Dear Readers,

As the above heading reads, the two companies that come to my mind, operating primarily in the farm machinery space are: VST Tillers Tractors, which is being covered below, while the other is Swaraj Engines (supplies tractor engines to Swaraj division of Mahindra and Mahindra ltd).

For the past few days, I had been tracking VST Tillers Tractors and Swaraj Engines and wanted their price to inch lower and now finally VST Tillers is quoting at investment worthy levels of Rs 425, which makes me excited all the more to share the details on the same. However, before we talk about VST Tillers, lets discuss about the govt. policy which is indirectly driving the growth for farm mechanization.

I am sure you may have heard of NREGA. While labourers/workers are very happy about the NREGA, farmers are crying their heart out.

Though Govt. has put in efforts to support farmers with its policy of Minimum support price (MSP) for the crop produce by the farmers, what is hurting their profitability is the rising wages for labourers, driven by government efforts to ensure a minimum level of paid work for rural households under its National Rural Employment Guarantee Act (NREGA). Farm labourers wages have gone up sharply. And even after paying higher wages there is no guarantee one will get workers.

Daily wages for female farm workers in the Jalgaon area have risen to Rs 100 this year from Rs 75 a year ago and for male farm workers to Rs 200 from Rs 50. Overall, farm wages in the area have more than doubled over four years.

The advent of NREGA has resulted in a significant structural break in rural wage inflation. The numbers are truly striking as between 1999 and 2005, pre NREGA, nominal wages in the rural economy grew at an average annual rate of 2.7% YOY. Post NREGA, average wage inflation almost quadrupled to 9.7% YOY between 2006 and 2009. Further, wage inflation continues to accelerate – between January 2010 and May 2011 (the last date for which this data is available) annual nominal wage growth averaged almost 20%.

Wage hikes are now linked to inflation: As if the pressure from rural wages to food prices was not enough, the desire to index NREGA wages to inflation has effectively institutionalized the wage-price in the rural economy.

This is indirectly leading to growing mechanization of agriculture: We are consequently witnessing that farmers are increasingly using tractors, tillers to substitute labor given the higher wage inflation as well as the growing scarcity of labor (given that other opportunities in rural India are opening up).

Let’s discuss VST Tillers Tractors Ltd.

V.S.T Tillers Tractors Ltd (VTTL) promoted by the V.S.T Group, a well known business house in South India, manufactures Power Tillers and Diesel Engines in technical collaboration and joint venture with Mitsubishi Heavy Industries and Mitsubishi Corporation, Japan. In 1984, the company entered into an additional technical and financial collaboration with Mitsubishi Agricultural Machinery Company Ltd, Japan for the manufacture of 18.5 HP, 4 wheel drive Tractor.

Some of the key highlights of VST Tillers Tractors are as follows:

VST is the largest manufacturer of Power Tillers in India with about 45% market share. It has delivered a strong CAGR of 27% in Power Tillers sales during last 5 years (FY06-11).

The annual market size of Power Tillers is about 53,000 and it is growing at very healthy rate of about 15-20%, mainly due to fast mechanization of agricultural industry.

During FY11, VST sold 23,449 Power Tillers for Rs. 262 crore as against 19,068 Power Tillers sold for Rs. 212 crore during FY10, registering a 23% growth in volume term and 23.6% growth in sales value.

The company also manufactures sub 20 HP tractors, where it has been witnessing strong growth and reported sales of 4,735 tractors in FY 11 against 3,758 tractors in FY 10 and 2,327 tractors in FY 09.

VST is a debt-free company Besides being debt free, the company holds liquid investments worth Rs 32 crores and cash balances worth Rs 20 crores.

As at 31st Mar’11, VST had a combined (tractors + tillers) production capacity of 30,000 (on double shift basis) while the company recorded a total sales of 28,184 (tillers + tractors) with 94% capacity utilization. In order to ensure that there’s no lack of growth on account of capacity constraints, VST has embarked on establishing a new Tractor manufacturing plant in Hosur, Tamil Nadu with an installed capacity of 30000 units p.a. (on double shift basis). The financial outlay for this project is budgeted at Rs. 66 crores and is proposed to be funded with a mixture of internal accruals and debt. The plant is expected to go on stream during the third quarter of 2012.

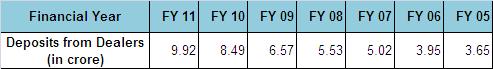

Over the years, VST Tillers Tractors Ltd., has established an extensive and efficient countrywide sales and after-sales service network and the same can be well gauged from the ever increasing deposits from dealers.

For the last 5 years, the company has recorded an annualized sales growth of 27%, while the bottom-line has recorded a much superior growth of 43% CAGR (compounded annual growth rate).

It cannot be denied that availability of adequate farm power is very crucial for timely farm operations for increasing production and productivity. The power productivity relationship shows that those states having higher farm power availability/ha have higher productivity. Hence, it can be concluded that the additional requirement of food grains in future will be met through improving productivity by using more farm equipment, hence, the demand of Tractors, Power Tillers and other machinery will continue to increase in future.

Moreover there is an inherent expansion in sub 20 HP (VST manufactures 18.5 HP tractors) tractor demand on account of shortage of farm labour/increase in wage rates due to the alternative employment opportunities available to workers under NREGA leading to increasing tractor viability even for small/medium size land owners. The inclusion of marginal/small farmers (with less than two hectare land holding) in the tractor market is potentially a strong demand driver as about 39 per cent of the agricultural land in India is owned by these farmers.

Going forward we expect the bottom-line growth to be in sync with the revenue growth as there’s not much scope for margin expansion. During high inflationary environment, such as the one we are facing now, the NPM margins should settle at 9% while on the higher end the company can clock NPM of 11%. The demand for farm machinery is strong and with the above expansion, which would double the existing capacity, the company should be able to maintain 20%+ annualized growth.

Given the market correction, the stock is currently trading at 8 times trailing twelve months earnings. The current valuations make the stock investment worthy from the standpoint of long term investment. Though agriculture sector growth has averaged around 3-4%, Indian agriculture is characterized by low farm mechanization and thus points to the significant scope that exists for raising farm machinery penetration, which bodes well for companies like VST Tillers Tractors Ltd.

Disclaimer: The above is just a stock specific view. VST Tiller is not yet a part of Alpha recommendation to our Alpha/Alpha Plus portfolio members and in future we may/may not recommend it to our members. Readers are suggested to carry out their own due diligence before making any investment decision.

Ekansh Mittal [[email protected]]