Dear Members,

We have released 25th Feb’18 – Dec’17 earnings update on Poddar Pigments, GIC Housing and Pokarna. The same has been produced below. For other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Date: 25th Feb’18

25th Feb’18 – Dec’17 Earnings update

Poddar Pigments (NSE – PODDARMENT) – Jan’17 Alpha stock

CMP – 282.00 (BSE); 282.05 (NSE)

Rating – Neutral; this is not an investment advice (refer rating interpretation)

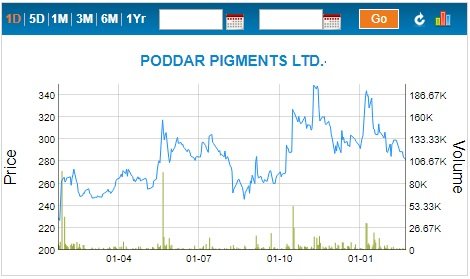

Poddar Pigments Jan’17-Feb’18 price chart Source: BSE India

Sales of the company for the Dec’17 quarter are up by 10.77% on YOY basis to Rs 84.84 crore. There’s some base effect because last year there was a dip in sales in Dec’16 quarter on account of demonetization.

Company’s main competitor Plastiblends has reported only 7% growth in sales.

During the quarter the company has reported gross margins of 21.22% against 24.28% in Dec’16 and 25.99% in Sep’17 quarters. Till now the company had been reporting improving trend in gross margins; however there’s a major contraction in margins in this quarter. It could be on account of both increase in crude prices and adverse product mix.

It’s important to note here that even Plastiblends has reported contraction in gross margins on YOY basis from 28.16% to 22.79%

Company’s operating expenses are up by only 4.6%; however on account of 306 bps contraction in margins, the EBITDA of the company is down by 19% on YOY basis to Rs 5.02 crore with EBITDA margins of 5.91%. The EBITDA margins of 5.92% are the lowest reported by the company in the last several quarters.

The company is a net interest earner and on the back of higher other income the PBT of the company for Dec’17 quarter is up by 12.46% on YOY basis to Rs 7.31 crore.

The stock is currently quoting around 15 times trailing twelve months earnings. The company holds around Rs 30-40 crore of surplus cash.

Poddar Pigments is a fundamentally very sound company and has reported decent performance over many years. As we keep repeating and looking at the past investments of the company, the capital requirement for expanding capacity doesn’t seem to be very high and considering the end users (polymer and textile industry) potentially the demand in the long run should also be good; however since some time now the growth in sales has been lacking with company running the plants at almost optimum capacity utilization and therefore we have a neutral rating on the stock.

GIC Housing Finance (NSE – GICHSGFIN) – Sep’16 Alpha stock

CMP – 399.80 (BSE); 400.90 (NSE)

Rating – Positive – 3% weightage; this is not an investment advice (refer rating interpretation)

GIC Housing Sep’16-Feb’18 Years price chart Source: BSE India

GIC has reported 11.19% growth in total income from operations on YOY basis. The company’s net interest income has increased by 20.77% on YOY basis. Growth in NII has been strong on the back of both higher AUM (19.50% growth over Dec’16) and increase in spread; though on QOQ basis the spreads have contracted.

As per the financial update shared by the company, the company’s loan portfolio is up by 19.50% with 12.26% increase in LAP portfolio, 15.78% increase in salaried portfolio and 29.15% increase in self-employed portfolio. The growth rates are slightly better in comparison to what company reported in Sep’17 quarter.

On the low base of Dec’16 quarter, the sanctions and disbursements have grown by 53% and 44% respectively.

Including provisions, the operating expenses have increased by 21.09%. During the quarter the company made provisions of 14.62 crore against 12.52 crore in year ago quarter.

On the front of asset quality, it continues to see some slippages with gross NPA increasing to 3.27% from 3.17% at the end of Dec’16. Even on QOQ basis the gross NPAs have increased from 3.03% to 3.27%. As far as net NPAs are concerned, it has come down to 1% from 1.12% at the end of Dec’16.

With decent growth in NII and control on operating expenses, the PBT of the company for the Dec’17 quarter is up by 22.26% on YOY basis.

GIC has been reporting decent numbers across all the parameters, except for asset quality. While in the last few quarters all the HFCs have witnessed some deterioration in asset quality, GICs 3.27% GNPA is amongst the highest in the listed space. We believe, with the impact of de-monetization dwindling and cash economy getting back in order, NPAs may go down in subsequent quarters and if the company is able to contain the NPAs there could be re-rating in the stock.

The stock is currently trading at 12.60 times trailing twelve months earnings and ~2.30 times book value. With Central Govt.’s strong focus on affordable housing and housing for all; we believe company might be able to sustain the current growth rate; however it will be important to watch out for the asset quality of the company.

Pokarna (NSE – POKARNA) – Jun’15 Alpha stock

CMP – 206.85 (BSE); 206.45 (NSE)

Rating – Positive – 3% weightage; this is not an investment advice (refer rating interpretation)

Pokarna Jun’15-Feb’18 price chart Source: BSE India

After few weak quarters, Pokarna has reported somewhat improved performance in Dec’17 quarter.

Sales of the company for the Dec’17 quarter are almost flat on YOY basis at Rs 87.90 crore. While granite has reported 20.96% growth in sales, quartz sales are down by 15.90% on YOY basis.

As far as granite segment is concerned, the improved performance is on account of higher productivity and efficiency in quarry operations. Going forward, management is expecting similar performance from granite segment. On the Quartz front, while the sales are down on both YOY and QOQ basis, the profitability has improved on QOQ basis.

As per the management, in the quartz segment they are focusing on higher end products i.e. products with higher margins and therefore while throughput (sales) might be lower the bottom line is likely to be maintained (unless crude prices or currency fluctuations are significantly adverse). Further, with stabilization in production of new colors, the sales might also increase.

The company is also working on promoting its own QUANTRA brand.

There have been some key developments during the quarter with company completing the purchase of 34 acre of land for new quartz facility. Going forward, it will take another 18 + months for commercialization of project. We checked with the management that besides the new line that they are coming up with, will there be scope for further expansion at the new piece of land and they did confirm that another line will be possible. Thus, the cost of 3rd line be could be substantially lower than the proposed 325 crore expansion for the 2nd line. Also, it might take much lesser time for the company to go ahead with 3rd line because both land and other infrastructure will be available.

In another development, the company has already received the confirmation from 2 banks for conversion of existing INR loans to foreign currency loans. The 3rd bank may also confirm soon.

Coming back to operating performance, on the front of raw materials the company has recorded gross margins of 78.81% against 80.30% in Dec’16 quarter. The contraction in margins is on granite front while there’s 36 bps improvement in gross margins in Quartz segment; this despite 15-20% increase in crude prices.

The company has exercised strong control on operating expenses with only 1% increase; however on account of flattish sales and some contraction in gross margins, the EBITDA is down by 7.86% on YOY basis to Rs 29.94 crore with EBITDA margins of 34.06%. The management is hopeful of maintaining margins in the range of 30-35%.

Company’s interest expense is down; however on account of lower other income the PBT of the company is down by 20% on YOY basis to Rs 18.61 crore.

Overall, the granite business of the company seems to be stable, while Quartz business will start growing only post expansion. Ignoring the delayed expansion, the company on an annualized basis can report PAT of 55-60 crore and the stock is currently quoting around 640 crore market cap. While the earnings growth will remain subdued over the next 2-3 years or so, we believe the valuations are reasonable around 11.60 times normalized TTM earnings. Further, as per the management the demand outlook for quartz continues to be very good with US market growing by 20% + on annualized basis.

Disclosure: Out of the stocks discussed above, I have personal investment in Pokarna.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: In Pokarna

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

Ekansh Mittal or its associates including its relatives/analyst do not hold beneficial ownership of more than 1% in the company covered by Analyst as of the last day of the month preceding the publication of the research report.

Ekansh Mittal or its associates/analyst has not received any compensation from the company/third party covered by Analyst ever.

Ekansh Mittal/Mittal Consulting/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market-making activity of the company covered by Analyst.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.