Dear Members,

We have released 9th May’20: National Aluminium Company Ltd (NSE Code – NATIONALUM) – Alpha/Alpha Plus stock for May’20. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 9th May’20

CMP – 28.40 (BSE); 28.45 (NSE)

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

National Aluminium Company (NALCO) is a Navratna Central Public Sector Enterprise under the Ministry of Mines. The Govt. of India holds 51.50% stake in the same.

The company has integrated operations in mining, metal and power with presence in all the three stages of aluminium production—bauxite, alumina and aluminium. Due to its access to high quality bauxite and coal mines, its cost of production is one of the lowest in the world.

It also operates 1,200 MW coal-based captive power plants, which are sufficient for its entire aluminium smelting capacity.

At around CMP of 28-29, we are looking at the company as a medium-term cyclical bet and the reasons are as follows:

- The stock is currently trading around 15 years lows of 25-30 odd levels.

- The company is debt free and had a cash balance of around Rs 2,100 crore (primarily in the form of fixed deposits) at the end of Dec’19 against market cap of Rs 5,300 crore

- NALCO is one of the lowest cost producers of Alumina across the world

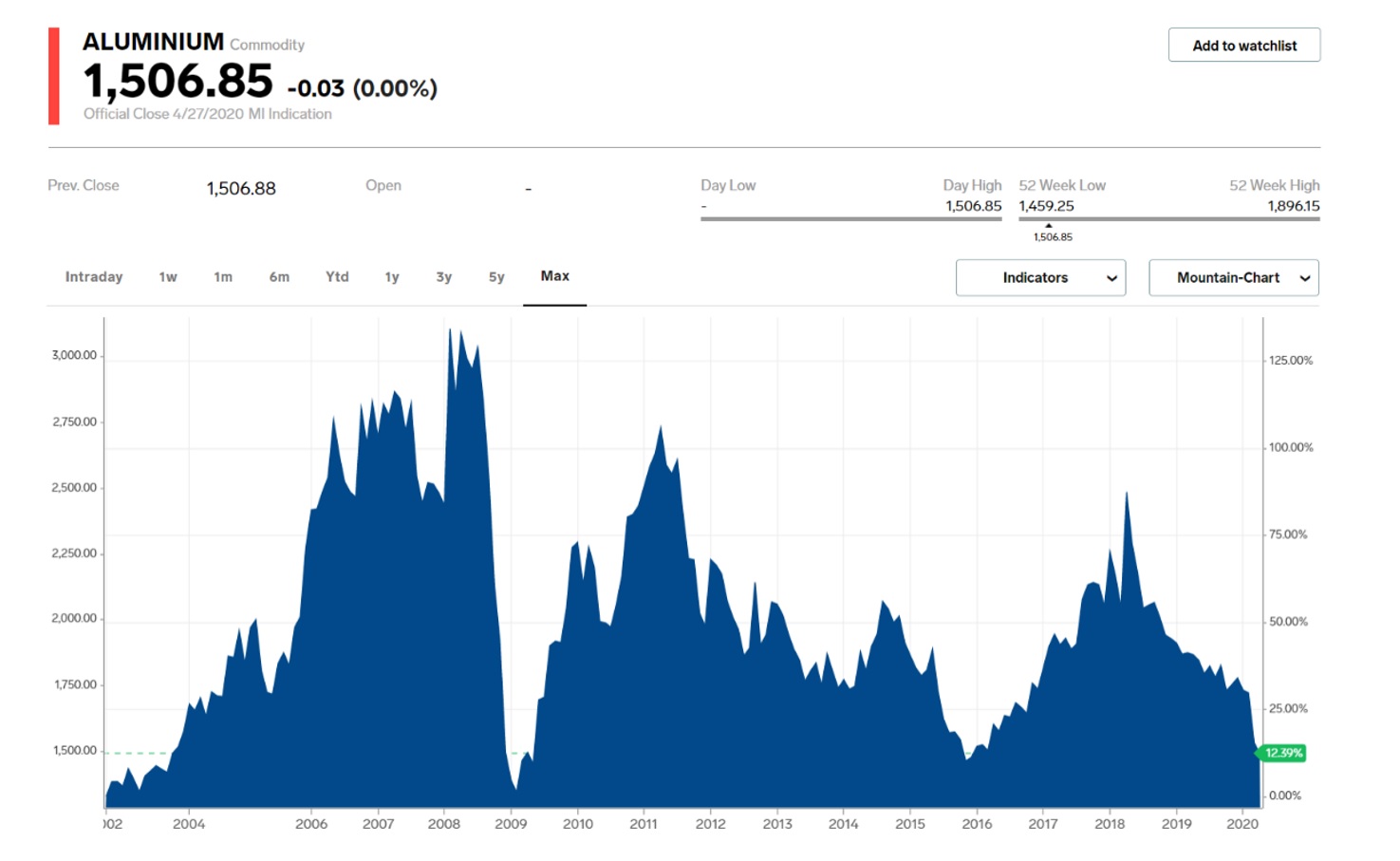

- Internationally, Aluminium and Alumina prices are heading towards record lows

Source: markets.businessinsider.com

Source: ycharts.com

- On account of correction in Alumina and Aluminium prices, NALCOs EBITDA margins have contracted to 1-2% from the highs of 34% recorded in Jun’18

- As mentioned above, the stock is trading near cyclical lows and tends to follow the Aluminium price pattern.

Source: moneycontrol.com

- Lastly, the company has been consistently paying annual dividend of Rs 2 or more. In CY 2019, the company paid dividend of Rs 5.75 per share.

Basic details

NALCO is India’s largest integrated Alumina-Aluminium complex, comprising bauxite mining, alumina refining, aluminium smelting and casting, power generation, rail and port facilities.

The capacities of the operating units are as below:

Source: Nalco Products folder

NALCO operates captive high-quality bauxite mines, which meet 100% of its alumina requirement for manufacturing aluminium. The 1,200 MW coal-based captive power plants are sufficient for its entire aluminium smelting capacity, while for feeding coal, it has a fuel supply agreement with Mahanadi Coalfield Limited for around 85% of its requirements.

This integration confers significant cost advantages, making NALCO one of the few low-cost producers of alumina across the world.

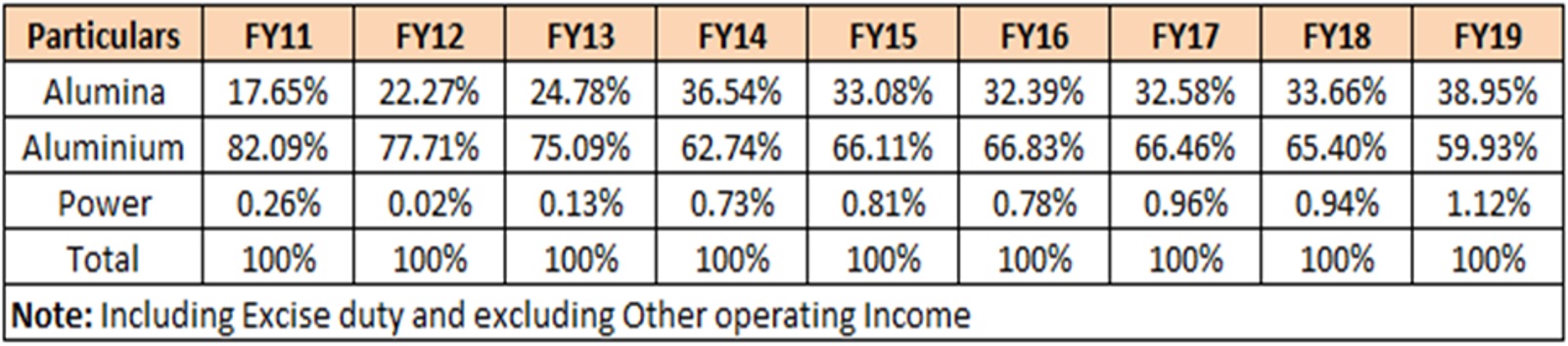

Product-wise revenue contribution – NALCO primarily consumes Alumina for Aluminium production and sells the surplus to third parties in the export markets.

As per the credit rating report, the low production cost for alumina (on account of its high-quality captive bauxite mine) provides NALCO with the flexibility to sell additional alumina as and when aluminium prices are less remunerative than those of alumina, so as to maximize profitability.

The product wise revenue contribution is as below:

Source: Katalyst Wealth Research

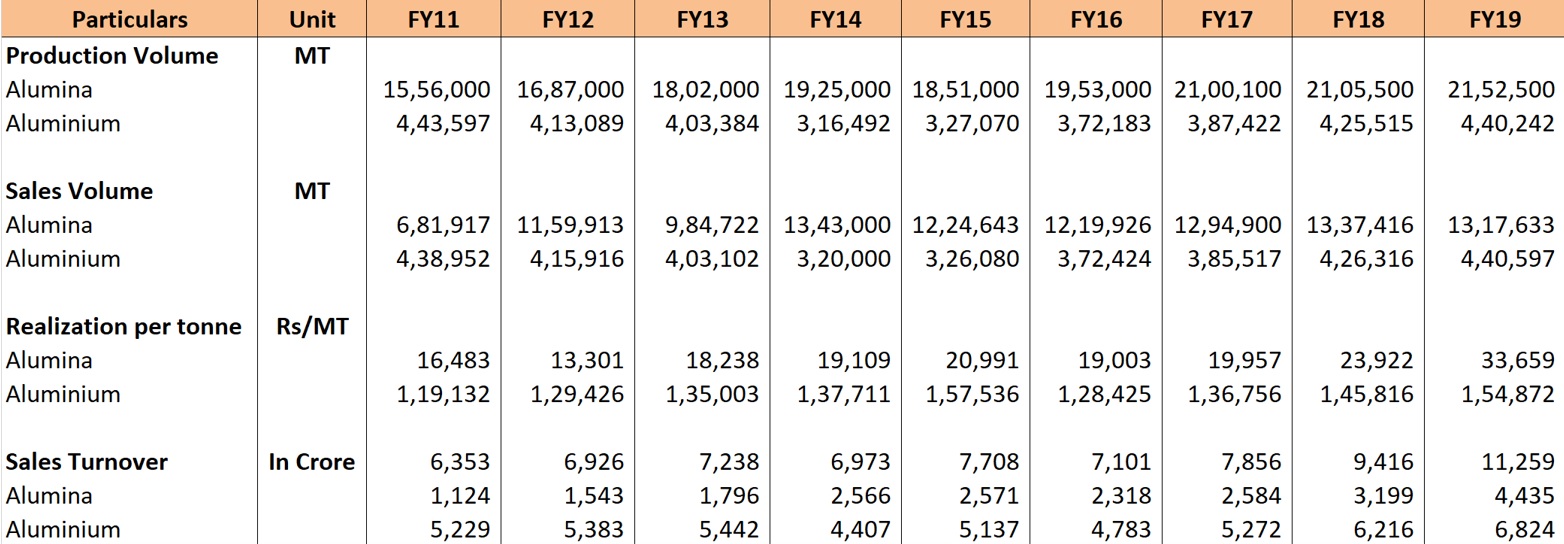

Production, sales and realization –

Source: Katalyst Wealth Research

As can be noted above, FY 19 was the best year both in terms of production and realization per tonne; however, the prices have been collapsing since Jun’18 and now below cost of production for a lot of companies.

Tough times for Aluminium Industry

We believe Aluminium and Alumina is a deeply cyclical industry and generally for such industries it’s important to not get trapped when the going is good and the industry is flourishing, because sooner than later the fortunes turn for bad.

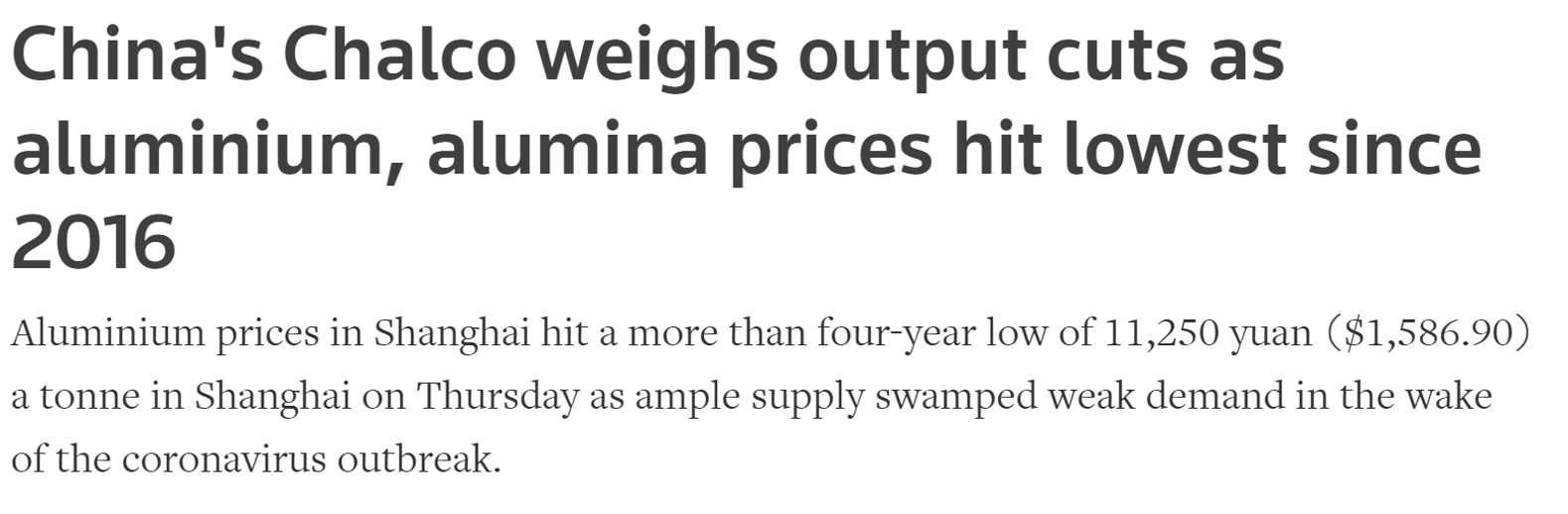

Similarly, bad times prove to be good from investment view point and based on the fall in the prices and the news flow it does look like the overall industry is going through a lot of pain.

As per the news report on Reuters, China’s biggest state-run aluminium producer, CHALCO is weighing the option of output cuts for aluminium and alumina. It is believed that most Chinese producers are losing money at current aluminium prices.

Source: reuters.com

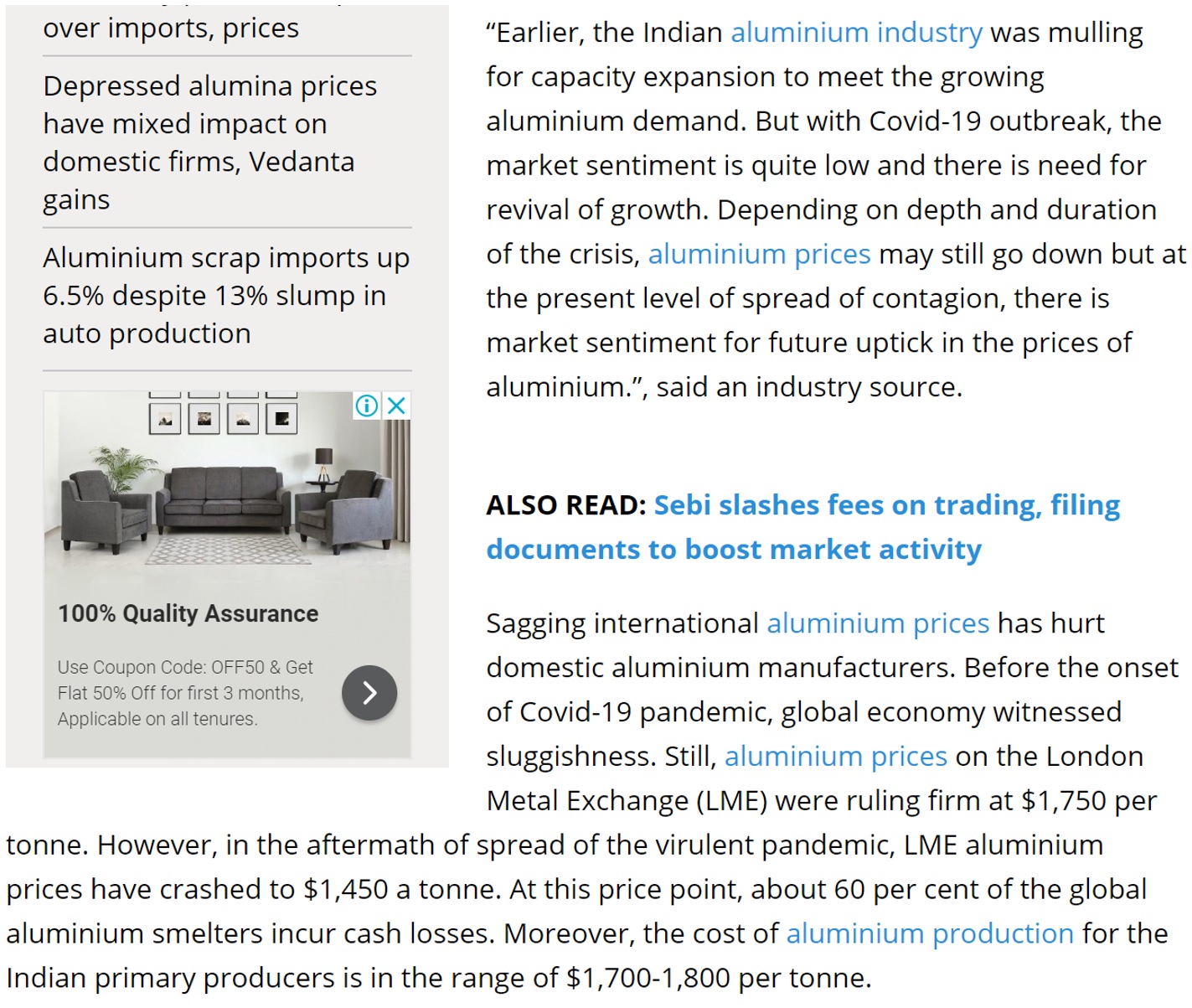

Source: business-standard.com

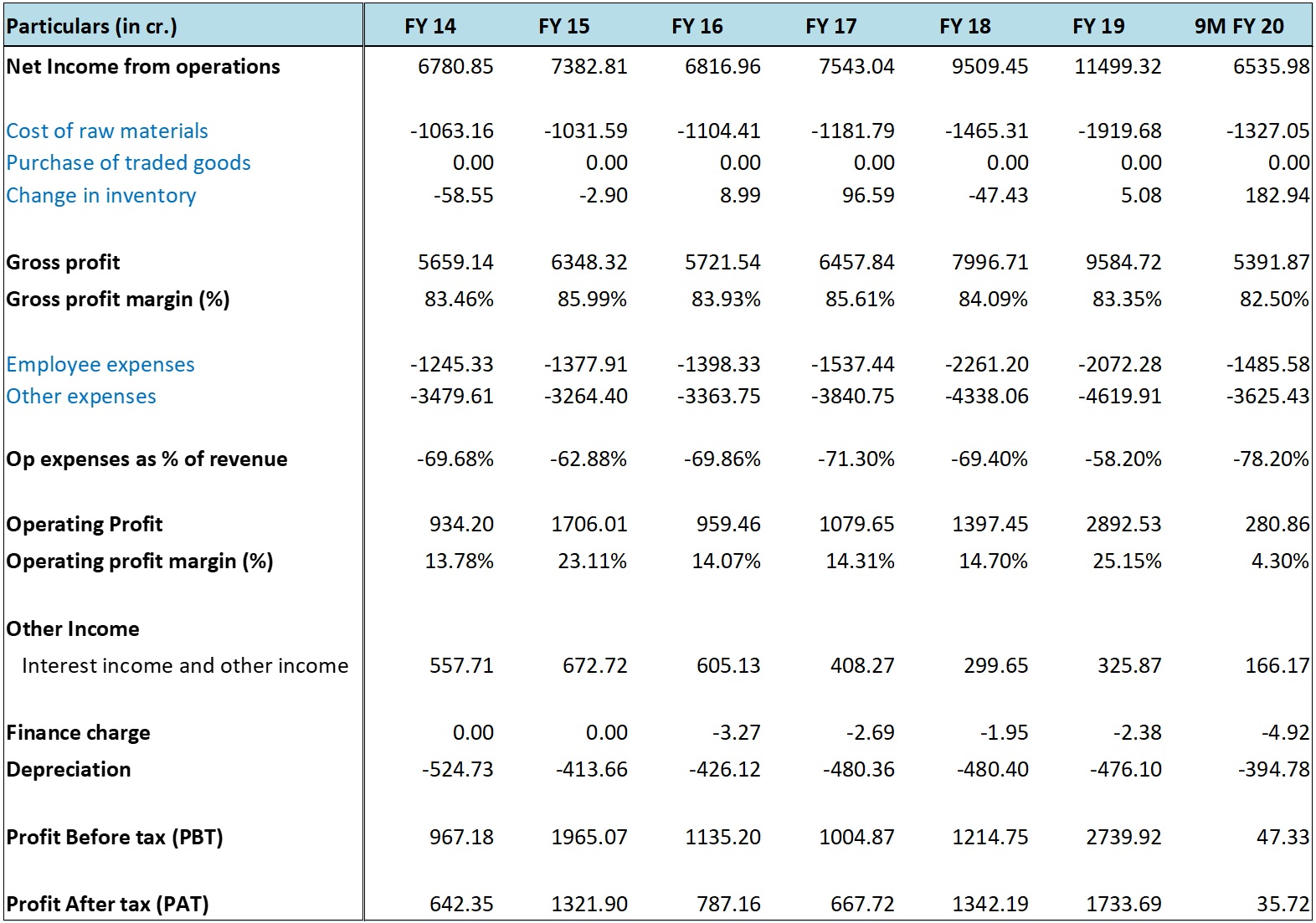

Performance Snapshot

Source: Katalyst Wealth Research

As NALCO operates captive bauxite mines, its performance is largely a function of alumina and aluminium production and realizations for both.

For feeding coal, the company also has a fuel supply agreement with Mahanadi Coalfield Limited for around 85% of its requirement. However, like 9M FY 20, sometimes a shortage in the availability of coal from Mahanadi coalfield can lead to higher power and fuel costs and thereby some impact on EBITDA.

Production as well isn’t likely to change much as the company has been producing close to peak utilization levels.

Thus, the overall performance is largely impacted by the change in the prices of alumina and aluminium. As already indicated in the above sections, both are trading close to the record lows of the last 10 years and already domestic and international manufacturers have started incurring losses and mulling production cuts.

Source: Katalyst Wealth Research

Can the prices go down further?

Surely, the prices can go down further and that would further hurt the performance of NALCO and other companies; however, NALCO is still much better placed with its huge cash reserves and one of the lowest costs of production.

Also, while the exact bottom for an industry can’t be known, various details point to the fact that industry is much closer to cyclical lows than highs.

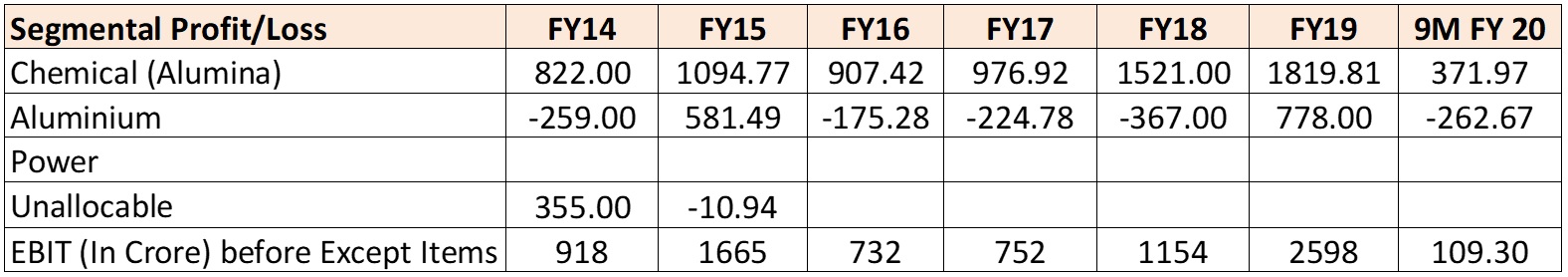

Dividend

Source: Katalyst Wealth Research

Besides the above-mentioned dividends, the company also came out with Rs 500 crore buy back at Rs 75/- per share in 2018.

Considering much lower profits in FY 20, the dividend might be lowered to say Rs 2/- per share; however, at around current price it would still amount to 7% + dividend yield.

Valuations

In our view, for deeply cyclical industries, earning is not a great tool for valuing the companies. Instead, replacement cost or other cyclical factors can prove to be more helpful.

NALCO is currently quoting at a market cap of 5,300 crore.

Against the same, the company has surplus cash to the tune of 2,100 crore which brings down the enterprise value to Rs 3,200 crore.

Further, the company has bauxite mining capacity of 6.82 MTPA, Alumina Refinery of 2.27 MTPA, Aluminium Smelting capacity of 0.46 MTPA and captive power plants (including wind power plants) of 1,400 MW.

The replacement cost for power plants is around 5 crore per MW which amounts to Rs 7,000 crore. As far as alumina refinery is concerned, the company is in the process of expanding the capacity from 2.275 MTPA to 3.275 MTPA at a projected cost of Rs 5,540 crore. So, for the existing capacity, the replacement cost will be around Rs 11,000 crore.

Further, we haven’t yet taken into account replacement cost for 0.46 MTPA Aluminium smelting capacity which could cost anywhere around Rs 5000 crore +.

Thus, the stock is currently available at an enterprise value of Rs 3,200 crore against replacement cost of more than Rs 22,000-23,000 crore.

Risks/concerns

With PSUs, capital misallocation has always been the major risk. Already, there are plans to diversify into unrelated minerals like Lithium and Cobalt and the same may prove to be value destructive.

The company is in the process of expanding its Alumina refinery capacity from 2.275 MTPA to 3.275 MTPA at a projected cost of Rs 5,540 crore. This expansion along with others can result in NALCO transforming from a cash rich company to moderately leveraged and can hamper the dividend paying ability of the company.

In the light of overall slowdown and further accentuated by Covid-19, the international prices for Aluminium and Alumina could fall further and could impact the stock price of the company.

Disclosure: I don’t have any investment in National Aluminium Company and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No