Dear Members,

We have released 29th Sep’19: Chaman Lal Setia Exports Ltd (BSE Code – 530307) – Alpha/Alpha Plus stock for Sep’19. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 29th Sep’19

CMP – 46.25 (BSE)

Rating – Positive – 3% weightage; this is not an investment advice (refer rating interpretation)

Introduction

In Nov’16 we recommended Chaman Lal Setia Exports (CLSE) at around 60 odd levels and closed it in Dec’17 at around 150 odd levels.

At the time of closure, despite liking CLSEs focus on efficient working capital management, we were apprehensive about higher valuations of 20 times earnings for a commodity business. Since then, the stock has corrected from highs of 200 odd levels to around current levels of 40-50.

We believe, the stock offers a decent opportunity around current levels as the valuations look low on seemingly depressed earnings and the fact that a lot of existing players may go down under in the wake of export related issues to countries like Iran and Saudi Arabia and general avoidance of extending credit to highly leveraged companies.

Basmati rice industry has seen collapse of several listed players and all of them were highly leveraged and had working capital issues. What we like the most about CLSE is its differentiated approach to business and focus on maintaining an asset light balance sheet.

Basic details

Promoted by Chaman Lal Setia, Vijay Setia and Rajeev Setia, Chaman Lal Setia Exports Limited (CLSE) was incorporated as a partnership firm in 1975, under the name Chaman Lal & Sons.

In 1995, it went public under its present name to finance the expansion and modernisation of the units.

CLSE is engaged in the business of milling, processing and trading of basmati rice.

The company has a paddy unit in Karnal (Haryana) and Amritsar (Punjab) with a rice processing capacity (including both milling and sorting) of 14 tonnes per hour.

The company also has a rice grading and sorting facilities in Amritsar (Punjab) and Kandla (Gujarat).

CLSE derives its revenue primarily from one segment i.e. sale of basmati rice. Besides purchasing paddy and processing at its own unit, the company is also engaged in procurement and sales of semi-processed rice.

The company’s product range covers raw, steamed and parboiled rice. The company also has innovative products in its portfolio i.e. diabetic’s basmati rice, pesticide-free basmati rice, etc.

Export of Basmati rice accounts for 85-90% of the turnover of the company. Out of the same around 30-35% sales are in own brands like ‘Maharani’, ‘Begum’, ‘Shaan’, ‘Royal India’ and ‘Mithas’ and the remaining in the form of private labels (packaging done under customers’ brand name).

Exports are further diversified across the countries such as USA, UAE, Mauritius, Saudi Arabia, Malaysia, Kuwait, New Zealand, Australia and Singapore, among others.

As per the management, no single country accounts for a very large share of exports as the company has been exploring markets outside the traditional Middle Eastern countries.

CLSE doesn’t export to Iran even though Iran along with Saudi Arabia accounts for 50-55% of basmati rice exports from India.

The domestic sales are only around 10-15% and largely through own brands. At the moment the management intends to focus more on exports and may look at domestic markets 1-2 years down the line.

Source: https://www.setiagroups.com/

CLSE is recognized as a star export house by the Government of India and is also accredited with ISO 22000:2005, HACCP and FDA (USA), Kosher, FSSAI certifications.

The company is focused on carrying out R&D, though not in a very big way. In the past the company has come out with products like: Maharani Rice with Low Glycemic Index suitable for Diabetics and Bhathi Sella Rice (Roasted Parboiled Rice).

While CLSE stresses on research in the field of processing of rice, we believe the real research is being done by Indian Agricultural Research Institute (IARI) in developing new varieties of Basmati Rice like: PUSA 1509, PUSA 1718, etc.

Basmati rice industry – Overview

After wheat and maize, rice is the world’s third principal staple food and is cultivated in more than 113 countries. Rice is one of the most crucial food crops in the world and a staple diet for nearly half the global population. Over 90% of the global rice output and consumption is centred in Asia, wherein the world’s largest rice producers, China and India, are also the world’s largest rice consumers.

There are two varieties of rice: Indica and Japonica. Basmati is an Indica variety.

Indica rice is long-grain rice and is usually grown in hot climate. This rice is fluffy and doesn’t stick together on cooking. Japonica is a short-grain variety of rice (fat and round grain) which is mainly characterized by its unique stickiness and remains moist, which helps it to be eaten with chopsticks.

Rice can be consumed in three forms i.e. white rice, brown rice and parboiled rice. White rice is the polished rice because both the outer layers i.e. husk and bran is removed. In brown rice only the husk is removed while the bran layer remains.

Parboiled rice undergoes an additional process of boiling and steaming to capture the nutritive value of bran in the rice. Parboiled rice has good demand in Middle East.

Basmati rice – Basmati rice accounts for ~2-3% in terms of volumes of the global rice industry. India accounts for over 70% of the world’s basmati rice production and the rest is accounted for by Pakistan.

Basmati is unique to the region. It can be grown where precise climatic conditions; soil quality and temperature exist and this only occurs in the Indo- Gangetic area of the Himalayas. It is also legally protected as a trade name. “Basmati” is protected under “The Geographical Indications of Goods (Registration & Protection) Act, 1999” of India, which prevents any rice grown outside of the Indo Gangetic area from being called Basmati.

Basmati rice constitutes a small portion (<10%) of the total rice produced in India; though by value it accounted for 60% of India’s total rice exports in FY 19.

PUSA 1121 (PB1121) – There have been various varieties of Basmati notified under the Seed Act, 1966. PUSA 1121, which was developed in FY04, was in FY11 notified by the Government of India as a Basmati variety.

PUSA 1121 has significantly altered the supply dynamics of the industry. Its share in total Basmati paddy cultivation is now more than 65% and has cannibalized other Basmati varieties and expanded the segment. PUSA 1121 has significant advantages over traditional varieties of Basmati.

The other approved Indian varieties include Dehradun, P3 Punjab, 386 Haryana, Kasturi (Baran, Rajasthan), Basmati 198, Basmati 217, Basmati 370, Bihar, Kasturi, Mahi Suganda, Pusa 1121, Pusa 1509 and PUSA 1718.

According to official estimates, PB1121 was grown in around 10 lakh hectares of land, of the total basmati acreage of around 15 lakh hectares in the key growing states last year. The short-duration variety PB1509 was grown in around 3 lakh hectares and the new PB1718 in around 1 lakh hectares. The traditional variety of basmati was grown in less than 1 lakh hectares during last year’s kharif season.

PUSA 1718 (PB1718) – This new basmati variety, which draws its parentage from the widely-grown PUSA 1121 (PB1121) has been endowed with two extra genes to fight the bacterial leaf blight disease, thus preventing lodging, besides increasing the yield.

Notified in 2017 by the agriculture ministry, PB1718 is gradually being accepted by farmers across Haryana and Punjab—the key aromatic and long-grain rice-producing regions of the country.

As per one of the reports, farmers who grew this new variety in the previous kharif season (2018) claimed that the yield increased to around 25 quintals per acre, as against around 18 quintals achieved for the widely-grown PB1121.

As per one of the experts, there are no effective pesticides available to deal with the bacterial leaf blight disease in PB1121 variety; however, PB1718 overcomes the problem.

PUSA varieties creating level playing field – Earlier, certain rice processors were known for their ability to select finer quality paddy out of the traditional Basmati varieties, but that advantage is no longer relevant as most Basmati being grown is PUSA 1121. Whatever limited product differentiation existed are slowly being eroded due to increasing homogeneity of Basmati.

Ageing of Basmati – While there are companies like KRBL, L T Foods that have created brands like India Gate, Daawat, etc on the premise of ageing of rice and sell their products at some premium to other brands; as per the management of CLSE, ageing was of significance for traditional basmati and doesn’t hold much significance in case of PUSA.

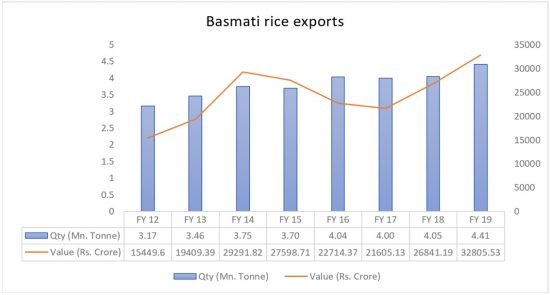

Basmati Exports – India’s Basmati rice exports increased at an astounding CAGR of 26% from Rs 2,824 crore in 2004-05 to Rs 27,598 crore in 2014-15.

Source: APEDA Agriexchange, Katalyst Wealth Research

Over the next 2 years i.e. from 2014-15 to 2016-17 exports dropped from Rs 27,598 crore to Rs 21,605 crore and then grew again at the rate of 23% CAGR to reach Rs 32,805 crore in FY 19.

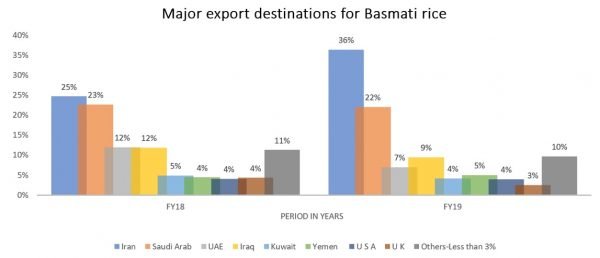

While basmati rice is consumed across the globe, West Asian countries account for ~75% of Indian basmati rice exports. Within West Asia, Iran and Saudi Arabia are the two largest buyers, together accounting for over 50% of basmati rice exports from India.

Source: APEDA Agriexchange, Katalyst Wealth Research

Some concerns around Basmati rice exports – Even as Basmati rice exports registered strong growth in FY 19, there is some uncertainty over level of imports by Iran in the light of ongoing trade sanctions; and tighter pesticide residue norms continuing to weigh on exports to European Union (EU). Also, some changes in import policies proposed by Saudi Arabia are likely to come into effect by the end of the year.

As far as Iran is concerned, the reserves (receivables against crude oil exports to India done earlier) being utilised by Iran for paying for its Basmati rice imports are declining with crude oil imports by India from Iran being discontinued since June 2019. This enhances the uncertainty on future trade with Iran, considering the ongoing trade sanctions.

While some comfort can be drawn from the fact that basmati rice forms a large part of the staple diet of Iran and Saudi Arabia; however, any considerable decline in level of imports by these countries can have a depressing impact on basmati rice prices and exert pressure on the industry participants.

New markets are opening – With Iran, the issues have been ongoing. In 2014-15, the country imposed a ban on basmati rice imports from India, citing its own healthy rice crop and large basmati inventory.

Saudi Arabia has been a steady partner in that sense, accounting for 22-27% of Basmati rice exports from India over the last 4 years.

The major factor that works in favour of Saudi Arabia is that it has no domestic rice production and the country depends fully on imports. Also, Saudi nationals include rice as a major part of their daily diet with Basmati being the most popular rice variety.

New markets like Japan, Korea, Australia, New Zealand, Indonesia, etc are opening up; however, their overall contribution is still low. USA, UK have also been maintaining their market share at around 4% each.

As per one of the reports, Basmati rice accounts for about 38% of total rice consumption in the Middle East, 4.4% in Europe, 1.3% in the US and 1.2% in Asia.

Promoters/Management

Chaman Lal Setia Exports is an owner operated business with Mr. Chaman Lal Setia and his sons Mr. Vijay Setia and Mr. Rajeev Setia at the helm of the affairs of the company.

Mr Vijay Setia is an Ex-President of All India Rice Exporters Association. Regd. (AIREA), Delhi. He has also worked with M/s. Gerson Lehrman Group as a consultant in the field of Food Technology for having in-depth knowledge of the subject.

The company has also seen induction of 3rd generation promoters with Mr. Ankit Setia and Mr. Sankesh Setia taking keen interest in the operations of the company.

As per Mr. Rajeev Setia, both Ankit and Sankesh have been exploring the export opportunities in a big way and have been adding customers in new countries.

Overall, the promoters have run the company well and much more efficiently than some of the larger listed peers.

The promoters own more than 70% stake in CLSE and therefore their interests are directly aligned with those of shareholders. They have also extended long term deposits worth more than Rs 40 crore to the company and on the same they charge interest of 12% p.a.

What is also interesting to note is that CLSE has been consistently paying dividends since 1996 (barring 2002). For a small company like CLSE, we see this as a positive sign.

On the front of related party transactions, there’s nothing eye-popping except for one lease rent of Rs 1.94 crore to sister concern AVN Group.

Performance Snapshot

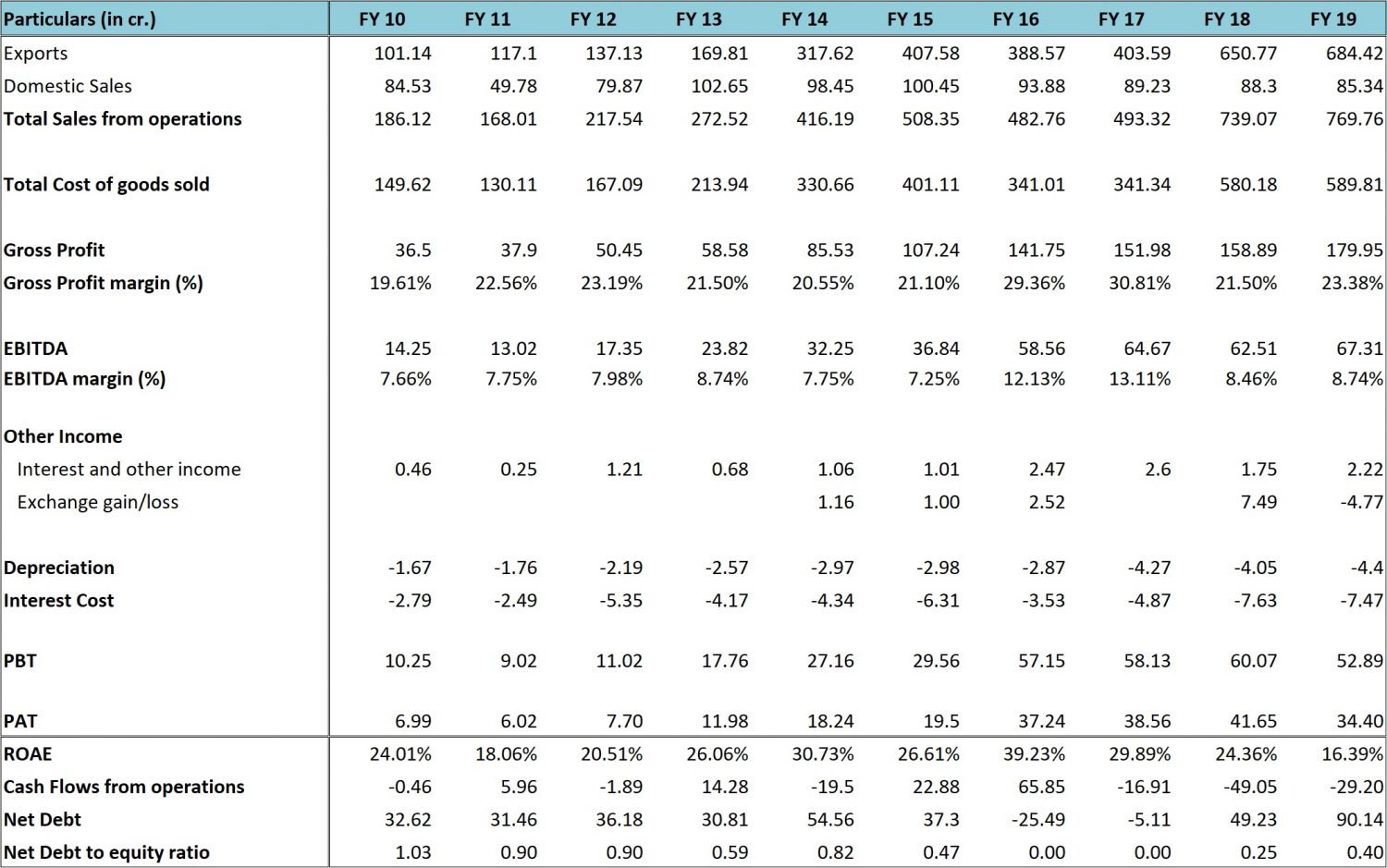

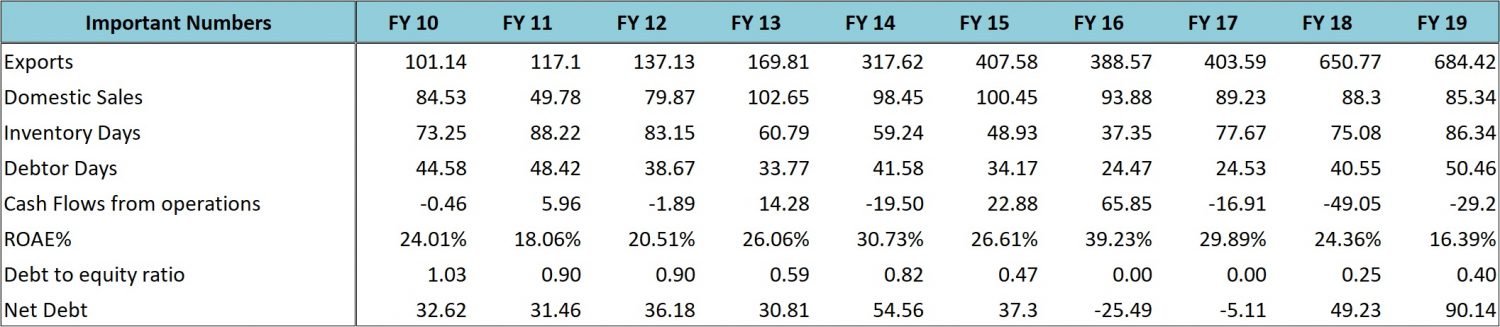

Source: CLSE ARs, Katalyst Wealth Research

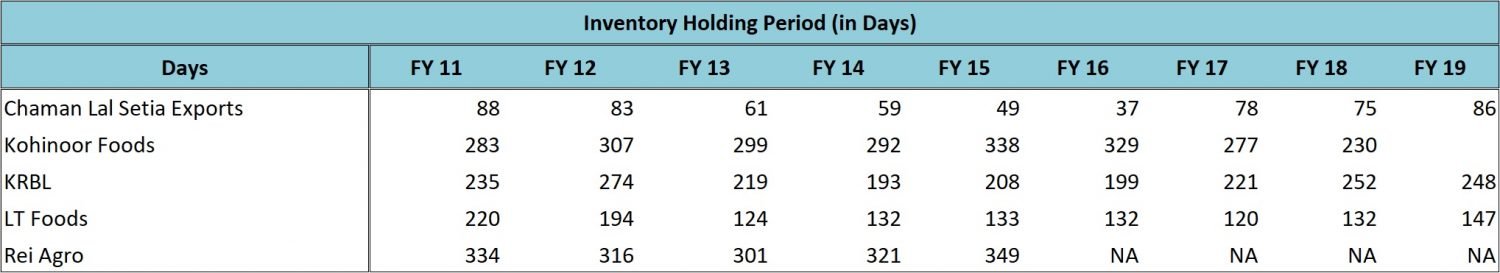

Processing and trading of basmati rice has seen several companies go bankrupt on failing to efficiently manage working capital and leverage on the balance sheet. Within the listed space as well, companies like Usher Agro, REI Agro, Kohinoor Foods, etc have either gone bankrupt or are on the verge of the same.

Companies like KRBL, L T Foods have created brands like India Gate, Daawat, etc on the premise of ageing of rice and command premium pricing for their export and domestic sales; however, at the same time they carry significant amounts of inventory on their balance sheet.

Source: Katalyst Wealth Research

As per the management of CLSE, ageing was of significance for traditional basmati and doesn’t hold much significance in case of PUSA and therefore unlike other players, they don’t believe in carrying significant amounts of inventory.

Thus, CLSEs focus has primarily been on trading of basmati rice and as a result it hasn’t expanded capacity, nor does it carry too much inventory on its books. In fact, the core focus of CLSE is marketing and the management has been trying to expand in both existing markets and looking for new geographies.

The only space where CLSE has expanded capacity is packing facility. As per the management, they have all kinds of packing available: half a kg, 1 kg pouch, 2kg jars, 5kg bags, conventional bags, one-time bags, etc as buyers in different countries have different requirements.

Contraction in Margins, increase in working capital – Since the last 2 years or so CLSEs margins have again contracted back to 8-9% EBITDA against 12-13% in FY 16 and FY 17 and at the same time the March ending working capital has also expanded.

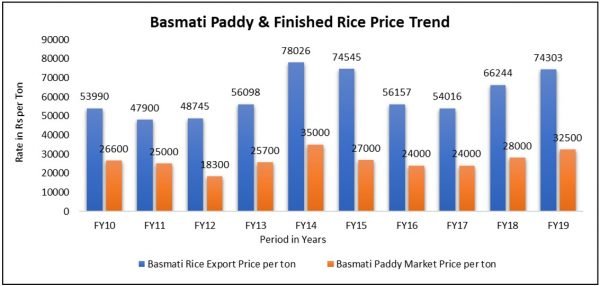

Below, we have shared the Basmati paddy prices (mandi) and export realizations per ton.

Source: APEDA Agriexchange, Katalyst Wealth Research

Taking into account the reported performance of the company for the last 10 years and the paddy and the export prices, our observation is that whenever the prices increase the working capital requirement of the company goes up.

Another important observation is that when paddy and rice prices go down, the gross margins of the company expand, case in point: FY 12, FY 16 and FY 17.

Going forward, considering the uncertainty around exports to Iran and expected good crop of Basmati paddy, the prices are likely to see some contraction. So, though sales growth might be muted, CLSE may start report improvement in margins and working capital.

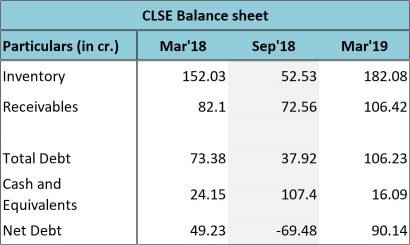

Seasonality in Balance sheet – Owing to the seasonality of rice harvest (October to December), the procurement of raw material goes up in the 2nd Half of the financial year and as a result the inventory and the debt is much higher at the end of the financial year than during the whole financial year.

Source: CLSEs BSE filings, Katalyst Wealth Research

As can be seen from the above illustration, at the end of H1 FY 19 (Sep’18), the company was cash rich with ~70 crore of surplus cash.

Similarly, as per the latest credit rating report of CARE, CLSE had cash balance and liquid investments of Rs 99.33 crore on 21st Jul’19.

Source: CLSEs ARs, Katalyst Wealth Research

As can be seen from the above illustration, in an industry where the mortality rate is high, CLSE is not only surviving, it has been performing reasonably well by adopting a differentiated approach of trading and not necessarily trying to establish a brand based on the ageing of rice.

As a result, the company has been consistently doing well on various metrics like working capital management, leverage and return on equity.

Valuations

From the above sections we know the following:

- Basmati rice can be grown only in India and Pakistan with India accounting for 70% market share

- Basmati rice industry has high mortality rate with several listed companies having gone bankrupt

- The primary reason for bankruptcy seems to be fixation with ageing of rice and maintaining high level of inventory and thereby debt

- CLSE rightly considers Basmati rice a commodity and follows a differentiated approach of trading in the same than focusing excessively on manufacturing and ageing

- The company is largely focused on exports and has been actively seeking new geographies. The company doesn’t export to Iran, even though Iran accounts for the largest share (~30%) of Basmati rice exports from India

- Overall, CLSE has less than 2% share in Basmati rice exports from India and could probably capture higher market share with the collapse of other companies

- The promoters of the company have long standing experience with 3rd generation joining the business

- Their interests are directly aligned on account of more than 70% stake in the company and the fact that they have extended loans of more than Rs 40 crore to the company

- Despite the twists and turns in Basmati rice exports from India and substantial changes in paddy and rice prices, the company has been quite consistent in terms of maintaining its sales and profitability

- Unlike its peers, CLSE has consistently done well on metrics like working capital management, leverage, return ratios, etc

- Last, but not the least, CLSE has been paying dividends since 1996 (barring only 2002)

At around current price of 45-47, the market cap of CLSE is around 240 crores. The net debt at the end of Mar’19 was around 90 crores; however, looking at the finance cost the average debt for the year should be around 60 crores.

The stock is currently trading around 7.5 times trailing twelve months earnings; however, if we take into account the recent changes in corporate tax rate, the adjusted multiple is 6.54. The Price to book value is 1.03 and the stock offers dividend yield of around 1%.

While there’s some amount of uncertainty regarding exports to Iran and it could increase competitive intensity in the short term, a lot of existing basmati rice companies could also face bankruptcy and thereby open the market further for companies like CLSE.

If there’s major drop in export realizations, there could also be contraction in margins in the short term (inventory loss); however, as we have seen in the past, the company has generally done well even during periods of lower realizations and exports and the margins and the balance sheet have improved during such times.

Risks/concerns

CLSE derives 85-90% of its sales from exports. As seen in FY 19, wide fluctuations in currency can impact the profitability of the company negatively.

The Middle East is the biggest export market for Indian basmati rice and accounts for over 70% of its exports. Hence, any political turmoil in this region may adversely impact India’s exports.

European Union has implemented stricter norms on use of pesticides for import of various crop varieties and the same has impacted sales to the region. Saudi Arabia is also contemplating implementing such norms and could impact the exports negatively.

While CLSE doesn’t sell to Iran, it could still face heightened competition from other players as they too may start exploring countries outside of Iran.

While CLSE doesn’t carry very high inventory; however, significant drop in prices of Basmati rice can impact the profitability in the short term.

Disclosure: I do not have any holding in Chaman Lal Setia Exports and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No