Dear Members,

We have released 31st Jul’19: FIEM Industries Ltd (NSE Code – FIEMIND) – Alpha/Alpha Plus stock for Jul’19. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 31st Jul’19

CMP – 361.45 (BSE); 361.15 (NSE)

Rating – Positive – 3% weightage; this is not an investment advice (refer rating interpretation)

Introduction

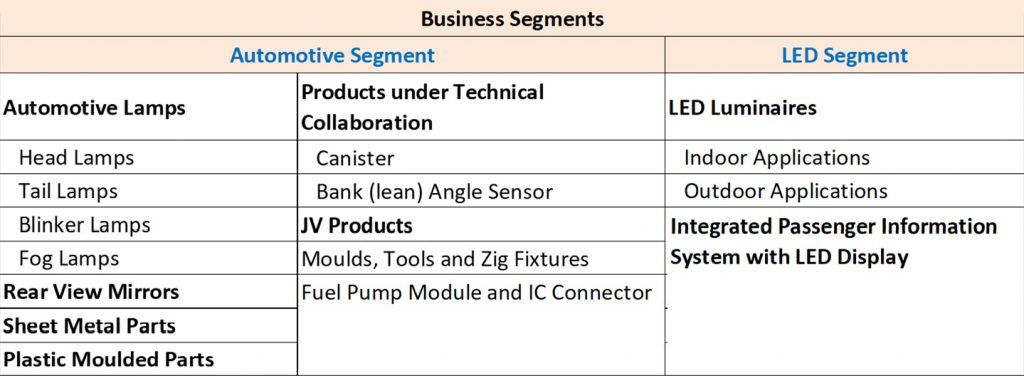

FIEM is one of the leading manufacturers of Automotive Lighting & Signalling Equipment and Rear-View Mirrors in India. It was among the first few companies in India to have introduced LED lights in two wheelers.

It is the 3rd largest player in the Indian automotive lighting market and derives more than 90% of its sales from 2-wheelers (2Ws).

As on date, we like several points about the company and they are as below:

Slowdowns in 2W segment are shorter – The domestic two-wheeler industry sales grew by around 5% in FY 19 at 2.12 crore units.

Source: Edelweiss Automobiles Jul’19 report

The entire automotive industry is going through a slowdown; however past data suggests that slowdowns in 2W segment are shorter (a year or so) and less pronounced.

Transition to LED lighting – Till there’s recovery in volume growth of 2W sales in India, the volume growth for FIEM is also likely to remain impacted; however continued transition from halogen to LED based lamps may help the company sustain double digit revenue growth.

It is important to note here that in case of 2Ws, the LED headlamps are 2-4x costlier than traditional lamps.

Expanding product portfolio – The company wishes to garner a large share of OEMs wallet and has been expanding product portfolio through JVs and tie-ups. In 2018, the company formed a JV with Aisan Industry Co. Ltd., Japan and Toyota Tsusho India Pvt. Ltd. for manufacture of Fuel Pump Module and IC Connector for Indian Market and its new client Bajaj Auto.

Similarly, the company has signed another technical assistance agreement for manufacturing of Bank Angle Sensor for Indian market.

Besides, it has set up design centre in Italy and formed a JV in Hong Kong for high class moulds/ tools for Automotive and other applications.

Promoter buying – Since the start of the calendar year 2019, the promoters of the company have bought (from open market) 3.90 lakh shares of the company worth Rs 17.80 crore.

The average price of their purchase is around Rs 455/- per share.

With these purchases, their stake in the company has increased by 2.94% to 66.54% at the end of Jun’19 quarter.

Low valuations – In the last one and a half years the broader markets have corrected sharply. FIEM too has corrected sharply from the peak of 1,450 to around current levels of 360-380.

The stock is currently trading around 8.5 times trailing twelve months earnings.

Looking at the history of the company, the current valuations are much closer to historical lows of 7.5-8 times earnings recorded by the company in 2012-13.

On a more consistent basis, the stock has traded in the range of 15-20 times earnings.

Basic details

FIEM was founded and incorporated by Mr. J.K. Jain in 1989. The company got listed on Indian bourses in 2006.

It is one of the leading manufacturers of Automotive Lighting & Signalling Equipment and Rear-View Mirrors in India. It also supplies plastic moulded parts and sheet metal components to various OEMs.

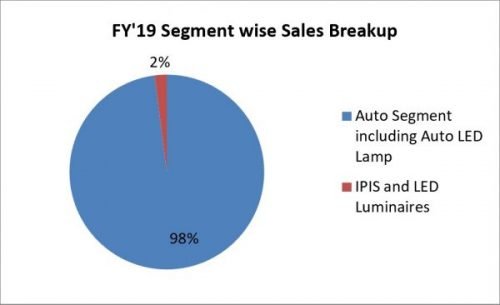

The company also has a separate LED segment for indoor and outdoor applications; however, the same accounts for only about 2% of the sales of the company.

Source: Company Presentation

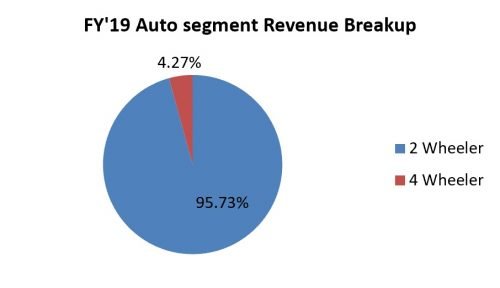

Source: Company Presentation

It is important to note here that within Auto segment sale, 2Ws account for more than 95% of the sales of the company.

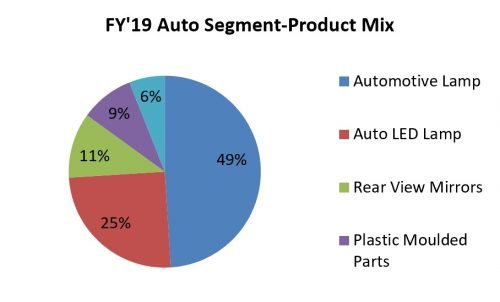

Source: Company Presentation

If we go into further bifurcation of Auto segment sale, we can notice that Automotive lamps and Auto LED lamps account for 74% of the sales of the company and the remaining comes from rear view mirrors, plastic moulded parts and others.

Source: Company Presentation

What is interesting to note is that Auto LED lamps contribution to total automotive lamp sales has increased to 34% (25% of total auto sales) from 15% in FY 18. Considering increasing penetration of LED content in automotive lighting, management is hopeful of Auto LED lamps contribution increasing to 50% in next 2-3 years.

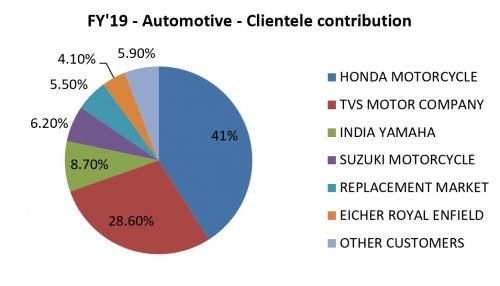

Client-wise revenue contribution – Major clients of the company include:

2W – Honda, TVS, Yamaha, Suzuki, Eicher Royal Enfield, Harley Davidson, Mahindra etc.

4W – Tata Marcopolo, Force Motors, Honda Siel, Hyundai, Daimler, Mahindra Reva etc.

However, Honda Motorcycle (HMSI) and TVS Motor company account for ~70% of the automotive revenue segment of the company. While the contribution from HMSI has come down from 45-46% in FY 18 to 41% in FY 19, revenue concentration is still high.

Source: Company Presentation

The revenue contribution from Yamaha and Suzuki has been increasing

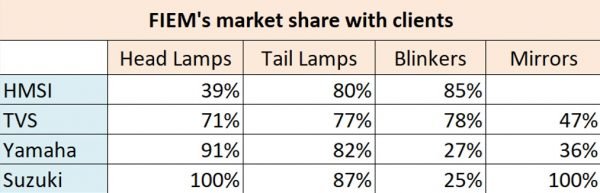

FIEM accounts for dominant market share with its key OEMs.

Source: Company Con-call

Below, we have shared the sales volume of all the major clients of FIEM. For Suzuki and Yamaha, only the domestic sales units are available and we have mentioned the same.

As can be noticed from the table, all the major clients of FIEM have been recording steady growth in volumes and account for almost 50% of the domestic sales volume combined.

Source: SIAM, Katalyst Wealth Research

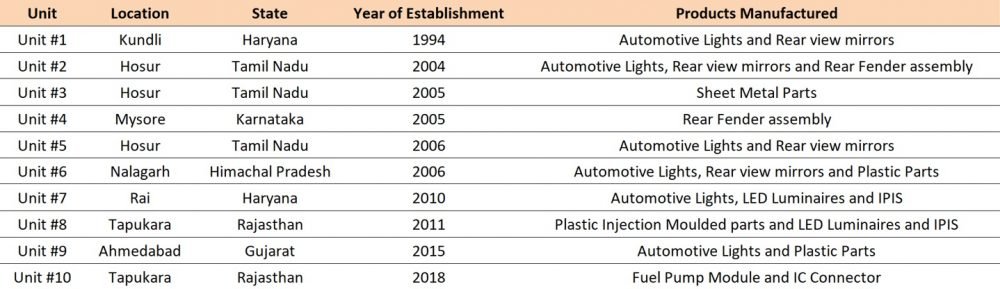

Manufacturing units – One of the best ways to grow business is to be where the customer is.

Source: Company Annual Report

In line with the same theory, the Company has established ten manufacturing facilities across India comprising ultramodern infrastructure with state-of-the-art technology and automation. These facilities are situated near OEM customers and facilitate logistic cost savings and just-in-time delivery.

Growth drivers – Overview

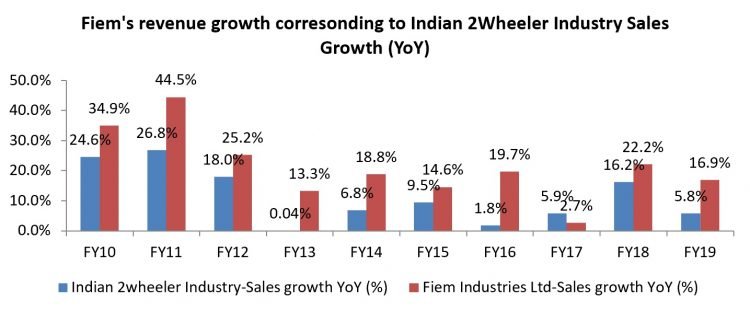

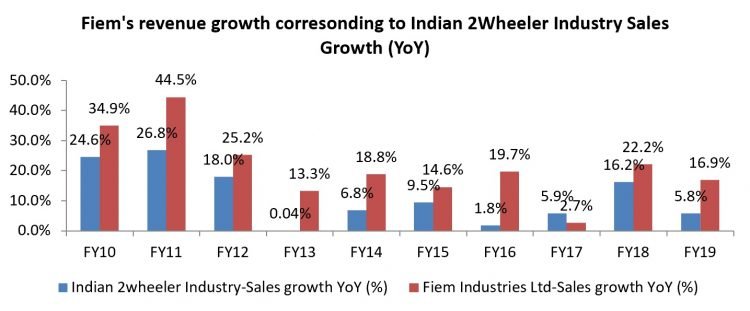

Over the years, FIEM has consistently outperformed 2W industry sales growth.

Source: SIAM, Katalyst Wealth Research

While growth in sales volume of 2Ws is the major driver of growth for the company, we believe, even in the absence of the same, continued LED transition will drive the revenue growth and margin expansion for the company.

Besides, increasing share of customer’s wallet through launch of new products is also likely to help FIEM sustain double digit growth rate.

LED lighting demand – The present market share of LED Lamps in the domestic 2W industry is low at around 15-20%. The increasing usage of LED lighting is evident from its growing demand from all the two-wheeler players.

Despite the fact that LED lamps cost 2-4x the normal halogen lamps, LED adoption has started gaining momentum owing to several benefits such as high energy-efficiency, higher luminosity and longevity and high flexibility in designing and aesthetics.

The increasing LED adoption by OEMs has widened opportunities for FIEM. Since LED lighting solutions are dearer than conventional variants, they can also generate superior margins for the company.

What is driving the growth of LED adoption in automotive lights – Regulations, aesthetics, energy efficiency and longevity are the key factors driving the growth of LED lamps in Indian automotive market.

Considering rising number of road accidents, the Indian government came out with the Automatic Headlamp On (AHO) regulation. The same was made compulsory for 2Ws from Apr’17.

To keep the cost low, initially OEMs removed the headlamp switch from new 2W models, enabling lights of the headlamp to be on at all times. However, conventional lamps consume a lot of power (even on low beam) and in turn drain the battery.

To counter the same, some of the new models are being launched with energy-efficient LED DRLs (day-time running lights) and this trend is likely to sustain. What makes LED DRLs even more important is that they increase the aesthetic value of the model.

Another important step is BS-VI implementation from 2020. To restrict fuel-economy drop in BSVI petrol variants, the role of LED lighting is likely to become even more important.

Most importantly, even the adoption of Electric Vehicles will be beneficial for automotive LED lamps segment. Lower power consumption is an important consideration in electric vehicles and here too LED lamps will be more effective.

Advantages of LED Lamps over conventional lamps

- LED lighting is 5x more efficient, reducing fuel consumption in petroleum vehicles and extending longevities of electric vehicles

- LED lighting promises 10-50x longevity compared to traditional sources

- LED lighting output remains more or less constant over time

- LED lighting is less fragile compared to ordinary light bulbs

- LED lighting offers clear and consistent shade of white light over time

FIEMs positioning in automotive lighting market – As per one of the reports, FIEM Industries is the largest player in the 2-wheeler automotive lighting segment along with being the third largest player in the overall automotive lighting market with ~13% market share.

Unlike other major players like Lumax, Minda, etc, FIEM is completely focused on 2W industry and supplies products to the likes of Honda, TVS, Yamaha, Suzuki, Harley Davidson, etc.

FIEM also exports lighting components to Honda Japan, and supplies to Honda Thailand and Honda Vietnam through Honda trading.

Source: Company Presentation

FIEM started its automotive LED lamp journey in early 2000 and it did so on the back of its in-house R&D. With an early-mover advantage, it commands significant market share of lighting components from its key customers and is likely to continue gaining on the back of LED lamps adoption over conventional lamps.

The company has been making the most of the various technological advancements witnessed in the automotive sector and has been increasing the integration of lighting products into vehicle styling, which provides wider opportunities for product development.

New Product development – Another small, though important development taking place at FIEM is the foray into new products.

Fuel Pump Module and IC Connector – The company has entered into a JV with Aisan Industry, Japan and Toyota Tsusho India to manufacture Fuel Pump module and IC Connector for 2Ws and 3Ws. The total investment in the JV is Rs 100 crore and out of the same FIEM has invested Rs 26 crore for 26% stake.

Fuel Pump module is basically a BS-VI application product and the company has secured orders from Bajaj Auto for the same.

During FY 20, the company expects sales of around Rs 50-60 crore from the same while the full capacity utilization is expected in FY 21 with sales of Rs 200 crore. The JV may further double the capacity in FY 22.

Bank Angle sensor – FIEM has signed a ‘Technical Assistance Agreement’ with TOYODENSO Co., Ltd., Japan and Toyota Tsusho Corporation, Japan for manufacturing of Bank Angle Sensor for Honda motorcycles for the Indian market.

Bank Angle Sensor is a safety sensor, which is being increasingly applied by OEMs in motorcycles and will have an increasing market in India. It switches off the fuel supply to the engine of motorcycle as a safety measure if the bike tilts over its prescribed limits and tends to tip over.

Canister – FIEM has also signed a ‘Technical Assistance Agreement’ with Aisan, Japan and Toyota Tsusho, Japan for manufacturing of Canister (part of evaporative emission control system).

Currently, the company is supplying the same to TVS and is expecting many more customer additions for the same.

Overall, as mentioned above, FIEM is looking to increasingly get a higher share of OEMs wallet through launch of new products.

Promoters/Management

FIEM was founded by Mr. J.K. Jain in 1989 and he is the Chairman and Managing Director of the company.

He is a first-generation entrepreneur and is in the automotive lighting business since 1970’s.

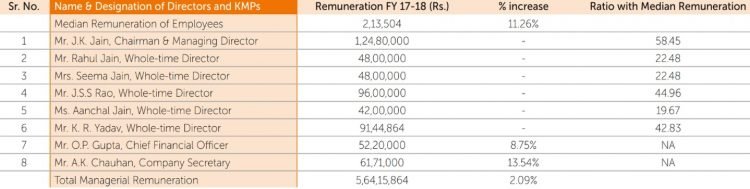

Like most of the owner operated businesses in India, Mr. J. K. Jain’s son and daughter have also been inducted into the business and are part of the Board of Directors.

What is good to note is that besides the family members, there are two other whole-time directors who have been on the board of the company since mid-2000 and are paid salary at par with Mr. J. K. Jain.

Source: Company AR FY 18

On the front of related party transactions, there’s nothing eye-popping except for one purchase of free-hold land worth Rs 12 crore from Mr. Rahul Jain (Whole time Director and Mr. J. K. Jain’s son) in FY 17.

As far as shareholding pattern is concerned, promoters hold more than 65% stake in the company at the end of Jun’19.

Source: bseindia.com

At the end of Mar’16 the promoters had ~70% stake in the company, however the same reduced to 63.59% after the company raised Rs 120 crore through QIP in Sep’16.

What is interesting to note is that in the last 7 months the promoters have increased their stake in the company from 63.59% to 66.54%. As per the records available with us, since the start of Jan’19 the promoters have bought 3.91 lakh shares at a total consideration of Rs 17.81 crore through open market. The average purchase price for the transactions works out to around Rs 455/- per share.

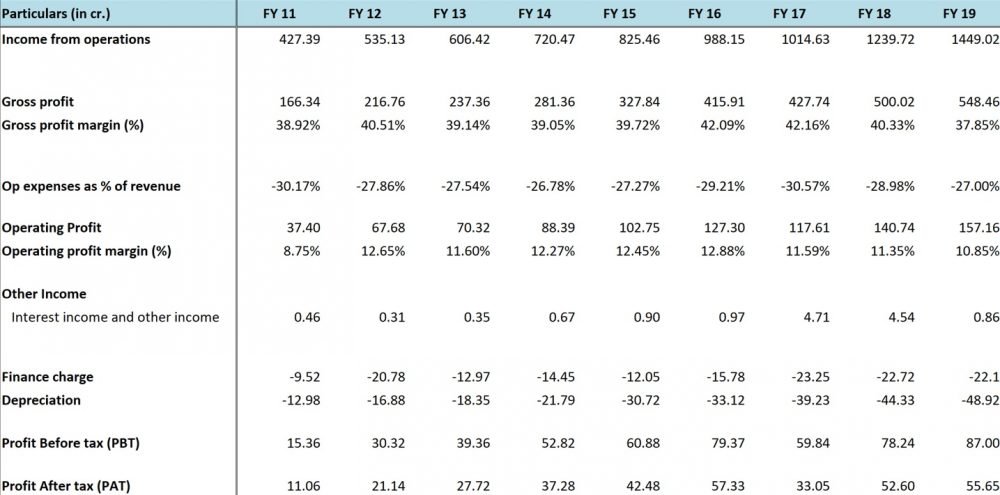

Performance Snapshot

Source: FIEM ARs

FIEM has been a consistent performer over the years. While there have been few years of only 5-6% growth in sales of 2Ws in India, barring FY 17, FIEM has outperformed industry growth rate by a reasonable margin.

Source: SIAM, Katalyst Wealth Research

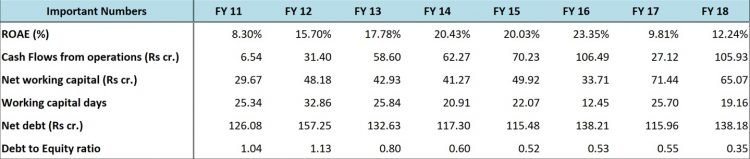

The company has done well not just in terms of sales growth, but also in terms of maintaining its operating expenses and passing on changes in raw material costs to its customers.

The gross margins have consistently been maintained around 40% and similarly the EBITDA has been maintained around 11-12%.

Source: FIEM ARs

Another notable feature of company’s performance is that its interest cost hasn’t changed much over the years, despite ~200% increase in scale of operations and doubling of fixed assets through addition of new manufacturing units.

The above can be attributed to consistently high cash flows from operations. It’s important to note that in the above figures we have reduced the interest expense and added back other income.

What is good to note is that even if we deduct the cost of depreciation, the company has still generated positive cash flows from operations and the same has helped the company keep the debt in check.

ROAE saw a dip in FY 17 to less than 10% as the company raised Rs 120 crore through QIP and the profits also contracted on account of flattish sales and losses in LED luminaire division.

It is important to note here that management has decided to stop any further investment in LED luminaire division and intends to focus completely on 2W division. The LED luminaire division contributed only Rs 29 crore to the top-line of the company in FY 19.

Valuations

From the above sections we know the following:

- FIEM is one of the largest players in the 2W automotive lighting market with strong focus on LED lamps.

- The company boasts of marquee clients like HMSI, TVS, Yamaha, Suzuki, Harley-Davidson, etc.

- The company accounts for dominant share of lighting business with its key OEMs.

- Barring FY 17, FIEM has consistently outperformed 2W industry sales growth by a wide margin.

- The present market share of LED Lamps in the domestic 2W industry is low at around 15-20%; however, the adoption of LED lamps is gaining grounds on account of both regulatory requirements like AHO, BS-VI, etc and on account of aesthetic value.

- LED lamps cost 2-4x the cost of conventional lamps and therefore even in the case of muted 2W sales growth, increasing adoption of LED lamps by OEMs should drive revenue growth for FIEM.

- FIEM is also looking to increasingly get a higher share of OEMs wallet through launch of new products like Fuel pump module, bank angle sensor, canister, etc.

- Promoters hold more than 66% stake in the company and bought more than 3.9 lakh shares in CY 19 at an average price of around Rs 455/- per share

At around current price of 360-380, the market cap of FIEM is 480 crore and the enterprise value is around 610 crore. Thus, the stock is currently trading around 8.5 times trailing twelve months earnings, 8.4 times EV/EBIT(1-t), 3.82 times EV/EBITDA and around 0.96 times book value.

Over the last 10 years, the lowest the stock has traded at is around 7.5 times earnings, 1.2 times book value (prior to the ongoing correction) and around 4.2 times EV/EBITDA.

While the ongoing slowdown in 2W industry is severe, we believe the market is already discounting the same to a large extent. Further, considering the facts that FIEM may remain immune to the slowdown to some extent and may also gain from EV transition, we believe it might be a good time to add on to the stock.

Risks/concerns

As already pointed out, the ongoing slowdown in auto industry is severe and if the volumes plummet further, both the earnings and valuations of FIEM can get impacted.

Like most of the auto-components supplier, FIEM also gets bulk of the revenue share from two key OEMs: Honda and TVS and the same poses multiple risks for the company like: slowdown at key OEMs, reduction in market share with key OEMs, etc.

FIEM has developed automotive LED lamps on its own while most of its competitors have foreign partners. While the same doesn’t seem to have impacted its growth in the LED lamps segment, the company might get impacted if competitors are able to develop better products and win the confidence of the OEMs.

Disclosure: I do not have any holding in FIEM Industries and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No