Dear Readers,

In this post we would like to discuss a micro cap stock Fluidomat (BSE Code – 522017). While small and micro cap stocks are fraught with risks, quick decision making and keeping a strong tab on the performance of such companies can also result in substantial gains.

Also, until one is really confident of the business model and prospects of such companies, it’s important to not get emotionally attached and exit at first sight of deterioration in performance.

Note: Please do not construe the below note on Fluidomat as an investment advice and carry out your own due diligence before buying/selling the stock.

Fluidomat

Fluidomat is a debt free company with a market cap of 35 crores. The Company deals in manufacturing and sale of Fluid Couplings and related spare parts which are used in various industries including thermal Power Plants, Steel, Cement, Paper, Chemical, Fertilizers, Coal and Ore-mining and Port handling facilities, etc.

As per the annual report the management foresees good growth prospects in exports, additional business of spares and spare coupling supplies for orders executed in last few years and new applications on oil transfer/oil export pumps installed on off shore drilling rigs.

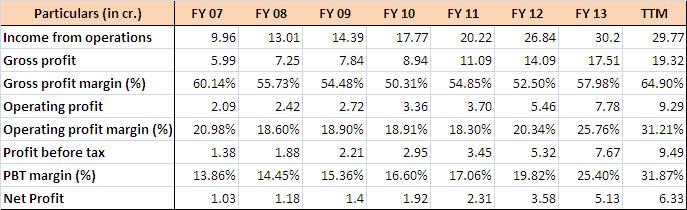

As far as financial performance of the company is concerned, the snapshot of the same is as below:

As can be observed from the above illustration, the performance of Fluidomat has been very good over the past few years and this is despite the fact that its customers are from capital goods segment and have been witnessing one of the worst slowdowns in the last 10-15 years.

The sales growth has been consistent at 15-17% CAGR; however the growth in profits has been exceptional.

The operating profit margins have expanded from 19-20% to 31% for trailing twelve months earnings. During the same period the company repaid its debt and is now sitting on surplus cash which is adding interest income. Also, it didn’t invest much in expanding capacity except for some maintenance CAPEX so depreciation cost has also been low. All these factors have resulted in 6 fold rise in net profit in last 7 years, albeit on a small base.

Promoters increasing stake – In the last 3 years Promoters have increased their stake by 5.73% to 52.42% at the end of Dec’13 and have made purchases in almost all the quarters. Promoters increasing stake in their own company is always a good sign.

Valuations – At current market cap of 35 crores, Fluidomat is trading at 5.5 times trailing twelve months earnings. The company is debt free with surplus cash of 5-6 crores and as illustrated above has good operating performance history with consistent growth, high margins, good cash flows and return ratios. In 2013, the company paid Rs 2.5/- per share dividend and so the dividend yield is also good at 3.40%.

Risks/Concerns – While the numbers look great, we are concerned about the sustainability of the margins. For the first 9 months of FY 14 the sales have slowed down, rather marginally lower in comparison to FY 13 and both gross and operating margins are at all time high. 65% gross margins and thereby 30% operating margins do not look sustainable to us and we expect some reversion in margins in the ensuing years.

In the absence of growth in sales, profits of the company can contract by 10-20% from current levels of 6.5 crores and we believe there’s decent probability of the same and should be given a serious consideration before initiating portfolio allocation in the stock.

Team Katalyst Wealth

https://www.katalystwealth.com/

Ph.: 0512-6050062, Mob: +91-98188 66676

Email: [email protected]