Dear Members,

We have released 26th Mar’19: SREELEATHERS Ltd (NSE Code – SREEL) – Alpha/Alpha Plus stock for Mar’19. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 26th Mar’19

CMP – 220.00 (BSE); 216.00 (NSE)

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

Sreeleathers Ltd (SL) is engaged in the business of dealing in all kinds of footwear and leather accessories. It is also engaged as retailer and wholesaler of footwear and leather articles.

The Company has more than 30 retail outlets (including outlets owned by franchise) spread over 9 states including West Bengal, Bihar, Jharkhand etc.

The company also sells its products online through its own website https://sreeleathers.com/

As on date, we like several points about the company and they are as below:

Very well managed business – SL is primarily a wholesaler and retailer of footwear and leather accessories and in general the inventory holding period for such a business is 2 months to 4 months; however Sreeleathers has consistently maintained its inventory days at around 30-35 days.

Similarly the debtor days are around 1-2 months for most of the companies; however here again Sreeleathers runs a tight ship with debtor days at around 1-3.

Focused on low-cost and low margin products – Major part of the product portfolio of the company is priced in the range of Rs 100-1,000 and thus its competition is largely with regional and unorganized players.

Company doesn’t own any manufacturing facility and sources its requirement from several small local vendors.

Unlike other companies in the segment, SL has lowest gross margins of 29% against 40-60% for its peers; however because of its overall low cost structure the company is still able to command 20% EBITDA margins.

Consistent growth in sales – Since FY 09 i.e. when the company changed its name and merged group entities to focus on the business of footwear retail, the company has recorded 22.5% CAGR in sales and much higher growth in profitability.

Reasonable valuations – Till now Sreeleathers has exhibited qualities of a high quality business.

There are some issues like non-payment of dividend (hoarding of cash), promoter related entities in same line of business (much smaller and not growing since few years), etc; however we believe the positives outweigh the negatives.

The current market cap of the company is 540 crore. It has cash and equivalents worth 115-120 crore (at the end of Sep’18) and the business is throwing lots of cash each year. The operating PBT of the company for the trailing twelve months is 36.5 crore and therefore excluding cash and equivalents the market is valuing the operating business at 11.6 times before tax earnings and around 12.2 times before tax earnings on including cash and equivalents.

Companies in the same segment (though much bigger) are trading at much higher valuations. Unless promoters indulge in mis-governance, we believe the current valuations of the company are reasonable on both absolute and relative basis.

Basic details

Early days – Sreeleathers Ltd was earlier known as Cat Financial Services Ltd. In FY 09, the promoters merged their private companies Deys Holding pvt ltd, Deys finance pvt ltd, Shree leathers Pvt ltd into Cat Financial Services Ltd.

Pursuant to amalgamation, name of the company was changed from Cat Financial to Sreeleathers Ltd and the primary business changed from financial services to retailing of footwear and leather accessories.

As part of the amalgamation, the company issued and allotted 21954812 equity shares to the shareholders of amalgamating companies and also got properties (land + buildings) valued at ~ 150 crore.

Business details – Since FY 09, retailing and wholesale of footwear and accessories has been the only business of the company and it has done well over the years.

Source: https://sreeleathers.com/

As can be seen from the above illustration, the company largely deals in low-priced products and is considered a value for money brand in the leather footwear and accessories segment. In fact, the queue outside its stores during the festive season is unparalleled.

On account of its low priced products, we believe the real competition of SL is with regional and unorganized players and that’s a big segment because unorganized players still account for 60-65% of the overall footwear market in India.

While the products are low-priced, it is believed that the company’s shoe store in Kolkata is the largest in India.

As per the store details shared on the company’s website, there are around 38 stores in India bearing Sreeleathers brand name (including outlets owned by franchise) and out of those around 30 are in eastern states.

It is important to note here that of the above 38 stores, not all of them come under Sreeleathers Ltd. For instance, the store in CP, Delhi comes under M/s Sreeleathers and is managed by MDs son Mr. Sumanta Dey; however M/s Sreeleathers does make purchases from Sreeleathers Ltd.

Over the years the company doesn’t seem to have added many stores because even in FY 10 it had around 30 stores (including franchise stores). However, as per the latest interview of the management with The Hindu Business line, the management is planning to expand in Western India by opening exclusive stores, both company-owned and franchisees.

The primary reason behind management contemplating opening of new stores is that MDs daughter is interested in looking after the business and has been inducted as one of the directors.

Besides, the company has already started its online store through its website https://sreeleathers.com/

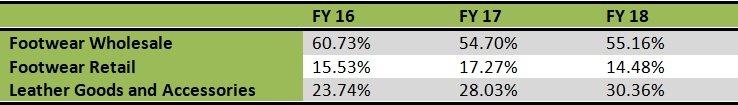

Sales bifurcation – The Company derives its sales from footwear and other leather goods and accessories.

Source: Sreeleathers ARs

Besides own exclusive retail stores, the company also makes sales to franchises and other wholesalers and dealers. As can be seen from the above illustration, wholesale accounts for more than 50% of the sales of the company and therefore company’s growth is not solely dependent on opening of own new stores.

Source: Sreeleathers Information memorandum

As per the information memorandum filed by the company in 2013, it had the above mentioned major customers. The above list indicates that the major customers of the company are mostly the franchise partners, dealers and wholesalers.

Out of the above Sumanta Susanta Overseas Pvt Ltd and Upkar Vinimay Pvt. Ltd are related entities.

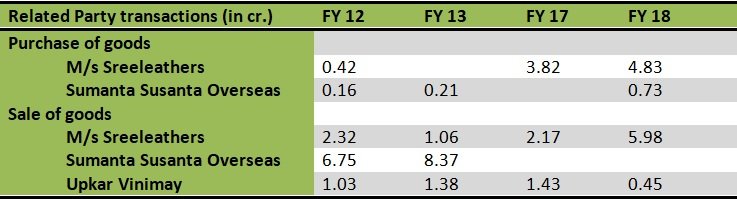

Related party transactions – Based on our research, we have found the following entities to be major related parties of SL.

- M/s Sreeleathers

- Sumanta Susanta Exports Pvt. Ltd.

- Sumanta Susanta Overseas Pvt. Ltd.

Source: Sreeleathers ARs

As mentioned above, M/s Sreeleathers runs the store in CP, Delhi and MDs son Mr. Sumanta Dey manages the same.

Sumanta Susanta Exports Pvt. Ltd. is primarily into exports of footwear and other accessories; however the scale of operations is small with the company reporting Rs 2.42 crore sales and Rs 0.14 crore PAT in FY 18.

Sumanta Susanta Overseas Pvt. Ltd. seems to be the largest related company as the same has been recording 31-34 crore sales on annual basis since the past 4-5 years. MDs son, Mr. Sumanta Dey manages the company; however the important thing to note is that the company hasn’t grown in the last 4-5 years with the sales declining from Rs 33.16 crore in FY 13 to Rs 31.8 crore in FY 17.

Looking at some of the details, appointment of Ms. Rochita Dey as additional director in FY 19, non re-appointment of Mr. Sumanta Dey as director in FY 19 and Mr. Sumanta Dey’s involvement in other companies, we believe Mr. Sumanta Dey will be running separate operations while Ms. Rochita Dey will helm the affairs of Sreeleathers Ltd in the years ahead.

Promoters/Management

Sreeleathers was started by Late Suresh Chandra Dey in 1950s. He had 3 sons.

His second son, Mr. Satyabrata Dey moved to Calcutta in 1985-86 to open a 700 sqft store in Lindsay Street that has now grown to 35,000 sqft. As per one of the articles, Satyabrata’s brothers also sell under the brand Sreeleathers, however they own different companies.

Mr. Satyabrata Dey is the Managing Director of Sreeleathers Ltd. He is a graduate and has completed Management Education Programme from IIM, Amhedabad.

Under the leadership of Mr. Satyabrata Dey, the company has grown tremendously over the years.

Recently, Ms. Rochita Dey has been inducted as an additional director in the company. She has done her MBA in finance from Syracuse University and is likely to spearhead the operations of the company in the years ahead.

We consider Promoter holding important from the perspective of skin in the game and it is good to note that at the end of Dec’18 the promoters had 64.94% stake in the company.

2 year back promoters had 63.79% stake in the company; however on the back of open market purchases by Mr. Satyabrata Dey, the overall stake has increased to 64.94%.

Performance Snapshot

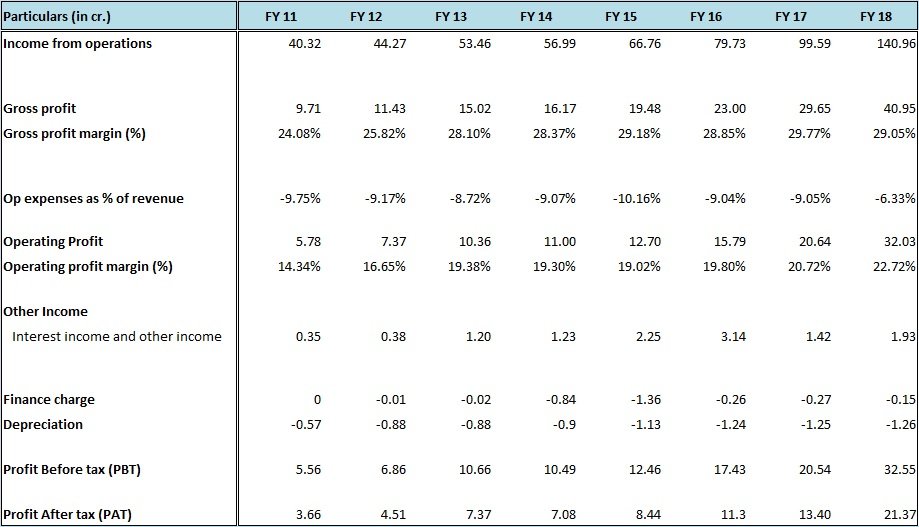

Source: Sreeleathers ARs

The most beautiful part about Sreeleathers is its performance over the years.

As can be seen from the above illustration the company has reported growth in sales year after year and has managed to report 22.50% CAGR in sales over the last 9 years.

Another important point about the performance is that company has managed growth while focusing on low priced products and most importantly low cost operations.

Looking at EBITDA margins of 19-22%, it is easy to get fooled into believing that Sreeleathers sells high margin products; however on checking gross margins one finds that company is in fact selling low margin products.

In general the gross margins in the footwear retail industry range from 40-60% while Sreeleathers commands 28-29%; as the company doesn’t own any manufacturing unit and maintains very low cost operating structure, it has been able to generate 19-20% EBITDA margins on consistent basis.

To sum it up, Sreeleathers is basically a trader of footwear and other accessories; however over the years it has become a brand in the value for money segment and the affinity for the brand can be judged from the queue outside the stores during the festive season.

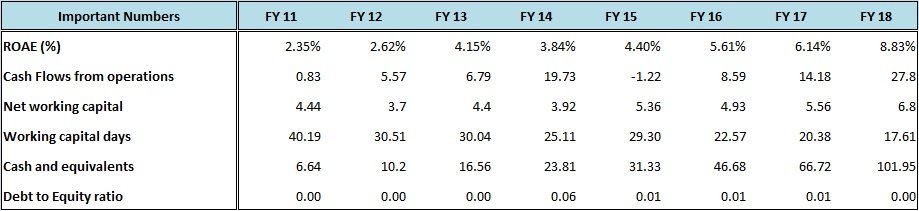

Source: Sreeleathers ARs

Another important aspect of the performance of Sreeleathers is its overall working capital management.

As can be seen from the above illustration that over the years the net working capital days (inventory days + receivable days – payable days) have trended downwards from 40 odd days in FY 11 to ~18 days in FY 18.

In the business of footwear retail, in general the inventory holding period is 2 months to 4 months; however Sreeleathers has consistently maintained its inventory days at around 30-35 days.

Similarly the debtor days are around 1-2 months for most of the companies; however here again Sreeleathers runs a tight ship with debtor days at around 1-3 days and this despite the fact that it generates more than 50% of its sales from wholesale.

Thus, on account of extremely efficient working capital management the company generates loads of cash and as a result it is debt free and holds cash and equivalents (investments in mutual funds) worth more than 100 crore.

An interesting observation that comes across from the above numbers is that Return on Average equity (ROAE), though increasing, has been perennially low at less than 10%.

Well, the above is on account of the fact that when amalgamation happened in FY 09, the company got real estate at revalued rate. As a result its books reflect land valued at 118 crore and buildings worth 35 crore.

At the time of amalgamation itself the company got the above real estate assets worth more than 150 crore. Then, the sales of the company were ~22 crore. Since then the company has spent only around 21 crore on fixed assets while the sales have increased from 22 crore to 140 crore and the PAT has increased from 0.13 crore to more than 20 crore.

Thus, the return ratios are optically lower while the operating business has been delivering very high rates of return.

Valuations

Till now Sreeleathers has exhibited qualities of a high quality business.

There are some issues like non-payment of dividend (hoarding of cash), promoter related entities in same line of business (much smaller and not growing since few years), etc; however we believe the positives outweigh the negatives.

The current market cap of the company is 540 crore. It has cash and equivalents worth 115-120 crore (at the end of Sep’18) and the business is throwing lots of cash each year. The operating PBT of the company for the trailing twelve months is 36.5 crore and therefore excluding cash and equivalents the market is valuing the operating business at 11.6 times before tax earnings and around 12.2 times on including cash and equivalents.

Companies in the same segment (though much bigger) are trading at much higher valuations. Unless promoters indulge in mis-governance, we believe the current valuations of the company are reasonable on both absolute and relative basis.

Risks/concerns

The company was paying dividends till FY 14. Since then it has stopped paying dividends. It did come out with an open market buy-back in 2017-18; however the maximum price set for buy-back was lower than then prevailing market price and as a result it could not buy-back any shares.

As the business is generating substantial cash flows from operations, we are not sure what the management intends to do with so much cash and see hoarding of the same as potential risk.

The company recently sold a property to Ms. Rochita Dey at Rs 15.5 crore. The book value of the same was ~ 8 crore. We believe such kind of related party transactions harm the interest of minority shareholders.

There’s lack of clarity regarding the role of Mr. Sumanta Dey, son of Mr. Satyabrata Dey, as he seems to be running different companies (though much smaller) with similar set of operations as Sreeleathers Ltd.

While the company has reported strong growth in the past, the same may not be maintained if it doesn’t open more stores.

Last but not the least, in the current market environment, the liquidity in the stock is a bit low.

Disclosure: I do not have any holding in Sreeleathers Ltd and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No