Dear Members,

We have released 4th Mar’18 – Dec’17 earnings update on Control Print and VST Tillers Tractors. The same has been produced below. For other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Date: 4th Mar’18

4th Mar’18 – Dec’17 Earnings update

Control Print (NSE – CONTROLPR) – May’14 Alpha stock

CMP – 450.25 (BSE); 450.90 (NSE)

Rating – Neutral; this is not an investment advice (refer rating interpretation)

Control Print 3 Years price chart Source: BSE India

For the Dec’17 quarter the company has reported 23.97% growth in sales on YOY basis to Rs 42.09 crore. The sales growth is good and in line with what the company has been reporting since last few quarters. Further, Control print should benefit from improving sales trend in end user industries like Steel, Cement, FMCG, Automotive, etc.

On the front of raw materials, the company has reported gross margins of 73.05% against 61.64% in Dec’16 quarter. Company’s gross margins tend to vary depending on product mix, with printers commanding much lower margins than consumables.

Company’s operating expenses have increased by 32.97%; however on account of decent growth in sales and more than 1000 bps expansion in gross margins, the EBITDA of the company is up by 74.71% on YOY basis to Rs 12.23 crore with EBITDA margins of 29.06%

The company has restated its results as per IND-AS and on account of the same its depreciation cost has increased from the earlier reported figures of 0.8-0.9 crore for a quarter. With clubbing of printers on lease from inventory to fixed assets and restatement of fixed assets at fair value, the depreciation cost has increased to around 2 crore.

Similarly, Dec’16 quarter’s depreciation cost has been restated with some adjustments and as a result it is up by around 3 crore; however assuming it to be around 1.8 crore, the company has reported 89.66% growth in PBT on YOY basis to Rs 9.54 crore.

Overall, company has been reporting decent set of numbers with more than 25% growth in sales and maintenance of EBITDA margins at around 25-27%; however going forward it will be important to see the impact of base effect because the numbers improved considerably in CY 2017. As per the management they are hopeful of sustaining double digit growth rate in the range of 15-20% on the back of growth in overall market and expected gain in market share. It is believed that the industrial coding and printing solutions market has been growing at around 1.5-2 times GDP growth rate.

The stock is currently trading around 23-24 times earnings.

VST Tillers Tractors (NSE – VSTTILLERS) – Dec’11 Alpha stock

CMP – 2634.55 (BSE); 2627.45 (NSE)

Rating – Neutral; this is not an investment advice (refer rating interpretation)

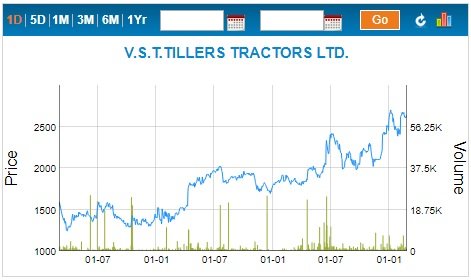

VST Tillers 3 Years price chart Source: BSE India

VST Tillers 3 Years price chart Source: BSE India

For the quarter ending Dec’17 VST Tillers has reported 16.83% increase in sales from operations on YOY basis to Rs 165.68 crore. During the quarter the company recorded sales of 7011 units (up 73.45% YOY) of power tillers and 2109 units (down 12.48% YOY) of tractors.

As per the management the tractors sales in Q3 got impacted on account of correction in stock levels at dealers and delay in subsidy allocation from Andhra Pradesh Govt. Despite the weakness in sales in Q3, management is hopeful of closing FY 18 with sales of ~11,000 tractors (9,636 in FY 17). As far as tillers are concerned, after a very weak 1st half, the sales have picked up tremendously in 2nd half and the management is hopeful of closing the year with sales of 28,000 tillers (25,515 in FY 17).

For FY 19, the management is targeting sales of 14,000 tractors and around 31,000 tillers. Higher growth in sales of tractors is expected on the back of new product launches and variants of existing products.

On the front of raw materials the company has recorded gross margins of 38.77% against 34.71% in Dec’16 quarter. During the quarter the company recorded onetime gain of Rs 3.4 crore on account of input tax credit and that’s why the gross margins are a bit higher. Further, higher contribution from tillers has also helped the cause of margin expansion.

The operating expenses of the company have increased by 15.97% i.e. more or less in line with sales growth. As the company has been launching new models and variants of existing models, the management expects the marketing expenses to remain at higher levels; however if the company is able to achieve the desired levels of sales, there could be expansion in EBITDA from the current levels of 14.90%.

So, on the back of ~17% growth in sales, expansion in gross margins and onetime gain of Rs 3.4 crore, the EBITDA for Dec’17 quarter is up by 53.79% on YOY basis to Rs 28.96 crore with EBITDA margins of 17.48%. Negating the impact of onetime gain, the company has recorded EBITDA margins of 15.43%

With lower depreciation and finance cost, the PBT of the company (excluding other income) is up by 72.96% on YOY basis to Rs 25.65 crore.

Since the last 3-4 years there hasn’t been much growth in the operations of the company. Firstly, the company suffered for two consecutive years on the back of weak monsoon and then last year demonetization impacted the sales. We believe the potential for the company to do well in the long run is good on the back of government’s focus on doubling farm income and company’s own focus on launching several new products (47, 30 HP tractors and 15 HP tiller in FY 19); further the company is also working on other products like reapers, transplanters, etc and these should help sustain the growth momentum in longer run; however in the short term factors like monsoon, DBT (direct benefit transfer), delay in release of subsidy, etc can act as dampeners.

Adjusting for higher other income and taking into account ~ 200 crore cash and cash equivalents, the stock is currently trading around 26-27 times earnings.

Disclosure: I have personal investment in both Control Print and VST Tillers Tractors.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: In Control Print and VST Tillers Tractors

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

Ekansh Mittal or its associates including its relatives/analyst do not hold beneficial ownership of more than 1% in the company covered by Analyst as of the last day of the month preceding the publication of the research report.

Ekansh Mittal or its associates/analyst has not received any compensation from the company/third party covered by Analyst ever.

Ekansh Mittal/Mittal Consulting/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market-making activity of the company covered by Analyst.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.