Dear Members,

We have released 25th May’19: Anjani Portland Cement Ltd (NSE Code – APCL) – Alpha/Alpha Plus stock for May’19. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 25th May’19

CMP – 153.15 (BSE); 155.40 (NSE)

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

Anjani Portland Cement (APCL) is engaged in the business of manufacturing cement.

It is part of the Chettinad group which is one of the prominent business houses in South India with diverse businesses including cement manufacturing, transportation, logistics and supply chain management and construction.

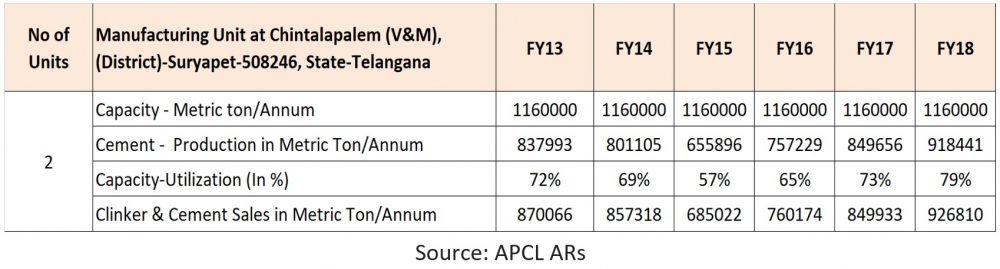

APCL commenced its cement manufacturing operations in 1999 with an installed production capacity of 1,98,000 tonnes per annum (TPA), with one production plant. Currently, it operates two integrated production lines with an installed production capacity of 11,60,000 TPA. It also has captive 16 MW power plant and operates limestone mines with probable reserves of 53 million tonnes.

As on date, we like several points about the company and they are as below:

Expected upturn in cement cycle – We see cement as a cyclical business and therefore in the case of cyclical businesses it becomes important to buy them when the valuations are actually low and not optically low.

Similarly, if one is able to buy a cyclical stock during low business cycle, then the probability of buying a cyclical stock at high valuation goes down further.

As far as cement sector is concerned, the last two years were not been so good for the industry with higher input costs and companies finding it difficult to pass on the prices on account of lower capacity utilization.

However, it seems that cycle is turning around as the utilization rates are improving and the cement prices have also started rising.

With stable govt. in place and expected push to infra and housing sector, the improvement in demand for cement sector is likely to sustain.

Debt free – While APCL has not been very aggressive in expanding capacity, it has focused on improving capacity utilization at the existing plant.

Since the low of 57% capacity utilization in FY 15, it recorded 79% in FY 18 and the same is likely to have improved further to 85% + in FY 19.

On the back of decent operating cash flows, the company is now debt free on net basis.

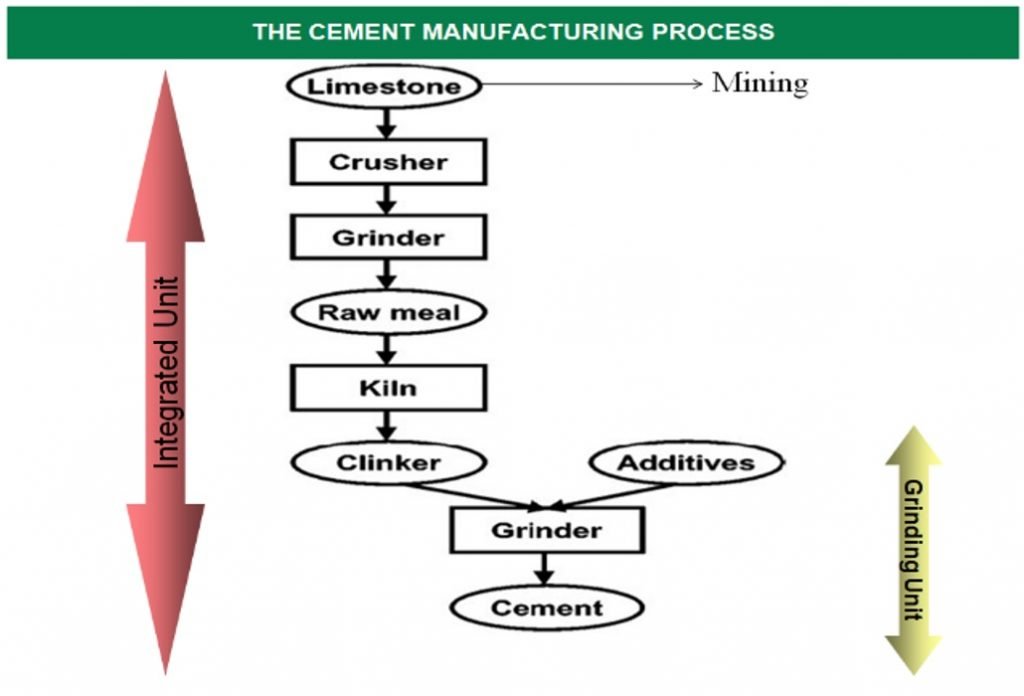

Going forward, the company may consider setting up grinding unit in Eastern regions of India; however, the cost of setting up grinding unit is substantially lower than an integrated unit.

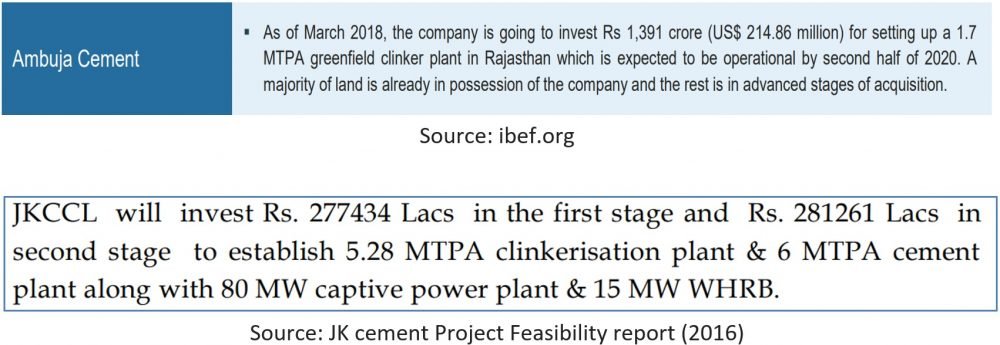

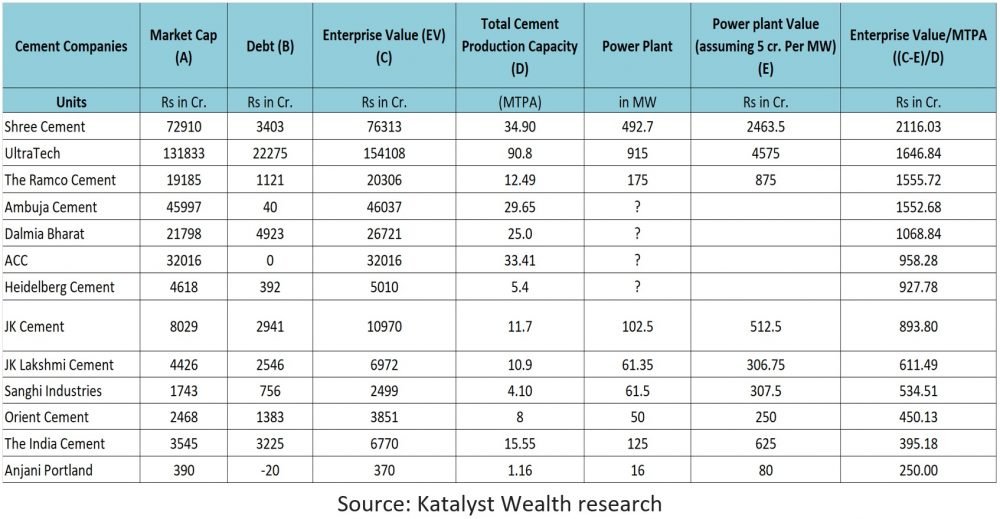

Cyclically low valuations – It is believed that replacement cost for 1 MTPA integrated greenfield cement unit is ~700-850 crore and if the company has limestone reserves, it becomes a huge advantage.

As far as APCL is concerned, it is currently available at an enterprise value of ~370 crore against replacement cost of ~890 crore (700 crore * 1.16 MTPA + 5 crore * 16 MW).

Thus, the stock is currently available around 0.42 times replacement cost.

While larger ones are trading around 0.8 to 2 times replacement cost, we believe the valuations for APCL are really low and the stock can trade around 0.7-0.8 times replacement cost during good times.

Basic details

APCL is part of the Chennai based Chettinad group which was formed in 1935. Chettinad group has a diversified business with interests in cement, construction, logistics, engineering, education, transportation, healthcare and other businesses.

One of the flagship companies of Chettinad group is Chettinad Cement Corporation Private Limited, being the holding company of APCL.

APCL was incorporated in 1983 as Shez Chemical Limited and was promoted by Syed Badruddin Shez and Naseerudin along with two NRI’s.

During the year 1985 the name of the company was changed to Shez Cements Limited. The company was acquired by K.V. Vishnu Raju during the year 1999 and the name of the company was changed to the current name APCL.

In the year 2014, Chettinad Cement Corporation Private Limited (CCCL) acquired 75% stake in APCL at an enterprise value of ~350 crore.

Cement unit – APCL has an integrated cement unit at Suryapet district of Telangana with installed capacity of 1.16 MTPA.

- Line 1 – Line 1 was set up in 1999 and comprises of a five-stage pre-heater and pre-calciner and has an installed production capacity of 0.4 MTPA.

- Line 2 – Line 2 was set up in 2010 and comprises of a five-stage pre-heater and pre-calciner and has an installed production capacity of 0.76 TPA.

APCL manufactures three types of cement: Ordinary Portland Cement (OPC), Portland Pozzolana Cement (PPC) and Composite Cement (CC). In FY18, OPC (43 & 53 grade) accounted for around 71% of the total production followed by PPC (25%) and CC (3%).

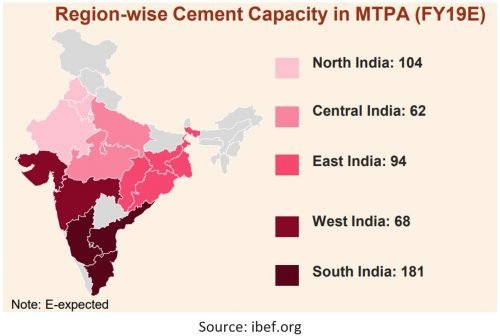

APCL sells its cement under the brand name of “Anjani” and has a dealer network presence across all the 5 southern states and Maharashtra. However, Andhra Pradesh and Telangana contribute more than 70% to the sales of the company.

In the past the management has indicated interest in expanding sales in eastern states like West Bengal and Odisha. Also, depending on the sales traction in the 2 states, to minimize the cost of transportation, the company may consider setting up a cement grinding plant in the eastern part of India.

Uninterrupted raw material supply – Limestone accounts for 60-65% of the raw material cost and its proximity and uninterrupted supply is key to the operations of cement manufacturing.

APCL sources limestone from its captive mines (probable reserves of more than 50 million tonnes) located at a distance of 7.5 km from the cement plant. The abundance, quality and access to limestone, is a key strength of the company.

Power and fuel – The company also has captive thermal power plant with an aggregate capacity of 16 MW.

It commissioned the same in Jan’17 and as per CARE Ratings report, the same accounts for more than 90% of the company’s power consumption.

Coal is the main fuel for manufacturing operations and is required for firing the pre-heater and rotary kiln as well as to generate power for grinding the clinker. In addition, coal is also the main source of fuel for the captive power plant.

The company buys coal from indigenous sources and also uses coal that is bought from Indian companies who in turn import from international markets, specifically South Africa, Australia and Indonesia.

In order to reduce dependence on coal, APCL has been proactively using alternate sources of fuel since the year 2010. Hyderabad and the nearby areas are replete with pharmaceuticals manufacturing companies which generate vast quantities of hazardous waste such as spent carbon, organic liquid and organic solid. This waste is costly to recycle and is difficult to eliminate. The waste generated by these companies is suitable for use in APCL’s manufacturing process as fuel. The pharmaceutical waste is easily available at significantly lower cost.

The alternate fuel has substituted coal to an extent of ~20% of company’s total fuel requirement. Nevertheless, coal still remains its primary source of fuel.

Cement industry – Overview

India is the second largest consumer and producer of cement in the world.

India has a lot of potential for development in the infrastructure and construction sector and the cement sector is expected to largely benefit from it.

Expecting such developments in the country and aided by suitable government foreign policies, several foreign players such as Lafarge-Holcim, Heidelberg Cement, and Vicat have invested in the country in the recent past. A significant factor which aids the growth of this sector is the ready availability of the raw materials for making cement, such as limestone and coal.

Market size – Cement production capacity stood at 502 MTPA in 2018. Capacity addition of 20 MTPA is expected in FY 19-FY 21.

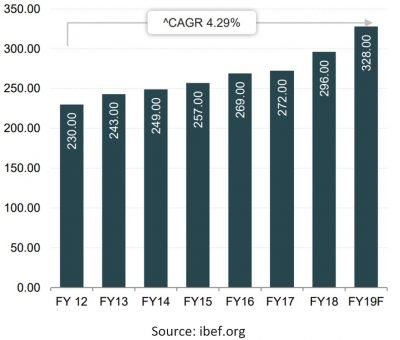

Over the last 6 years the cement consumption in India has recorded 4.3% CAGR. As per one of the reports, due to the increasing demand in various sectors such as housing, commercial construction and industrial construction, cement industry is expected to reach 550-600 MTPA by the year 2025 and record 9.2% CAGR in consumption over 2018-2025.

As per one of the estimates, the per capita cement consumption at 210 kg is currently the lowest among developing countries while the world average is 580 kg. The demand potential for cement in India can be further gauged from the fact that while India produced ~290 MT of cement in FY 18, China produced ~2,370 MT.

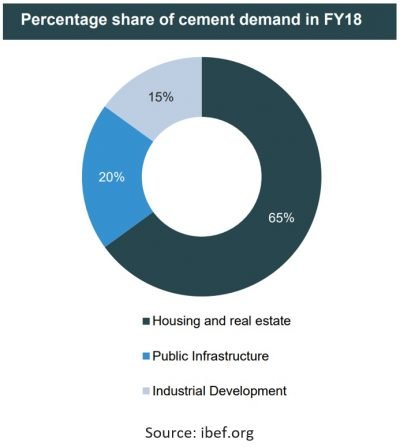

Growth drivers – The demand for cement in India can be attributed to three main sectors viz. Housing and Real Estate, Public Infrastructure and Industrial Development.

The factors that will lead to increase in demand from these sectors include:

Housing and Real estate:

- Government initiatives like Housing for All to push demand in the sector.

- Real Estate market in India is expected to reach US$ 1 trillion by 2023 from US$ 120 billion in 2017.

- Strong growth in rural housing and low-cost housing to amplify demand.

Public Infrastructure:

- Projects like Dedicated Freight Corridors and ports under development.

- Metro rail projects already underway in most major cities.

- Government of India’s push with Smart Cities Mission and AMRUT.

- Road execution speed now at ~ 30 kms/day

Industrial development:

- Recovery in economic growth is expected to lead to growth of CAPEX in the industrial sector and in turn increase in demand in the long run

Promoters/Management

In the year 2014, Chettinad Cement Corporation Private Limited (CCCL) acquired 75% stake in APCL at an enterprise value of ~350 crore.

Chettinad group is one of the prominent business houses in South India with diverse businesses including cement manufacturing, transportation, logistics and supply chain management and construction.

Chettinad Cement Corporation Private Limited (CCCL) the promoter of APCL was incorporated in the year 1962 and has been in operation for more than five decades with presence across all five southern states and Maharashtra. CCCL has installed capacity of 12 MTPA.

The promoter and the Chettinad group companies continue to offer support to APCL in the form of Inter corporate deposits (ICDs), corporate bank guarantees, imported coal requirements, etc.

We consider Promoter holding important from the perspective of skin in the game and it is good to note that at the end of Mar’19 the promoters had 75% stake in the company.

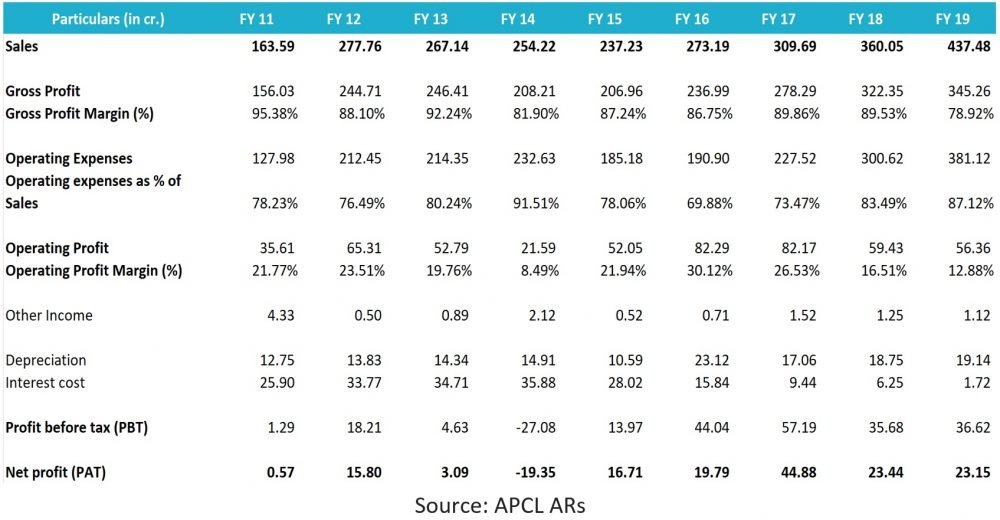

Performance Snapshot

The performance of cement company is dependent on following major factors:

- Capacity utilization of plants

- Pricing and availability of raw material, especially limestone

- Pricing and availability of coal

- Inward and outward freight cost

- Selling price of cement

As far as APCL is concerned, it has access to good quality limestone through its own mines and the same are at a distance of around 7.5 km from the cement plants.

Regarding capacity utilization, since the Chettinad group took over the reins of the company in FY 15, the numbers have been consistently improving and have hit a high of ~85% + capacity utilization in FY 19.

It is believed that the demand growth is likely to sustain and therefore APCL should be able to maintain the current high levels of capacity utilization.

In fact, since Jul’18, APCL has also started trading in cement wherein it procures cement from CCCL and sells it under “Anjani” brand in Tamil Nadu, South Karnataka and Kerala through its own network of dealers and distributors.

The major pain points for the company since the last 2 years have been the freight cost and the power and fuel cost and limited ability of the company to raise prices.

On account of 22% increase in average landed cost of imported coal, the power and fuel cost increased by more than 20% in FY 18 (against 16% increase in sales) while the net cement sales realization (excluding freight cost) declined by 5.5%. The similar story continued in FY 19 with higher power and fuel cost.

In general, it’s been observed that margins tend to be very cyclical in the cement industry and if the demand sustains, the company should be able to pass on the rising costs through increase in prices.

In our view, for a cyclical industry, it is more important as an investor to ensure that one is not buying the stock at potentially peak business earnings.

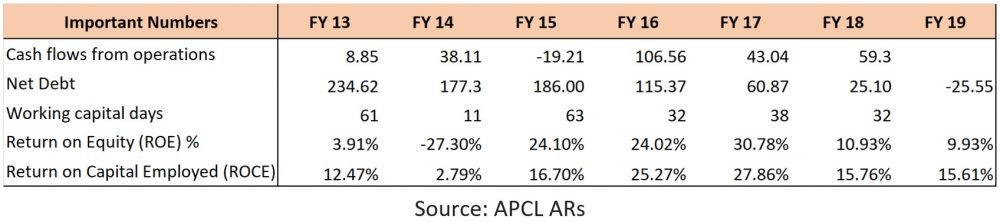

As far as other important numbers are concerned, the company has done well in terms of cash flows, return ratios and overall balance sheet structure.

At the end of Mar’19, the company is debt free and holds surplus cash to the tune of around 25 crore.

Going forward, if the company decides to set up a grinding unit in eastern parts of India, it won’t have to take much debt as it is consistently generating close to 50 crore cash from operations annually.

Valuations

From the above sections we know the following:

- APCL has 1.16 MTPA integrated cement unit, backed by limestone reserves and 16 MW captive power plant

- At the end of FY 19 the company recorded capacity utilization in excess of 85%

- Chettinad Cement Corporation Pvt. Ltd. acquired 75% stake in APCL in 2014 at an enterprise value of ~350 crore. It is important to note here that in 2014 APCL did not possess 16 MW power plant which cost the company ~80 crore in FY 17.

- The company is debt free with surplus cash of around 20-25 crore.

- The company is currently going through a low earnings phase and in the past the company has recorded higher profits, despite higher borrowings and lower capacity utilization.

From the above illustrations we know that it costs around 800-850 crore to set up a greenfield 1 MTPA integrated cement unit.

At around current price of 150-155, the market cap of APCL is 390 crore and with 20-25 crore surplus cash the enterprise value is 370 crore.

Taking conservative estimates, APCL is currently available around 0.42 times replacement cost of ~890 crore (700 crore * 1.16 MTPA + 5 crore * 16 MW).

While larger ones are trading around 0.8 to 2 times replacement cost, we believe the valuations for APCL are really low and the stock can trade around 0.7-0.8 times replacement cost during good times.

Risks/concerns

If the company embarks on a large debt funded capex, the valuation metrics will change.

In case of sustained rise in input costs and lower demand, the profitability and the valuations of the company will be impacted.

Unlike other cement companies, APCL is already running its plant at around 90% capacity utilization and therefore the scope for growth in sales is limited.

Disclosure: I do not have any holding in Anjani Portland Cement Ltd and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No