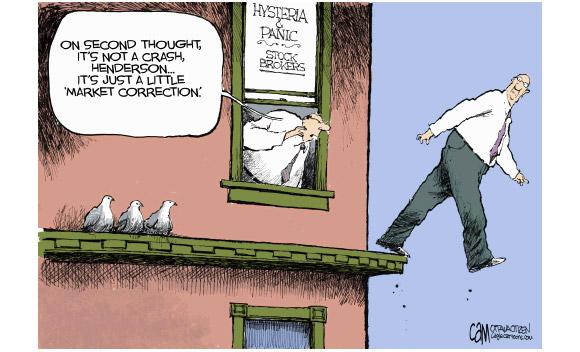

In the recent past stocks in general have corrected a lot and most of the stocks are down 20-40% from their recent highs. It’s very normal for an investor to get panicky at such times, however remembering few things does help:

Such corrections have happened in the past (will happen in future) and over a period of time markets have recovered and have gone on to record new highs.

Not every market correction is similar to 2008-09 market correction. Those are very few and far. Don’t know if this will be similar to 2008-09 but only talking in terms of probability.

Market bottoms can’t be predicted and are only known in hindsight; gradual accumulation is the way to go while knowing very well that stocks may fall just after your purchase.

The maximum downside in the stocks is 100% (of course, without leverage) while there’s virtually no limit to gains and therefore over longer term odds are heavily stacked in favour of investors who don’t deviate much from basic principles of stock selection.

Lastly, please take time to read a very interesting article on fool.com (link provided) which gives insights into how volatile the best performing stocks (stocks that have delivered more than 100x gains in 20 years) have been with average corrections of 20-30% and occasional corrections of 50% and 75% +. You can read the article here – https://www.fool.com/investing/general/2016/02/09/the-agony-of-high-returns.aspx

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-72-75050062, Mob: +91-9818866676

Email: [email protected]