Dear Members,

We have released 24th Jul’20: Gujarat Ambuja Exports Ltd (NSE Code – GAEL) – Alpha/Alpha Plus stock for Jul’20. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 24th Jul’20

CMP – 158.85 (BSE); 158.95 (NSE)

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

Gujarat Ambuja Exports Limited (GAEL) was established in 1991 by late Mr Vijay Kumar Gupta, and is currently managed by his son, Mr Manish Gupta.

GAEL is principally involved in the Agro-processing business with dominance in Maize products and Edible oils. It competes in the domestic and global markets and caters to food, pharmaceutical and feed industry.

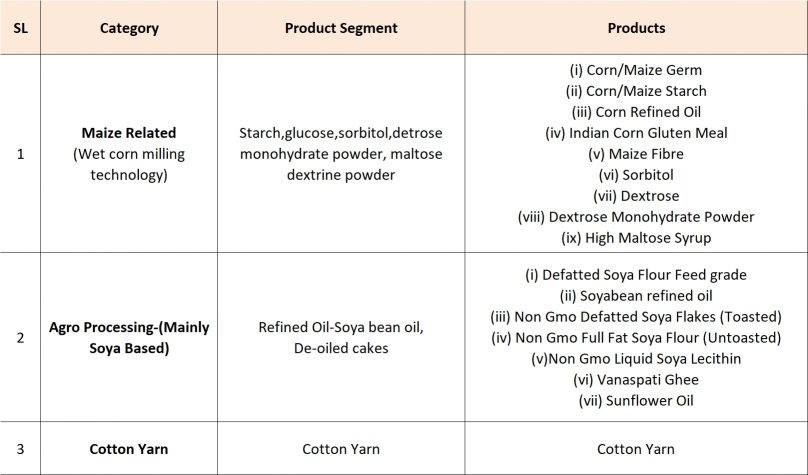

The company is mainly engaged in three segments:

- Maize processing through corn wet milling for manufacturing starch, glucose, sorbitol, dextrose monohydrate powder, and maltose dextrine powder

- Agro processing for manufacturing refined oil (mainly soya bean oil) and de-oiled cakes (DOC) and

- Cotton yarn manufacturing

At around CMP of 160, we are looking at the company as a medium-term bet and the reasons are as follows:

- GAEL is now the largest player in India in Maize processing with market share in excess of 20%

- Maize processing is increasingly becoming the core and focus area and provides stable margin profile and better growth potential on the back of increasing demand for starch and its derivatives

- Volatile and significantly less profitable Agro processing and Cotton Yarn divisions are gradually losing significance in the overall scheme of operations of the company

- Company has competitive advantages in the Maize segment as the end customer approvals are stringent and it also has logistical advantages as its manufacturing facilities are spread across states like Gujarat, Uttarakhand, Karnataka, Maharashtra and the new one is coming up in West Bengal

- FY 20 was relatively tough for the Maize segment as the average maize prices increased by over 55% in 9M FY 20 over 9M FY 19 due to steep hike in minimum support price; however, now the prices have softened and the profitability has again started improving

- The company will realize the full benefit of Phase-2 expansion of Maize processing unit in Chalisgaon in FY 21. It’s also in the process of expanding its overall capacity by 25% by setting up a 750 TPD (tonnes per day) capacity in West Bengal

- The company doesn’t have any long-term debt and only small amounts of working capital debt

- Lastly, despite the depressed Maize segment earnings of FY 20, the stock is still available at ~12 times trailing twelve months earnings.

- Lastly, the company has been consistently paying dividends since more than 10 years now, though the pay-out has been in the range of 5-15%.

Basic details

GAEL is principally involved in the Maize processing and the agro processing businesses. It also has a small Cotton Yarn division; however, the contribution from the same to the overall sales and profitability is less than 5%.

In fact, the cotton yarn division has been impacting the profits negatively since the last few years.

Source: GAEL’s website

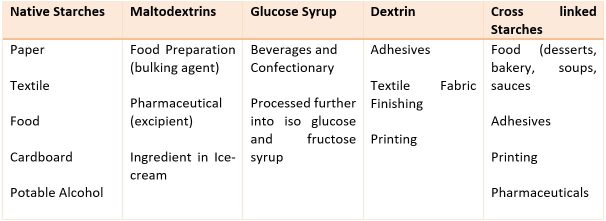

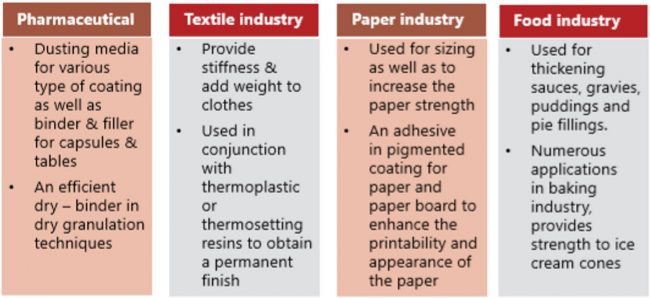

Maize Processing – In the maize processing segment, the company manufactures Starches & value-added downstream products which find applications in industries like Food, Pharma, Textiles, Paper, Leather, Adhesives, etc.

Some specific applications of Corn starch and derivatives include:

Source: Katalyst Wealth Research

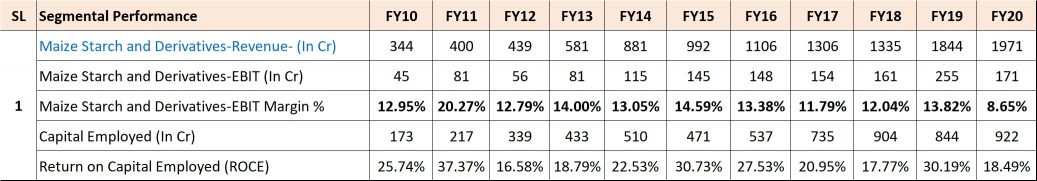

In a short span of 10-12 years, Maize processing has grown from less than 15% of the sales and profits of the company to more than 50% of the sales and 70% of the profits of the company at the end of FY 20.

The company is the largest player in India with a capacity of 3000 tons crushed per day (TPD) and market share of 21%.

Source: GAEL Annual Reports

As can be noticed above, there’s been a consistent increase in sales and profits of the Maize division with the company also backing the same with steady increase in capital deployed.

Since FY 10, sales of the Maize division have grown at 19% CAGR, EBIT has grown at 14.3% CAGR and Capital Employed has grown at 18% CAGR.

Being a commodity, the margins tend to be volatile and therefore as an investor it’s always better if one is able to enter in around lower spectrum of margins than when the margins are significantly higher than the mean.

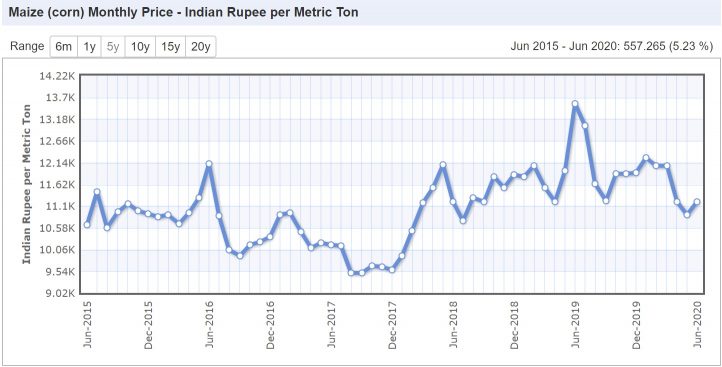

What led to lower margins in FY 20 – Due to a steep hike in minimum support price and lower production in Karnataka and Andhra Pradesh, average maize prices increased by over 55% in 9M FY 20 when compared to 9M FY 19. As it is the major raw material for Maize processing division of GAEL, the profitability got impacted.

With increase in imports from Ukraine, Russia and Myanmar after government opened up imports for private players, the maize prices started softening in Jan 2020.

Expanding Steadily – Due to better growth potential on the back of increasing demand for starch and its derivatives, the maize processing division has become GAEL’s core and focus area.

The company offers a wide range of products such as starch, starch derivatives, and starch by products which find application in the food processing, pharmaceutical, paper, and textile industries.

To continue expanding the operations, the company successfully set up phase-I of maize processing at Chalisgaon in Maharashtra in Mar 2018 with installed capacity of around 1000 Tonnes per day (TPD) and thereby became the largest player in the domestic maize processing industry with total installed capacity of 3000 TPD.

GAEL also completed capex of phase-II at its Chalisgaon plant in June 2019 whereby company is manufacturing other starch derivative products.

The full benefit of the phase-II expansion will accrue to the company in FY 21.

Besides, the company has started setting up a new plant with installed capacity of 750 TPD at Malda, West Bengal at a cost of around Rs 219 crore which is proposed to be funded entirely out of internal accruals.

The company has already acquired land at the project location and also entered into lease agreement with the West Bengal Government agency. Before the onset of Covid-19, the commercialization of the plant was expected in March 2021.

Competitive Advantages – The Starch and Starch derivatives manufactured by GAEL are used across the industries with major applications in Food and Beverages and Pharmaceuticals.

For the above-mentioned industries, the cost of starch-based products is minuscule in the overall cost of raw materials; however, they play an important enabling role and therefore the approvals by the end customers for the manufacturing set up and the products are stringent.

GAEL has been approved by and supplying its products to reputed companies like Heinz India, ITC Ltd, Patanjali Ayurveda Ltd, Asian Paints Ltd, Dabur India Ltd, Welspun India Ltd, Hindustan Unilever Limited, etc

Another major cost is the Freight and forwarding charge which includes the logistics cost of bringing in Maize from the farmers and supplying products to the end customers or distributors.

Here again, GAEL has certain level of advantage over others because of its market leading size enabling it to buy in bulk and get marginal discount in comparison to others. Also, it’s multi-location facilities across maize producing states like Gujarat, Maharashtra, Karnataka and upcoming one in West Bengal help in easy availability of raw material and some amount of savings in logistics cost.

Outlook for Starch and Starch Derivatives – Starch production in India is highly fragmented, with a variety of manufacturers offering different sources, grades and derivatives of starch as per their distinctive capacity levels.

The Indian starch industry is still at a nascent stage and derives about 40 products from Maize, whereas more than 800 products of starch and starch derivatives are being derived in the international arena.

Still, the overall market has witnessed significant changes in the last few years and the prospects look promising with many large players investing in the quality of starches and derivatives.

Demand – Per capita starch consumption in India is 1.5 Kg as compared to global average of 6.1 kg. The consumption in India is nearly one fourth in comparison to China, thereby indicating enormous scope of growth.

The demand for corn starch & starch derivatives looks very promising in India as all the major user segments are recording good growth in their production. The major users of starches and derivatives are food, textile, paper, and pharma sectors.

Source: FICCI Maize Vision 2022

The growing consumption of convenience foods and the healthy year-on-year growth in the paper and textile industries are creating a highly fertile ground for the growth in corn starch sales across the world, but particularly in the Asia Pacific region. Starch derivatives, including glucose syrup and HFCS, are used widely across many industries.

The most interesting and promising of all the sectors is the high-value food processing industry where the demand for starches and derivatives is in a nascent stage, but strong. The demand for Indian starch in food is increasing by 20% with frozen food being the dominating segment; the use of starch in noodles and soups is also increasing, use of starch in ground spices is also a key contributor.

Besides, there’s good potential for export of Corn Starch and derivatives from the Indian market.

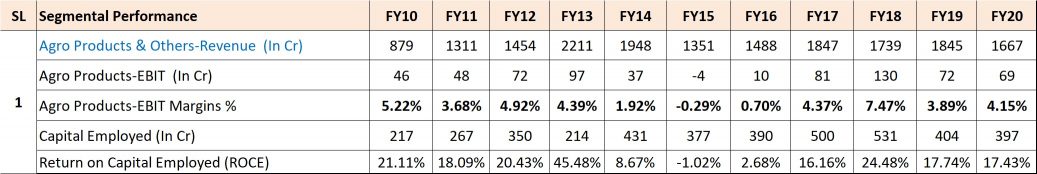

Agro Processing (Mainly Soya based) – Before embarking on achieving leadership status in the Maize processing segment, Soya based processing was the mainstay of GAEL. However, the performance of the same hasn’t been very encouraging and as can be observed from the numbers below, the company too hasn’t been pushing capital into the same with capital employed remaining more or less same over the last 6-7 years.

Source: GAEL Annual Reports

The only good thing is that the operations of the Soya division have mostly been stable, barring FY 15 and FY 16 when the margins dipped significantly. In those years, exports and operating margins of company’s De-Oiled Cakes (DOC) declined significantly as global soybean prices declined to USD 360-370 per tons, against Indian soymeal prices of USD 500 making Indian exports uncompetitive.

As per one of the reports, the agro processing division has been operating at 25% capacity utilization since some time now. So, on the positive side, in a good year with favourable economics, the agro division can give a real boost to the overall profitability of the company; however, it won’t be consistent and can be used as an exit opportunity, especially if the stock price also reacts positively.

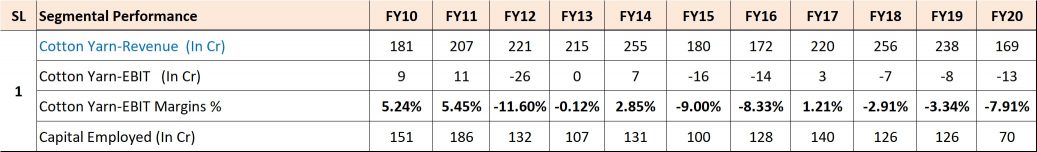

Cotton Yarn – This is again a legacy business and very small in the overall scheme of operations. However, it’s been contributing negatively to the profitability and it would be great if the management decides to come out of the business or sell out the same.

Source: GAEL Annual Reports

The only good thing is that here again the capital deployed has generally trended downwards over the years.

Promoters/Management

GAEL is an owner operated business and over the last few years Promoters have done a good job of scaling up the Maize processing business and becoming the largest player in the industry with 20% + market share.

Mr. Manish Kumar Gupta is at the helm of the affairs of the company. He is around 50 years of age and has been on the Board of Directors of the company since Aug’91, i.e. almost 29 years.

Source: Katalyst Wealth Research

The promoters own 63.81% stake in the company and therefore their interests are directly aligned with those of shareholders.

Since Mar’20, they have bought 82,541 shares at a total cost of Rs 88.25 lakhs. Out of the same, they bought 30,201 shares in the month of June 2020 at an average price of Rs 135.56 per share.

On the front of related party transactions, there’s nothing eye-popping that has come to our attention, except for the remuneration of CMD, Mr. Manish Gupta which was Rs 25.84 crore in FY 19.

Source: GAEL AR 2019

One can argue that the remuneration is on the higher side; however, it is important to note here that out of the total, Rs 25 crore was in the form of commission as a % of profits while the fixed component was quite small.

From our experience, we would rather have promoters/management take higher amounts upfront and have skin in the game than use other questionable means of siphoning out money from the company.

Performance Snapshot

Source: GAEL Annual Reports

The above performance snapshot doesn’t tell much except for the fact that sales and profits have more or less been range bound with the only major positive being no major increase (rather decrease) in finance cost.

The consolidated performance (i.e. all the 3 businesses) snapshot hides more than it reveals and therefore it’s important to look at segment wise results to get the true picture of what’s happening at GAEL.

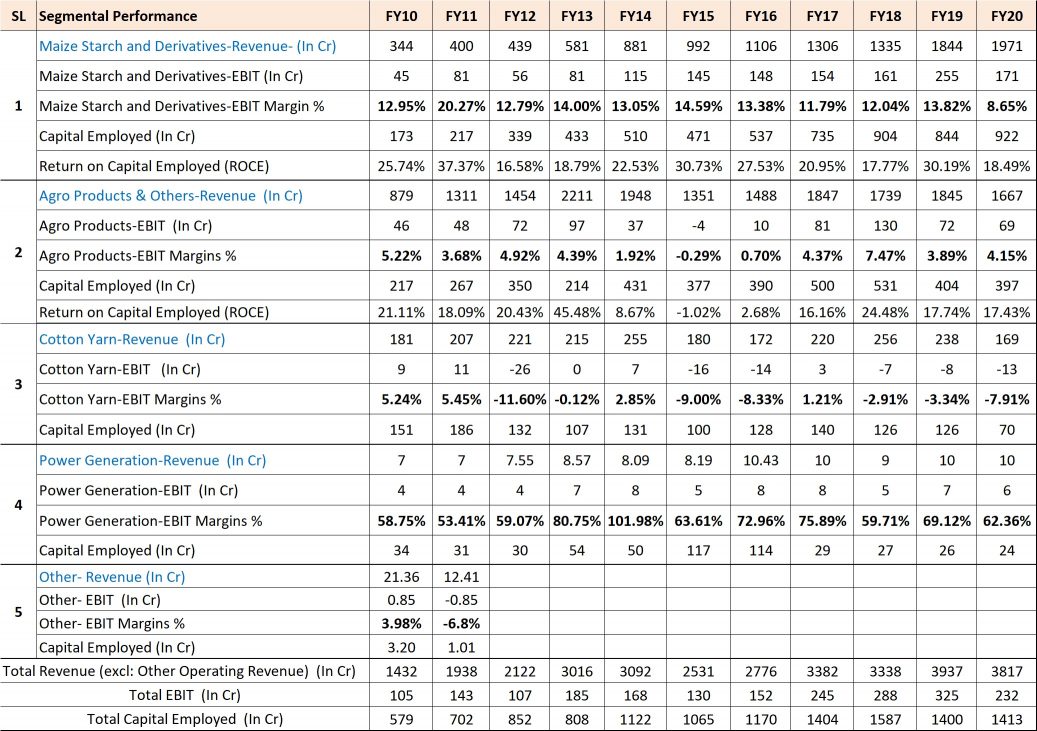

Source: GAEL Annual Reports

As discussed in the sections above, the performance of the Maize division has been phenomenal and is the focus area of the company since few years now. The maize division has done well on all the parameters including sales growth, stability of margins (especially since FY 12) and Returns on Capital Employed.

For the reasons discussed above, the growth story for the Starch and Starch derivatives looks structural with long run-way ahead.

The company too has been pushing for growth with capital employed growing by 4 times in 10 years and doubling in last 5 years.

GAEL has further embarked on a greenfield capex worth Rs 219 crore and the same will increase the overall capacity by 25% from 3,000 TPD to 3,750 TPD.

FY 20 wasn’t so good for the Maize segment as the average maize prices increased by over 55% in 9M FY 20 in comparison to 9M FY 19 and the company recorded decadal low EBIT margins of 8.65% against the normal range of 12-14%.

Source: indexmundi.com

The prices have softened since then and the EBIT margins for the maize division are already back to 12% in H2 FY 20 against 5-6% in H1 FY 20.

Going forward, with expansion in capacity and reversal in margins, the maize division is likely to report good growth in sales and profitability.

As far as Agro processing and Cotton yarn divisions are concerned, we don’t expect significant shift in their sales and profitability, except for one-offs. For instance, the agro processing division has been running at only 25% capacity utilization and therefore in a good year with favourable environment, it can deliver very good numbers and on the bad side, something similar to FY 15 may pan out.

The good thing is that management hasn’t pushed more money into both the Agro processing and Cotton yarn divisions in the last 5-6 years.

Source: Katalyst Wealth Research

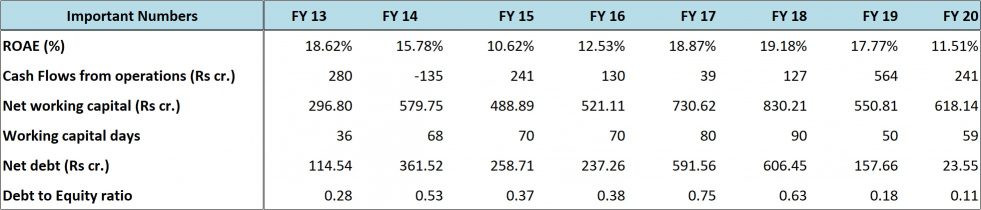

As far as other numbers are concerned, as can be noticed above, here again the company has done well. The average ROAE for the last 7-8 years is 15% +, cash flows from operations have been very good and the working capital management too has been excellent.

Further, despite spending around Rs 600 crore in the last 5 years on expansion of fixed assets, the long-term borrowings are almost zero. Whatever little debt is mostly for inventory stocking and seasonal in nature.

Valuations

GAEL is currently quoting at a market cap of 1,800 crore. The company is largely debt free and so the enterprise value is almost same as market cap.

For the last 5 years the average PBT of the company is Rs 201 crore and at the current tax rate it amounts to PAT of Rs 150 crore.

Taking into account full benefit of phase-II expansion in Chalisgaon and the proposed expansion in West Bengal, we believe GAEL might be able to expand Maize processing sales to Rs 3,000 crore in 3 years from Rs 2,000 crore in FY 20. Further, with reversion in EBIT margins to 12-14%, we believe there can be significant improvement in the profitability of the Maize division.

Assuming similar performance of Agro processing and Cotton yarn divisions as in FY 20, the overall PAT of the company can improve to 250-280 crore in next 3 years from Rs 146 crore in FY 20.

We believe the scope for major deterioration in the performance of the company from the current levels is low as the FY 20 performance was already on the lower side on the margins front.

Thus, considering the relatively depressed FY 20 earnings and the good potential for growth in the years ahead, we believe the valuations are reasonable at around 12 times trailing twelve months earnings for the biggest and the best managed company in the maize processing segment.

Risks/concerns

Agro processing and Cotton Yarn divisions continue to be a drag on the performance of the company. A change in strategy with high capital deployment in the two segments can worsen the outlook for the company.

The minimum support prices for the major crops including maize are being increased on regular basis. Any major hike, like in FY 20, can again impact the ability of the company to pass on the prices to its customers and can impact the profitability.

The good performance of the Maize division can be undone by the bad performances of the agro and cotton yarn divisions, like it happened in FY 15 and FY 16.

Slowdown in end user industries like textiles, food, paper, etc, can result in slow growth rate for the usage of starch and starch derivatives.

Disclosure: I don’t have any investment in Gujarat Ambuja Exports and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No