Dear Members,

We have released 27th May’18: Mirza International Ltd (NSE Code – MIRZAINT) – Alpha/Alpha Plus stock for May’18. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 27th May’18

CMP – 122.60 (BSE); 123.15 (NSE)

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

We all like to see good transformations in the company and if those transformations turn out well and if we as investors are able to catch on to them at an early stage, the ensuing returns can be really good.

So, here we are talking about Mirza International which is well known for its REDTAPE brand of shoes, apparels and accessories.

Well, Mirza International is one of India’s leading manufacturers and marketer of leather footwear and finished leather. Till now the company had primarily been supplying to leading international brands and as a result 70-75% of its sales came from exports and out of the same more than 80% came from private label manufacturing for leading international footwear companies.

The main overseas markets for the company are UK, USA, France and Germany. In fact, as per the management, in UK the company has a reasonably high share in the men’s leather footwear mid-segment category.

Coming back to transformations, till very recently Mirza International had all along been an export and leather focused Footwear Company; however now they are bringing about changes at various levels:

- Export oriented to domestic oriented

- White label to own brand driven

- Leather focused to multiple segments

- Only men to now men and women

We believe the above changes if executed well can lead to faster growth, margin expansion and re-rating of the valuations of the company.

Basic details

Mirza International is India’s foremost leather footwear manufacturer and exporter. The company holds the distinction of selling footwear with its own brand name of RED TAPE in the discerning markets of US and UK.

Besides RED TAPE the company also owns other brands like OAKTRAK, BOND STREET, etc; however RED TAPE is the most well known brand of the company.

The company has very strong infrastructure in place with 6 integrated manufacturing facilities with total capacity of 6.4 million pairs of footwear per annum. Besides, it has 1 tannery which is fully equipped with effluent treatment plant (very important considering a lot of other tanneries in the region use common treatment plant which is non-functional most of the time and therefore cause lot of pollution), 2 in-house design studios and warehouses to serve e-commerce channels.

Ongoing transformations

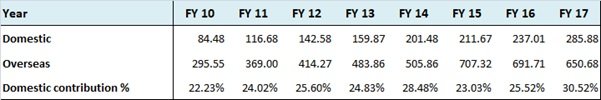

Export oriented to domestic focused – Until recently, Mirza had primarily been an export-oriented company with exports contributing more than 75% to the sales of the company in FY 15; however with the recent slowdown in export markets the management has changed focused and is now aggressively expanding its presence in India.

Source: Mirza’s Annual reports

For FY 18, the share of domestic sales is expected to go up to 40% and if the management estimates turn out to be true then in FY 19 the share of domestic sales could go above 50%.

In order to propel domestic sales and take advantage of increasing online sales, the company will be opening 70-100 large format online/offline stores in calendar year 2018. The company has partnered with PAYTM Mall and through its online/offline stores it will offer physical shopping experience of its online range combined with online discounts, prices, and Paytm Mall offers.

We believe expanding presence in India could be good for the company as the brand is already well-established and the market potential is also very good.

White label to own brands – While exports were largely private label supplies (around 80% +), domestic sales are completely branded and therefore increasing domestic sales could be margin accretive for the company.

For the nine months FY 18 the branded sales of the company have grown by 32.14% on YOY basis while the unbranded sales have declined by 10.52%. The strong growth in branded sales can be attributed to high growth in domestic sales and decline in exports sales.

Further, based on the segment results shared by the company, the margins and profitability in branded sales are substantially higher in comparison to unbranded sales.

Leather focused to multiple segments – Since inception, Mirza International has always been a leather focused company; however considering the strength of its brand and wide distribution network, the management has now expanded into faux leather footwear, sports and casual shoes, and apparels and accessories.

Expansion into other segments is also the reason why domestic sales are expected to grow rapidly. In FY 18, the company launched faux leather shoes under BOND STREET brand and Sports and Casual shoes under RED TAPE brand and both the new launches are growing rapidly. Similarly the apparels segment is also growing rapidly and recorded 90% growth in the first nine months of FY 18.

As per the management there’s growing preference for sports and casual shoes and while there are companies like NIKE, Addidas, PUMA, etc catering to high end segment, there’s dearth of good players in the mid segment and that’s what the company is targeting through its portfolio of RED TAPE Athleisure shoes.

Similarly the lower end BOND STREET faux leather footwear is a natural extension to the company’s RED TAPE leather footwear and the market size is much larger in comparison to the premium leather shoes.

Women sports shoes – In Mar’18 the company introduced women sports shoes under RED TAPE brand.

The women sports shoes segment is again a neglected category, especially in the mid-range segment and that’s what the management is targeting. Also, women’s footwear is a relatively faster growing segment than men’s footwear.

As per the management they are targeting to achieve sales of more than half a million pairs annually in next 2 years in women’s footwear segment.

Overall, we believe the management’s focus on domestic markets and expansion into new segments should propel the growth of the company and the same can also be margin accretive considering increasing proportion of branded sales.

As far as exports are concerned, they have been declining since achieving the peak sales of Rs 707 crore in FY 15; however what could bring in some relief for the company is the recent depreciation of INR against USD and Pound Sterling. Even if the decline in exports sales is arrested, the domestic sales alone could propel the overall growth of the company to around 15-20%.

Promoters/Management

Like several Indian companies, Mirza International is largely a family run business with 3 generations of Mirza family managing the affairs of the company.

Most of the family members have an educational background in leather and shoe technology. The recent additions to the management team, Mr. Shuja Mirza and Mr. Faraz Mirza are looking into the marketing operations of the company with Mr. Shuja Mirza laying a strong focus on domestic markets. In fact he is the driving force behind the expanding domestic operations of the company.

In owner operated companies it is important from shareholder’s perspective that owners have high stake in the company and in the case of Mirza International the promoters own more than 70% stake in the company.

On the front of corporate governance a few things that can be pointed out are amalgamation of promoter owned companies in FY 16 which resulted in dilution in equity and increase in promoter holding; though at the same time the amalgamation did result in expansion in margins and profitability and was seemingly margin accretive. Further, the promoters charge guarantee commission, i.e. they charge commission from the company for the guarantee provided against the loans availed by the company. Including guarantee commission the overall payments to the promoters are on slightly higher side at more than 20% of the net profit of the company.

Operating Performance

Source: Mirza’s Annual Reports

As can be observed from the above illustration, Mirza’s performance over the years has been very consistent. The company has grown its sales in all the last 5-10 years though the pace of growth has tapered off-recently.

Source: Mirza’s Annual reports

The recent low growth in sales can be attributed to contraction in exports; however it’s good to know that domestic sales are fast catching up and as explained in the earlier sections the focus on domestic sales is so strong now that management is targeting 400-450 crore domestic sales in FY 18 and around 700 crore in FY 19. Thus, even if exports don’t grow and remain around current levels of 600-700 crore, there could be strong traction in the overall sales growth of the company for the next 2-3 years.

As far as margins are concerned, here again Mirza’s performance has been very consistent with EBITDA margins hovering in the range of 15-18%. As the company is now focusing more on domestic sales, the share of branded sales is likely to go up in comparison to white label sales and the same could have positive impact on the EBITDA margins of the company.

The company has done well on the front of balance sheet and cash flows, because except for the recent increase in equity share capital (on account of merger of Genesis Footwear) the company didn’t dilute its equity at all. Also, it has managed its debt well with the debt equity ratio declining from 0.90 at the end of FY 07 to 0.31 at the end of FY 17. If we were to ignore the impact of merger, even then the debt equity ratio declined to 0.70 at the end of FY 15.

Going forward the company won’t be expanding its capacity because sports shoes are being outsourced while the in-house manufacturing units are currently running at around 80% capacity utilization. Thus, the incremental debt if any at all would be towards funding working capital requirements of the company and opening of large format online/offline stores.

The company has also done well on the front of capital allocation with both ROE and ROCE having been maintained in the range of 15-20%.

In our view while the recent growth has been subdued, the overall financial performance of the company has been good. Going forward, if the company is able to scale up domestic sales at the pace envisaged and arrest the decline in export sales, 15-20% YOY growth for the next few years is quite achievable.

Valuations

From the above sections we know that Mirza International is transforming from B2B to a B2C company, increasingly focusing on domestic sales in comparison to exports and reducing risk by diversifying from leather footwear to multiple segments.

We also know that while the recent growth has been subdued, the next few years are expected to be good for the company in terms of growth in sales and profitability.

Lastly, we also know that companies like Relaxo, Bata, Khadim, etc are trading at around 40-50 times earnings; though obviously they have much higher brand recall, are largely domestic sales driven and have better return ratios.

Thus, considering the above factors of ongoing transformations (B2B to B2C, higher share of domestic sales, diversification, etc) and expected growth in the ensuing years, we believe the stock is reasonably valued at around 18-19 times trailing twelve months earnings.

Risks and Concerns

Mirza International is a family run business and there are several siblings participating in the operations of the company. Any dispute amongst them can result in division and impact the performance of the company.

Since FY 15 the exports have been going down continuously. As per the management the demand outlook is still not great and with recent reduction in duty drawback rates the margins have gone down further. In case the decline in exports is not arrested, the impact of incremental domestic sales will be negated.

Last but not the least, issues like bank guarantee commission, merger of promoter controlled entities, etc can keep investors away and raise doubts about the corporate governance practices of the company.

Disclosure: I don’t have any investment in Mirza International and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

Ekansh Mittal or its associates including its relatives/analyst do not hold beneficial ownership of more than 1% in the company covered by Analyst as of the last day of the month preceding the publication of the research report.

Ekansh Mittal or its associates/analyst has not received any compensation from the company/third party covered by Analyst ever.

Ekansh Mittal/Mittal Consulting/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market-making activity of the company covered by Analyst.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.