Dear Members,

Hope you all are doing well.

We have completed 2 years of Model Sheet service and would like to share with you our Performance card.

The Model Sheet service was started on 15th Aug’18 and the purpose of the same was 2-fold:

- Determine performance of our stock research on Portfolio basis (against benchmark indices) than on individual stocks basis

- Give an easily replicable (from any point onwards) sheet to members so that they can make the most of our equity research services

I think the first point is quite clear and doesn’t need any explanation.

As far as second point regarding replicability and from any point onwards is concerned, mostly members tend to ignore the same and here I would like to spend some time on the topic.

So, in any Model sheet update, you will find weightages for all the stocks at that particular date. The weightages are based on current value of the holding in the stock and the total portfolio value. If one were to replicate the same weightages and make the changes as per subsequent updates, the returns on his/her portfolio will mirror that of Model sheet.

Ex. For instance, the current value of the Portfolio is around 56 lakhs. Suppose the same increases to Rs 67 lakhs by the end of next Independence Day i.e. 15th Aug’21, then all those who would have replicated it with similar weightages would notice a similar 20% increase in their portfolio value.

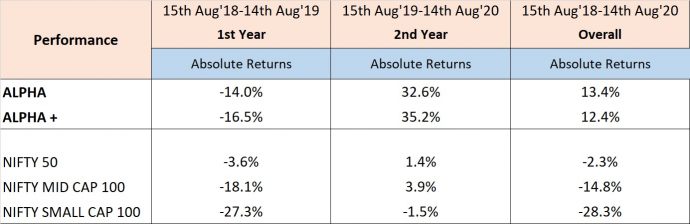

Coming back to the Performance, over the last 2 years we have achieved 12.5-13.5% absolute return which translates into 6-6.5% CAGR against negative returns for all the major indices.

As you all are aware, our major focus area is small and mid-cap segment and therefore the real benchmarks for comparison are MID and SMALL CAP indices; however, we endeavour to outperform all the major benchmark indices, including the large cap-based NIFTY.

The first year i.e. 15th Aug’18-14th Aug’19 wasn’t great wherein we recorded 14-16.5% drop. While we outperformed MID and SMALL Cap indices, NIFTY outperformed us by a decent margin.

2018-19 was also a period of huge polarization with a handful of expensive stocks getting more expensive by the day while the others were getting butchered. As we believe in Growth at Reasonable Valuations philosophy, we couldn’t participate in the high-flying expensively valued companies and ended up underperforming NIFTY.

There were also a few wrong stock selections as well.

While we don’t expect to make gains on all our stock investments, there are surely a few lessons to be learnt from the losses. For instance, rapidly changing industries isn’t our forte and that is so true for the Media Industry. Similarly, without growth, no matter how high quality an industry or company might be in terms of operations, valuations can still take a good beating.

Last but not the least, all the industries are cyclical to varying extents.

As a Research Analyst and Investor, it’s never easy underperforming benchmark indices; however, we did believe that 2018-19 kind of polarization cannot continue forever and eventually markets will take a liking for reasonably valued good small and mid-cap companies.

Luckily, the above did pan out and the last 1 year has been really good with our Model sheets delivering 31-35% returns against -1.5-4% for other major benchmark indices. With the same we are now outperforming all the major benchmark indices by a good margin.

A special mention here for the Pharma stocks because without the two Pharma stocks, the above wouldn’t have been possible. What is also important to note is that we initiated coverage on the both during 2017-18 when the Pharma cycle was in a downturn. So, while it took 2-3 years for the stocks to perform, it’s been worth the wait.

As mentioned above, we believe all the industries are cyclical and we are increasingly trying to identify good companies during bad turns of cycle. Normally, during bad turns both the earnings and the valuations get depressed; but the same can also provide a good entry point with relatively lower downside risk.

As the cycle turns around (may not happen in all the cases), we get the dual advantages of expansion in earnings and valuations rerating.

Currently we are excited about a lot of our initiated stock ideas because it looks like we have been able to add on to them during not so good business cycle and depressed valuations, while the potential for growth remains strong.

Finally, signing off and hoping to not get complacent and continue with the good performance in the years ahead.

Note: Model sheet is an information service, same for all and a reflection of our research analysis. It doesn’t take into account anyone’s personal financial situation or risk profile. Please consult your financial adviser before following or implementing the same partially or in totality.

Wish you Good Health and Wealth.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

By subscribing to Alpha/Alpha Plus, you agree to accept the following terms/conditions:

www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690. The model sheet service is an extension and reflection of our research analysis and is in no way a portfolio advisory or buy/sell recommendation for you. The purpose of model sheet is to get a tentative performance snapshot on portfolio basis than on individual stock basis. It is basically a Performance measuring tool, similar to say an index.

The model sheet service is basically an information service and doesn’t take into account your personal financial situation or risk profile. Please consult your financial adviser before following or implementing the same partially or in totality.

The transactions mentioned are not the actual transactions, but take into account the ending prices for the day and ~0.3% transaction charge.

For the purpose of calculation of returns, the surplus cash (cash i.e. not invested in stocks) will be assumed to be invested in liquid funds at around ~6% return per annum.

There’s zero refund policy because as soon as you subscribe to the same you get access to the complete portfolio snapshot.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.