Dear Members,

We have released 19th Sep’20: Insecticides (India) Ltd (NSE Code – INSECTICID) – Alpha/Alpha Plus stock for Sep’20. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 19th Sep’20

CMP – 495.25 (BSE); 495.35 (NSE)

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

Insecticides India is a leading Agro Chemicals Manufacturing company engaged in the manufacturing and marketing of crop-protection products like: Insecticides, Herbicides, Fungicides, Biologicals and Plant Growth Regulators (PGRs).

The company commenced operations in 2002 and is promoted by Mr Hari Chand Aggarwal and his son Mr Rajesh Aggarwal.

In the above-mentioned product categories, the company offers 100 + formulation products (including 21 + Maharatna Products) and 22 Technical Products.

At around CMP of 495, we like the company for the following reasons:

- The company has a strong presence in both the formulations and technical product categories and is further enhancing presence in technical production capabilities through expansion at Gujarat and Rajasthan Facilities

- Focus on Launch of New Products – The company has consistently been working on developing R&D based innovative products. It already has 13 products approved under 9(3) category and working to launch a total of 10 products in FY 21.

- Phasing out Generic Products – With the launch of new products, the management is focusing on replacing the generic (high volume-low margin) products with the high margin Maharatna products.

- Exports – The company currently exports to 20+ countries and intends to expand to 50+ countries and 100+ customers by the end of FY 23.

- FY 20 and Q1 FY 21 were relatively tough for the company on the front of margins. However, going forward, on the back of higher sales of Maharatna products and the launch of new products, the company is likely to record double digit growth in sales and earnings.

- The company has attained debt free status as of Jun’20 and intends to maintain the same over the next few years.

- The company has outlined Rs 110 crore + CAPEX for the expansion of formulation and technical capacities and intends to fund the same through internal accruals.

- Lastly, despite the depressed earnings of the last 2-3 quarters and one-time extraordinary loss of Rs 10 crore, the stock is still available at ~13.6 times trailing twelve months earnings.

Company details

Insecticides India was incorporated in 1996 and commenced operations in 2002. It was promoted by Mr. Hari Chand Aggarwal and his son Mr. Rajesh Aggarwal.

The Company is in the business of manufacturing and distribution of Agro-Chemicals comprising of Technical and Formulations under categories like: Insecticides, Herbicides, Fungicides, Biological and Plant Growth Regulators (PGRs).

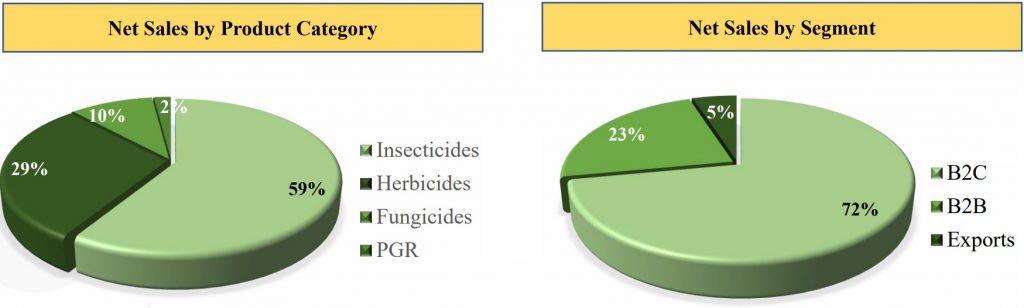

The sales break up for FY 20 is as follows.

Source: Insecticide’s Q4 FY 20 Presentation

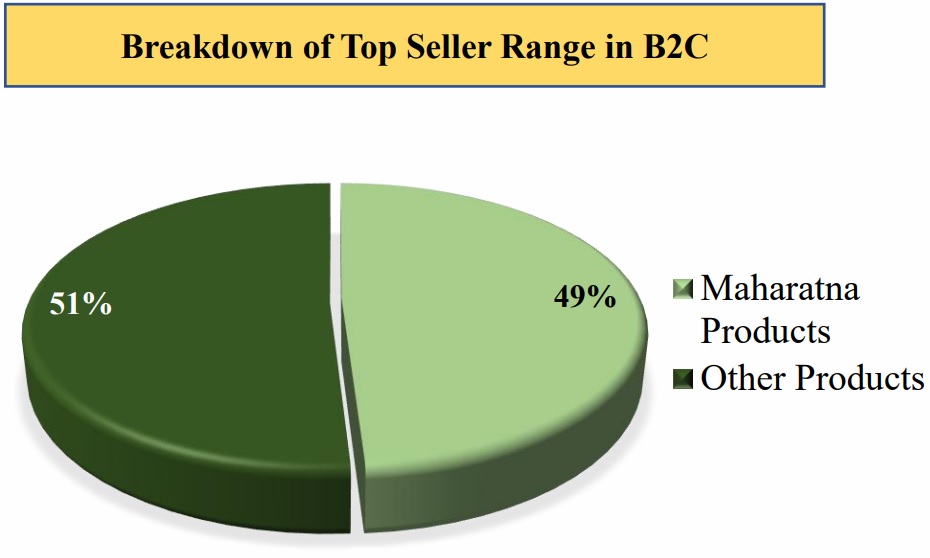

The company offers 100 + formulation products (including 21 + Maharatna Products) and 22 Technical Products. Maharatna products generally command higher margins in comparison to other generic products.

As per the management, new product launches and some Maharatna products command gross margins as high as 40-50% while some generic products command margins as low as 15% with the average being around 30%.

Source: Insecticide’s Q4 FY 20 Presentation

Thus, if the company is able to increase the share of new launches or Maharatna Products, there’s scope for expansion in the margins of the company.

Dealer and Distribution Network – The Company has established a nationwide sales infrastructure comprising of 375 + Stock keeping Units (SKU), 5,000 + distributors, and 60,000 + dealers/Retail Outlets.

Technical Collaborations – The company has done well in terms of providing latest technology and products to its customers through its tie ups with leading companies across the world:

- Nissan, Japan – Marketing Tie up for specialty products Fungicide PULSOR (2012), Selective Herbicide HAKAMA (2012) and Miticide KUNOICHI (Oct 2019)

- Nihon, Japan – Tie up for SUZUKA (Flubendiamide) (2016) AIKIDO (2018) & HAKKO (Buprofezin) (2016)

- Momentive, USA – Tie up with MOMENTIVE Performance Material INC, USA for AGRO SPRED MAX (2016) for silicone based super spreader

- Amvac, USA – Technical Collaboration for manufacturing and marketing of THIMET (2006) & NUVAN (2012)

- OAT Agrio, Japan – The company signed a JV with OAT Agrio, Japan for setting up a R&D Centre in India with an objective of inventing new agrochemical molecules in India for the international market. Further, the company also has a tie up for PGR ROOT BEAD (2017) PGR CHAPERONE (Dec 2019).

Manufacturing Facilities – The company has a total 5 formulation plants, 2 Technical synthesis plants and 1 Biological manufacturing plant under toll arrangement. These units are spread across the states of Rajasthan, Gujarat and Jammu and Kashmir.

The aggregate installed capacity is following:

- 19,400 KLPA Liquid

- 75,750 MTPA Granules

- 18,770 MTPA Powder

- 13,800 MTPA Active Ingredient and Bulk

Backward and Forward Integration – The management has planned a CAPEX of Rs 110 crore for the next 2 years for setting up a formulation’s unit at SEZ, formulations and technical unit (with major focus on technical unit expansion) in Rajasthan, and 30,000 MTPA pesticide and pesticide intermediates unit at Dahej, Gujarat.

Basically, the major focus is around setting up technical units so as to backward integrate and have a greater control over raw material availability and cost.

The benefit from the above expansions is expected to accrue from FY 22 onwards.

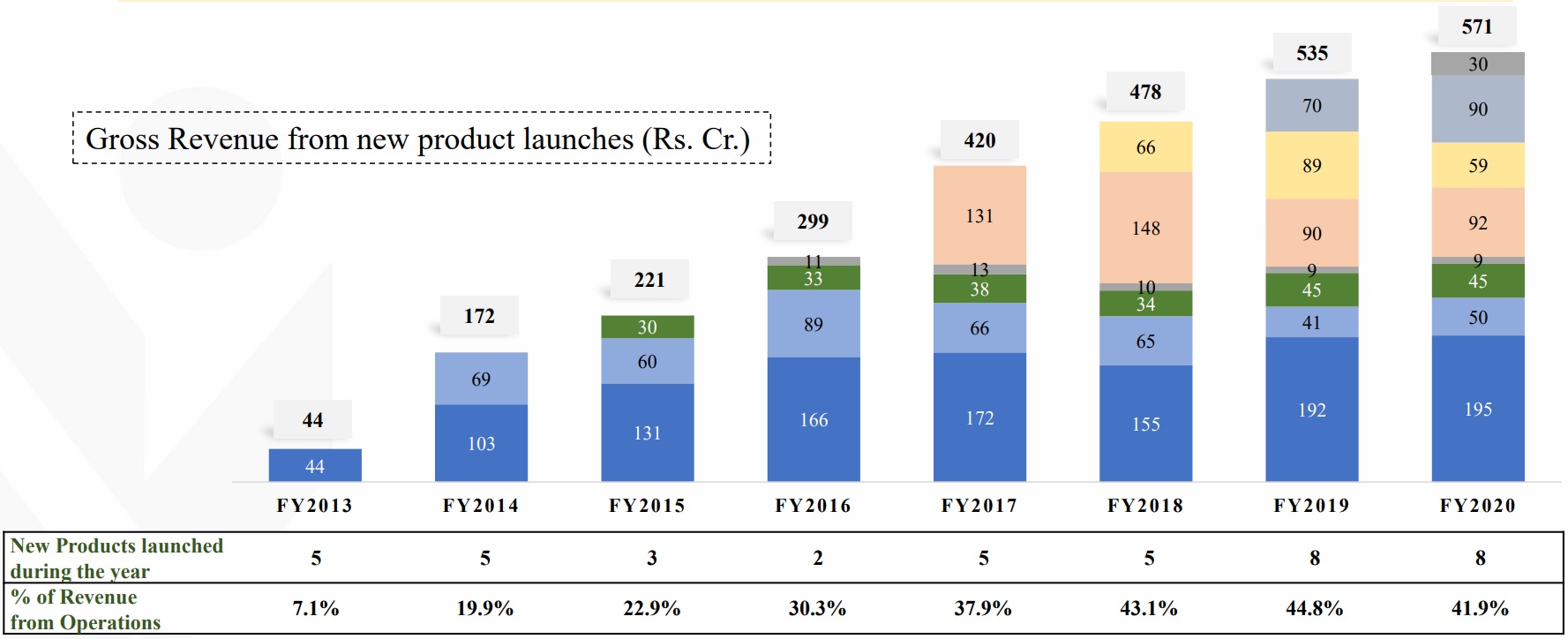

New Product Launches – As mentioned above, some of the new product launches command significantly higher margins than the average and as part of phasing out generic products strategy, the management has been actively working on developing R&D based innovative products.

For the same it relies on in-house R&D and international partners to launch new products. The company has 5 R&D centres and over 75 experienced scientists working to develop new products by understanding the grass root problems that farmers are facing.

The company has a proven track record of introducing new products each year with the number of new launches increasing from 2 in FY 16 to 8 in FY 20. The company has already launched 2 new products in Q1 FY 21 and intends to launch a total of 10 products in FY 21.

The company also maintains a product freshness index to measure the total sales from the new products launched since 2013.

Source: Insecticide’s Q4 FY 20 Presentation

Another important point to note is that Insecticides India has 13 products approved under 9(3) category and intends to launch new products from the same.

The 9(3) category corresponds to First-time manufactured/imported products in India and it takes almost 5-6 years for the products to get registered under this category. On the other hand, 9(4) category corresponds to already registered pesticides and the timeline for registration is relatively shorter at 2.5-3 years.

Source: Insecticide’s Capital Market 2019 Presentation

As can be noticed above, the registration pipeline has 22 products under 9(3) category which will be first time manufactured/imported products in India. Successful registration and launch of such products can result in the expansion of Maharatna product basket of the company.

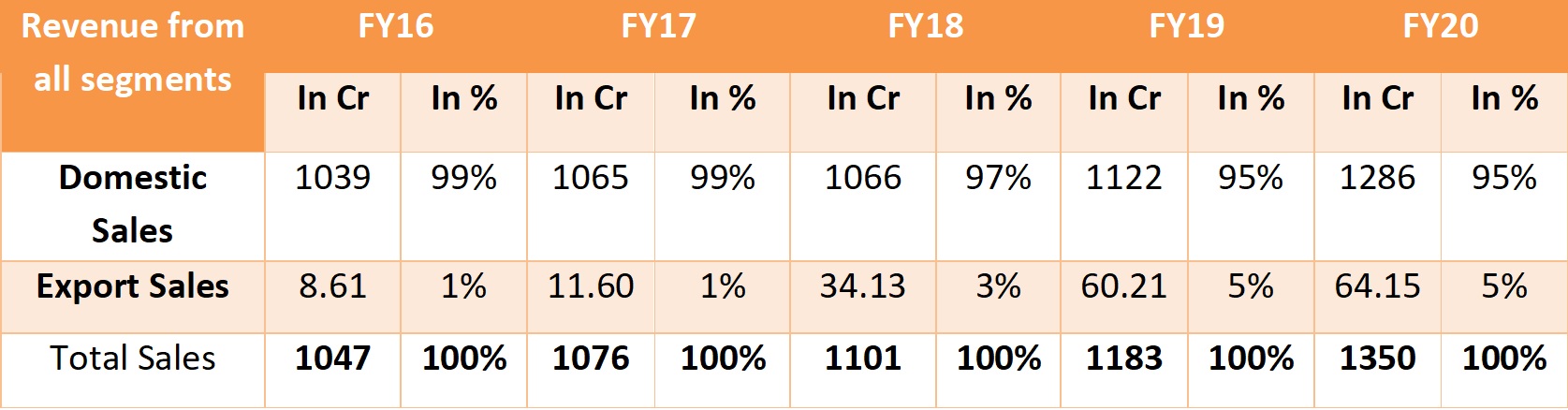

Exports – This is another area the management is increasingly focusing on.

Source: Insecticide’s Annual Reports

So, before FY 16, the export sales were almost zero; however, since then the contribution has been increasing with exports accounting for 5% of sales in FY 20.

In fact, the management was targeting 100 crore sales from exports in FY 20; however, Pakistan, which accounted for 50% of the company’s export sales in FY 19, stopped importing and as a result the company could not achieve its target.

The company is currently exporting to 20 + countries and intends to expand to 50 + countries and 100 + customers by the end of FY 23. It also intends to achieve Rs 300 crore export sales by FY 23.

In order to multiply export sales and meet FY 23 target, the company is coming up with export-oriented unit at SEZ Dahej for formulation of Insecticides & herbicides.

Basic details on Agrochemicals Industry

Technical and Formulation – Agrochemicals are manufactured and sold mainly in two forms – Technical and Formulations.

Technical are the first stage of manufacture where the chemical is concentrated and unsuitable for direct use. This is then processed with other materials known as formulates to develop the finished agrochemicals, known as formulation.

Different kinds of Agrochemicals – Crop protection chemicals are broadly classified into the following classes:

- Insecticides: The chemicals that are used to protect plants from insects and pests are known as insecticides. 22% of the global crop protection chemicals market is constituted by the insecticides

- Fungicides: This class of crop protection chemicals is used to control the spread of fungal diseases in plants. They constitute about 27% of the global agrochemical market

- Herbicides: Herbicides are chemicals that kill or control the growth of weeds in the cultivation area. Globally, they constitute about 44% of the total agrochemical market

- Bio-pesticides: They are pesticides of biological origin i.e., derived from animals, plants, bacteria etc.

- Others: This includes plant growth regulators, nematicides, rodenticides and fumigants. They constitute 7% of the total agrochemical market

Agrochemicals Landscape in India – As per JLIEDU, India stands fourth in agrochemicals management and its current market value is $4.1 billion. It has been estimated that the market will reach $8.1 billion by 2025. The exports market is expected to reach $4.2 billion by 2025.

In spite of its huge market, India lags in terms of the agrochemical consumption that amounts to 0.65 kg per hectare approximately.

The low usage of agrochemicals in India can be gauged from the fact that around 3 years back the size of the domestic Brazilian crop protection market was around 5 times the market size of India and this is despite the agricultural area in Brazil being half of that of India.

In India, about 30% of crop output is lost due to attacks by pests, weeds, and other diseases. Another problem is low productivity per hectare and declining soil fertility. Exponentially growing population and ever-increasing demand for food necessitates the use of more agrochemicals to increase the yield per hectare.

India also has the advantages of low manufacturing cost and low cost of qualified manpower and can serve as the manufacturing partner for the innovator companies. India already is a net exporter of pesticides to countries such as US, Brazil, France, China and some other European & African countries.

Currently R&D expense as a percentage of sales of Indian companies is about 1% compared to 11-12% globally. Thus, about 70% of all pesticides used in India are generics.

Agriculture Reforms – After several decades of no major reforms in agriculture, recently, the government has undertaken landmark agricultural reforms, freeing farmers from restrictions on sale of their produce and ending the monopoly of traders.

It has also opened the window for private capital by allowing farmers to enter into deals with large buyers such as exporters and retailers.

The reforms are expected to catalyse the sector and give a boost to rural incomes.

The key measures of the legislation passed are as follows:

- Farmers are free to sell their produce to anybody, anywhere. There won’t be any barriers for intra and inter-state trade in agricultural produce

- Farmers are free to tie up with large buyers, exporters and retailers

- Cereals, pulses, oil-seed, edible oils, onions and potatoes have been removed from the list of essential commodities. No imposition of stock limit except under exceptional conditions

Overall, the reforms are expected to yield better return to farmers, increase their incomes and also give them better access to high quality seeds and agro chemicals.

Promoters/Management

Insecticides India is an owner operated business and over the last 18 odd years Promoters have done a good job of scaling up the agrochemicals business from practically nothing to Rs 1,350 crore + in FY 20.

Mr. Hari Chand Aggarwal is the Promoter, Chairman and whole time Director of the Company. Mr. Hari Chand Aggarwal is associated with the Company since its inception.

Mr. Rajesh Aggarwal (son of Mr. Hari Chand Aggarwal) is the Managing Director of the company and took over the charge as the Managing Director in 2006. Under his stewardship, the company went public and got listed on BSE and NSE in 2007.

Source: bseindia.com

The promoters own 68.89% stake in the company and therefore their interests are directly aligned with those of minority shareholders.

In Mar’20, they bought 29,016 shares at a total cost of Rs 60.17 lakhs.

On the front of related party transactions, there’s nothing eye-popping that has come to our attention. Even the promoter’s remuneration comprises largely (more than 75%) of Bonus and Performance incentives.

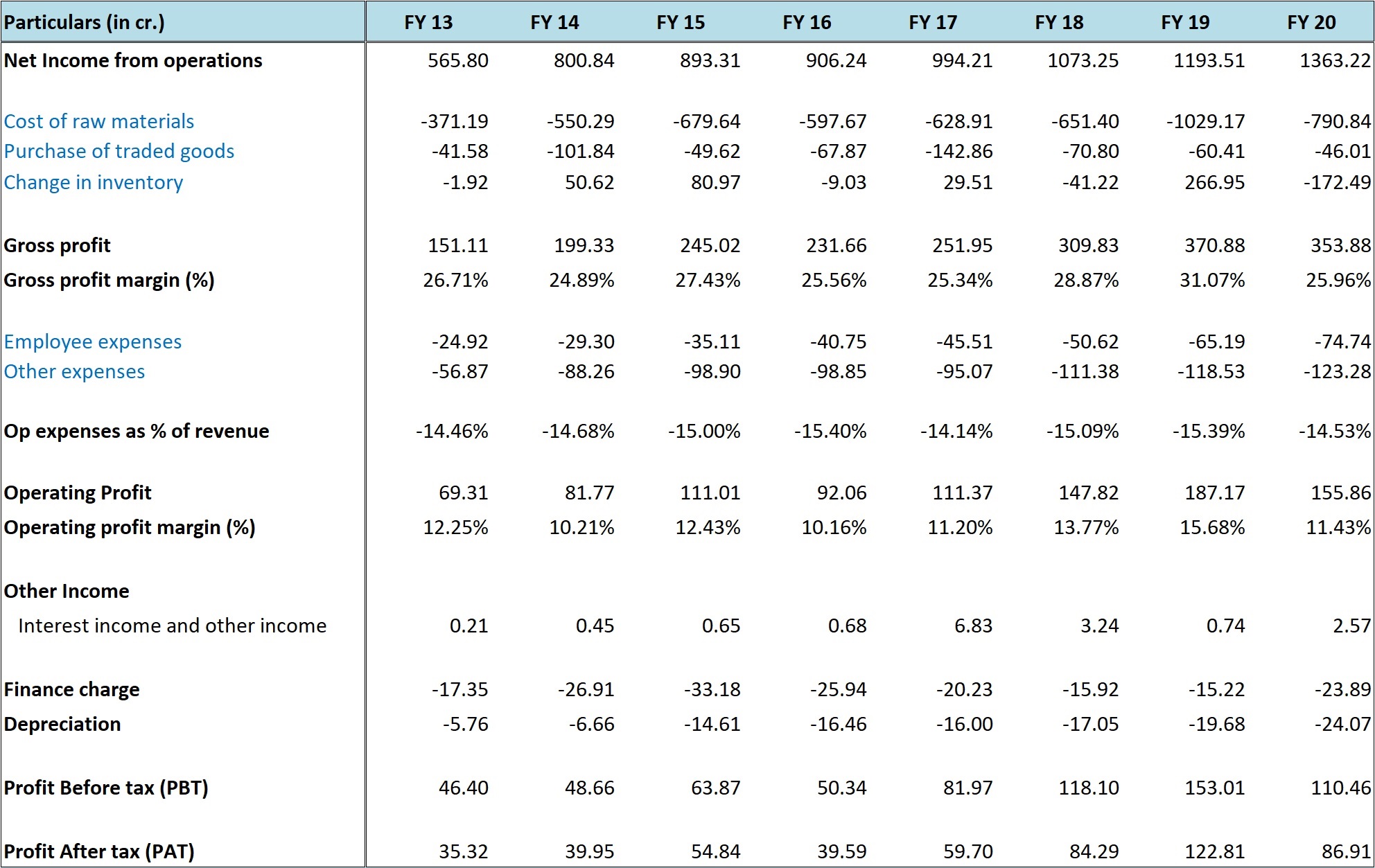

Performance Snapshot

Source: Insecticides India Annual Reports

Insecticides India has more or less been a consistent performer over the years in terms of sales growth and has averaged around 10-11% growth in top-line year on year.

As far as gross margins are concerned, they have kind of fluctuated between 25-31% with an average of 27% over the last several years.

The gross margins of Insecticides India are a function of raw material pricing, product mix (share of Maharatna products and other generic products), etc. FY 20 was relatively bad with gross margins of 25.96% and the reasons are as follows:

- Higher contribution from low-margin generic products in comparison to Maharatna products and

- Decline in realizations for 2 key products Nuvan and Thimet.

In compliance of Govt. Regulations, the company had to stop the production of Nuvan and Thimet from 31st Dec’18 and it had stocked decent amounts of inventory of the same for FY 20. However, taking into account the covid-19 situation and the company’s effort to raise cash, it disposed of Nuvan, Thimet and other generic products at competitive prices which resulted in lower gross margins.

Going forward, the gross margins could again see an improvement on the back of company’s strategy to backward integrate, phase out generic products and launch new products, some of which could come under Maharatna category.

With expansion in Gross margins, the overall EBITDA margins are also likely to improve to 12-13% or even higher against 11.43% recorded in FY 20.

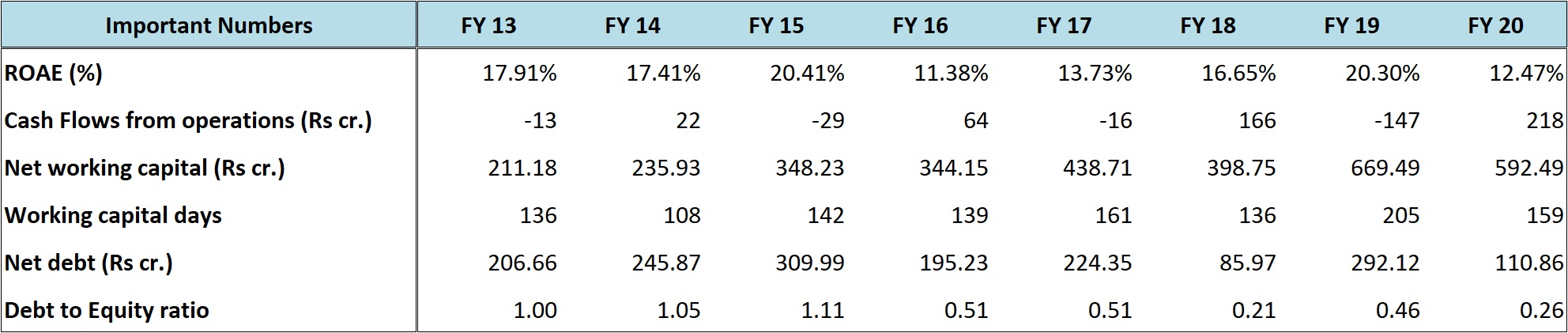

Source: Insecticides India Annual Reports

Another important facet of Insecticides’ performance is working capital management. So, in general, the working capital days for the company are generally on the higher side at around 130-140 days; however, the number increased substantially to around 205 days in FY 19.

As a result, the net debt also increased.

Basically, as per the govt. regulations, the company had to stop the production of Nuvan and Thimet from 31st Dec’18 and as a result it stocked up substantial inventory of both the products to continue serving the markets in FY 20.

The company could clear off the inventory of Thimet by the end of FY 20 and expects to sell off Nuvan by Diwali this year.

Also, in the light of the covid-19 situation, the management took a conscious decision of improving collection efficiency and reduce credit period. As a result, at the end of Jun’20 the company could achieve debt free status with surplus cash of around Rs 17 crore.

Importantly, the management intends to maintain the debt free status despite the ongoing CAPEX of Rs 110 crore.

As far as other numbers are concerned, as can be noticed above, here again the company has done well. The average ROAE for the last 7-8 years is 16% +, cash flows from operations have been a bit lower than reported profits, but should improve going forward with strong focus on collection efficiency and reduced credit period.

Growth Plan – We believe the company is likely to continue recording 11-12% CAGR in sales over the next few years on the back of recently introduced products, new launches and higher share of exports. The management intends to increase the share of exports from 5% in FY 20 to around 15% in FY 23.

Further, the company could also witness expansion in EBITDA margins to 12-13% or even higher (from 11.43% recorded in FY 20 and 10.02% on TTM basis) on the back of company’s strategy to backward integrate, phase out generic products and launch new products, some of which could come under Maharatna category.

Another major fillip to the earnings can come from debt free status of the company. Till now the company’s annual interest cost has ranged from 15-25 crore and if the same is reduced to zero or less than Rs 5 crore, the net earnings will get a further boost.

Assuming 11% CAGR in earnings between FY 20-23, 12.5% EBITDA in FY 23, debt free status and around Rs 36 crore depreciation for FY 23, the company can double its PAT to around Rs 145-150 crore in next 3 years from Rs 74-75 crore recorded on TTM basis.

Valuations

Insecticides India is currently quoting at a market cap of 1,025 crore. The company was debt free at the end of Jun’20 with surplus cash of around Rs 17 crore and therefore the enterprise value is largely same as market cap.

On TTM basis the company has recorded PAT of Rs 75 crore (including one-time extraordinary loss of Rs 10 crore). As discussed above, the margins on the TTM basis are on the lower side in comparison to both the average and the peak margins recorded by the company.

On depressed earnings (including one-time loss), the stock is still available at 13.66 times earnings which we believe is reasonable considering the past track record, debt free balance sheet and the prospects of growth.

As also discussed above, we believe the scope for major deterioration in the performance of the company from the current levels is low and it can potentially double its earnings to around Rs 145-150 crore by FY 23.

Over the last 8-10 years the stock has largely traded in the range of 10-30 times earnings. Assuming 15 times FY 23 earnings, the stock can more than double over the next 3 years.

Risks/concerns

Farming in India is still dependent on adequacy and consistency of rain and therefore the demand for agro chemicals also tends to fluctuate with good/bad monsoon.

Govt. ban on specific Agro chemicals just like the ban on Nuvan and Thimet can impact the sales of Insecticides India negatively, especially if its major products fall into the banned category.

Insecticides India’s performance over the last 2-3 quarters has been subdued in comparison to other agrochemical-based companies. Our investment thesis is based on expected turnaround in company’s performance over the next few years. If the same doesn’t pan out or if the performance deteriorates further, the returns from the stock will be impacted.

Disclosure: I don’t have any investment in Insecticides India and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No