Dear Members,

We have released 30th Nov’20: Ruchira Papers Ltd (NSE Code – RUCHIRA) – Alpha/Alpha Plus stock for Nov’20. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 30th Nov’20

CMP – 50.35 (BSE); 50.20 (NSE)

Face Value – 10

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

In Mar’17 we recommended Ruchira Papers (RPL) at around 145 odd levels and closed it in Feb’18 at around 185 odd levels.

At the time of the closure, despite liking Ruchira’s focus on operational efficiency and gradual expansion through de-bottlenecking, we were apprehensive about the proposed greenfield CAPEX of Rs 800 crore and the execution challenges considering company’s annual profitability of around Rs 40 crore.

Since then, the fortunes of the paper industry have turned negative with around 8-10% drop in realizations in FY 20 and now drop in volumes on account of Covid-19.

The stock too has had a major fall from the highs of 200 to lows of 30 and currently trading around 50.

We believe at around current market cap of Rs 120 crore the stock offers a good cyclical opportunity from a medium-term perspective. The downside looks low while we expect a gradual recovery in the fortunes of the paper industry with unlocking and return to normalcy (expected opening of schools, offices, etc in 2021).

As far as major greenfield expansion is concerned, the company is facing issues in acquiring land and at the same time not pursuing the project aggressively. Instead, the focus is again on debottlenecking and making other operational improvements which will positively impact the bottom-line.

Company details

Promoted by Mr. Umesh Chander Garg, Mr. Jatinder Singh and Mr. Subhash Chander Garg, Ruchira Papers Ltd (RPL) is engaged in the manufacturing of Kraft Paper and Writing & Printing Paper (WPP).

The Company’s writing & printing paper finds application in note books, writing material, wedding cards, shade cards, children’s colouring books, copier paper and bill books.

Kraft Paper finds its application in the packaging Industry especially for making Corrugated Boxes / Cartons and for other packaging requirements.

The company manufactures paper only from the agriculture waste and waste paper and is therefore engaged in paper production with very low carbon footprint.

The company uses agricultural residues such as wheat straw, bagasse, sarkanda and other materials. It doesn’t rely on wood-based fibre for its raw material requirements.

As per the management, until some years ago, there was no economic use for the straw that remained after farmers harvested their cereal crops in Himachal Pradesh, Haryana and Punjab. Nearly 90% of the remaining stalks were burned to clear fields for the next harvest and this caused immense pollution.

Manufacturing paper from agricultural residue has several benefits:

- Promotes the use of renewable crop, reducing the demand for wood-based fiber

- Reduced cost from the transportation of wood-based moulded to lighter, stronger alternative

- Reduced CO2 emission by 25% compared with conventional wood fiber pulping

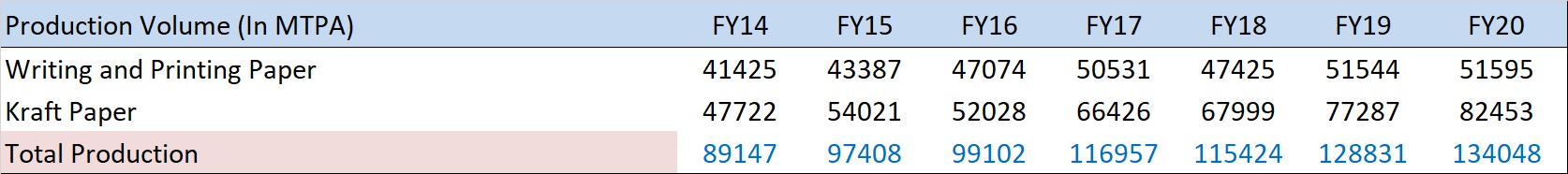

Revenue share between WPP and Kraft Paper – Around 30 years back the company set up Kraft Paper manufacturing facility with a small 2,310 TPA (tonnes per annum) capacity. Over the years the company undertook several phases of expansion and produced around 82,500 Tonnes in FY 20.

Source: Ruchira’s Annual Reports

In 2008, the company set up a 33,000 TPA manufacturing facility for writing and printing paper, while prior to that it was manufacturing only Kraft paper.

Source: Ruchira’s Annual Reports

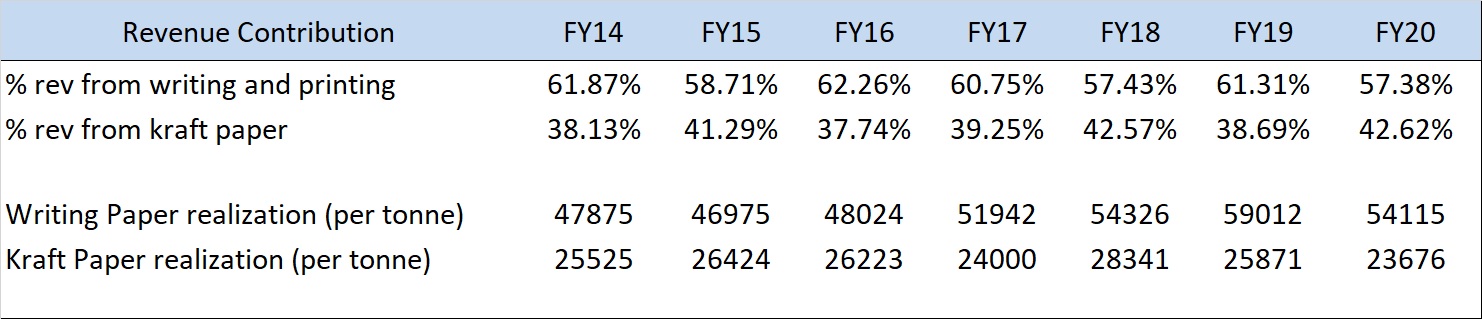

It is important to note here that WPP commands much higher realizations than Kraft Paper and therefore despite lower sales in terms of tonnage, WPP now accounts for more than 60% of the sales of the company against 0% before 2008.

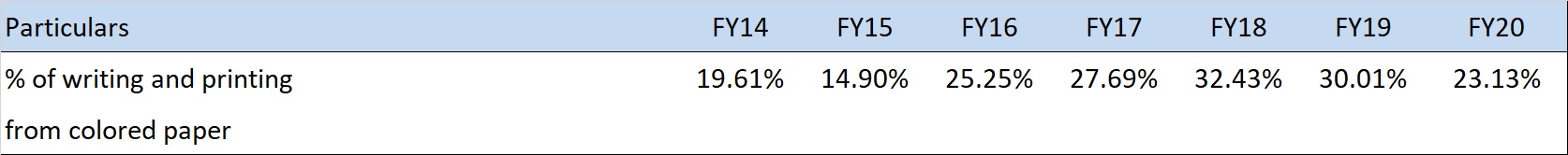

Value added – Within WPP, the company has extended from the manufacturing of ordinary paper varieties to various value-added. The company introduced coloured paper in 2011; the proportion of revenue derived from this product is increasing in the Writing & Printing business.

Source: Ruchira’s Annual Reports

Coloured paper generates a premium of Rs 2 to Rs 3 per kg over the prevailing Writing & Printing paper average.

In FY 20, the Company further extended to the manufacturing of the copier paper. The product was launched in the latter part of FY 20, so the sales were negligible; however, the company could sell 500 tonnes of the same in Q1 FY 21 and hoping to sell 6000 tonnes per annum in the coming years.

The realizations on Copier Paper are again higher than Writing & Printing paper average.

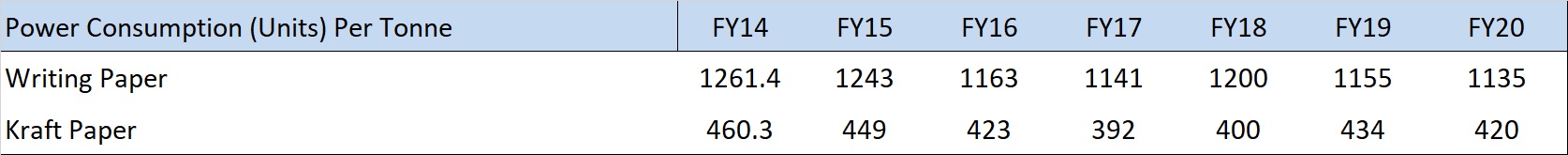

Focus on Operational Efficiency – Being in a commodity business, it’s easy to get lured into making big bang investments during good times, only to repent later when the cycle is down.

With respect to Ruchira, we like their focus on operational efficiency and not necessarily the obsession to be the largest paper company in India.

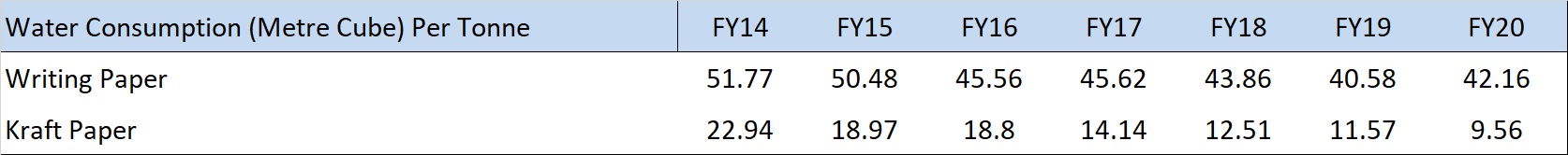

Source: Ruchira’s Annual Report 2020

Source: Ruchira’s Annual Reports

Source: Ruchira’s Annual Reports

In FY 20, the company embarked on a Rs 44 crore modernization within its writing & printing paper unit with the objective to enhance operational efficiency, moderate costs and reduce its carbon footprint.

The company has already modified its existing size press at WPP unit and now working on replacing existing turbine with the objective of improving efficiency and produce more power from the same unit.

Similarly, the company will be investing around Rs 11 crore to make improvements to the ETP with the objective of using lesser water and reduce the pollutants to the minimum in the effluent water.

Basic Details on the Paper Industry

The Indian paper industry accounts for about 4% of the world’s production of paper. The estimated turnover of the industry is Rs 70,000 Cr. Moreover, paper usage per capita in India lags in comparison to most other major economies – 13 kg per capita vs global average of ~ 50 kg and 150-200 kg per capita for more developed countries.

Consumption of paper is closely linked to the economic development of a country. In India, though the per capita consumption of paper is low, it is gradually improving with economic growth. Industrial production, expenditure incurred on the print media, government spending on education, population growth and literacy levels are the key contributing factors.

CRISIL Research estimates moderation in industrial activity as well as exports to have moderated paper demand to a muted 1-3% in fiscal 2020 but demand to recover and grow at a faster paced 5-year CAGR of 5-6% to ~22 million tonne by fiscal 2025.

Covid-19 Impact – As per Deepak Mittal, past president of Karnataka Paper Merchants’ and Stationers’ Association, the writing and printing segment has been the worst-affected sector in the paper industry due to its huge reliance on the education sector.

Close to 60% of the demand of the segment comes from the education segment and barring 10th and 12th standards, the schools are unlikely to open for the ongoing academic year.

To add to the problems, the commercial printing segment, like diaries, calendars, promotional printing like brochures, catalogues, etc have been badly impacted as lot of companies have either cancelled their requirements for this year or moved their promotional exercises to digital.

Overall, in FY 20, globally the demand for writing and printing grades is expected to shrink by 18% and in India too the number is expected around 20-22%.

Medium Term Outlook – Globally, the consumption of the writing and printing paper has been steadily declining.

- Global writing and printing paper demand in 2007: 105 mn

- Global writing and printing paper demand in 2020: 75 mn

This is due to the adoption of digital medium in a big way (magazines, commercial printing, iPads in schools, etc).

After recovering majority of losses of FY 20 in FY 21, globally the writing and printing paper grades are expected to shrink by an average of 4.9% until 2024.

However, India is expected to be an exception and its demand is expected to grow by an average of 3-4% pa till 2024 and reach 6.5-mn tonnes/ annum, thereby adding ~ 1-mn tonne pa to its kitty.

India’s share in the global writing and printing paper was 4% in 2014 (3.56-mn) and by 2024, we will be 11% (currently, we are at 7.3%), thereby being the only major market in the world to grow in the writing and printing paper segment.

The education sector is expected to provide the biggest boost in demand for the writing and printing paper segment with households allocating majority of their incomes on children’s education. There is a long way to go before India reaches a saturation point in this segment.

Promoters/Management

Ruchira Papers is an owner operated business. The company is promoted by Mr. Umesh Chander Garg, Mr. Jatinder Singh and Mr. Subhash Chander Garg. The above 3 are from diverse fields and look after various operations of the company.

Mr. Jatinder Singh addresses finance, administration and procurement, Mr. Subhash Chander Garg looks after taxation, marketing and sales while Mr. Umesh Chander Garg manages the production, maintenance and technical aspects.

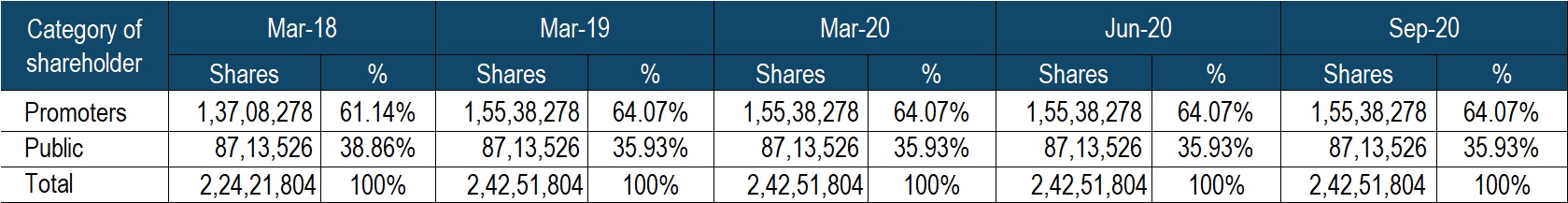

In small cap companies, we believe it’s important as an investor that the promoters hold reasonably high stake and in the case of Ruchira Papers the promoters own more than 60% stake in the company.

What is even more significant is that since FY 13 the promoters have been regularly increasing their stake in the company, mostly through open market purchases and once (in FY 19) through preferential allotment of 18.30 lakh shares at Rs 140.50 per share.

Overall, we find the promoters to be good as they have managed the operations very efficiently. We like their focus on various aspects of the business such as water conservation, working capital management, power and fuel consumption efficiency, value addition, etc.

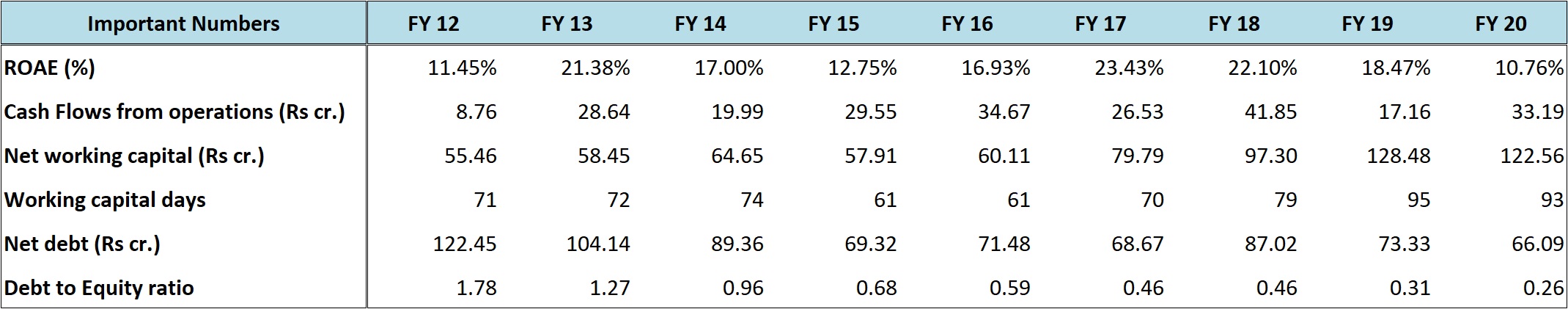

Since FY 10 they have been continuously reducing debt while gradually expanding the manufacturing capacity.

Source: bseindia.com

Performance Snapshot

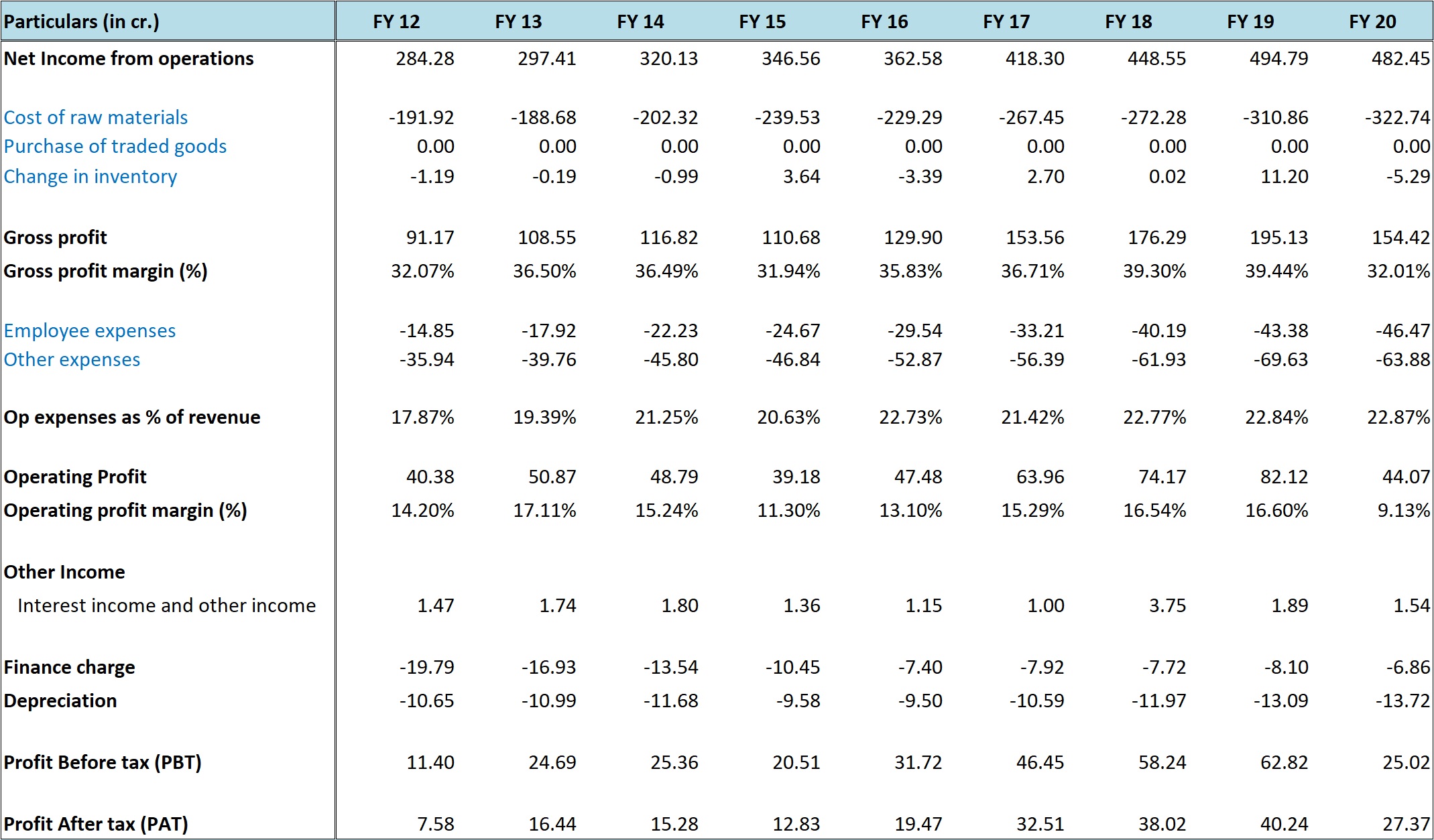

Source: Ruchira’s Annual Reports

Paper Industry is very competitive with not much differentiation in terms of end product and therefore the industry is largely commodity in nature.

The performance of companies belonging to such industries tends to be deeply cyclical and for investors it’s important not to get trapped at the high end of the cycle.

Similarly, while investing at the lower end of the cycle, it’s important to stick to good companies that can sustain the downturn and emerge stronger when the cycle turns around for good.

In case of Ruchira, the going was good till FY 19; however, FY 20 saw a dip in margins and the profitability on account of 8-10% drop in realizations for both the Writing and Printing paper and Kraft paper segments.

The drop in realizations wasn’t accompanied by a commensurate decrease in raw materials cost and as a result the gross margins contracted to lows of 32% against the average of 35-36% and highs of 39-40%.

Source: Ruchira’s Annual Reports

True to the nature of the industry, once every few years such erosion in realizations does indeed transpire. In fact, the Kraft paper realizations in FY 20 were the lowest of the last 7 years.

As a result, despite higher production and sales volume, FY 20 witnessed more than 50% contraction in PBT.

H1 FY 21 has been further bad for the company on account of the Covid-19 lockdown and major impact on Writing and Printing Paper sales as a result of the closure of the educational institutes.

Majority of the educational institutes are unlikely to open for the ongoing academic year; however, FY 21 is expected to be a normal year.

Already, in the Sep’20 quarter the company could achieve 80% of the sales of Sep’19 quarter and the performance is only likely to improve with every passing quarter.

Source: Ruchira’s Annual Reports

While the profitability got impacted in FY 20 and H1 FY 21, the balance sheet and other operational parameters continue to be good.

The company has already implemented part of the Rs 44 crore modernization CAPEX, however, the overall debt at the end of Sep’20 was still low at around Rs 70-72 crore.

Further, with the introduction of the copier paper, higher power generation from the new turbine, the profitability is likely to gradually improve in the quarters ahead.

Valuations

What attracted us most towards Ruchira Papers is the valuations.

True, the profits have been impacted; however, that’s the nature of the cyclical industry unless the demand for the writing and the printing paper has been permanently impacted.

At around current price of Rs 50, the stock is available at a market cap of Rs 120-125 crore.

The debt equity ratio is low at around 0.27 with net debt of around Rs 70 crore.

The 7 years average PAT is around Rs 25 crore and the average cash flows from operations (after deducting interest and adding back other income) for the last 7 years is around Rs 29 crore.

The book value is around Rs 107 against the current market price of Rs 50.

Overall, qualitatively, the company has done well over the years. We also believe the bad phase will turnaround with gradual improvement in profitability in the quarters ahead.

Thus, we believe statistically the valuations are quite low and the stock offers a decent opportunity of 100% + gain over the next few years.

Risks/concerns

Writing and Printing Paper segment accounts for 60% revenue share of the company and much more in terms of profitability. The segment has been degrowing globally. If a similar trend starts playing out in India, the performance and the valuations of the company will be permanently impaired.

Water is an essential ingredient in the paper manufacturing process; any restriction on the usage of water can adversely impact the production of the company.

Effluent treatment is also an essential part of paper manufacturing process; any laxity on that front can bring in troubles for the company.

Disclosure: I don’t have any investment in Ruchira Papers and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No