Dear Members,

We have released 18th Mar’18 – Dec’17 earnings update on IPCA Laboratories and Atul Auto. The same has been produced below. For other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Date: 18th Mar’18

18th Mar’18 – Dec’17 Earnings update

IPCA Laboratories (NSE – IPCALAB) – Nov’12 Alpha stock

CMP – 669.05 (BSE); 667.55 (NSE)

Rating – Neutral; this is not an investment advice (refer rating interpretation)

IPCA Lab 3 Years price chart Source: BSE India

After several bad quarters, IPCA has reported somewhat improved performance in Dec’17 quarter. Post GST, with operations returning to normalcy, the company has reported growth across the segments.

For Dec’17 quarter the company’s sales are up by 14.53% on YOY basis to Rs 859 crore. The same has been achieved on the back of 12% growth in domestic formulations and 17% growth in exports formulations.

In the domestic formulations, except for anti-malaria, most of the other therapies like pain, cardio-vascular, anti-bacterial, derma, etc have reported strong growth. As per the management, increasingly company’s exposure to the volatile anti-malarial segment is coming down with only 8% contribution to domestic sales in 9M FY 18. Pain segment is the largest contributor with 44% and growing at decent pace.

As far as International business is concerned, except for generic business which is down 8%, all other segments like branded and institutional have reported strong growth. The generic business is down largely on account of almost zero business from US and decline in sales in UK and South Africa.

On the front of raw materials, the company has recorded gross margins of 65.80% against 67.16% in Dec’16 quarter.

The company has exercised good control on operating expenses. As per the management they have been consulting on reviewing cost structure. They have also been rationalizing man power in both manufacturing and marketing segment. As a result, despite increase in sales, the overall operating cost is up only 0.5%

So, with increase in sales and rationalization of cost, the EBITDA of the company is up by 37.62% on YOY basis to Rs 151.2 crore with EBITDA margins of 17.60%. With no major change in depreciation and finance cost and some gains on exchange front, the PBT of the company is up by 93.06% on YOY basis to Rs 122.75 crore.

As far as other developments are concerned, IPCA has completed the remedial process and has sent the invitation to US FDA for all the 3 units under import alert; however it’s difficult to predict as to when the US FDA will come for inspection. Health Canada recently inspected the 3 units and found them compliant. Regarding anti-malarial WHO global tender business, it should commence from Q1 FY 19. The business will pick up gradually as the company gets registered with more and more countries.

The management is hopeful of continued good growth in branded exports and pick up in UK sales in FY 19. Also, with decreasing contribution of anti-malarial business, management is expecting 14-16% growth in domestic business.

Overall, for FY 19, management is guiding for 12-15% growth in sales and expansion in EBITDA margins by 200-250 bps to around 18-19%. It’s important to note here that when the going was good, IPCA used to record 20-25% EBITDA margins; however since the USFDA import alert, its utilization levels have dropped significantly and thereby margins have also dipped considerably.

Overall, things are now looking up for IPCA and considering company is able to achieve the stated guidance, the stock is trading around 20 times forward earnings. While company has been clearing all the inspections; US FDA inspection and its clearance will be key to further growth and re-rating of the stock.

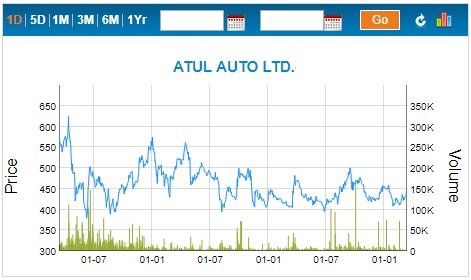

Atul Auto (NSE – ATULAUTO) – Jul’13 Alpha stock

CMP – 443.90 (BSE); 444.85 (NSE)

Rating – Positive – 3% weightage; this is not an investment advice (refer rating interpretation)

Atul Auto 3 Years price chart Source: BSE India

Sales of the company for the Dec’17 quarter are down by 4.36% on YOY basis to Rs 127.92 crore. Against overall industry growth, Atul has reported de-growth in numbers in Dec’17 quarter as it resorted to controlling dealer inventory and thereby witnessed share drop in sales in the month of October 2017; however since then the months of November, December, January and February have witnessed growth in volumes of (YOY) 3%, 13%, 70% and 26% respectively.

Despite more than 10% drop in volumes in Dec’17 quarter, the drop in sales is only 4.36% on the back of higher realizations.

As far as raw materials are concerned, the company has recorded gross margins of 27.29% against 27.59% in Dec’16 quarter.

Company’s operating costs are lower; however during the quarter it incurred Rs 2.48 crore towards product development charges. The charges are towards development of BS VI diesel engine and alternative fuel 3-wheeler. In future as well, company may have to incur some charges towards product development.

The company continues to be debt free and as per the management the working capital situation has also improved.

As far as other developments are concerned, the e-vehicle is being sold in Gujarat and Bihar and will be soon introduced in other pockets and across the network. The product is currently recording 10% month on month volume growth. As far as exports are concerned, the company currently sells in 11 countries and expects to expand to 33 countries in next few years. As mentioned last time, in the long run, alternate fuel 3-wheelers, exports and e-rickshaws are likely to be the growth drivers for the company.

The stock is currently quoting around 22 times FY 18 (E) earnings.

Disclosure: Out of the stocks discussed above, I have personal investment in IPCA Laboratories.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: In IPCA Laboratories

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

Ekansh Mittal or its associates including its relatives/analyst do not hold beneficial ownership of more than 1% in the company covered by Analyst as of the last day of the month preceding the publication of the research report.

Ekansh Mittal or its associates/analyst has not received any compensation from the company/third party covered by Analyst ever.

Ekansh Mittal/Mittal Consulting/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market-making activity of the company covered by Analyst.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.