Dear Readers,

I hope you all had an inspiring financial year. I was recently having a conversation with a friend of mine who told me that he invested Rs 1.5 L in a PPF account. Just out of curiosity I asked why he chose PPF over an ELSS fund and was surprised to find out that he thought PPF was the only instrument to invest in for the purpose of reducing taxable income.

In this blog, please allow me to share why I personally have been investing in various ELSS funds over a PPF to avail the benefits under section 80C.

Before I begin let me give a brief of what both of these instruments are –

ELSS – Equity Linked Savings Scheme is a mutual fund scheme. Much like any other equity mutual fund, they invest in a diversified pool of stocks. The money invested in these schemes is tax exempted under section 80C up to Rs. 1.5 Lac. However, Long Term Capital Gains Tax of 10% is applicable if your gains exceed Rs. 1 Lac. The lock in period for these schemes is 3 years and is favoured by individuals with a comparatively higher risk appetite. The returns on these funds are market linked so you can expect a return that is similar to what an average mutual fund would give. Usually they range between 10-15%.

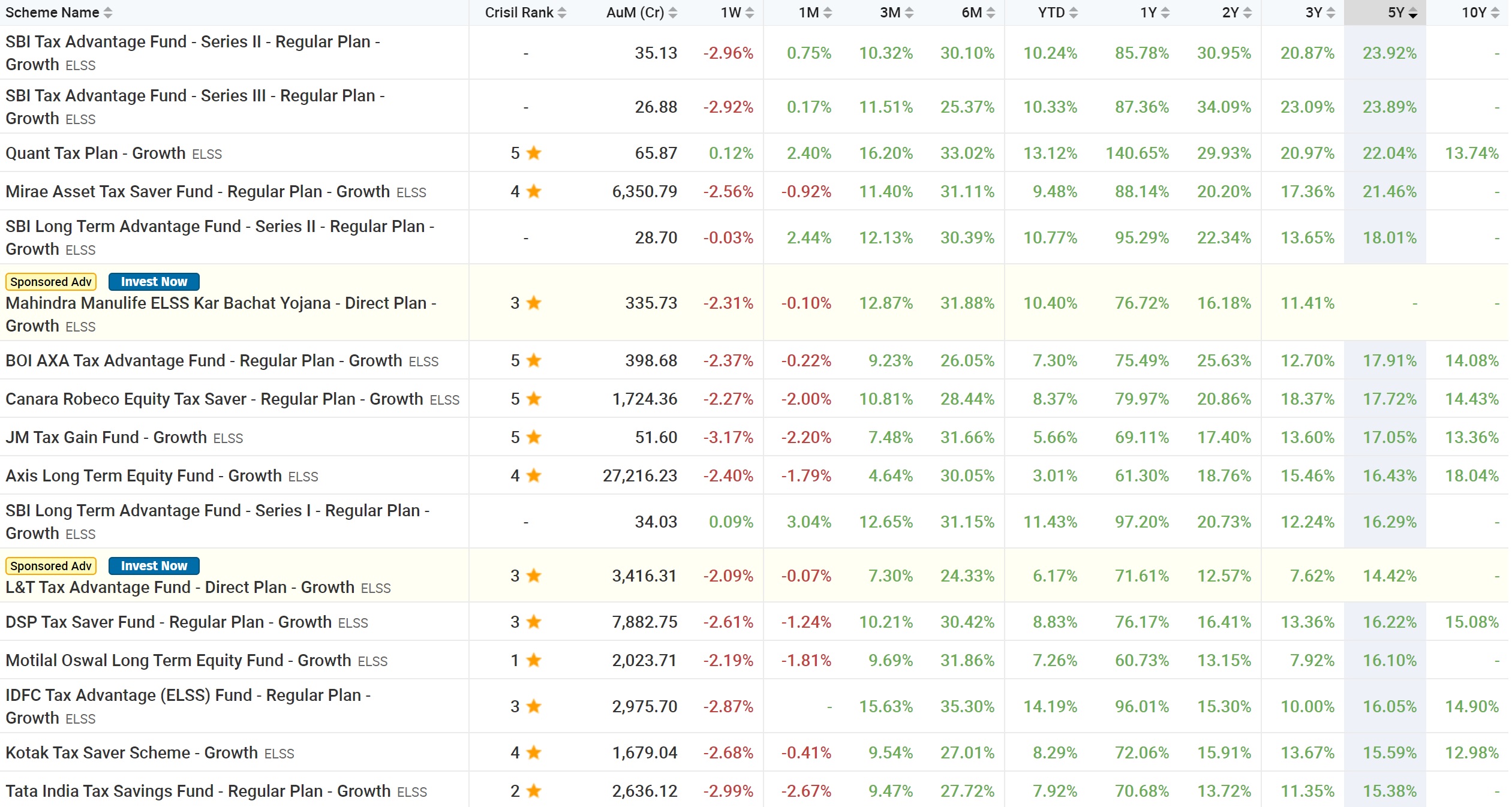

Best Performing ELSS: (Source: Money Control)

Worst Performing ELSS : (Source : Money Control)

Well the numbers look good, even for the worst performing ones; however, do remember the fact that at the end of Mar’20, the returns would have been substantially lower or even negative on 3 and 5 years basis.

Public Provident Fund – PPF is a long term investment instrument that has been the favorite of many for a long time now. The money invested and interest earned in this instrument is not just tax exempt but also guaranteed by the government. It is a highly secure place to invest with a lock in period of 15 years. It is favoured by individuals looking to invest for their retirement and their returns average between 7-8%.

(Source : PaisaBazar)

Why I invest in ELSS –

- In my 10+ years of investing in ELSS, the returns on ELSS have been good.

- I have a stable financial risk profile and am confident that I will not have to withdraw that money in an unfavorable market condition.

- The lock in period is shorter which provides me higher liquidity.

- I have the flexibility to shift from one ELSS fund to another if the one I choose first doesn’t perform well.

(Source: Ventura1.com)

Some risks to remember –

- An event like Mar’20 or a longer term correction can affect returns on ELSS for a longer period of time

- The risk of a particular ELSS fund not performing cannot be discounted

- Unlike PPF, Capital gains exceeding 1 lakh a year on ELSS are taxable

Note – One can also divide their 80C funds between ELSS and PPF to avail the benefits of both.

To conclude, the best investment option for you will depend completely on your current financial situation and financial goals. I hope this blog helped you understand the various available options and will help you make an informed decision. Last, but not the least, do consult your Investment Advisor.

Have a good day!

– Archit Mehrotra

Unlock the Power of Wealth Creation with Equities. In our list of recommendations, currently we have 12-13 stocks which are Investment worthy and in the buy-range at this point of time

You can access latest Investment Recommendations, Special situation opportunities and Model sheet by opting for Premium Memberships HERE