Dear Readers,

Having read about Warren Buffett, several investors like to practice and emulate his consolidated portfolio approach, however following an approach without following the principles of the same can be disastrous as is the case with several investors.

Recently read The Warren Buffett Way by Robert G. Hagstrom…the book is excellent and as the title suggests it encapsulates the Warren Buffett’s way of investing. The book also outlines Buffett’s tenets i.e. the tenets for following focused investing (consolidated portfolio approach) and I have briefly discussed some of the principles below:

Investing in stocks is akin to partial ownership of businesses and when you are not running the business yourself and intent to own only few businesses (stocks) in your portfolio then it becomes all the more important to thoroughly understand the business, management, financial details and the valuations because market being volatile, it will constantly test your confidence and understanding, more so in the case of consolidated portfolios and those who invest without understanding the business will either chicken out or face disastrous results.

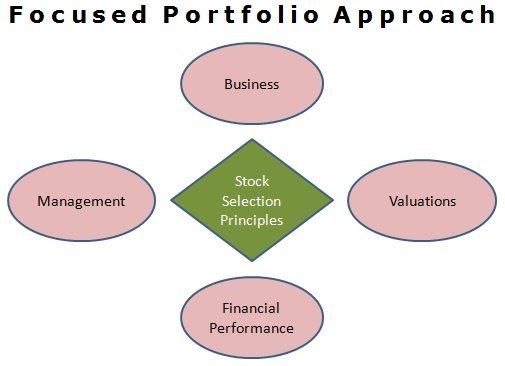

So, what are the things you should watch out for in the stocks? Well, the qualities you should check for before investing can be categorized into 4 major categories and they are: Business qualities, Management qualities, financial performance and lastly the valuations.

Business qualities – First and foremost the business should be simple and understandable. From personal experience and as Peter Lynch mentioned in his book “One up on Wall Street”, the simple and understandable businesses are normally around ourselves i.e. the products/services we may already be using as that helps in determining as to how the company is generating sales.

Also, for a simple and understandable business, the company should have a simple corporate structure with probably few products/services. For an example, how does one really analyze a company like Reliance Industries which has so many businesses, subsidiaries, cross-holdings, etc. All these add to the number of variables required for analyzing the company and also thereby impact the business.

In mathematical terms, when you have an option of solving a simple algebraic equation (with fewer variables) for probably higher marks (read returns in stock market), why would you waste your time on a complex equation with lesser marks?

Lastly, when a business is simple and understandable you will be much better positioned in terms of determining the long term prospects of the business while when in the first place you are unable to understand the business itself, how in the world are you going to have any reasonable view of the long term prospects of the company.

Similarly, during business downturns, understanding of the business and its prospects will help you in much better decision making.

Management qualities – You just don’t need a good horse but also a good jockey to win the race and that’s why management/promoters of a company cannot be ignored.

One has to determine if the management is rational, transparent and if their own skin is involved in the game or not. At the same time, one also has to be wary of managements that spoon feed the details especially the future guidance and talk about very specific numbers. Businesses are not run on excel sheets and therefore if the management is giving very precise guidance and also consistently achieving the same, management might be fudging the numbers.

Similarly, if the company is making several acquisitions or initiating new line of business (not related to existing business), management is probably over aggressive or isn’t probably sure of the prospects and therefore you too shouldn’t be.

Look for managements that are willing to talk to shareholders during periods of trouble and not only when the going is good. Similarly a lot can be judged about the management by reading last 5-10 years annual reports, their commentary about the business, etc.

Financial performance – If a business is good and the management is rational, it will most probably reflect in the financial performance of the company in terms of growth, return ratios, cash flows and a robust balance sheet.

If the numbers aren’t good and you have a positive view on both business and management, you should be more cautious about your assessment and double-check the business and management qualities.

The financial performance should be assessed not over 1-2 years but over 5-10 years. Financial prudence is a habit and should be judged only over longer periods.

Investors in general are fixated only on net profit, EPS and the income statement while completely ignoring the all important cash flows and return ratios. First of all, the sales, net profit and EPS do not tell anything about the capital allocation efficiency, leverage, etc and at the same time income statement can be manipulated very easily.

By reading annual reports and thereby cash flow statements, balance sheets, etc one not only gets to know about the capital allocation efficiency but also if the company is employing financial shenanigans and fudging the numbers.

Valuations – Finally, once you have assessed the business, management and the financial performance, it will boil down to the valuations. You will have to ask yourself the following questions:

What is the value of the business?

Can the business be purchased at a significant discount to its value?

Determining valuations is again a subjective exercise and there’s no fixed number for the same. One can’t be exactly right about the valuations; however it’s important to work out several cases ranging from conservative to slightly aggressive and check against what the market is currently offering.

For a high quality business run by a rational management, unless you grossly overpay, the returns over the longer term will be in general good.

So, next time you think of building a consolidated portfolio, don’t ignore the four major pillars of stock selection.

Best Regards,

Ekansh Mittal

https://www.katalystwealth.com/

Ph.: +91-72-75050062, Mob: +91-9818866676

Email: [email protected]