (5 years) – Rs 14 crore (this is the period during which we had one of the worst slowdowns and the company could not record growth)

If one is to consider the above stock as a business (which everyone should ideally do while investing in any stock), and say if you were to acquire 100% of the business, then you will have to shell out Rs 63 crore (the market capitalization). Now that you would have full stake in the company, you will be left with Rs 19 crore cash, Rs 10 crore in liquid investments and a steady business delivering you operating cash flows to the tune of Rs 14 crore per annum.

So, you effectively paid just Rs 34 crore for acquiring the business (Rs 63 crore – Rs 19 crore – Rs 10 crore = Rs 34 crore. assuming you sell out liquid investments) thats delivering Rs 14 crore in operating cash flows. Excellent deal. Where does one get such lucrative opportunities of ROI of 40% before tax.

You may think that who would buy out a business as described above. Well, there are certain Control Value Investors who seek such opportunities and at times even turn acquirers of the listed business. The best example that I can site for you is none other than Mr. Warren Buffett. Though he used to invest in companies only for minority stake and remain a passive investor, however in certain cases he bought so much stake in the company that he overturned the bad management and started running the company on his own or appointed a new CEO. Before discussing about Warren Buffett and the most famous Control situation of Berkshire Hathaway, lets imagine a hypothetical situation.

How you too can act as a Control Value Investor if you have some few crores in your kitty?

Well if you have don’t have the above amount i.e Rs 63 crore and just about Rs 15-20 crore, you can still consider acquiring 100% in the company. However, for the same you will have to think like Henry Kravis, who introduced a novel concept of Leveraged Buyout.

From the above calculations you are aware that the market is taking an extremely negative view of the stock and the stock deserves much higher valuations. You also notice that Promoter holding is extremely low at 23.80%.

Now, you believe that business operations of the company are worth more than Rs 50 crores (3.5 times average cash flows), not accounting for the surplus cash and the liquid investments. So you come to the conclusion that market capitalization should at least be Rs 80 crores (50 crore + 30 crore cash and cash equivalents) and thats a very conservative estimate. Since the total number of outstanding shares are 0.24 crore, the minimum value of the stock should be Rs 330, while the CMP is 258.

Taking cognizance of the above situation and considering the fact that market is in bad shape, you borrow Rs 70 crore from bank, add your 10 crores and make a tender offer to all the shareholders of LECS at Rs 330 per share. Since the stock is quoting at 258, your offer price is 28% above the stock price. Imagine that all the shareholders tender their share to you and you now hold 100% equity in the company.

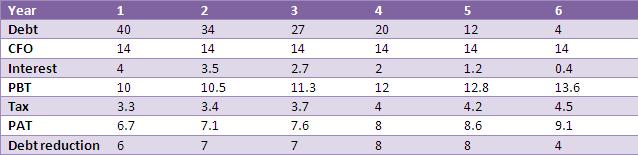

Since now you are the boss of the company, the first thing you would do is retire 30 crore of debt (using the surplus cash and liquid investments of the company) from the Rs 70 crore you had borrowed to acquire the company. This leaves you with the operating business which is generating Rs 14 crore in operating cash flows and Rs 40 crore debt on the books of the company. Using the cash flows from the business, you will be able to pay off all of debt within just 6 years as illustrated below.

So, within 6 years you will be left with debt free company delivering operating cash flows of Rs 14 crore per year against your investment of 10 crores.

Berkshire Hathaway – Warren Buffet’s control value investment case

Berkshire Hathaway was an ailing textile company available at a market cap of less than its net working capital. In 1962, Warren Buffett began buying stock in Berkshire Hathaway after noticing a pattern in the price direction of its stock whenever the company closed a mill. Eventually, Buffett acknowledged that the textile business was waning and the company’s financial situation was not going to improve. In 1964, Stanton (Part of the management group before Buffett took over) made a verbal tender offer of $11.50 per share for the company to buy back Buffett’s shares. Buffett agreed to the deal.

A few weeks later, Warren Buffett received the tender offer in writing, but the tender offer was for only $11.37. Buffett later admitted that this lower, undercutting offer made him angry. Instead of selling at the slightly lower price, Buffett decided to buy more of the stock to take control of the company and fire Stanton (which he did). This is how Warren Buffett became the majority owner of Berkshire Hathaway.

Best Regards,

Ekansh Mittal

https://www.katalystwealth.com/

B-47, 1st Floor, Dayanand Colony, Lajpat Nagar – IV, New Delhi 110024

Ph.: 011-41730606, Mob: +91-9818866676

Email: [email protected]