Dear Sir,

We are very happy to inform you that on the back of popular demand and for the benefit of our premium members we have launched Model Portfolio service on 15th Aug’18

Model Portfolio service is being offered only under the following two subscriptions: Alpha & Model Portfolio and Alpha + & Model Portfolio.

Note: Existing Alpha/Alpha + members can mail us on [email protected] for payment details on Model Portfolio service.

Model Portfolio

Over the last 7 years or so I have achieved around 34-35% CAGR on my personal portfolio and we have also been sharing stock recommendations with our premium members since mid 2011. Considering several requests from our existing members, we would now like to introduce Model Portfolio service for their benefit.

We also believe, that with the recent market correction, the timing is right from longer term investment perspective.

What is it – The model portfolio service is basically an extension and reflection of our research analysis and the sole purpose of the same is to determine performance of our research analysis on portfolio basis than on individual stock basis. It is basically a Performance measuring tool, similar to say an index.

Until now we had been offering stock recommendations; however with model portfolio we will arrange those stocks on say an imaginary corpus of Rs 50 lakhs with occasional buy/sell transactions and addition deletion of stocks in the portfolio and share the details across with the members.

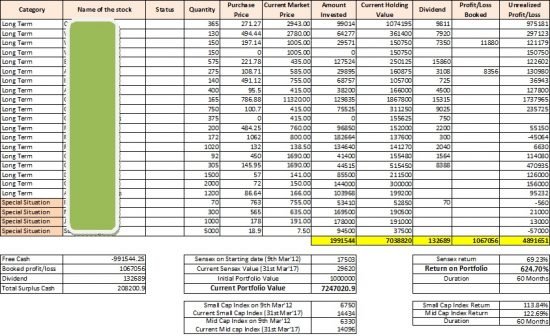

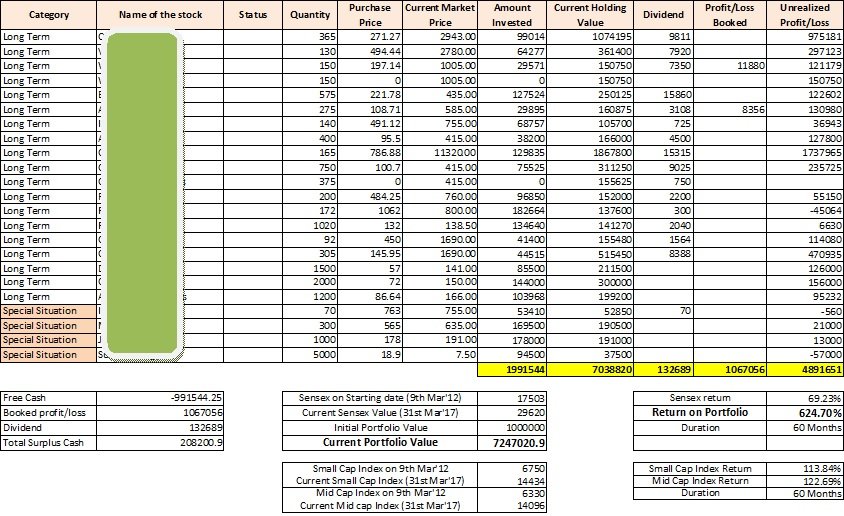

It looks something like this:

Note: This is for illustration purpose and not the current model portfolio

Investment objective – Like our research, the objective of the model portfolio will be to create wealth in long run by investing in stocks of easy to understand, well run companies, run by competent management and available at seemingly reasonable valuations. To sum it up, growth at reasonable valuations will be the main objective.

The model portfolio will also consist of occasional participation in special situation opportunities.

The target of model portfolio will be to outperform benchmark indices over a cycle of 3-5 years and generate decent absolute returns on investment.

How is it beneficial for you? The money remains with you and you are free to follow it partially, totally or ignore it completely.

What it is not? The model portfolio service is an extension and reflection of our research analysis and is in no way a portfolio advisory or buy/sell recommendation for you.

It is basically an information service and doesn’t take into account your personal financial situation or risk profile. Please consult your financial adviser before following or implementing the same partially or in totality.

Is Model portfolio suitable for you? Well, if you like our research, believe in our investment objective, look at stocks as partial ownership of businesses, believe in long term wealth creation potential of equities; then model portfolio might be suitable for you.

However, if you are looking for customized portfolio for yourself, want your risk profiling to be done, then this model portfolio may not be suitable for you and you should consult SEBI registered investment adviser.

Refund policy – There’s zero refund policy for model portfolio service because as soon as you subscribe to the same you will get access to the complete portfolio snapshot.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

By subscribing to Alpha & Model Portfolio/Alpha Plus & Model Portfolio, you agree to accept the following terms/conditions:

www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690. The model portfolio service is an extension and reflection of our research analysis and is in no way a portfolio advisory or buy/sell recommendation for you. The purpose of model portfolio is to get a tentative performance snapshot on portfolio basis than on individual stock basis.

The model portfolio service is basically an information service and doesn’t take into account your personal financial situation or risk profile. Please consult your financial adviser before following or implementing the same partially or in totality.

The transactions mentioned are not the actual transactions, but take into account the ending prices for the day and ~0.3% transaction charge.

For the purpose of calculation of returns, the surplus cash (cash i.e. not invested in stocks) will be assumed to be invested in liquid funds at around 6-7% return per annum.

There’s zero refund policy for model portfolio service because as soon as you subscribe to the same you get access to the complete portfolio snapshot.