Dear Readers,

Well I personally don’t have any issues with Brokerage houses and relationship managers assigned by them. Nor do I believe that our relationship  manager wants us to lose money, however he’s stuck in such a bad job of generating brokerage for his firm and thereby additional commission and performance linked bonus for himself, that he cannot help but coerce you and convince you to trade and trade not just in cash but in F&O and now also in currency and commodities. And as you know, the more you trade the more you lose.

I look after my account on my own and don’t usually approach my relationship manager. Why should I, when in a month the maximum transactions are at the most 2 or at times none at all.

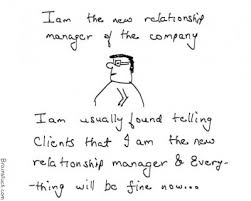

A few days back I got a call from my relationship manager. He informed me that he’s my new relationship manager (not sure if it happens in your case but I am allotted a new relationship manager every 2-3 months) and the next thing he jumped on (just like a hunter jumps upon his preys) was, “Sir, you haven’t done any transaction since many days.” Further he said, “I can see you are sitting on profits on your investments in stocks. If you wish you may sell them, unblock money, and trade in currency and gold. My clients have made huge money trading in gold and silver.“

So very clearly the intent of my RM was to make me trade more for his short term performance boost, while least concerned about the long term interests (Read profitability) and association with his clients.

These days the employees at stock broking houses are in the firing ranges of their bosses. Faced with continuing decline in revenues, many domestic brokerages are cutting salaries and firing employees to reduce operating costs and stay profitable. Hmm…probably my newly assigned RM has realized, that he too may be issued a pink slip and is thus giving his last shot.

Well the irony is that brokerages are themselves to be blamed for the mess they are in. Their actions are clearly reflective of the golden egg story. They seek out new retail investors flush with capital, make them trade on leaverage (Read 10-20x of your capital) without clearly laying out the risks, only to see retail investors lose their money and turn away from one of the best asset class i.e. equities.

They are crying foul that retail investor participation has witnessed the sharpest decline in many years and yields (commission) have reduced as investors are trading more in option contracts than the cash market. So, here again who else is responsible other than the brokerage houses.

It is understandable that brokerage houses are bracing for one of the coldest winters of their lives. How can a business sustain if its very sustainability depends on regular addition of new clients without building up on the relationship with the older ones. The same story goes with trading advisory firms, which are constantly seeking ways of burning retail investors of their hard earned money.

Watch out, you too may soon get a call from your RM or a sales manager of trading advisory firm. I hope you are now better equipped to deal with him.

Ekansh Mittal