Dear Sir,

Safari Industries is a relatively well known name in the space of Luggage, travel bags and accessories.

The company is listed on the exchanges (NSE – SAFARI) and has been quite a wealth creator over the last 6 years appreciating from 60-65 odd levels in Jan’14 to around current levels of 600-630 in Jan’20. That’s around 45% CAGR.

Recently, we came across the company while running through one of the screens and the first thing that struck us was that the stock is trading expensive at more than 50 times trailing earnings. These days it is quite common for some of the stocks to trade at such hefty valuations and we therefore expected both consistent growth in sales and profitability and reasonably good quality of earnings.

While the numbers don’t disappoint on the growth front; we believe the quality of numbers is not good. Rather, based on cursory glance on numbers (as produced below), we believe the quality is rather bad as the company is finding it extremely hard to convert profits to operating cash flows and supporting the so called good looking growth through infusion of debt and equity.

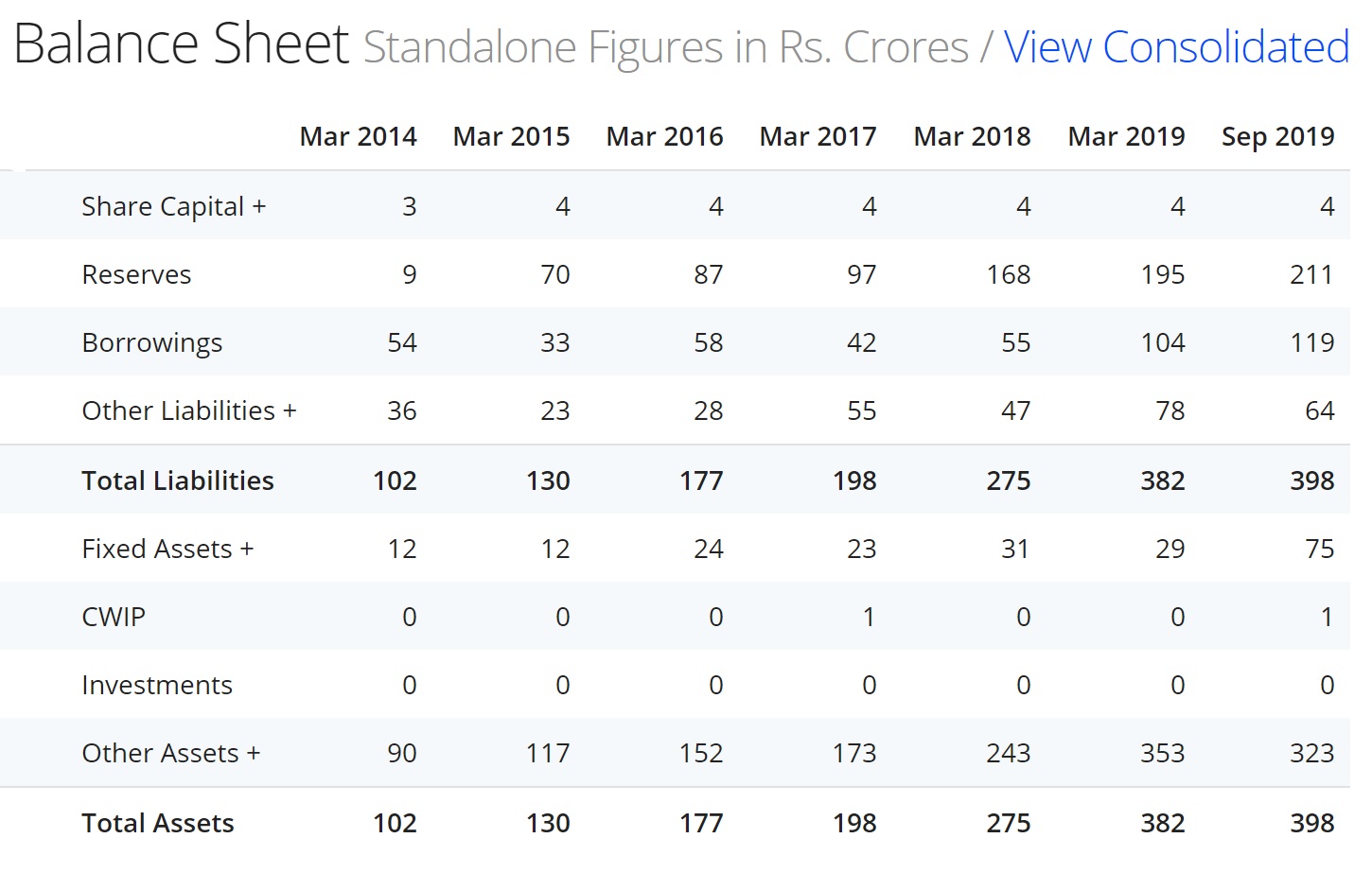

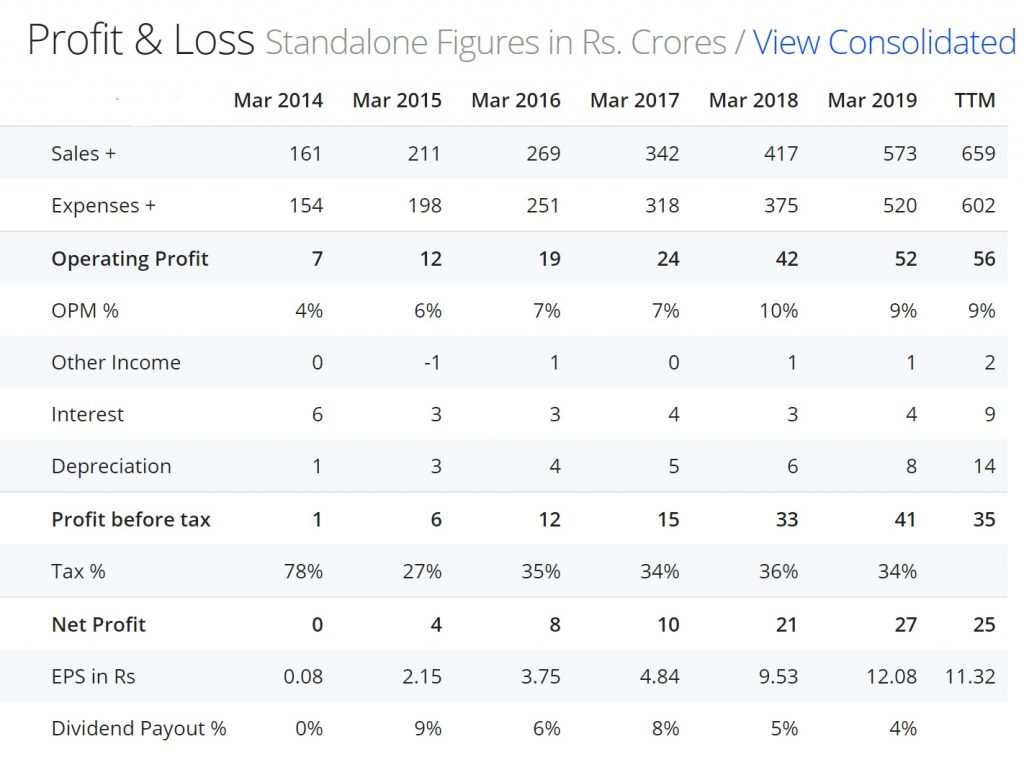

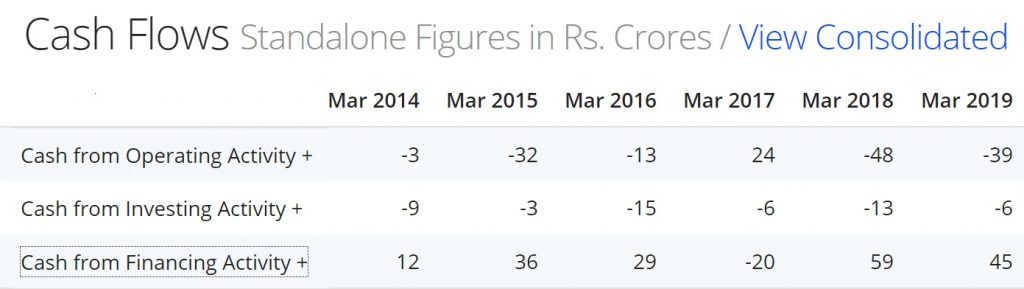

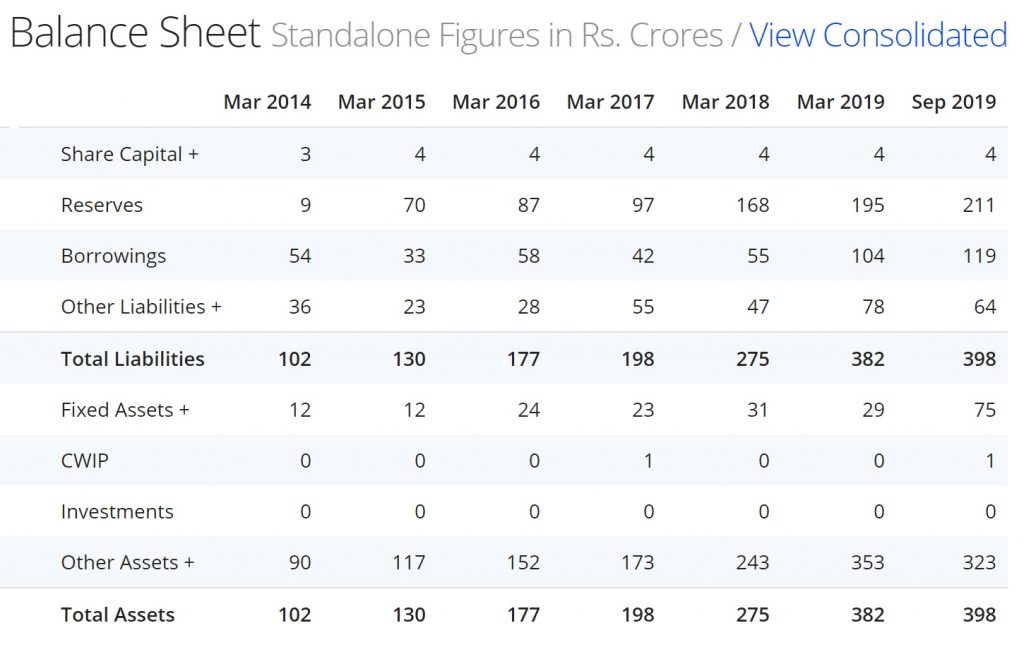

Below, we have produced screenshots of P/L, B/S and Cash flows for your reference:

So, if we look at P/L alone, the numbers look good with strong growth in sales and profitability. However, as with any fundamental research, P/L doesn’t tell much unless combined with analysis of B/S and Cash flows.

Source: Screener.in

Source: Screener.in

So, as we were saying above, we have doubts about the quality of earnings. Firstly, in the last 6 years, the company has generated positive cash flows from operations only once and the impact of the same is visible in the balance sheet. It raised equity in FY 15 which helped it reduce debt to some extent; however since then it has been consistently raising debt as obviously the cash flows have been negative.

So where is the money getting stuck? As the numbers suggest, the money is getting stuck at both the inventory and the receivables level. Since FY 14, the receivable days have increased from 70 odd levels to around 90 and the inventory days have increased from 85 to 98.

Consistently increasing cash conversion cycle is never a good sign and at times also a precursor to impending problems at the company level.

Looking at the numbers, we believe one should analyze the reported growth in more detail as there have been several instances in the past wherein the companies with strong growth but consistently negative cash flows have defaulted.

Disclosure: I don’t have any investment in the stock.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No