Dear Readers,

Hope you are doing well.

I think you may already be aware that Govt. has slashed effective corporate tax rate to 25.17% for domestic companies from around 34.9% earlier.

Previously, the Govt. had reduced effective tax rates on companies with turnover up to Rs 400 crore to 29.12%; however, even those will now be taxed at 25.17%

Seemingly, it looks like a great move and will make the Indian companies more competitive with tax rates now comparable with tax rates in other manufacturing hubs.

Assuming status quo, i.e. tax base doesn’t widen, growth rates do not improve, the Govt. will lose revenue of around Rs 1.45 lakh crore; however, macroeconomics is hardly as simple as it seems and there could be 2nd, 3rd order effects which could reduce the losses or could prove to be revenue accretive for the govt. in medium to longer term.

Conventional thinking suggests that when tax rates are reduced, the compliance and thereby the tax base widens. Similarly, higher profits with companies could spur the investments and the demand, unless of course companies decide to hoard all the surplus profits.

All said and done, market has responded positively and rightly so because all else remaining same, the PAT for companies in highest tax bracket is going to increase by ~15%.

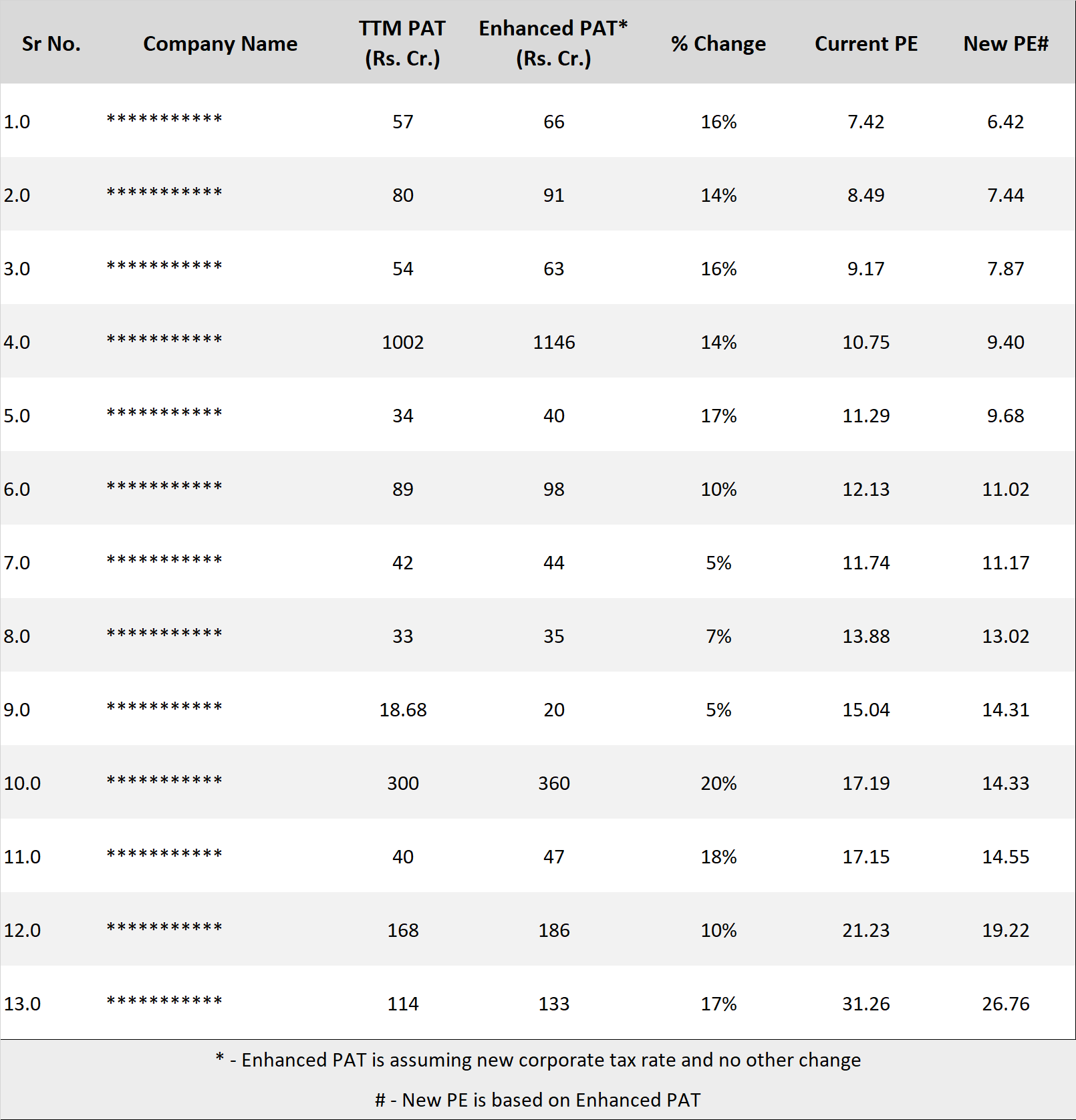

As far as stocks under our coverage are concerned, the following are paying more than 25.17% tax at present and will benefit from slashing of corporate tax rates.

Below, we have compiled the details in terms of change in PAT (assuming everything else remaining equal) and change in PE (assuming current prices):

Source: Katalyst Wealth Research

As can be noted from the illustration, the effective increase in PAT is 14.63% and despite the run up in some of the stocks on Friday, 20th Jul’19, the valuations have become even more attractive.

As most of them have regular capital needs, the additional profits will only strengthen the balance sheets and will help the companies carry out CAPEX through internal accruals itself. In others, we expect increase in dividend payout.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]