Dear Sir,

Caplin Point is engaged in the business of Pharmaceuticals – producing and marketing wide range of generic formulations and branded products in overseas markets.

The company primarily focuses on the emerging markets of Latin America, Caribbean, Francophone and Southern Africa and is today one of the leading suppliers of Pharmaceuticals in these regions.

Back in the day, i.e. around 6-7 years back, we used to like the numbers of the company and considered it worthy of investment; however, for some reason did not invest and missed out on a huge-huge 20-30 bagger.

Recently, the stock had corrected and we started looking at the numbers again to see if there’s any potential investment opportunity. The numbers didn’t disappoint on the growth front with both sales and profits growing at a fast clip; however, looking at the working capital data, we are not sure if the sales are actually true.

The cash flows are no where near the reported PAT and most of it is getting stuck in receivables. In fact, since Mar’16 the receivables have grown 20 times against around 3x growth in sales.

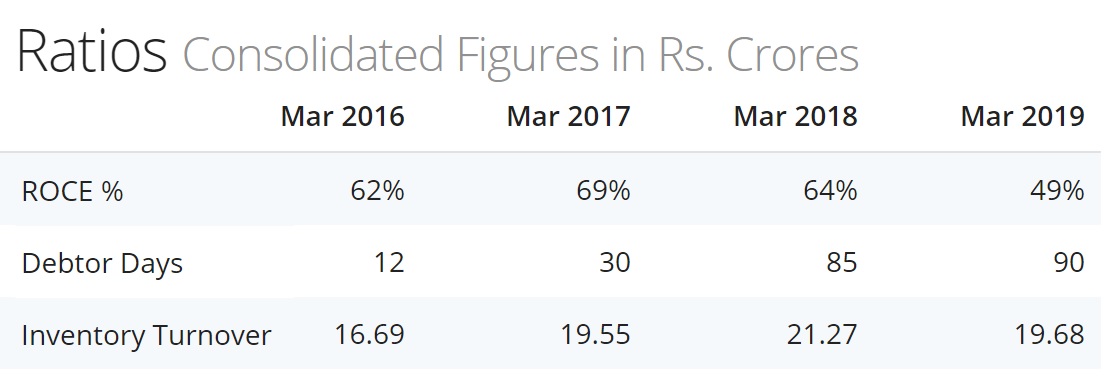

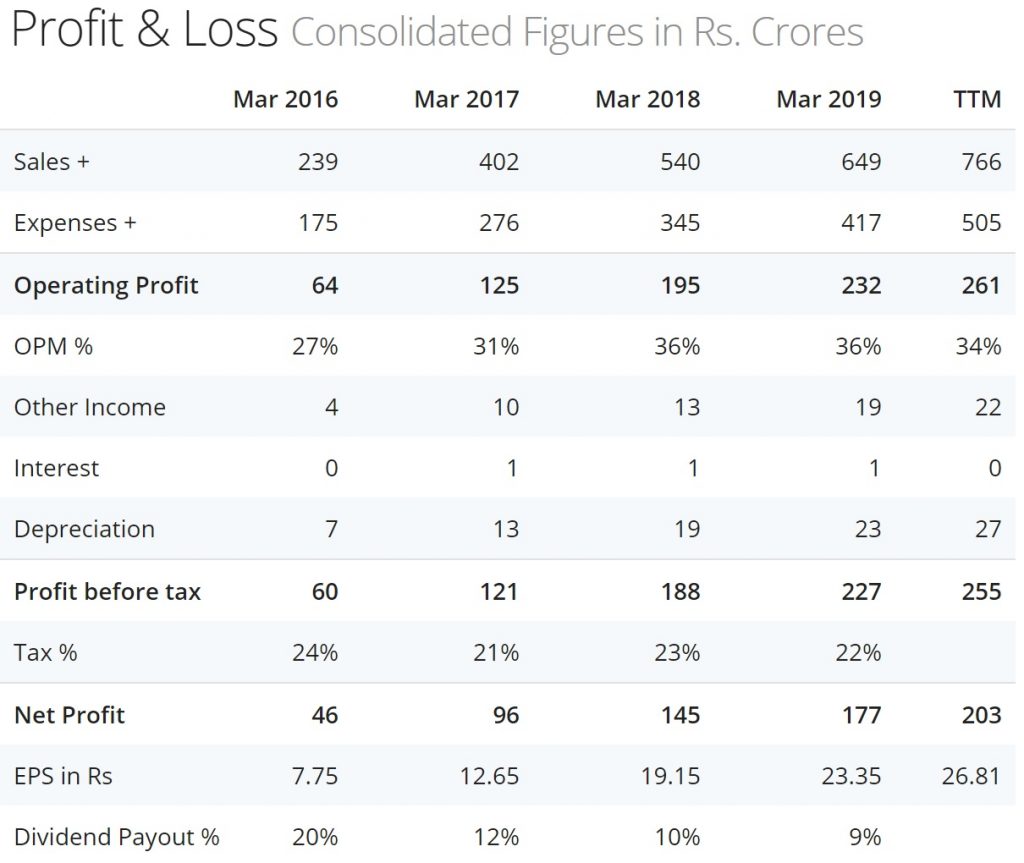

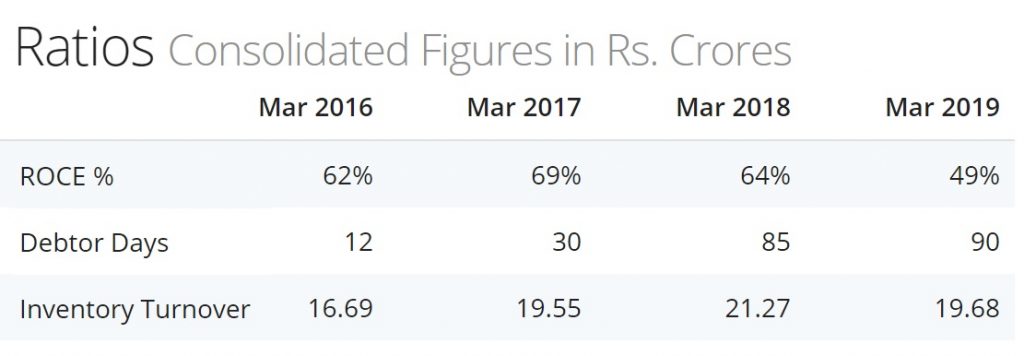

Below, we have produced screenshots of P/L, Cash flows and ratios for your reference:

Source: Screener.in

Source: Screener.in

So, if we look at the Profit/loss statement alone, there’s been huge growth in the sales and profits. The interest payments are also negligible, indicating debt free balance sheet. However, as with any fundamental research, P/L doesn’t tell much unless combined with analysis of B/S and Cash flows.

Source: Screener.in

Source: Screener.in

Source: Screener.in

Source: Screener.in

If we notice closely, the problem lies with cash flows from operations. While the company has been reporting PAT in excess of 100 crore, the cash flows from operations are much lower at less than 50%. This is primarily on account of cash flows getting stuck in receivables.

At the end of Mar’16, the company’s receivables were only around 8 crore; however the same have risen to 160 crore at the end of Mar’19 and 230 crore at the end of Sep’19. That’s a marked shift with almost 9-10 times increase in debtor days and leaves us with doubt about the sanctity of sales reported by the company.

Looking at the numbers, we believe one should analyze the reported growth in more detail before bottom fishing in the stock. In the past, there have been several cases where the sales turned out to be fictitious.

Disclosure: I don’t have any investment in the stock.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No