Dear Readers,

We read several annual reports in a year and make notes for our reference.

We believe Annual Reports are one of the best documents to increase your understanding of the company.

However, do keep in mind, such notes are mostly cut, copy and paste from the annual reports of the companies and are in no way a research report or a recommendation on the stock.

Here are some interesting details from the Annual Report 2020 of Acrysil Ltd:

-

General Information – 3 manufacturing plants, 82 Distributors, 80 Galleries, 400 + SKUs, 55+ countries to export, 1500 + dealers

-

65 Franchise, 500,000 pa Quartz sinks capacity, 90,000 pa Stainless Steel capacity, 7,000 pa appliances capacity

- General Comments – Acrysil, with the objective of driving growth and developing value, has been opening new avenues by market expansion and product innovation

-

We have been paying special focus on asserting brand dominance, which is highlighted by our global partnerships with reputed retailers for home improvement products

-

The testing times of the pandemic were transformed into opportunities, as your Company is experiencing record online sales of its products

New/Returning Member

Just a Few days beck we released our New Stock Recommendation for our Premium Members. You can read about it HERE

You can access latest Investment Reports, Special situation opportunities by opting for Premium Subscription at the following LINK

-

We have sufficient production capacity to meet the existing demands and any additional demands in near future

-

Our presence in the home improvement sector ensures that we will not be much impacted by this transition in consumer behavior. As people continue to stay at home, they will be looking for home improvement products, leading to growth opportunities for us

- The home improvement retailer and the Kitchen Worktop fabricators segments have received a rousing reception from our target audience. This has been driving the growth of Acrysil in the last year.

-

The Company has established tie-ups with reputed retailers in the home improvement sector. As a result, our identity will improve and our stature as a brand will amplify.

-

Our main emphasis will be on the US, UK and EU markets. There’s already been a good flow of orders from the USA and Germany.

-

Our online sales increased significantly during the pandemic, as the lock-downs prevented any chances of a showroom experience to our customers. The North American market, in particular, has seen staggering success in this regard.

-

We are using our vast distribution network and tie-ups with home retailers to explore new ways of interaction with our customers and provide a better overall experience. This strategy will be crucial for our growth and expansion in the UK market

-

The online sales pan-India nearly doubled due to the pandemic, as the customers trusted Acrysil to deliver safe, durable and modern products which would cater to their multiple needs

- Growth Plans – We export to more than 50 countries worldwide. Over the next five years , we expect to gain traction between 75 to 80 nations

-

Our dealer network has increased by 15% in FY20, to ~1500 over the last three years. We are focusing on strengthening our distributor network relationships and penetrate more markets.

- On the domestic front, your Company will continue to open new showrooms and galleries for its showcasing its products. We have enhanced our identity by penetrating markets such as J&K, Leh-Ladakh, Meghalaya, Puducherry, Jamshedpur, Arunachal Pradesh and Kerala.

- In FY21, new Carysil franchisees will also be roped in for increased market penetration, pan-India

- To increase our penetration, develop a strong network and capitalize on opportunities in North America, we have incorporated a wholly-owned subsidiary “Acrysil USA INC” to deal in kitchen, bathroom and tile products

-

In the UK market, we enhanced our equity stake to 100% stake in Acrysil Products Limited, formerly known as Homestyle Products Limited.

-

Quartz Sinks Overview – The quartz sinks are now being preferred for their durability, which is why we have grown our manufacturing capacity by 1,00,000 units. This will prove crucial in exploring new markets and using different strategies. As the only organisation which manufactures quartz sinks in Asia with Schock Technology, Germany, Acrysil prides itself to be the most popular and trusted choice among the builders

-

The manufacturing capacity now stands at 5 lakh sinks p.a in FY20. The quartz sinks remain a major contributor to the Company’s revenue with a share of 73% in FY20. We have manufactured more than 120 models for improving our product portfolio

-

In light of recent developments, it was noticed that the quartz sinks are now more preferred over their stainless-steel counterparts. This trend has been observed in America , Germany, UK and France

-

Acrysil’s quartz sinks are available in more than 1,500 outlets in India and are trusted by builders and various modular kitchen studios for their premium segment

-

In FY20, 3,86,751 quartz sinks of Acrysil were sold, in comparison to 3,45,510 in FY19. On the other hand, Rs 146.57 crores worth of these sinks were exported and the domestic sales reached Rs 34.89 crores

-

SS Sinks – In FY20, this segment had a 16% share in our consolidated revenues. Furthermore, the installation of the PVD plant aids in providing the Kitchen steel sinks with a metallic finish coating to give customers a stylish experience

-

As of now the manufacturing capacity of steel sink stands at 90,000 Sinks p.a. Press Sink Capacity stands at 60,000 sinks p.a and Quadro sink capacity at 30,000 sinks p.a.

-

Quadro (Designer) sinks production capacity is almost 100% utilized while Press steel sinks are approximately at 70% utilization

-

The stainless steel sinks have accumulated a revenue of Rs 21.39 crores, which was Rs 21.40 crores in FY19

-

During FY20 we introduced a new range of innovative products like Square Sinks and Micro Radius.

-

Appliances – It is our plan to explore more markets and increase our global footprint. The revenues from kitchen appliances amounted to Rs 15.82 crores in FY20, in comparison to Rs 15.26 crores in FY19

-

Quartz wash basins and tiles – The Company sold 804 washbasins in FY20, as compared to 841 in FY19. The aggregate value of this segment is Rs 0.96 crores for FY20, which was Rs 1.21 crores in FY19. Furthermore, the Company sold 30,619 3D tiles in FY20, as compared to 22,163 in the previous fiscal year. The aggregate value of 3D tiles in FY20 stands at Rs 0.78 crores, as compared to Rs 0.57 crores in FY19

- New Launches – Our Quartz Apron Front sinks have marked a huge success in the North American market

-

During the year, we introduced Quartz Antibacterial Sinks and Stainless Steel integrated worktops.

-

We have also set up Special Purpose Machines (SPM) to ensure seamless installation of counter-tops which will boost the market overseas

-

Our newly commissioned Physical Vapour Deposition (PVD) plant provides a metallic finish for our Stainless Steel Kitchen Sinks

-

Share allotment – During the year 7,50,000 shares allotted to Promoters. The company has converted 7,50,000 share warrants into equity shares of Rs 2 each to promoter investors on preferential basis at a premium of Rs 108 per equity share on 13th October, 2019

-

Standalone numbers:

-

Loans to subsidiaries: 2.16 cr vs 4.63 cr

-

Bad debt and Provision for doubtful advances: 1.99 vs 0.88

-

current maturities of long term debt: 5.57 vs 6.07

-

Export incentives and credits (part of other operating income): 9.16 cr vs 8.94 cr

-

Other income: 4.98 cr (including 4.09 foreign currency fluctuation) vs 2.73 cr (Including 0.73 foriegn currency fluctuation)

-

-

Consolidated Numbers:

-

CWIP: 9.09 cr vs 3.50 cr

-

goodwill: 23.92 cr vs 23.5 cr

-

cash and equivalents: 19.5 cr vs 14 cr

-

borrowings: 100.19 vs 96.87

-

Bad debt and Provision for doubtful advances: 2.11 vs 0.89

-

Export incentives and credits (part of other operating income): 9.16 cr vs 8.94 cr

-

Other income: 4.73 cr (including 4.10 foreign currency fluctuation) vs 2.13 cr (Including 0.74 foriegn currency fluctuation)

-

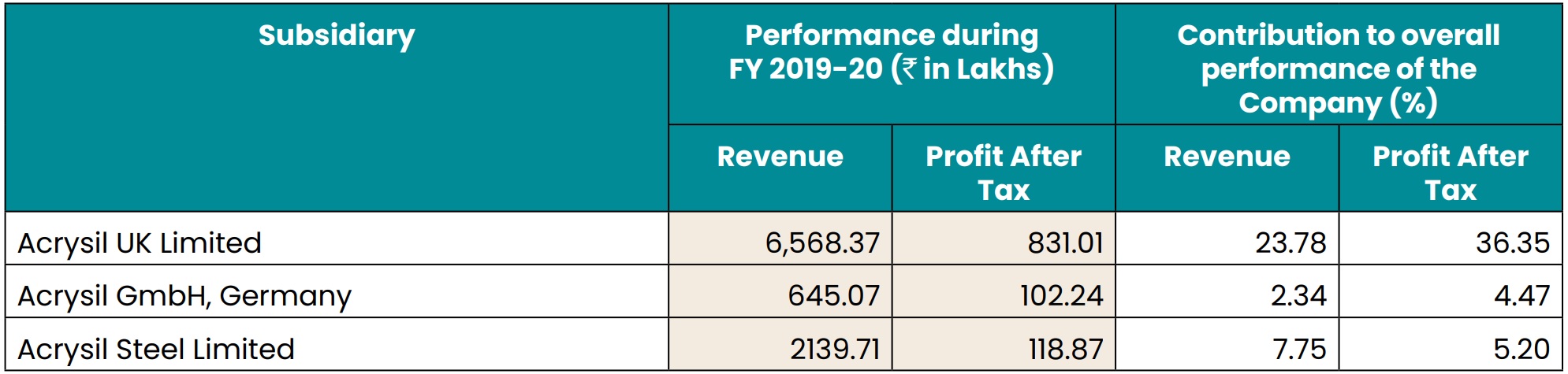

- Performance of Operating Subsidiaries

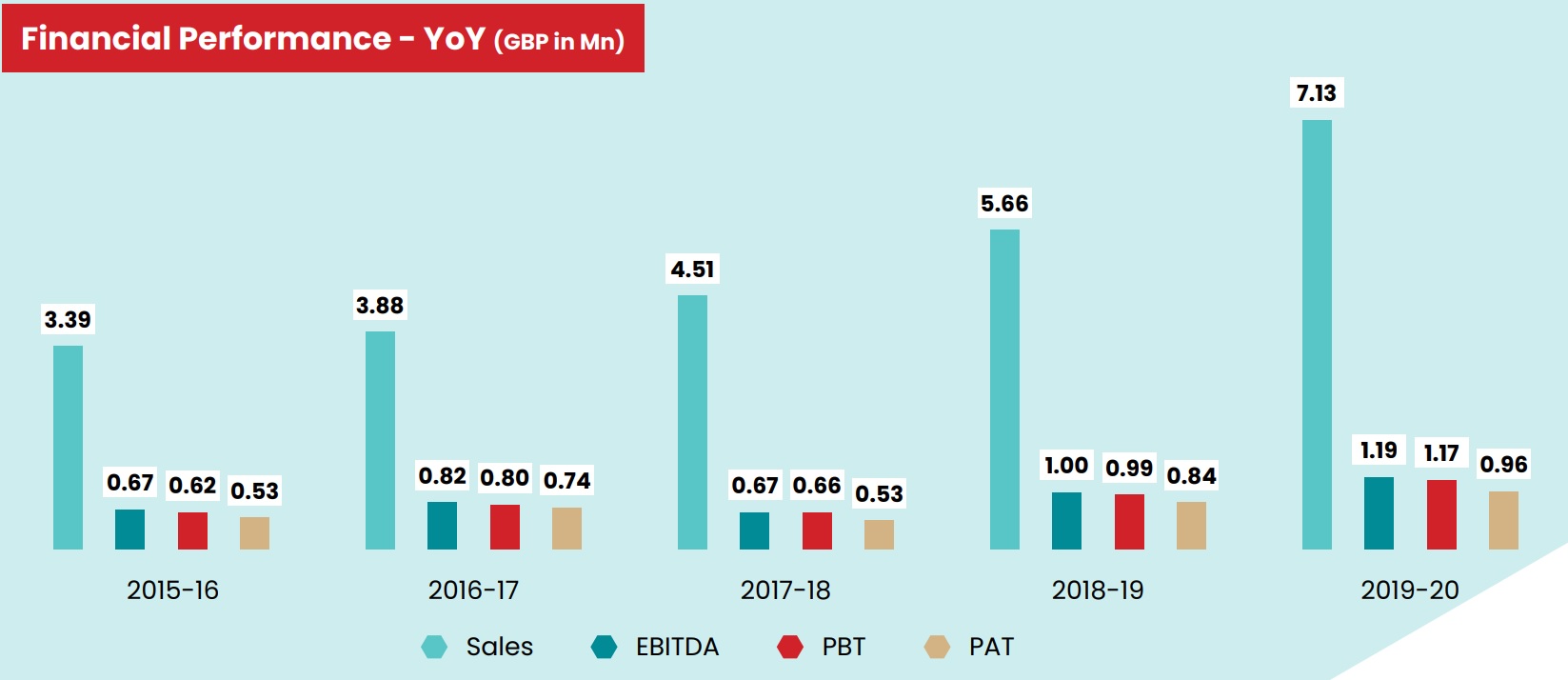

- UK Based Subsidiary’s Performance

Disclosure: This is neither a research report or a recommendation on the stock. I have personal investment in the stock.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: Yes

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – Yes

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No