Dear Sir,

Indraprastha Medical Corporation is an interesting case as it keeps giving a trading opportunity for 15-20% absolute gain every now and then.

For the past 2 years or so the stock has been trading in the range of 31-40 and we ourselves have invested in the stock at around 32-33 and exited at 38-40 for short term gains a few times.

Recently, on 15th Sep’13 we recommended it to our Alpha + members at around 33.5 and closed it on 20th Nov’13 at Rs 39.5 (including Rs 1.6/- per share dividend) with ~18% absolute gain in 2 months.

If the stock retraces to 31-33 levels, we may again recommend it to our Alpha + members. The detailed note shared with members on 15th Sep’13 has been produced below for your reference.

15th Sep’13: Alpha plus – Trading opportunity in Indraprastha Medical (NSE Code – INDRAMEDCO)

Dear Sir,

We would like to bring to your notice a short-medium term trading opportunity on Indraprastha Medical Corporation (NSE Code – INDRAMEDCO)

The rationale behind initiating this opportunity are as below:

- Good dividend yield of 4.8% at around current price of 33.5. The ex-date for Rs 1.6/- per share dividend is 19th Sep’13, so all those who buy the stock before 19th Sep’13 will be eligible for the dividend.

- Very strong support at 31.5-32; in the last 3 years, the stock has never closed below 30.50 and has closed below 31.5 only on 2 occasions.

- In the last 2 years, the stock has given an exit opportunity in the range of 38-41 every 4-5 months

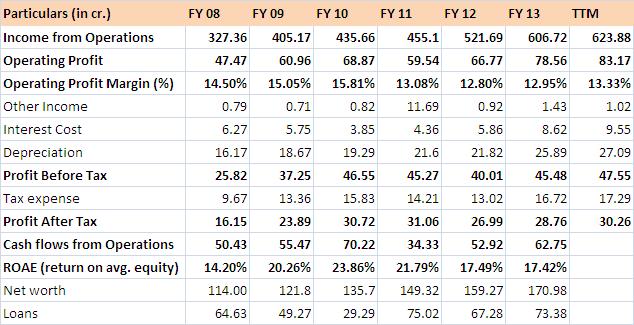

Except in case of a major market correction, we don’t see any reason for the stock to go below 31-32 in the wake of strong business fundamentals and reasonable valuations (TTM PE – 10, PB – 1.8 and dividend yield – 4.8%)

- Indraprastha Apollo hospital (main hospital of INDRAMEDCO) in Delhi has recently completed 22% expansion in its bed capacity by adding 127 beds (74 single rooms, 33 general ward beds and 20 ICU beds) taking the total bed strength of the hospital to 710 beds.

- The company has reported good numbers for the quarter ending Jun’13 with 12% growth in sales and 18% growth in profits. As the company generates very strong cash flows from operations, it is expected to re-pay bulk of the debt it had taken for addition of beds and we therefore expect further improvement in performance in the ensuing quarters.

Investment and Exit strategy

Investment strategy: Start with 5% portfolio allocation in the current price range of 31-34 (CMP: BSE – 33.50; NSE – 33.50) before 19th Sep’13.

Exit Strategy: If the stock reaches 38-41 please sell completely.

To sum up, we feel that the downside risk in this opportunity at current levels is low, while there’s good probability of securing 15-20% absolute return in a matter of 3-4 months or even less.

The concern with this opportunity is that there’s no fixed time-line. The stock may achieve 38-40 levels within a month or the holding period may even extend to 5-6 months.

In case of any queries, feel free to drop a mail or call us.

Best Regards,

Ekansh Mittal

https://www.katalystwealth.com/

Ph.: 0512-6050062, Mob: +91-9818866676

Email: [email protected]