Dear Members,

We have released 30th Jan’21: Shree Pushkar Chemicals & Fertilizers Ltd (NSE Code – SHREEPUSHK) – Alpha/Alpha Plus stock for Jan’21. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 30th Jan’21

CMP – 124.55 (BSE); 125.50 (NSE)

Face Value – 10

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

Shree Pushkar Chemicals & Fertilizers Limited (SPCFL) is a leading producer of dyestuffs and dye intermediates, and fertilisers like SSP, SOP, NPK, and chemicals like sulphuric acid and DCP, i.e., cattle feed.

The company was incorporated in Mar’93 by Mr. Punit Makharia and was primarily involved in the import and trading of chemical products and dye intermediates.

In 2001, the company established its manufacturing base and started manufacturing dye intermediates. Since then, the company has been expanding both horizontally and vertically and evolved into a backward integrated dye manufacturing company and fertilizers with zero waste model.

At around CMP of 125, we like the company for the following reasons:

- Integrated dye manufacturer – SPCFL is one of the few integrated manufacturers of dye intermediates and dyestuffs and thus has very low dependence on outside supplies for critical raw materials.

- Zero waste model – Company focuses extensively on utilizing the waste generated to convert into value added by-products and has thus been able to tackle the pollution problem which is so critical to the functioning of the dyes industry.

- Launch of New Products – Company’s focus on backward integration and conversion of waste to value added products has resulted in newer avenues of expansion with fertilizer and cattle feed divisions being examples of the same.

- Exports – In the last few years the company has obtained registration/ certification with the following international organisations: “Bluesign” accreditation, ZDHC (Zero Discharge of Hazardous Chemicals) and GOTS certification (Global Organic Textile Standard). With the same the company has started marketing dyes under its own brand name of “DYECOL” in international markets like: Switzerland, Austria, Bangladesh, Singapore, Korea, Taiwan, etc and receiving great response with 3-fold increase in sales in the last few years.

- Expansions – The company is in the process of expanding Dye Intermediates capacity from 9,000 MTPA to 22,000 MTPA and the same will be operational in FY 22. The company has also doubled its SSP fertilizer capacity from 200,000 MTPA to around 400,000 MTPA through acquisition of Madhya Bharat Phosphates (MBPL) at a cost of Rs 28 crore and FY 22 will be the first year with full consolidation of the same.

- Despite the organic and inorganic expansions, the company continues to be debt free on net basis.

- The Promoters have been continuously increasing stake in the company through open market purchases.

- Despite the depressed earnings of the last few quarters, the stock is still available at ~12.5 times trailing twelve months earnings (here, we haven’t included Jun’20 quarter as it was mostly under lockdown)

- On the back of expansions and acquisitions, we believe there’s a strong probability of doubling of PAT from Rs 30 crore to Rs 55-65 crore over the next 2-3 years.

Company details

Shree Pushkar Chemicals & Fertilizers Limited (SPCFL) was incorporated on March 29, 1993 by Mr. Punit Makharia as Shree Pushkar Petro Products Limited. The company commenced operations with the trading of imported chemical products and dye intermediates.

In 2001, the company changed focus from trading to manufacturing and made a modest beginning with a single plant for manufacturing Gamma Acid (dye-intermediate).

Since then, the company has been expanding both by way of backward and forward integration and has:

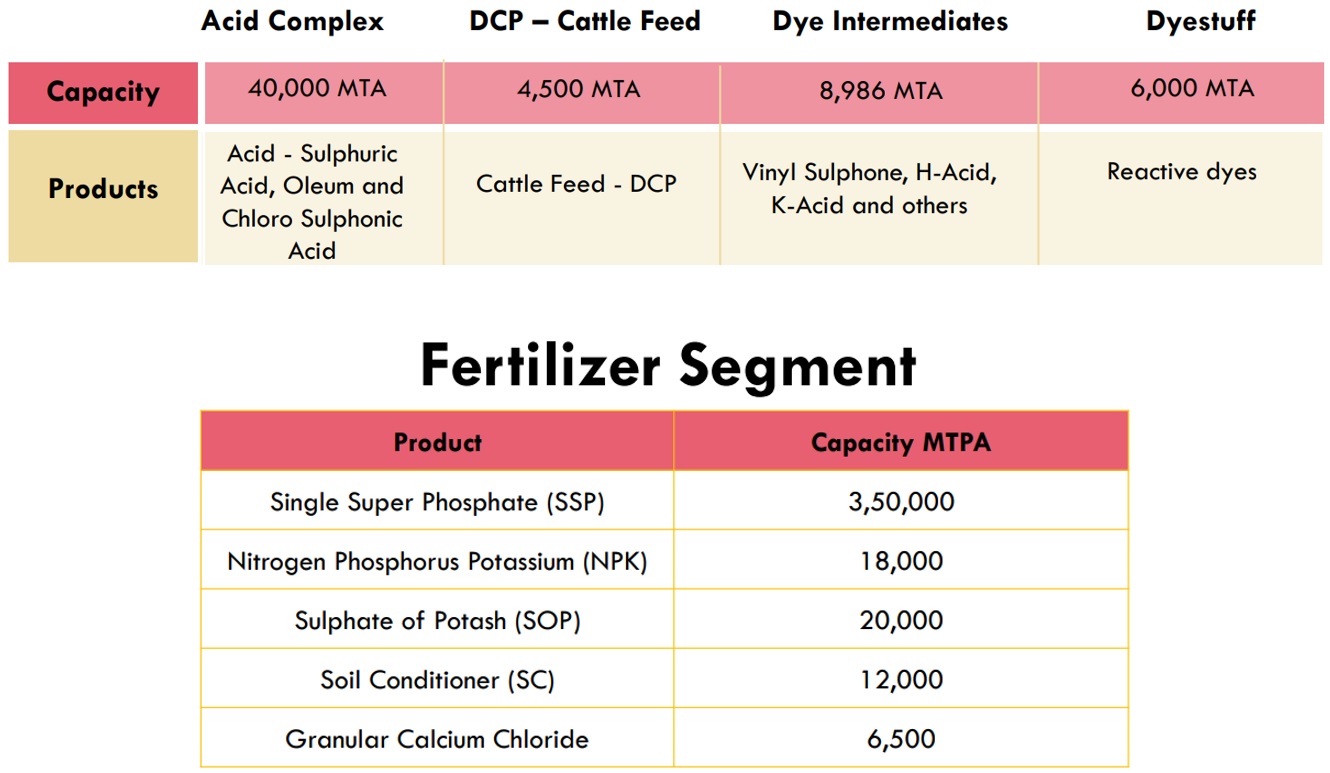

- ~9,000 MTPA capacity for dye-intermediates,

- 6,000 MTPA capacity for dye-stuffs (forward integration)

- An acid complex with 40,000 MTPA capacity for manufacturing of Sulphuric Acid and its derivative Acids – like Oleums & Chloro sulphonic Acid (CSA) with a captive power plant based on the waste heat generated in the manufacturing of acids (backward integration)

- A plant for manufacturing of Di-Calcium Phosphate-DCP (A cattle feed supplement) based on spent acid generated in the manufacturing of dye-intermediates (waste to value-added)

- Fertilizers like SSP (Single Super Phosphate) based on 70% acid generated in the manufacturing of CSA (waste to value-added) and

- Soil Conditioner based on Gypsum generated in the manufacturing of DCP (waste to value-added)

Source: SPCFLs Q2 FY 21 Investor Presentation

The distinctive focus of the company on converting the waste generated into value added by products like Fertilizers and Cattle Feed Supplements has helped the company tackle the pollution problem so typical of the dyes industry and avoid major shutdowns commonly faced by other manufacturers.

Further, lower wastage also helps in lowering treatment cost of effluents through in-house Effluent Treatment Plant (ETP)

Dye Stuff and Dye Intermediates segment – Dye Intermediates find application in manufacturing of dyes, which, in turn, are used as colouring agents in textiles. China and India govern the industry with a market share of ~75% and ~15% respectively.

Over the past few years, stringent environmental regulations, rising labour and power costs and lower export incentives have eroded the low-cost competitiveness of Chinese manufacturers and brought integrated dye manufacturers in India at par with their Chinese counterparts.

If at all the China + 1 hypothesis becomes true, Indian dye manufacturers like SPCFL can gain tremendously on the back of the shift in market share from China to India.

As far as SPCFL is concerned, the company started with the manufacturing of dye intermediates in 2001 and forward integrated into manufacturing dye stuffs in 2016.

In the interim it also backward integrated into manufacturing of key raw materials and also set up acid complex for manufacturing of Sulphuric acid and derivative acids for captive consumption.

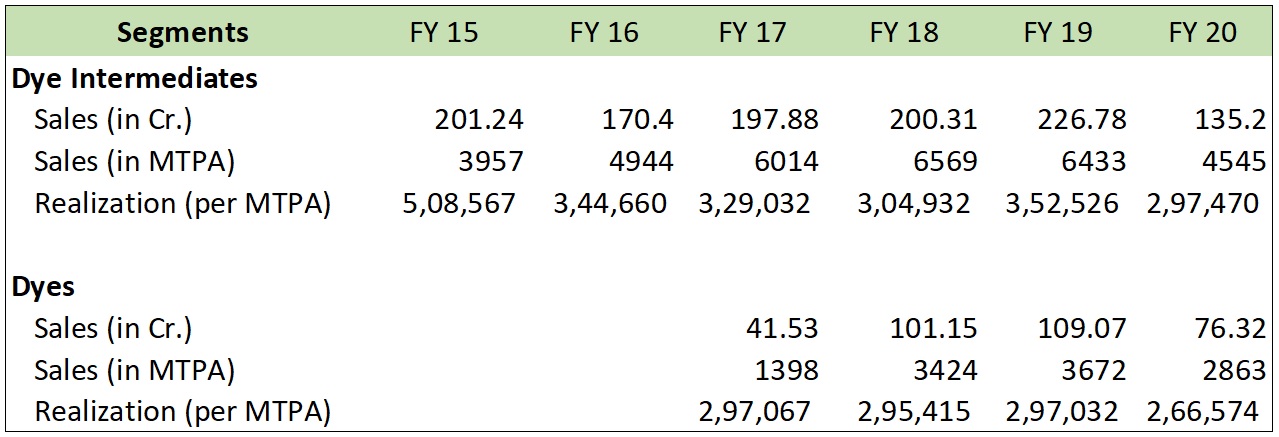

The company produces a wide portfolio of dye intermediates – H-Acid, Vinyl Sulphone, K-Acid, Gamma Acid, R Salt, among others. Also, the capacities are fungible to a certain degree across products and are produced on the basis of global demand and captive requirements; however, H-Acid and Vinyl Sulphone account for the bulk share of the production and sales.

In FY 19, the company attained 96% capacity utilization in the Dye-Intermediates segment (including both internal consumption and external sales).

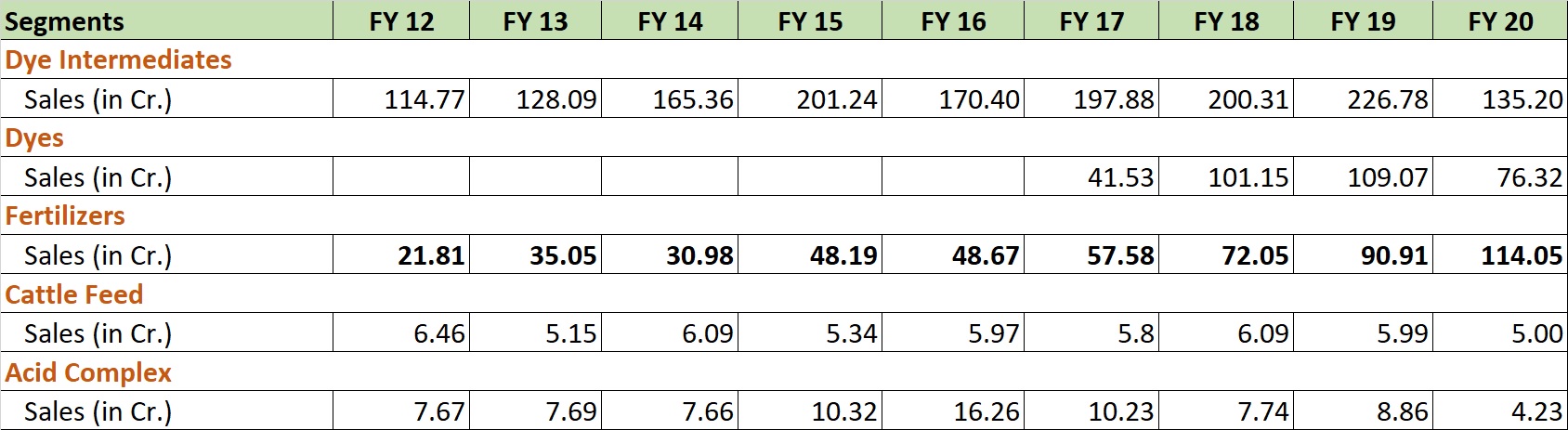

Source: SPCFLs Annual Reports

FY 20 sales were lower on account of the planned shutdown of the Unit-1 for the purpose of repairs & renovation of the dye-intermediate plants. The company spent around Rs 5 crore on the same and the production was expected to start from the end of CY 2020.

Besides the revamp of Unit-1, the company will be completing CAPEX of Rs 75 crore by the end of FY 21 for setting up a new unit i.e., Unit-5. With the commercialization of the same, the Dye Intermediates capacity of the company will increase from 9,000 MTPA to 22,000 MTPA.

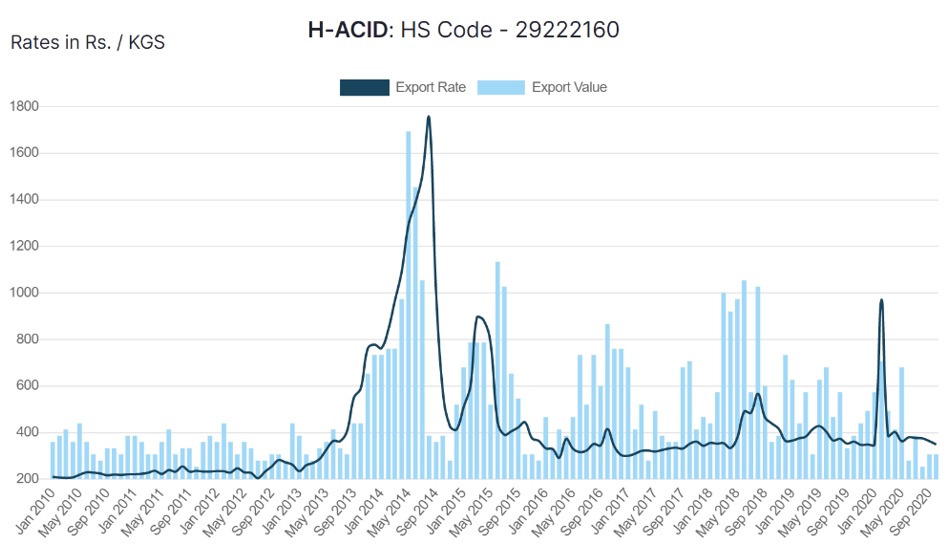

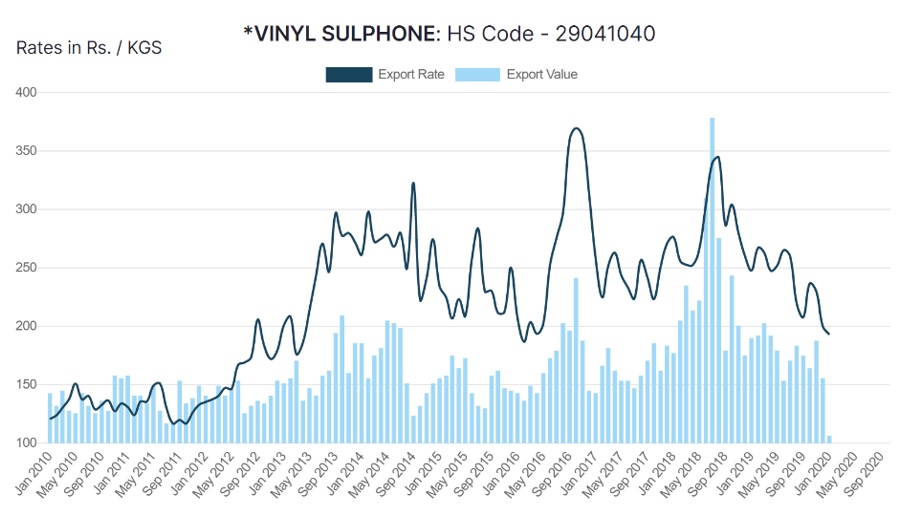

Besides capacity expansion and the revamp of the older unit, another factor that could work in favour of the company is if the prices of H-Acid and Vinyl Sulphone increase from the current levels.

H-Acid and Vinyl Sulphone are the two major Dye Intermediates produced by the company for selling externally and further for production of Dyes.

Source: Screener.in

Source: Screener.in

In FY 14 and FY 15, the prices of H-Acid increased sharply from around 200-250/kg to a high of 1,750/kg. Similarly, the prices of Vinyl Sulphone also increased from 120-150/kg to 250-300/kg.

The sharp increase was on account of shutdown of several small and large dye intermediates manufacturing units in China. Since then, the prices have come down; however, as the cost of production has increased in China as well, the prices are higher than the levels witnessed in 2010-2013.

FY 20 was again not so good in terms of prices as the demand was slow; however, it seems like the prices of the both the intermediates have bottomed out with H-Acid trading around 380-385/kg and Vinyl Sulphone 180-185/kg in Nov’20 against lows of 335 and 150-155 in Apr-May’20 respectively.

On the back of DI capacity expansion to 22,000 MTPA and the revamp of Unit-1, the management is hoping to cross sales of Rs 500 crore in the dyes segment alone in the next 2 years.

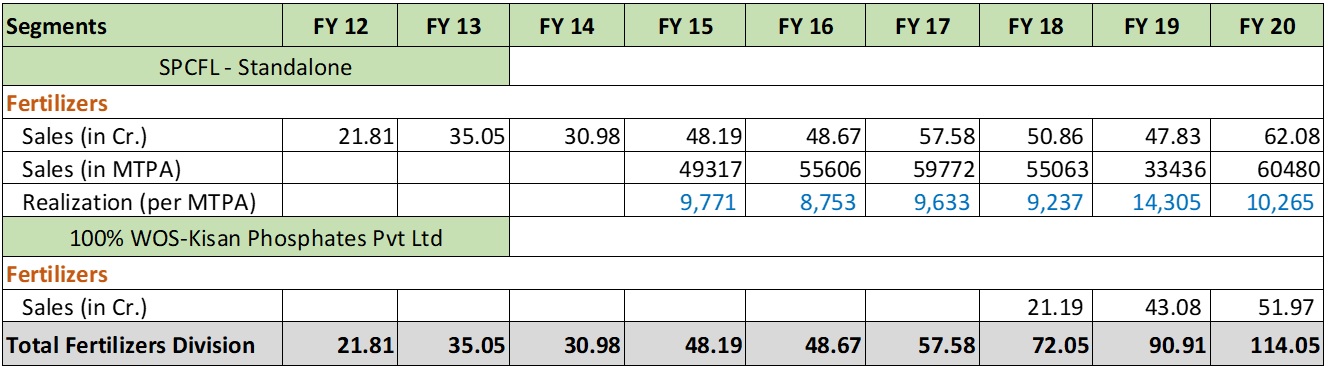

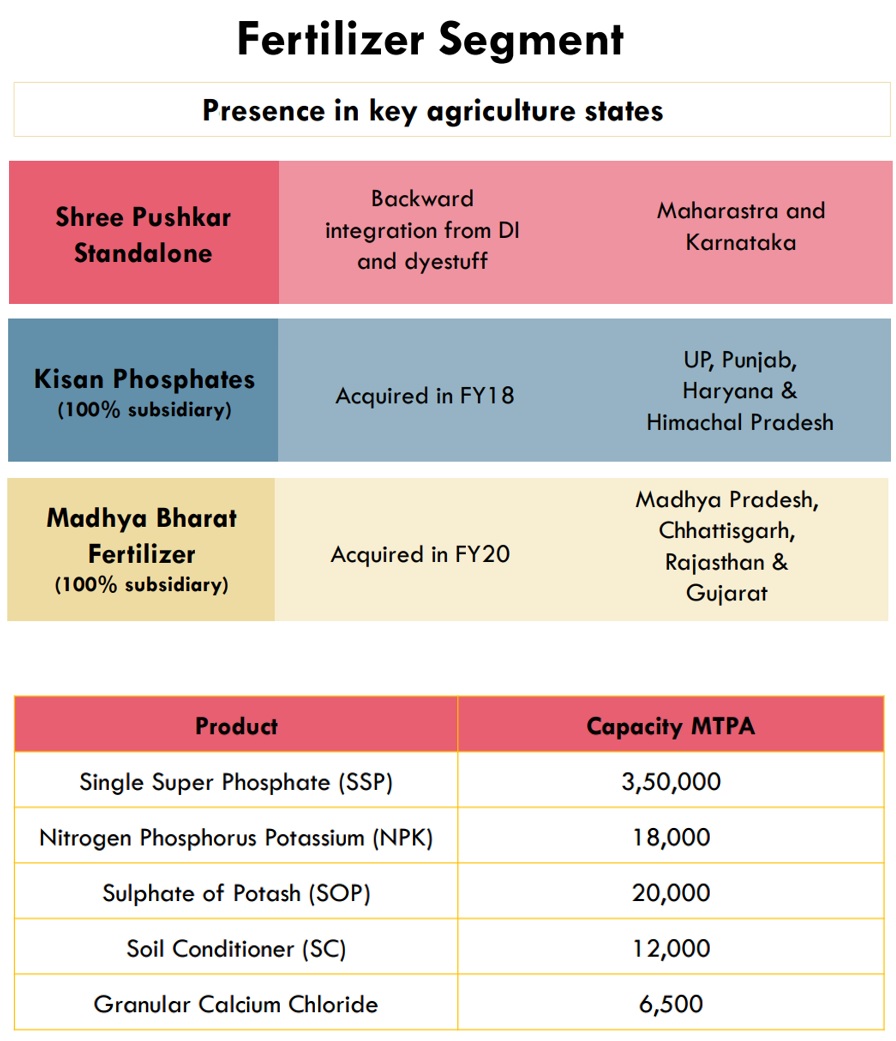

Fertilizers segment – SPCFL started with the fertilizers segment in 2011 with FY 12 being the first year of sales for the segment.

This segment came into being with the company’s focus on conversion of waste to value added by-products. Thus, SPCFL started producing fertilizers like SSP (Single Super Phosphate) based on 70% acid generated in the manufacturing of CSA.

Having started with a single product, the company now has a fairly pronounced division having 5 different products namely SSP, SC, NPK, SOP and GCC.

The company has been expanding the fertilizer division through a combination of addition of new products and acquisition of sick units at extremely low cost.

Source: SPCFLs Annual Reports

In fact, the contribution of the Fertilizers segment has increased from 13.7% in FY 12 to 33.31% in FY 20.

Source: SPCFLs Q2 FY 21 Investor Presentation

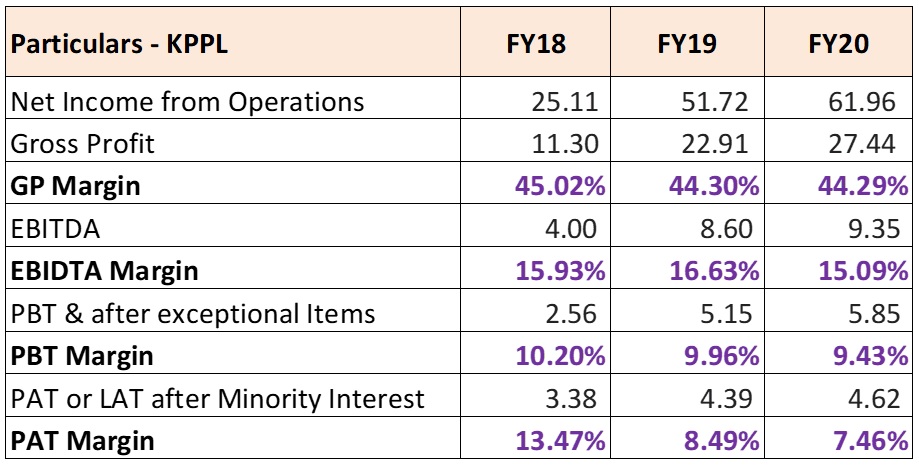

Kisan Phosphate (KPPL) Acquisition in FY 18 – In FY 18, SPCFL took over an existing Fertiliser unit engaged in the manufacturing of SSP in the state of Haryana with a capacity of 1,00,000 MTPA, by acquiring 100% shares of the company for a total consideration of Rs 9.02 crore, thus making it a fully owned subsidiary of SPCFL.

The company paid for the acquisition by allotting 4,26,540 equity shares of the company to the shareholders of KPPL.

Immediately on acquisition, the company implemented the reorganization cum expansion plan wherein the high-cost term loan from IOB was repaid and an expansion for setting up a 100 TPD Sulphuric Acid plant with a captive power plant of 0.70 MW was taken up.

To finance the reorganization and expansion plan, the company took a term loan of Rs 7 crore and subscribed to 0% Compulsorily Convertible Debentures of KPPL worth Rs 12.29 crore.

Source: SPCFLs Annual Reports

FY 19 was the first full year of consolidation of KPPL with SPCFL and as can be noticed in 2 years KPPL has delivered PAT equal to the purchase consideration of Rs 9.02 crore.

Madhya Bharat Phosphates (MBPL) Acquisition in FY 20 – In FY 20, the company acquired one more SSP manufacturing company namely Madhya Bharat Phosphates Private Limited (MBPL) in the state of Madhya Pradesh, through NCLT under the IBC code.

SPCFL invested around Rs 28 crore for the acquisition of MBPL.

MBPL has two SSP plants. The main plant is at Jhabua with 1,50,000 MTPA capacity and the second plant at Bhopal has 50,000 MTPA capacity.

The company has already commenced production from the Jhabua plant from 6th Jun’20. Earlier, the management had planned to sell off the Bhopal Plant; however, as they noticed good potential for sales in Madhya Pradesh, they have decided to retain the same and will start production from the same in the coming months.

Thus, taking into account the capacity of Bhopal Plant as well, the combined capacity of SSP at SPCFL (including subsidiaries) is around 400,000 MTPA.

The sales from MBPL will start consolidating from H2 FY 21.

In FY 20, without MBPL, the company recorded Fertilizer sales of around Rs 114 crore. The management believes that through MBPL they can generate additional fertilizer sales of around 100-110 crore.

International Sales – International sales is another area the management has been focusing on and has done well over the past few years.

Source: SPCFLs Annual Reports

Source: SPCFLs Q2 FY 21 Investor Presentation

In FY 18, the company received “Bluesign” accreditation from “Bluesign Technologies AG” Switzerland, a well acclaimed global accreditation organisation. The accreditation gave SPCFLs dye plants the status of “System Partner”. Further the company also received registration/certification from ZDHC (Zero Discharge of Hazardous Chemicals) and GOTS (Global Organic Textile Standard).

In FY 19, in addition to the marketing of generic dyes, the company introduced dyes under its own brand name of “DYECOL” and started marketing in countries like Switzerland, Austria, Bangladesh, Singapore, Korea, Taiwan, etc.

International accreditations seem to have helped the company in scaling up international sales as the same increased from Rs 19 crore in FY 17 to Rs 85 crore in FY 19.

As mentioned above, if the China + 1 hypothesis becomes true, the opportunity landscape in the international markets could open up further.

Promoters/Management

SPCFL is an owner operated business. The company is promoted by Mr. Punit Makharia, CMD and Mr. Gautam Makharia, JMD.

The 2 are supported by Dr. N. N. Mahapatra (Business Head – Dyes) and Mr. Deepak Beriwala (CFO).

Dr. N. N. Mahapatra joined the company in Aug’18 as Business Head – Dyes. He is a B.Sc (Tech) in Textile Chemistry from UDCT, (now ICT) Mumbai. He also holds M.Sc and Doctorate in Applied Chemistry from Utkal University, Orissa. He did his M.B.A from I.M.M, Kolkata.

In small cap companies, we believe it’s important as an investor that the promoters hold reasonably high stake and in the case of SPCFL the promoters own more than 66% stake in the company.

What is even more significant is that since FY 17 the promoters have been regularly increasing their stake in the company, mostly through open market purchases and once through preferential allotment of 6.16 lakh shares at over Rs 200 per share.

Source: bseindia.com

On ignoring the preferential allotment, the promoters have bought around 16.85 lakh shares through open market purchases and have thus been able to increase their stake in the company from 60.27% in Mar’16 to 66.53% at the end of Dec’20.

During CY 2020, their average purchase price was around Rs 105/- per share.

Overall, we find the promoters to be good as they have managed the operations very efficiently. We like their focus on various aspects of the business such as zero waste, growth through organic and inorganic expansions, prudent debt management, etc.

Performance Snapshot

Source: SPCFLs Annual Reports

Source: SPCFLs Annual Reports

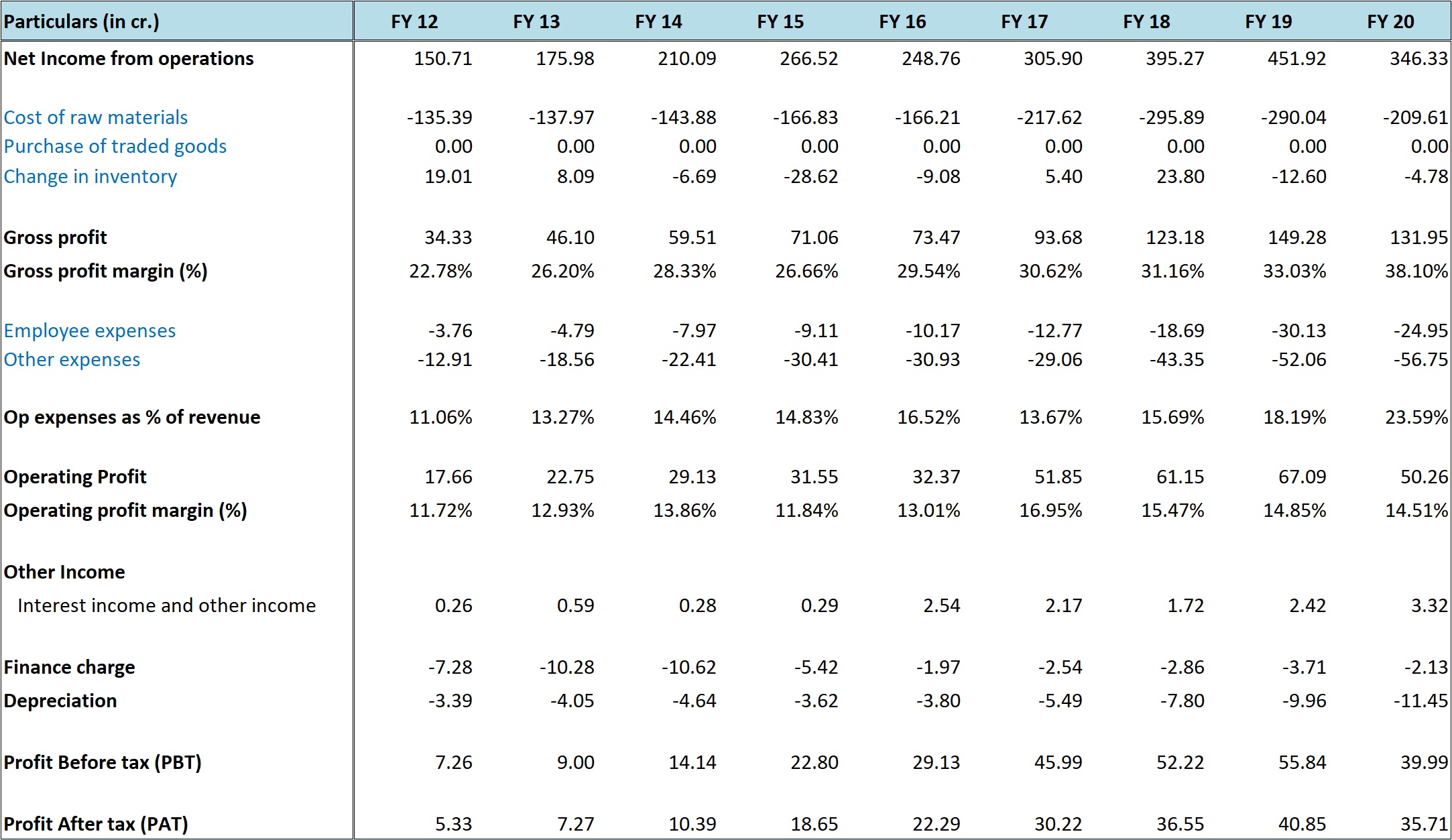

SPCFL has been a consistent performer over the years with growth across both the major divisions of Dyes and Dye Intermediates and Fertilizers.

Cattle feed division is used only to the extent of utilising the spent acid generations from the dye intermediates division and similarly Acid complex is largely used for captive consumption.

As can be noticed above, the dye intermediates division was reporting consistent growth despite huge fluctuation in prices and captive consumption for dye stuffs manufacturing FY 17 onwards.

The sales for FY 20 got impacted by around 60-65 crore on account of shutdown of Unit-1 for the purpose of repair and renovation. The demand was also on the lower side.

The company forward integrated into manufacturing dyes in FY 17 and the division has been reporting good growth on the back of both domestic and international sales.

Starting FY 22 onwards, the company will have the benefit of additional 13,000 MTPA capacity in dye intermediates section against the current capacity of 9,000 MTPA. The CAPEX cost for the same is Rs 75 crore and the company had already spent Rs 58 crore by the end of Q2 FY 21.

On the back of additional capacity, the management is hopeful of crossing 500 crore sales mark in the Dyes and Dye Intermediates segment in the next 2 years.

The Fertilizers division was started in FY 12 and here again the growth has been quite good on the back of addition of new products, capacity expansion and acquisition of KPPL in FY 18.

The company further acquired MBPL in FY 20 and that could bring in additional sales of Rs 100-110 crore in FY 22 or 23, thus doubling fertilizer sales from Rs 114 crore recorded in FY 20.

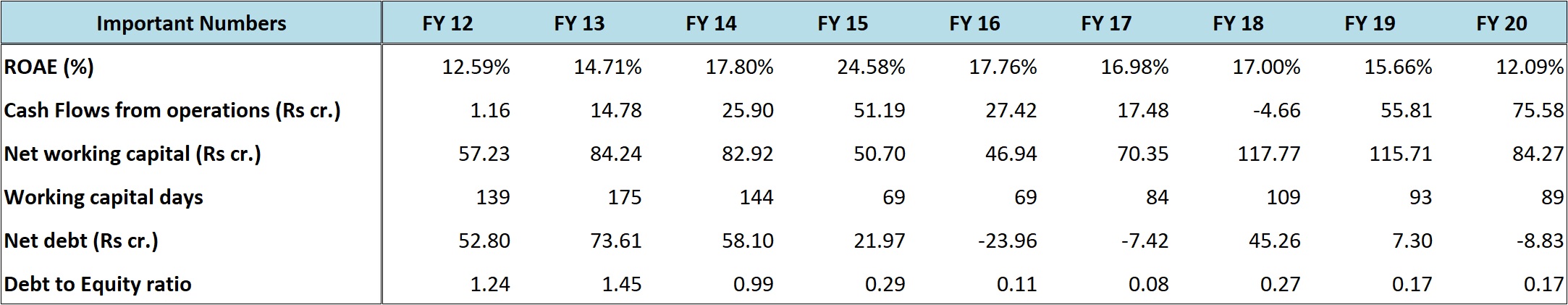

Source: SPCFLs Annual Reports

Another good aspect about SPCFL is its good performance on various operational parameters like cash flows, return ratios, debt management, etc. As can be noticed above, the company was debt free on net basis at the end of FY 20 and this despite being in the midst of Rs 110 crore CAPEX.

Source: SPCFLs Q2 FY 21 Investor Presentation

Overall, the next 2-3 years look good for the company with high probability of 100% growth in sales to around Rs 700 crore and similarly doubling of profits assuming the company is able to maintain around 9% PAT margins.

Valuations

At around current price of 125, SPCFL is available at a market cap of Rs 385 crore. The company is debt free on net basis and therefore the enterprise value is also around Rs 385 crore.

For the past 4 years the company has recorded average PBT of Rs 48.5 crore. The PBT in FY 20 was lower at Rs 40 crore as the company lost around Rs 60-65 crore sales for the reasons explained in the above sections.

Even with depressed PBT of Rs 40 crore, at current tax rates the PAT works out to Rs 30 crore and therefore the stock is available at around 12.8 times FY 20 earnings.

FY 21 is somewhat exceptional in nature on account of lockdown in Q1 and gradual recovery of the dyes segment since then; however, Q3 of FY 21 is expected to be at par with Q3 of FY 20.

From the above sections we also know that over the next 2-3 years there’s strong probability of doubling of Dyes segment sales and Fertilizer sales and that too without the overhang of any major debt.

Thus, considering reasonable valuations at present and a strong probability of doubling of PAT to 60-65 crore in next 2-3 years, we believe the stock is offering a good opportunity around current level of 125.

Risks/concerns

Dyes industry is highly polluting in nature and subject to stringent environmental regulations. Though SPCFL follows a Zero Waste model, lapses in effluent discharge can result in shutdown of units.

Sale of fertilizers involves getting subsidy from the government and therefore elongated receivable cycle. Increasing contribution from fertilizer segment can impact the working capital and the cash flows of the company.

Fertilizer sales are still primarily dependent on monsoon in any particular year and therefore growth is erratic across the years.

Disclosure: I don’t have any investment in Shree Pushkar Chemicals and Fertilizers and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No