Dear Members,

We have released 7th Aug’20 – Jun’20 earnings update on Manappuram Finance and Aarti Drugs. The same has been produced below. For other updates, please refer the following link – https://katalystwealth.com/category/latest-updates/

Date: 7th Aug’20

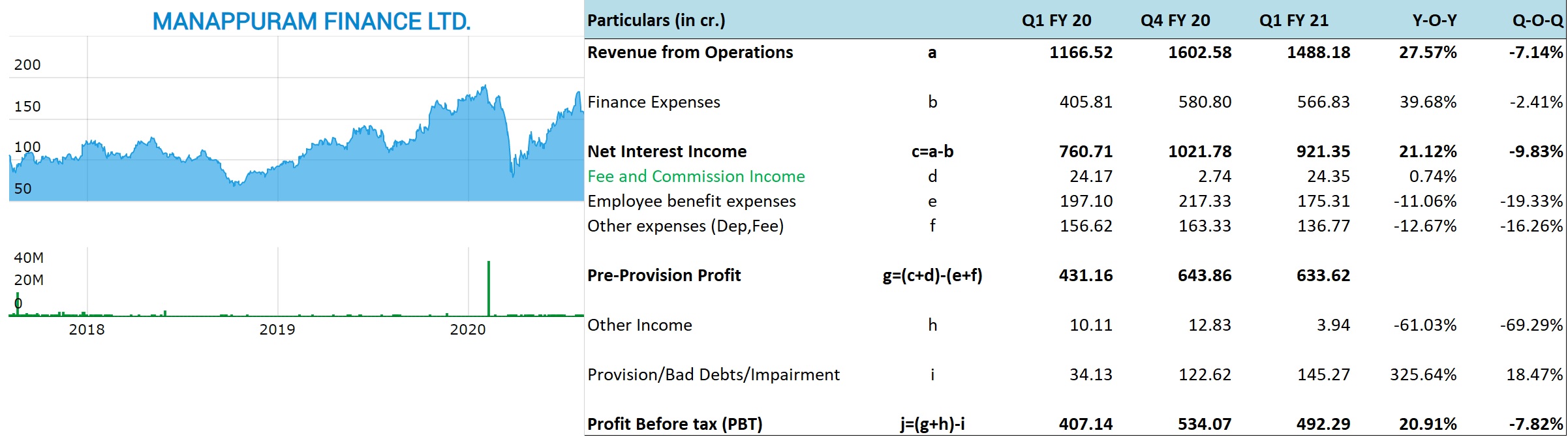

Manappuram Finance (NSE – MANAPPURAM) – Jul’17 Alpha stock

CMP – 161.60 (BSE); 161.60 (NSE)

Rating – Positive – 8% weightage; this is not an investment advice (refer rating interpretation)

Source: bseindia.com

Manappuram has reported decent set of numbers for Q1 FY 21; however, the real picture will emerge only from Q3 FY 21 onwards when the shield of the moratorium will be over and the company will start recognizing NPAs, especially in the non-gold businesses.

On the consolidated basis the company has reported 25.6% growth in AUM on YOY basis, 21.12% growth in Net interest income, 47% growth in pre-provision profits and 20.9% growth in PBT.

Gold Loan business – Gold Loan AUM grew by 33% on YOY basis and 5% on QOQ basis. The entire growth was on account of increase in gold prices even as gold tonnage and customer base de-grew by 4-5% on QOQ basis.

The Avg. LTV was around 57% against RBI limit of 75% (increased to 90% for banks till 31st Mar’21).

As per the management, the decline in the tonnage can be attributed to substantial increase in gold prices. For the borrowers, gold is extremely important to them and they try to ensure that only the required tonnage is pledged. So, with higher prices, tonnage growth tends to slow down or even decline in case of sharp increase in prices. The opposite happens when the gold prices go down.

Online gold portfolio has been consistently increasing and stood at 63% at the end of Jun’20 and 48% at the end of Mar’20. The management expects the same to increase to 70% by the end of FY 21.

Regarding demand, it was lower in Q1, primarily on account of 10% of the branches not being operational and with the events like marriages, other functions, academic season getting deferred.

Also, at least till now the management hasn’t witnessed any material change in aggression by banks and other NBFCs in the gold loans space.

Overall, for FY 21, the management is still hopeful of 10-12% growth in gold loans and the overall share of the gold loans to increase to 78-80% from around 67-68% in FY 20.

Microfinance – Microfinance business of the Company continues to be the most impacted on all the parameters like AUM, profitability and asset quality. In Q1 FY 21, AUM de-grew by 8% on QOQ basis as there were no disbursements during the quarter.

The company reported 2.6 crore loss in the microfinance division on account of higher provisions.

As per the management, they made covid-19 related provision of Rs 75 crore during the quarter in addition to Rs 55 crore provided in Q4 FY 20, taking the total to Rs 130 crore i.e. around 2.6% of the total MFI book.

Majority of MFI customers opted for moratorium in phase 1 (April and May) while in Phase – 2 collection efficiency was 55% in June and around 70% in July. So, around 25-30% of the book is still under moratorium which ends on 31st August.

The management expects some pain after the moratorium and the normalcy in collections to return only from Q4 FY 21.

Vehicle finance – Vehicle finance is the 3rd largest segment after Gold Loans and MFI.

During the quarter the loan book de-grew by 5.5% on QOQ basis. Out of the total look book, around 68% pertains to commercial vehicles, 23% two-wheelers and 10% passenger vehicles.

As per the management the CV finance business was already under some stress even before the lockdown and the NPAs got aggravated further during the lockdown. The GNPA increased from 2.9% at the end of Q3 FY 20 to 9.9% at the end of Q1 FY 21. The NNPA is around 4%.

The collection efficiency has been improving month on month with 42% collection in April, 58% in May, 75% in June and around 85% in July. Around 37% of the customers opted for moratorium in phase 1 and currently there are none in phase 2 as the company has been convincing its customers to not avail moratorium on account of the disadvantages associated with the same.

The normalcy in the business is expected only from Q4 FY 21 onwards as even though the vehicles have started plying on the roads, the utilization is still around 60-65%.

Housing finance – The Housing finance portfolio of the company is relatively small at just about Rs 627 crore and down less than 1% on QOQ basis.

The collection efficiency has been improving month on month with 50% in April, 60% in May, 76% in June and around 85% in July.

The GNPA at the end of Jun’20 was 5.1% and the NNPA was 3.9%.

Liquidity – As far as liquidity is concerned, the access to the funds has been comfortable with uninterrupted access including CP rollovers and funds from banks and AMC partners. The company has also been able to reduce its dependence on commercial papers and as a result increase the liability tenor from around 260-270 days at the end of Q3 FY 20 to around 452 days at the end of Q1 FY 21.

Cost Cutting – The company has set up a committee that will focus on optimizing costs and bring down the operating expenses further by looking at the areas besides the security costs. For instance, with higher share of online gold loan, the OPEX as a % of gold loan AUM can come down further.

Overall, as mentioned above, we are not so much concerned about the gold loan business, while we do expect some pain in both the microfinance and the CV finance businesses. Still, the company seems better placed than few banks and most of the other NBFCs.

Also, it’s good to note that the management is completely focused on collections and doesn’t intend to push for growth in the non-gold segment in the near term.

Given the above-mentioned factors, we believe the valuations are reasonable at around 2.24 times book value and have retained the positive rating on the stock.

Key risks to our rating will be much higher NPAs in the non-gold businesses, significant drop in gold prices or loss in market share to other NBFCs and banks.

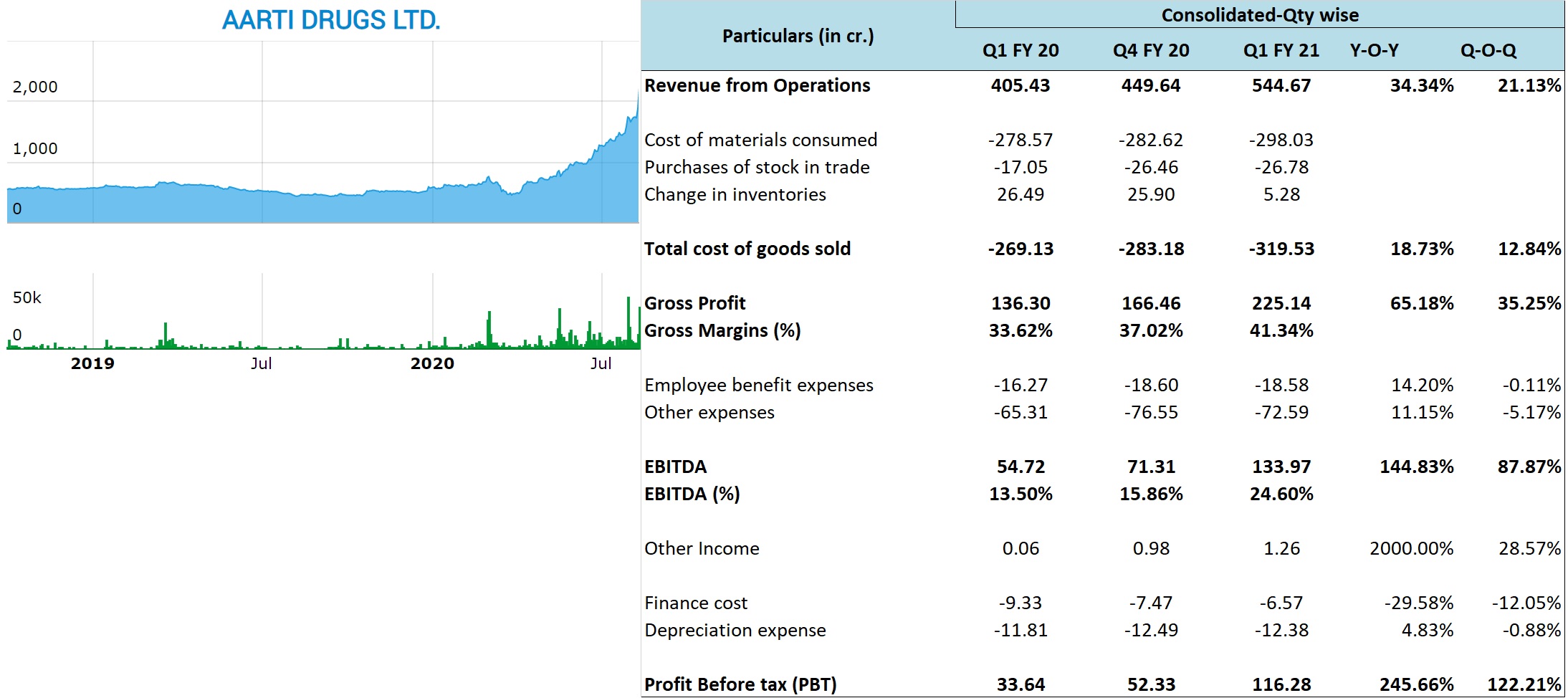

Aarti Drugs (NSE – AARTIDRUGS) – Sep’18 Alpha stock

CMP – 2353.60 (BSE); 2356.45 (NSE)

Rating – Neutral; this is not an investment advice (refer rating interpretation)

Source: bseindia.com

Aarti Drugs has reported very good set of numbers for the Jun’20 ending quarter.

On consolidated and on YOY basis the company has reported 34.34% growth in sales, 65.18% growth in gross profits, 144.83% growth in EBITDA and 245.66% growth in PBT. Around Rs 15 crore sales pertaining to the Mar’20 quarter got pushed to the Jun’20 quarter, so there’s marginal impact of the same.

Of the total sales, APIs contributed 85% and the rest came from formulations.

During the quarter domestic API sales grew by 28.19%, export API by 29.13% and formulations grew by 89.49% on YOY basis.

Around 50% of the YOY growth in the API segment was due to the volume growth. Within API, domestic sales accounted 65.11% and 34.89% came from exports.

In Formulations, 50% came from exports.

Sales growth – On the sales front, the management believes the Q1 was slightly subdued as the volume growth was hindered in the month of April as the company could not run its factories efficiently. Going forward, the management is hopeful of even better volume growth.

Regarding pricing of products, there was an increase during the quarter as there was a shortage and also the competition including the Chinese companies increased the prices across the board. The management believes that the current prices can sustain for the next 1-2 quarters but beyond that a lot would depend on how the competition, especially China prices the products.

Margins – So, during the quarter the gross margins expanded to 41.34% against 34-35% for FY 20 and ~33% in FY 19. On the back of the same and good growth in sales, the EBITDA margins expanded to 24.60% against 13.50% in Q1 FY 20 and 14.50% for the whole of FY 20.

As mentioned above, higher realizations are the primary reason behind the expansion in margins.

We don’t think the company can sustain 24-25% EBITDA margins in the long run; however, as per the management they are quite hopeful of closing FY 21 with 18-20% EBITDA margins. Before Covid-19, the management used to project 15-16%; however, they are now noticing some structural changes wherein even the Chinese companies are focusing more on profits and have thereby increased the prices.

Thus, 18-20% looks sustainable to the management in the medium term.

Formulations – As far as formulations division is concerned, the company has been running its plants at about 75-80% utilization; however, capacity is not a major constraint as the company has also been getting some products manufactured from other 3rd party sites.

The main focus is on addition of new products through R&D and opening up of new markets.

Exports will be the major growth driver for the formulation’s unit; also, the profitability is higher in the export markets.

For FY 21, the management is hopeful of recording 250-280 crore sales from formulations.

China Factor – Increasingly, buyers are looking for additional suppliers from countries other than China. Thus, it can be a good opportunity for API and chemical industry in India and can do well over the next few years.

Our assessment – Aarti Drugs seems favourably placed and expected to perform well over the course of next few years. At current capacity and product prices, the company can do about 2,200-2,300 crore sales from APIs and there’s no limit as such for formulations.

For FY 21, we believe the company can clock a turnover of ~ Rs 2,200 crore on consolidated basis. Assuming 19% EBITDA margins, the company can do a PBT of Rs 340 crore and PAT of about Rs 250 crore.

Thus, at around current price the stock is trading at 21.8 times our assumed FY 21 earnings.

Considering the opportunity ahead, expected structural shift towards India, reasonable entry barriers in the industry, the valuations look reasonable; however, we cannot ignore the fact that the current higher realizations and the margins may not sustain. Also, the stock has had a 1 way run up from 450 odd levels to around current levels of 2,300.

The pharma sector is surely getting a lot of interest now with many not so good companies appreciating at the same time.

Thus, one can consider partial profit booking (15-20%), especially if the stock has become a large part of one’s portfolio. As a profit protection strategy (trailing Stop loss), we may consider exiting the stock in case of a fall below 1,850 odd levels.

Disclosure: I have personal investment in Manappuram Finance and hold Aarti Drugs in wife’s account.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: In Manappuram Finance

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – Yes, investment in Manappuram Finance. Aarti Drugs in wife’s account.

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No