Dear Sir,

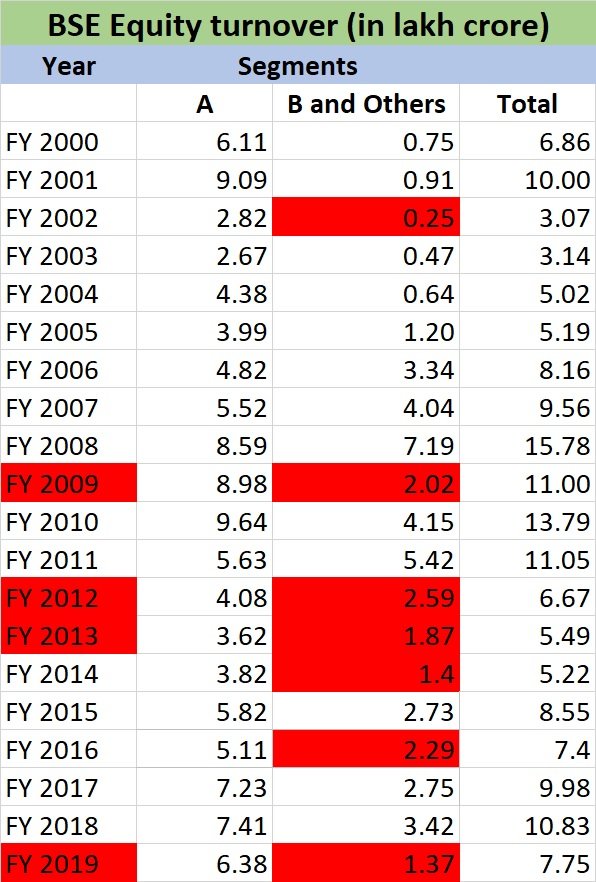

Just look at the below equity turnover data and you will know what I am saying.

Every time the markets correct in a big way (2008-09, 2011-12, 2018-19), the investor participation goes down substantially.

Frankly, it’s painful to see the investors make the same mistake of entering the market at highs and exiting at lows.

In fact, I see the same pattern with some of my friends and relatives who were pursuing me aggressively in 2016, 2017 for equity advice and are now nowhere to be seen when the time is ripe for investments.

I cannot help but ask them, how do you expect to make good money when you don’t invest during lows.

See, how ironic it is; Flipkart comes up with Big Billion Day sale and its turnover increases manifold because customers just can’t stop buying from the company.

Stock markets go down, offer a similar sale on stocks and the turnover goes down because investors turn a blind eye. In fact, they come in hordes when the stocks have already appreciated much.

You cannot consistently break the simple rule of Buy Low and Sell high and expect to make money in the long term.

I know it’s not always easy to remember the rules and execute them because you will be acting against the crowd; however, nothing comes easy in life, especially money.

Best Regards,

Ekansh Mittal

Research Analyst

https://katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]