Dear Members,

We have released 21st Jan’20: Maithan Alloys Ltd (NSE Code – MAITHANALL) – Alpha/Alpha Plus stock for Jan’20. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 21st Jan’20

CMP – 557.05 (BSE); 559.00 (NSE)

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

Maithan Alloys Limited is India’s largest Manganese (Mn) Alloys producer and exporter, with over two decades of experience and continuous growth.

As on date, we like several points about the company and they are as below:

High quality company in commodity space – It’s extremely rare to find a high-quality company in commodity space and we believe Maithan Alloys has all the attributes of the same.

Despite the vagaries of the sector, the company has in general been consistent in terms of sales growth, has good return ratios (on absolute basis and best amongst its peers), conservative yet growth-oriented promoters and a debt free balance sheet with surplus cash to the tune of 40% of the current market cap of the company.

Cyclical low – In case of a commodity company, in general one makes great returns by investing during sectoral lows and exiting when the going is still good.

As far as Maithan Alloys is concerned, the stock is down 45% from its peak and the gross margins are close to 8-year lows.

More importantly, the peers of Maithan Alloys are reflecting the true pain in the sector as stocks like Indian Metals and Ferro Alloys, Balasore Alloys, Ferro Alloys Corporation, etc are down 70-90% and their operating margins are close to decadal lows.

While things can go worse (for the sector) before improving, on account of extremely strong balance sheet, we believe Maithan will only emerge stronger.

Conservative yet growth oriented – In a commodity industry, when the going is good, it is easy for the promoters to lose their head, expand aggressively using debt and then face the repercussions during the slowdown.

As far as Maithan is concerned, it accumulated huge reserves over the last 2-3 years and is now in the process of expanding its capacity by 50%, entirely through internal accruals.

The company is also engaged in discussions with companies at various stages of insolvency with the objective to acquire and turn them around.

Basic details

As mentioned above, Maithan is India’s largest Mn Alloys producer and exporter and is in the business since more than 2 decades.

More importantly, it is amongst the lowest cost producers of Mn alloys in the world and has the best operating performance amongst domestic peers. In fact, it is one of the few companies that has remained profitable across the market cycles.

Currently, the company has the capacity to produce about 2.4 lakh tonnes per annum which is ~1% of global Mn alloy supply and ~10% of domestic supply.

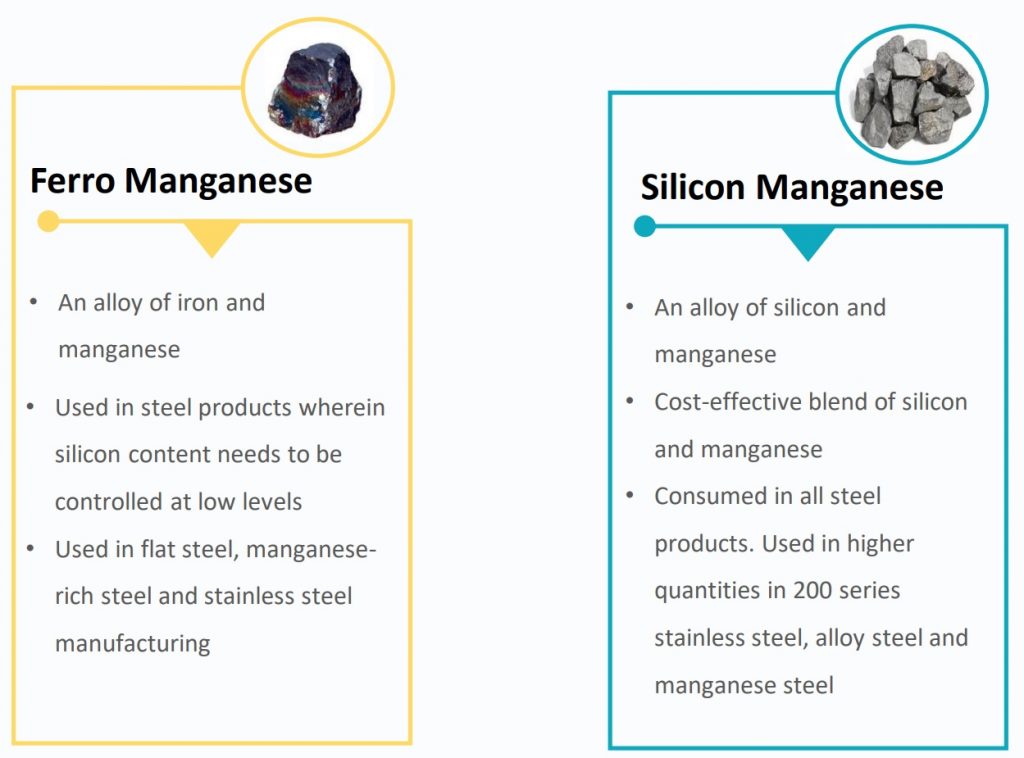

Over the years, the company has attained a certain mastery over Mn alloys. This basket comprises of both the products, Ferro Manganese (FeMn) and Silico Manganese (SiMn). In addition to the same they also produce small quantities of Ferro Silicon (FeSi).

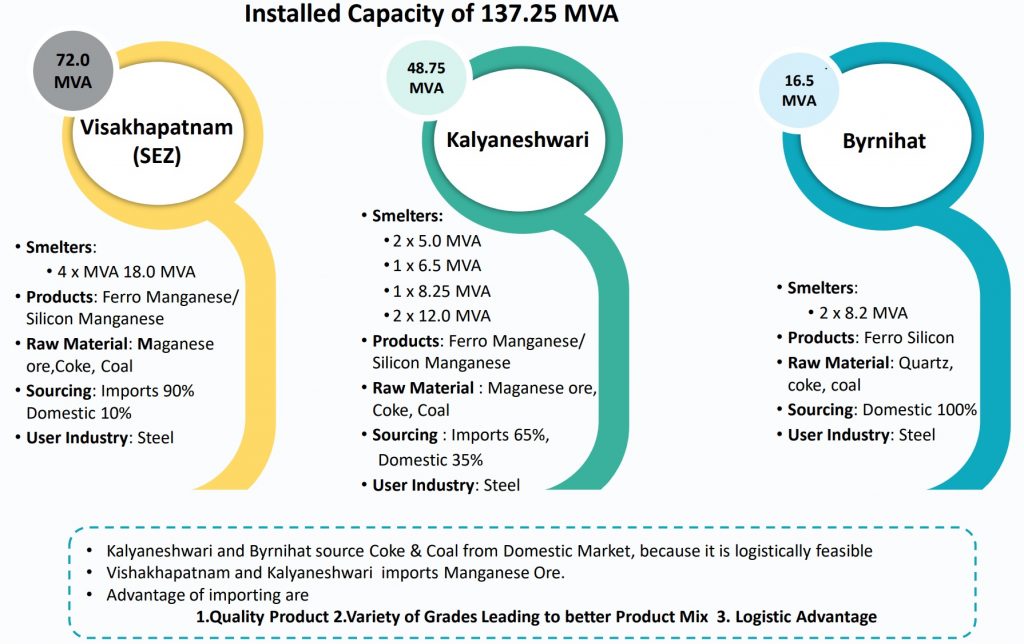

Manufacturing facilities – The company has three plants:

Source: Maithan Alloys Q2 FY 20 Presentation

- Kalyaneshwari, this is the oldest plant contributing about 40% of the revenues. The company started its operation there with the capacity of 10 MVA in 1997 and gradually increased to 48.75 MVA by 2007. This plant makes Ferro manganese and Silico manganese for the domestic market.

- The second plant is in Brynihat in Meghalaya. This contributes about 10% of the revenue and was started in 2009 with the capacity of 16.5 MVA. The company manufactures only Ferro Silicon here; at this location logistics do not favor Manganese Alloys.

- The third and the newest plant is in Visakhapatnam which contributes 50% of the revenue and was started in 2012 with the capacity of 36 MVA and then enhanced to 72 MVA the next year. The company manufactures Ferro manganese and Silico manganese at this plant, and this is all for the export market because it is located in the SEZ.

Raw material sourcing – As per the management, in an average cost scenario, out of the total variable cost about 50% is Manganese ore cost, 30% is power cost, 15% coke and coal cost and the rest is 5%.

Thus, the most important raw material for Maithan is Manganese ore and the second most important expense to look at is Power cost.

As the company is located close to ports, it imports Manganese ore from Africa and Australia. Another reason is that although MOIL can supply Mn ore, Maithan only sources about 10% of annual requirement from them for quality consistency related reasons.

The Company procured more than 86% by value of its Mn ore through imports during FY 19.

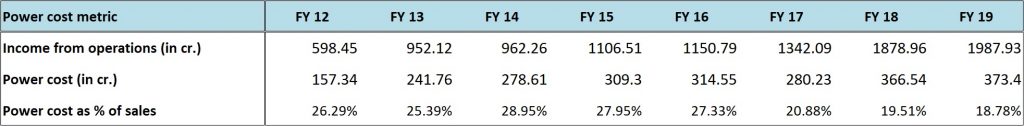

Power cost – Maithan does have a captive power plant; however, its capacity is only 15 MW and is at Meghalaya unit which accounts for 12% of the overall production capacity of the company.

Source: Katalyst Wealth Research

For other units, the company sources power from Damodar Valley Corporation in West Bengal and from Andhra Pradesh Eastern Power Distribution Company Ltd for Visakhapatnam unit.

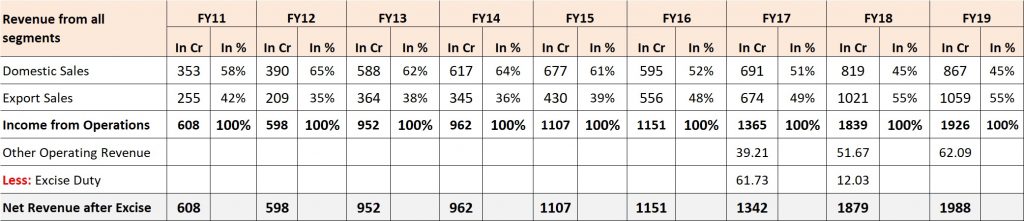

Clientele – Maithan’s sales are more or less equally divided between domestic and exports.

As per the management, in the domestic market, ~100% of its clients are associated with the Company for over 7 years. However, an important point to note is that in the domestic market ~80% of the company’s material goes to Steel Authority of India (SAIL). So, there’s some amount of client concentration risk.

Source: Katalyst Wealth Research

As far as exports are concerned, they are mostly to the Asian economies excluding China. As per the management, the growth in Asian markets has been relatively better than European markets; logistically as well, its advantageous to focus on Asian markets than Europe and US.

Overview of Mn Alloys industry

Manganese alloys are the largest produced ferro-alloys in the world with a share of about 41% of the global production of ferro alloys.

Manganese is an essential requisite for iron & steel production due to its capability for sulphur fixing, de-oxidising and good alloying properties. It enhances steel’s mechanical properties – strength, hardness, toughness, stiffness.

As per one of the reports, in 2017 the global consumption of Mn alloys was ~20mn tonnes, with SiMn accounting for ~70% of the volumes.

Source: Maithan Alloys Q2 FY 20 Presentation

The fortunes of Mn alloys industry are directly linked to the growth in the Steel consumption in India and globally.

As per one of the reports, ~1.5% of Mn Alloy is required to produce each tonne of Steel.

In the domestic market it is expected that steel makers will increase the capacities by about 16 million tonnes (incremental demand of 0.24 million tonnes for Mn alloys) over the next 3-4 years. Additionally, stressed assets are being resolved, which will lead to estimated CAPEX of about Rs. 75,000 crores over the next three years.

On the exports front as well, Asia Ex-China Growth is expected to be ~5% and Maithan already has a strong presence in Asian economies, excluding China.

As per the management, as they are the market leaders and low on the cost curve, selling their produce is not a major problem for them. In an excess capacity situation, realizations can come down; however other players get pushed off first and have to shut down, but selling is not really a problem for the company.

Currently, the bottleneck is production as they are running their capacities at optimum levels. The management has already approved a greenfield project that will enhance the capacity by 50%; however, there’s still some time before the same gets commercialized.

Promoters/Management

Maithan Alloys is an owner operated business and till now the promoters have done a really good job of running the operations of the company.

Mr. S. C. Agarwalla is at the helm of the corporation as the Chairman and the Managing Director and is ably supported by his two sons Mr. Subodh Agarwalla (Whole Time Director and CEO) & Mr. Sudhanshu Agarwalla (President and CFO).

Both the sons of the chairman have impressive profiles with Mr. Subodh Agarwalla having done his B. Tech from IIT BHU and MBA from IIM Bangalore. Mr. Sudhanshu Agarwalla has done his MBA from XLRI Jamshedpur.

Source: Katalyst Wealth Research

The promoters own 74.99% stake in the company and therefore their interests are directly aligned with those of shareholders.

On the front of related party transactions, there’s nothing eye-popping that has come to our attention.

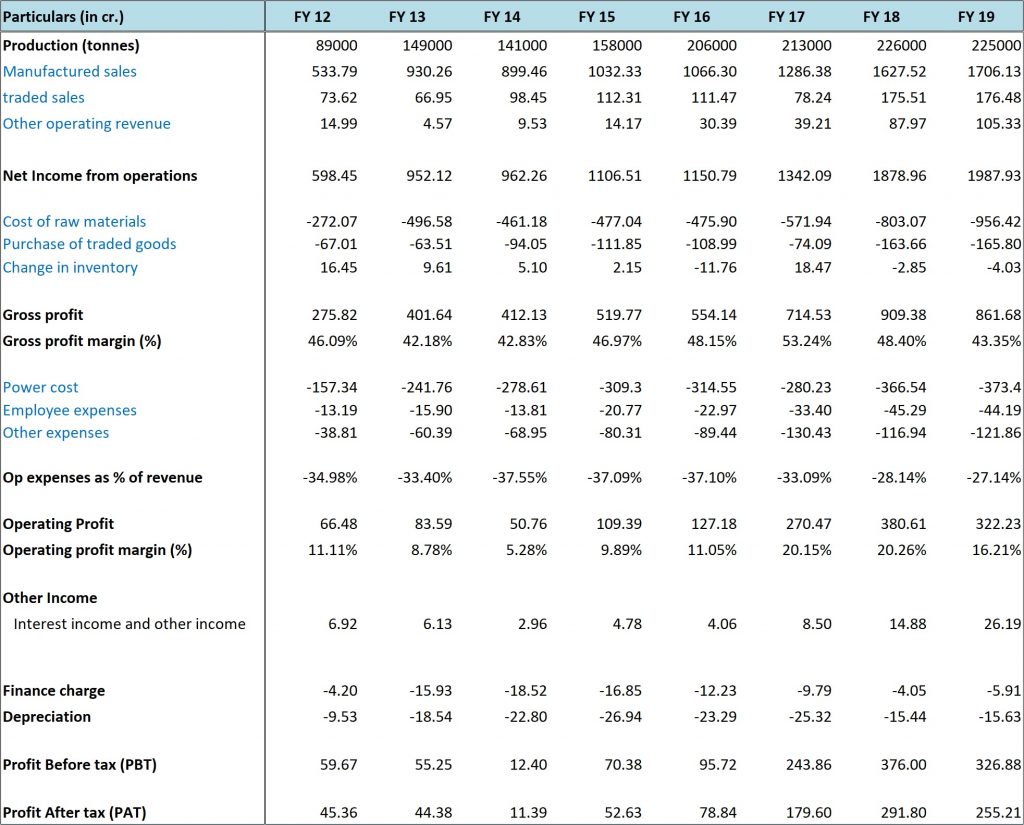

Performance Snapshot

Source: Maithan Alloy’s ARs

Below are some of the key highlights of Maithan’s performance over the last 8 years:

- Growth in production of Mn alloys – 14.1% CAGR

- Growth in Manufactured sales – 18.05% CAGR

- Growth in Net income from operations – 18.75% CAGR

- Growth in gross profit – 17.70% CAGR

- Growth in operating profit – 25.27% CAGR

- Growth in PBT – 27.5% CAGR

On a longer-term basis, the company has reported great set of numbers and despite the vagaries of the sector, there’s reasonable level of consistency.

What is important to note is that at the end of FY 19 the gross margins of the company are closer to 8-9 year lows of 42-43% and this is important from investment viewpoint as we don’t want to be investing near the peak of the cycle.

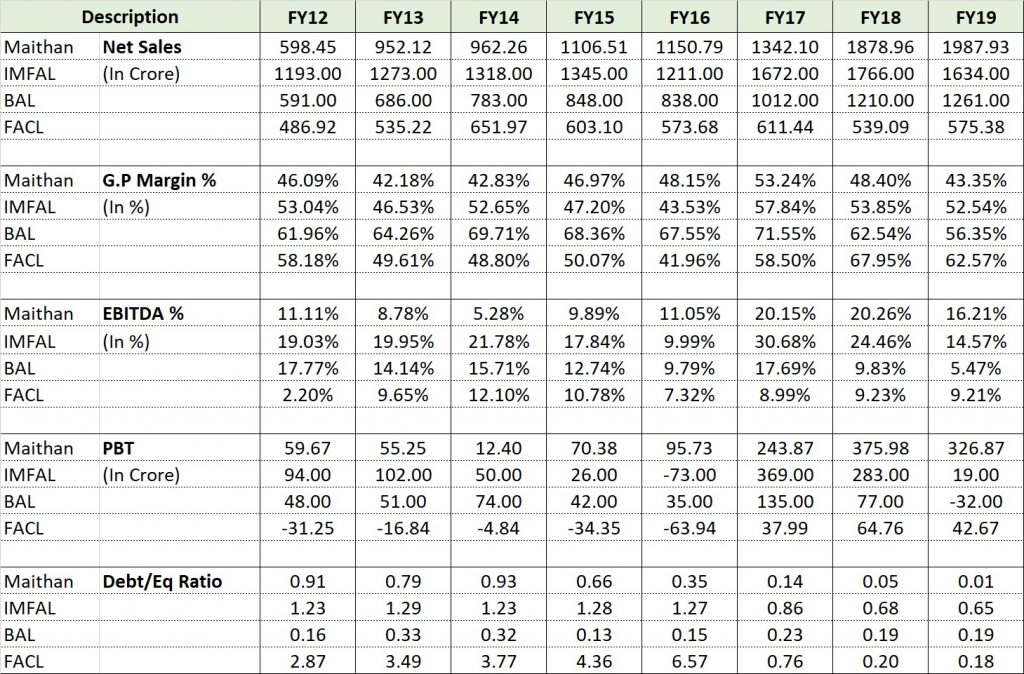

Source: Katalyst Wealth Research

The pain in the sector can be gauged from the numbers of peers like Indian Metals and Ferro Alloys (IMFAL), Balasore Alloys (BAL), Ferro Alloys Corporation (FACL). IMFAL and BAL have reported a major drop in their EBITDA margins and PBT in FY 19 in comparison to FY 17 and FY 18.

Similarly, all of them have reported muted growth over the years while Maithan has been growing consistently.

In the case of Maithan, despite lower gross margins, the company is still performing well and has held on to its operating margins by focusing on operational efficiency and running plants at optimum utilization levels.

As per the management, they are confident of sustaining long-term EBITDA margin in the range of 15-17%.

They believe they have a 4% headroom over competition on EBITDA front. At lower than 8% EBITDA, the industry enters a cash-loss scenario. So, in the worst case scenario they expect their margins to not go below 12%.

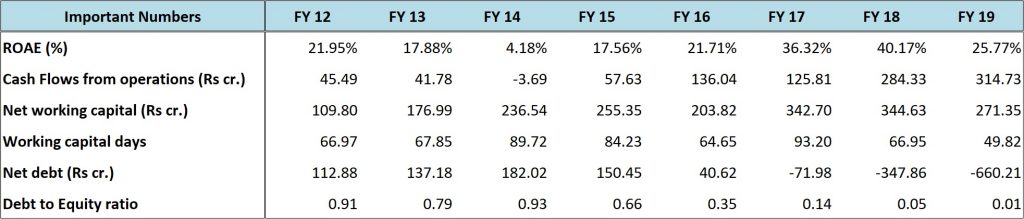

Another important facet of Maithan’s performance is how well it has delivered on parameters like return ratios, working capital management, cash flows, debt equity, etc.

Source: Katalyst Wealth Research

The company is debt free and holds surplus cash to the tune of Rs 650-670 crore.

In a con-call, this is what the management had to say about expansion and debt management:

“In the past, let us say, our history of 20 years we have always been taking loans for one expansion project. We have been repaying that and in many cases prepaying the loan and only after the old loan is on the verge of getting totally prepaid is when the next project is planned, and the next term loan is taken. With this strategy we were able to grow from 10 MVA in 1997 to 137 MVA by the end of 2012 – that is in 15 years we were able to grow by 14 times. So, this has proved to be successful recipe and in spite of it being a low risk thing growth has been high. So, we intend to continue with the success recipe, and are constantly evaluating inorganic growth opportunities along with the announcement of a Greenfield CAPEX of about Rs. 275 crores. We need to conserve cash for the short-term because we are uncertain how much money we will be spending on the inorganic growth front”

Aiming for growth – As the company has accumulated cash reserves of more than 650 crore, it has outlined following growth plans:

- The board has approved setting up a Greenfield Ferro alloy manufacturing unit in West Bengal with an estimated capacity of 1.2 lakh tonnes per annum. This plant is going to be suitable to make both Chrome as well as Manganese Alloys i.e. it will be fungible. The unit is proposed to be set up by May’21 at an estimated cost of about 275 crore. The entire CAPEX will be funded from internal approvals. The company has bought the land for the same.

- The management is also looking at inorganic route and engaged in discussions with companies at various stages of insolvency with the objective to acquire and turn them around.

Valuations

The stock is currently quoting at a market cap of 1620 crore.

The company has surplus cash to the tune of 650-670 crore and therefore the enterprise value is around 960 crore.

The stock is currently quoting around 7.4 times TTM earnings, 1.37 times book value and 0.82 times TTM sales.

In FY 19 the company recorded sales of 1988 crore and operating margins of 16.21%. As the industry is cyclical, the downturn can intensify and the realizations can go down further.

Below, we are doing a stress test on the earnings:

- Annual Sales – 1800 crore (assuming 10% drop in realizations)

- Operating margins – 12% (management’s estimate of bad case margins)

- Operating profit – 216 crore (1800 * 0.12)

- Depreciation + interest cost – 23 crore

- PBT – 193 crore (216 – 23)

- PAT – 144.36 crore

So, on ignoring surplus cash and the related other income, the operating business is available at 6.65 times stressed earnings which we believe is quite reasonable.

If we were to assign 20% discount to cash surplus, the market cap comes to 1488 crore (960 crore + 528 crore) which is only 8% lower than current market cap of 1620 crore.

Thus, even for cyclical business and taking into account the quality of operations and earnings, we believe the valuations are quite reasonable. Add to that, the new plant of the company should be up and running in 15-18 months and that will start contributing positively to the earnings of the company.

Risks/concerns

Just a few months back the stock had corrected to lows of 400 and in case of really bad markets, similar correction cannot be ruled out.

At the time of last con-call in May’19, the environmental clearance for the greenfield capex was still pending.

The company is pursuing inorganic route wherein it is looking to acquire a company going through insolvency and turn it around. Acquisition can prove to be tricky and burdensome if not executed well.

Disclosure: I don’t have any investment in Maithan Alloys and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No