Research on stocks has improved significantly over the years; however I believe most of the time investors tend to ignore the most important document for research and that is the Annual Report of the company.

Yes, Annual Report is the most important document but probably also the most ignored one.

Basically, Annual Report of any company is the report card of the financial year gone by and when you read several such report cards, you get to know a lot about the business, the promoters, what they said, what they achieved and how they achieved.

Since the last few years the companies (including the smaller ones) have started coming out with investor presentations; so while such presentations are extremely important in terms of understanding the business of the company, such presentations also tend to hide more than they reveal.

Invest in bad times for better future: Get access to our top 14 stock ideas including the very latest one in our Alpha and Alpha + subscriptions – Check HERE

EMI facility: Now you can buy our subscriptions on EMI. In the check out page (LINK), chose online payments through PayU and in the payment options you will get EMI facility from 6 credit card issuer banks

Below, I have stated some key points that one can get check in Annual Reports and improve their overall understanding of the company:

Management Discussion and Analysis (MDA) – Most of the time MDAs are cut, copy and pasted from various sources and get repeated across various annual reports of the company; however a lot of times one gets to read the management’s view about the industry and the overall outlook for the company. One also gets to read about the steps the management might be taking to improve the overall functioning of the company.

The MDA becomes especially important in smaller companies where the information is already scarcely available. Management’s statements when evaluated over several years help understand the thought process and probably the path ahead.

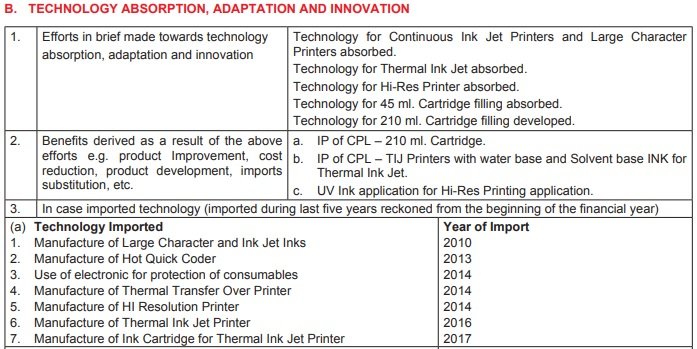

R&D/Technology imported – Well this can be an important point depending on the type of company one is doing analysis on; like it helped me immensely in building conviction on Control Print in its early stages.

Source: Control Print AR 2018

Basically the company was transforming from being a distributor of coders and markers to in-house manufacturer and for that it had to continuously bring in new technology from outside India. So, on reading the Annual Reports of the company it became quite clear that rather than just claiming the company was actually importing new technology each year and indigenizing the manufacturing of coders and related consumables.

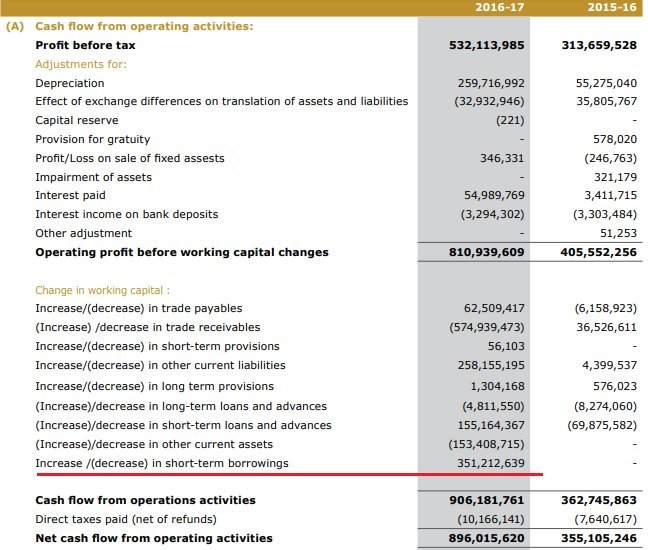

Schedules of Balance sheet, P&L and Cash flows – On various sites we tend to get the consolidated view of balance sheet items or the cash flows as reported by the company; however we don’t get to know what has actually gone into each balance sheet item or how the company has arrived at its cash flows.

Source: BLS International AR

For example look at the above Cash flow statement of a company – It has added short term borrowings to cash flow from operations and the same inflates the operating cash flows. So while this may/may not be the accounting practice across the companies, a diligent investor will make his own adjustments to the numbers to arrive at more meaningful numbers.

Management’s remuneration – This is again something one normally doesn’t get anywhere else other than Annual report. So the purpose of checking management’s remuneration is to see whether the management is taking home too much salary or not and whether the remuneration is aligned with their performance or not.

Related Party transactions – Checking related party transactions is again important from the view of knowing whether the promoters are trying to short-change the minority shareholders by probably buying or selling too much from/to related parties (and probably leaving margins in those companies).

Basically, it’s an important piece of information and becomes relevant in case of too many transactions.

Shareholding changes – While changes in shareholding can be gauged from the quarterly filings on the exchanges, in the Annual reports one gets to see the top 10 shareholders of the company.

This is especially important for investors who follow the practice of replicating the investment strategies of well-known individual and institutional investors who are known, or believed, to have exhibited good performance.

Besides top 10 shareholders, one also gets to check the changes in shareholding of promoters and other executive and independent directors. Following shareholding of promoters/directors is especially important from the purpose of understanding if they have the skin in the game or not.

Off-balance sheet items – Last, but not the least, there are certain important off-balance sheet items like contingent liabilities, tax disputes, other claims, etc. What I have normally observed is that books of those companies tend to be clean where the tax disputes or other claims are lower.

While no single point can make or break the investment thesis, it does help to know how the company you are invested in is faring on all the above points. Also, all the above points add immensely to the qualitative analysis of the company.

Disclosure: I hold Control Print in personal account and have recommended it to clients. Currently, we have a neutral rating on the stock. For a more detailed disclosure, please read below.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: In Control Print

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document.

This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – Yes, investment in Control Print

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No