Dear Members,

We have released 29th Mar’21: Kaveri Seed Company Ltd (NSE Code – KSCL) – Alpha/Alpha Plus stock for Mar’21. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 29th Mar’21

CMP – 489.35 (BSE); 487.00 (NSE) Face Value – 2.00

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

Kaveri Seeds is one of the leading seed producing companies in India.

With over three decades of industry experience, it has emerged as a premier multi-crop seed producing Company in India and specializes in the production of crop seeds including maize, cotton, rice, pearl millet, mustard, wheat, sorghum, sunflower and a number of vegetables.

At around CMP of 490, we like the company for the following reasons:

- Shift from Cotton to Non-Cotton – Kaveri has predominantly been a Cotton seed producer; however, since the past few years the share of non-cotton products like Maize, Rice, Vegetables and other products has been steadily rising and the management intends to bring down the share of Cotton to around 40% from 70% a few years back.

- Expected improvement in margins – Shift from cotton to non-cotton is not only beneficial in terms of diversification of revenue base and price control on cotton seeds, it can also help improve growth in profitability as non-cotton crops command margins upward of 30% + against around 20% for cotton.

- Rice and Vegetables can be the major growth driver – Rice acreage in India is around 3.5 times the acreage of cotton while the area under hybrids is around 8% against 90-95% for cotton. Being amongst the top 3 players in Hybrid Rice in India, with the right products, rice can become the major growth driver for the company in the years ahead.

- Similarly, the vegetables seeds market in India is valued at around Rs 3,000 crore, growing at 20% and Kaveri has just 1% market share and has only recently started growing big on a small base.

- Guidance – The management has been maintaining revenue growth guidance of 10-15% year on year and 15-20% growth for PAT year on year.

- Buy-backs – In FY 16, SEBI had ordered forensic audit of the company’s books and it was believed that the cash in the books may not be real; however, since FY 18 the company has carried out 3 buy-backs worth ~ Rs 200 crore each and also paid dividends worth 8-10% of the PAT.

- Income tax raid in FY 18 – In FY 18 Income tax department conducted search proceedings on the company. Aggrieved by the departments’ basis for initiating search proceedings, the Company filed a writ petition before the Hon’ble High Court of Telangana, Hyderabad, challenging the validity of the search proceedings. The Hon’ble High Court has granted interim stay against assessment proceedings pending disposal of the writ.

- Valuations – Kaveri Seeds is a debt free company and holds surplus cash to the tune of 350-450 crore at different points of time. The current market cap is Rs 2,950 crore and therefore the enterprise value is ~ Rs 2,600 crore. On excluding other income, the operating business is trading at 9.8 times pre-tax trailing twelve months earnings.

Company details

Kaveri Seeds is one of the largest home-grown seed companies in India.

Backed by its strong R&D program, the Company specializes in the production of crop seeds including maize, cotton, rice, pearl millet, mustard, wheat, sorghum, sunflower and a number of vegetables.

The company is amongst the top 5 players in major seed segments like: Cotton, Rice, Maize, Bajra, etc and is also working on achieving significant market share in vegetables like: hot pepper, tomato, gourds and okra.

Infrastructure

Production and marketing of seeds requires capabilities in terms of R&D, access to large areas of land for production, testing centres, storage and packaging and finally distribution.

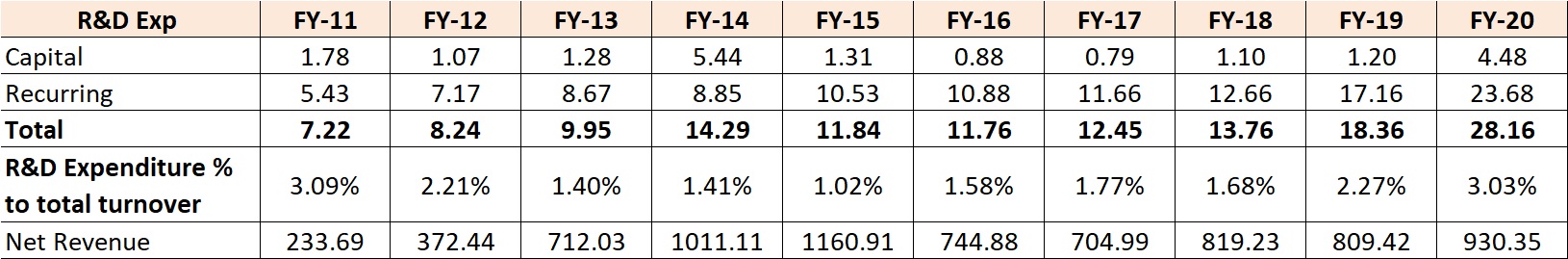

R&D – Kaveri focuses on the development of quality hybrid and inbred seeds that offer higher yields and for the same it has a fully equipped, state-of-the-art biotechnology laboratory and its R&D team comprises of about 145 personnel, including more than 40 Scientists.

Source: Kaveri’s Annual Reports

The company also has an enormous germ-plasm bank, to sustain innovations in the seed market.

Other Infrastructure – The company has access to 1 lakh + producers with 65000 acres of land area for seed production and about 120 out-reach trial centres across India for hybrid testing.

It also has 7 Seed Processing plants equipped with equipment for pre-cleaning, grading, cob drying, storage and packing and around 10 lakh sq. ft. cumulative warehouse space across India.

Marketing and Distribution – The company has a pan-India presence with a strong distribution network consisting of about 40,000 dealers/distributors.

Product Segments

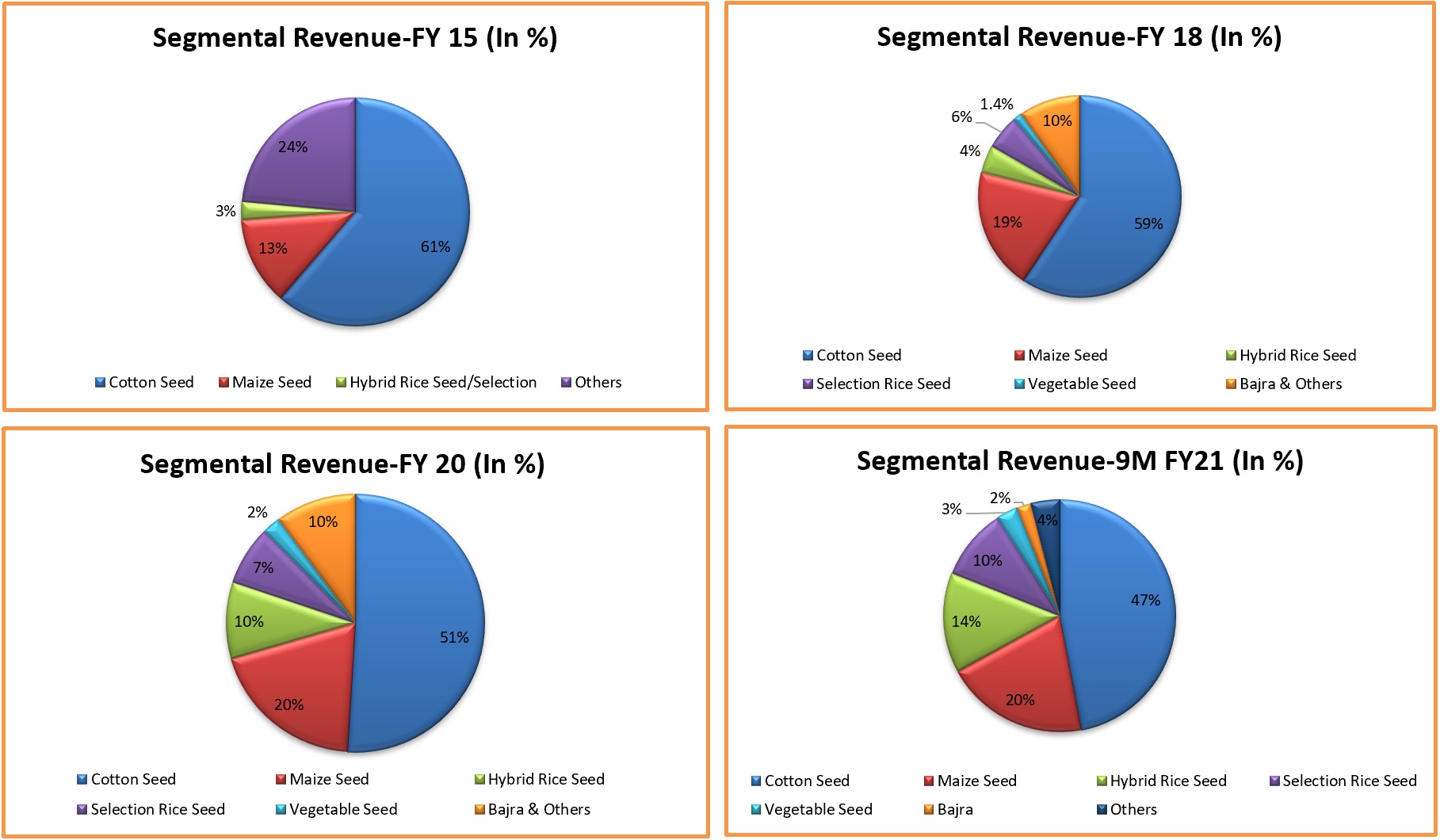

As mentioned above, Cotton was the major contributor to the sales of the company and still continues to be; however, since the past few years its share in the overall sales of the company has been declining and the management’s target is to reduce it to 40% in the next few years.

Source: Kaveri’s Concalls and Presentations

We believe the rising share of other crops is positive for the company as it not only helps it in diversifying the revenue base, but will also help in expanding margins and improving the rate of growth of both the sales and profits.

As per the management, their strategy is to add many crops to the portfolio, spend a decent sum on R&D, continuously launch new hybrids and expand market share across India. On the back of the same they are hopeful of maintaining 10-15% growth in top-line and around 15-20% growth in bottom-line.

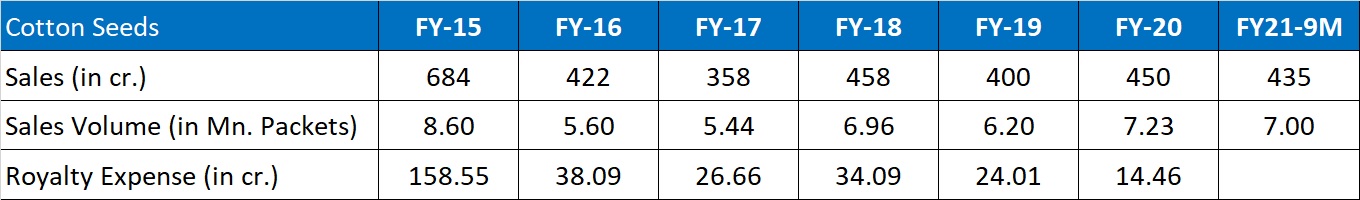

Cotton – Indian hybrid seeds industry continues to be dominated by BT cotton hybrids and as is evident from the charts above, even Kaveri derives major part of its sales from cotton seeds.

Source: Kaveri’s Concalls, Presentations and Annual Reports

However, the sales volume and value topped out in FY 15 and bottomed out in FY 17.

Under the Cotton Seed Price (Control) Order, 2015, the government has been fixing a maximum sale price for Bt cotton every year taking into account the seed value, recurring royalty (trait value), trade margins and others.

In Mar’16, the government slashed royalty fees by 74%, from Rs 163 per packet to Rs 43 (excluding taxes) and since then the royalty fees has been coming down and has been scrapped complete for FY 21.

The Cotton Seeds industry is well developed with almost 95% of the total acreage under hybrid seeds and the growth in this space can only come from increasing market share and developing new hybrids.

Kaveri has been predominantly operating in the southern states of Andhra Pradesh, Telangana, etc; however, it has now been gaining market share in the western and northern states of Gujarat, Maharashtra, Haryana, etc, even though it has lost some in Andhra and Telangana.

As per the management, based on the promising product pipeline and gain in market share, they are hopeful of maintaining 5-10% growth in the cotton segment.

Rice – After Cotton, Rice (Hybrid and Selection) has become the second largest contributor to the sales of the company at around 24% for 9M FY 21 against only around 3% in FY 15.

Source: Kaveri’s Concalls, Presentations and Annual Reports

Kaveri has been reporting significant growth in the rice segment and has been growing at 30-40% on consistent basis since the last few years.

In terms of Hybrid Rice, the company has close to 10% market share while the leader has close to 27-28% and the management intends to become the leader in the same.

The hybrid rice industry has been growing at around 5-8% and we believe the potential for growth for Kaveri is immense and this is because of the following few factors:

- Rice acreage in India is around 3.5 times the acreage of cotton

- Rice acreage under Hybrids is only around 8% in India against 95% for cotton

- About 53% of China’s rice acreage is under hybrids

Combined with the above, the management seems quite determined to grow rapidly and has been continuously working on improving the product pipeline. We believe, in the next few years, rice could become the largest revenue contributor for the company.

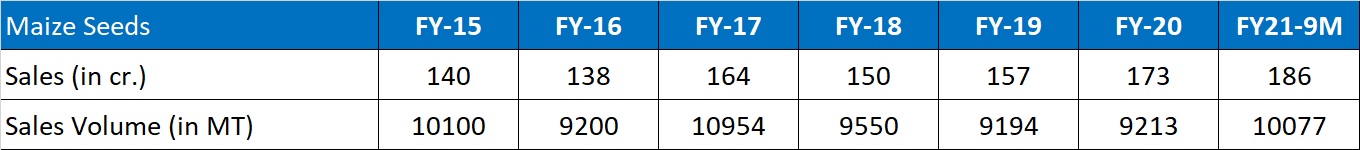

Maize – Maize is the third largest product for the company and its share in the sales of the company has increased from 13% in FY 15 to 20% in FY 20.

However, the growth has been tepid over the last few years.

Source: Kaveri’s Concalls, Presentations and Annual Reports

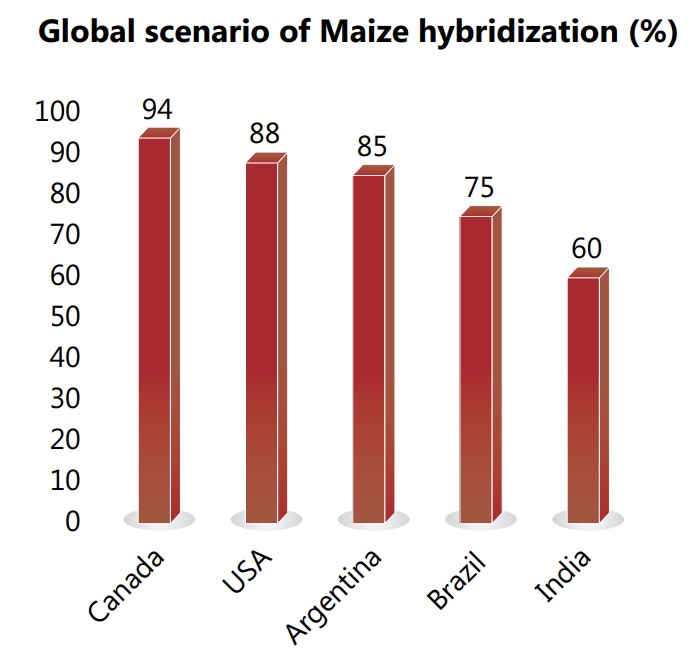

The hybridization rate in Maize in India is only around 60% against much higher for countries like Canada, USA.

Source: FICCI-PWC Maize Vision 2022

As per the management, they see immense potential for maize as a crop in India and with government’s initiative on ethanol, etc, maize is expected to be the preferred crop for the farmers going forward and the company has also been working on adding new hybrids.

In FY 20, the company developed KMH 8333 and KMH 8322 in the Maize segment.

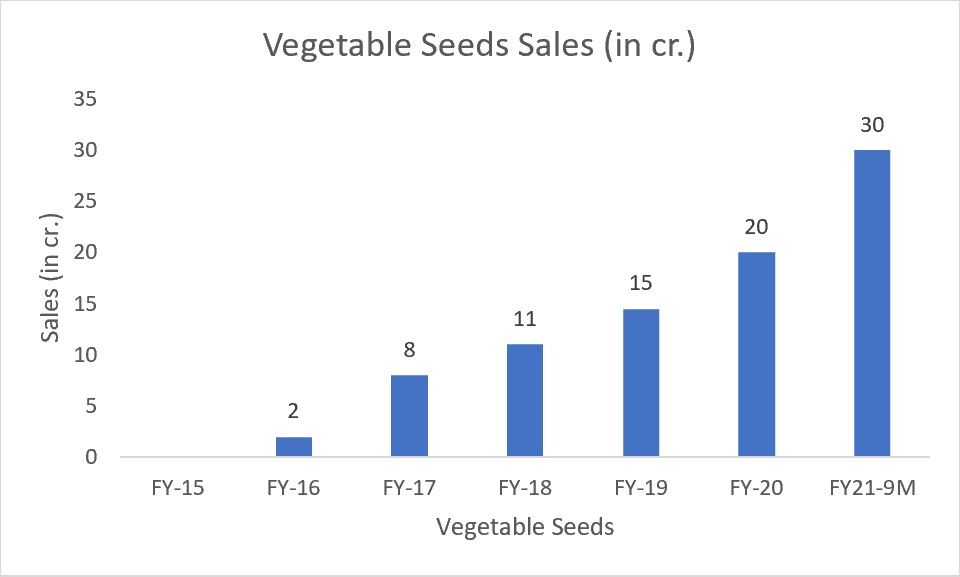

Vegetable Seeds – From being one of the largest seed producers of cotton, maize and rice, the company has accelerated its efforts to improve the yield of vegetables like tomato, hot pepper, okra, bitter gourd and others. The 4 vegetables also command the highest share of hybrid vegetable seeds sales in India.

The company has also introduced new crops like cabbage, beetroot, carrot, marigold, sweet pepper, pumpkin, muskmelon.

Source: Kaveri’s Concalls, Presentations and Annual Reports

The vegetable hybrid seeds market in particular is valued at Rs 3,000 crore and growing at around 20%. Kaveri’s market share is extremely low at 1%; however, the company had been working on developing the products since the last 10 years and is now growing rapidly, though, on a small base.

The management has set a target of Rs 100 crore sales in next 5 years.

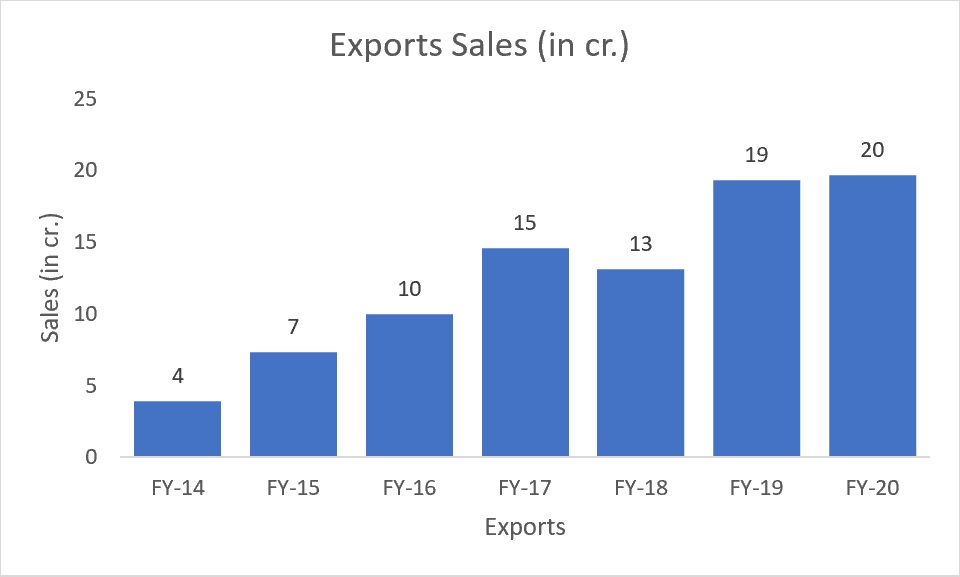

Exports – With a growing market for agricultural seeds, in India and abroad, there is a huge demand for export of seeds and India’s contribution is only 9% of the overall market.

Source: Kaveri’s Annual Reports

Kaveri has the potential to produce a significant amount of hybrid seeds, which can be produced at cheaper costs when compared to other countries.

As per the management, they have sent samples to 9-10 countries including Egypt, Pakistan, Bangladesh, Nepal, Myanmar, Sri Lanka, etc. and the results have been encouraging. However, it will take another 2 to 3 years to get a major breakthrough.

The management has set an ambitious target of Rs 100 crore exports in the next 5 years.

Seeds Industry Overview

Seed is the basic and most critical input for sustainable agriculture and it only accounts for ~5% of the total input cost to the farmers.

India has emerged as the 5th largest seed market in the world and was valued at USD 4.1 billion in 2018, growing at a CAGR of 15.7% from 2011-2018. The seed industry is expected to continue growing in double digits over the next few years.

Growth drivers of Seed Industry

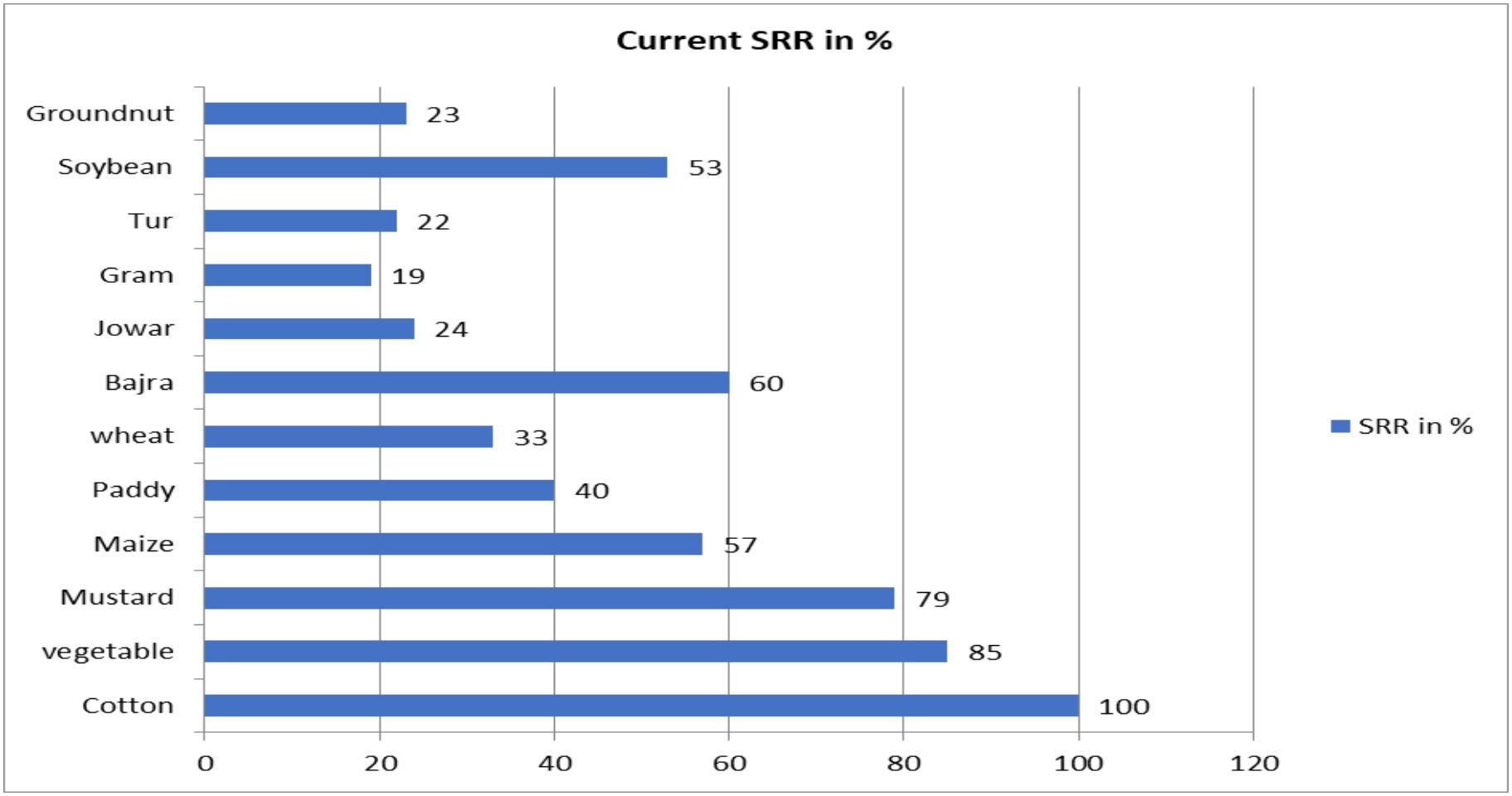

- Increasing adoption of Hybrid Seeds: The use of hybrid seeds has silently but, consistently witnessed growth along with other seeds; however, the potential for adoption is still huge as hybridization is only around 8% in paddy, 60% in maize and 40% in Bajra

- Enhancement in Seed Replacement Rate (SRR) – SRR is a percentage of area sown out of total area of crop planted in the season by using certified/quality seeds other than the farm saved seed. A better seed replacement rate shows a better utilization of the Certified / Quality Seeds. Since certified seeds are better in productivity, the Seed Replacement Rate is directly proportional to productivity

Source: Seedtest.org Jun’19 Presentation

- Exports – India’s contribution to global seed trade is minuscule in single digit; however, the private players here have the potential to produce a significant amount of hybrid seeds which can be produced at cheaper costs and offered to other countries at competitive prices

What makes the hybrid seeds business interesting is that unlike, say fertilizers or irrigation, it has little to do with government subsidies. The experience of the last decade shows once farmers see higher yields, they are willing to spend on better quality seeds.

Promoters/Management

Kaveri Seed is an owner operated business. The company was started by Mr. G V Bhaskar Rao who is also the Chairman and Managing Director of the company since its inception.

Mr. Rao has a bachelor’s degree in Science (Agriculture) from Andhra Pradesh Agriculture University.

He is supported by 2 Whole Time Directors (WTD), Mr. C. Vamsheedhar, who oversees the organisation’s overall marketing activities, segment wise product development and pan-India promotional activities and Mr. C. Mithun Chand, who monitors the day-to-day operational aspects of administration, finance and accounts departments.

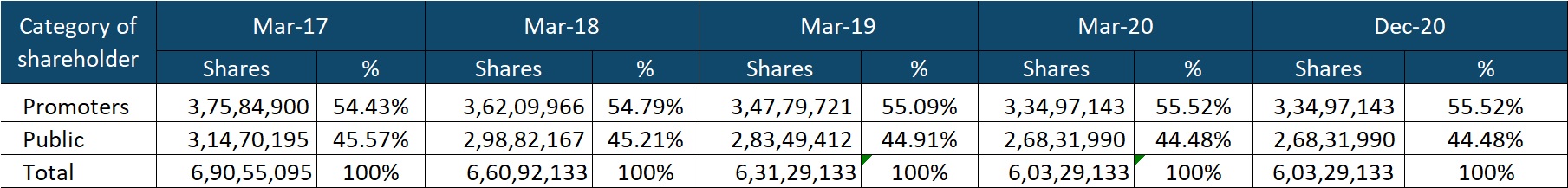

In small cap companies, we believe it’s important as an investor that the promoters hold reasonably high stake and in the case of Kaveri the promoters own more than 55% stake in the company.

Source: bseindia.com

Since Mar’17, the promoters’ stake in the company has increased by 109 bps and that’s on account of buy-backs carried out by the company.

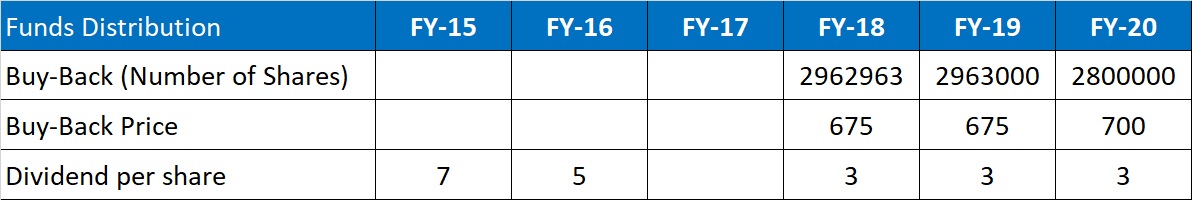

Buy-backs/Dividends

In FY 16, SEBI ordered forensic audit of the company’s books and it was believed that the cash in the books may not be real; however, since FY 18 the company has carried out 3 buy-backs worth ~ Rs 200 crore each and also paid dividends worth 8-10% of the PAT

Source: Kaveri’s Annual Reports

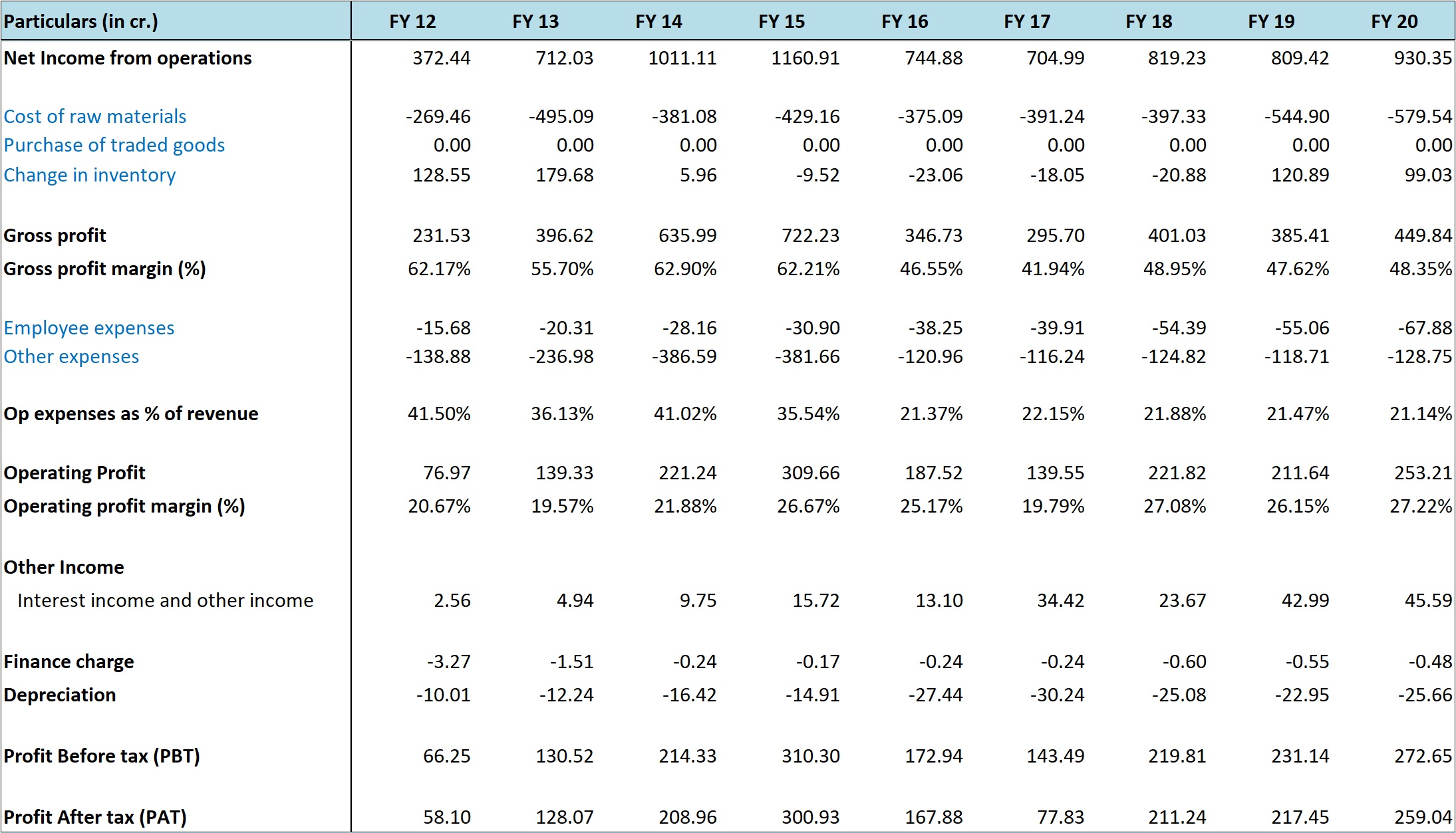

Performance Snapshot

Source: Kaveri’s Annual Reports

Kaveri’s performance can be dividend into pre-FY 15 and post FY 15 segments.

In the five years from FY 10, its sales increased from Rs 162 crore to Rs 1,100 crore + and profits increased from Rs 30 crore to Rs 300 crore and at its peak the company had a market cap of Rs 6,500 crore.

However, FY 15 was also the time when the advent of pests and declining yields prompted farmer agitations that eventually resulted in the government regulating the prices at which cotton hybrids were sold. The government slashed the royalty fees to Monsanto by 74% and the maximum sale price of genetically modified Bollgard II cotton seeds was reduced to ₹ 800 (per 450gm packet) from ₹ 830-1,000 earlier.

This set the stage for reduced sales and profitability in the cotton seeds business.

However, since FY 17 the company has been reporting gradual improvement in performance and that is largely on the back of increasing share of non-cotton products.

The company had set a target of 500 bps reduction in revenue contribution from cotton and from 59% in FY 18 it is already down to 47% for 9M FY 21. The next target is to reduce it further to 40%.

Increase in share of non-cotton products comes with an added advantage of higher profitability. Due to price control, the margins in cotton seeds are relatively lower at less than 20% while the non-cotton products command margins upward of 30% +.

At its core, the seeds business is about the pipeline of products and based on its strong R&D infra and spends, the company has been continuously working on introducing new hybrids in its core segments of Cotton, Rice, Maize, Vegetables, etc and is hopeful of maintaining 10-15% growth in top-line and 15-20% growth in bottom-line.

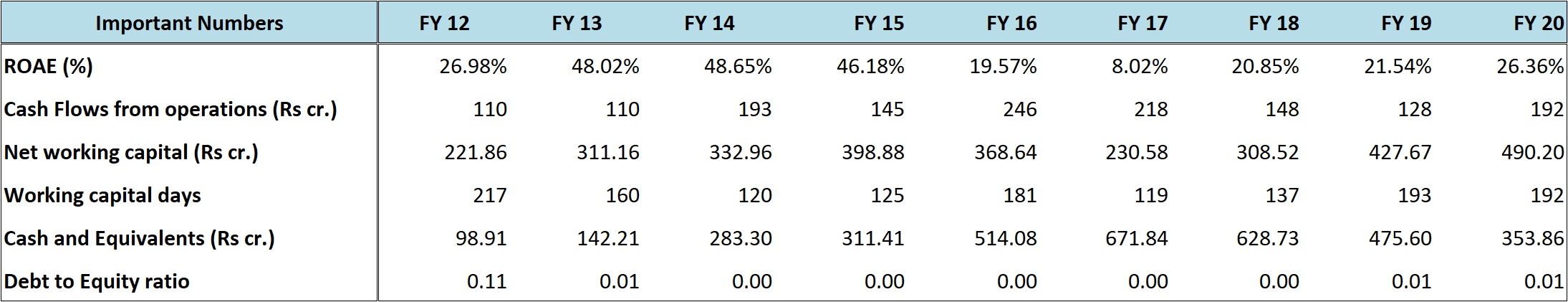

Source: Kaveri’s Annual Reports

Kaveri’s return ratios and cash flows have been good; though, also supported by the fact that the company pays no tax on business income.

Its income is classified as agricultural income and therefore the company does not pay taxes on business income. As per the management, they see no reason not to take advantage of the exemption afforded to it and that they would be happy to pay taxes if the laws change.

Valuations

At around current price of 490, Kaveri Seed is available at a market cap of Rs 2,950 crore. The company is debt free on net basis and at any point of time holds cash and equivalents surplus of Rs 350-450 crore.

The management also intends to maintain a minimum balance of Rs 300 crore for potential liabilities, if any.

Effectively, the stock is available at an enterprise value of Rs 2,600 crore.

Post the FY15-FY17 cotton seeds fiasco, the business is again gaining traction and this time it’s more diversified in terms of revenue base with strong possibility of reasonable growth over the foreseeable future.

Also, it’s been 5 + years since the SEBI ordered a forensic audit and even though the audit got completed a few years back, the company hasn’t heard back since.

The company has also been paying back Rs 200 crore + annually to shareholders in the form of buy-backs and dividends.

Overall, unless something negative comes up now, major issues of forensic audit or income tax search seem to be behind for the company.

Coming back to valuations, for the trailing twelve months the company has recorded operating PBT/PAT (zero tax on business income) of Rs 266 crore against an enterprise value of Rs 2,600 crore.

Thus, effectively the stock is available at 9.8 times operating earnings.

As mentioned above, unless something negative crops up on the forensic audit front or the tax search front, we believe the valuations are quite reasonable for a leading hybrid seeds company with a good potential for double digit growth.

Risks/concerns

Like Cotton, if other seeds also come under price control, it will be negative for the company.

Currently the company doesn’t pay taxes on business income; any change in laws regarding the same can negatively impact the profits of the company.

Crop patterns and seed sales get impacted by monsoon in any particular year and the decrease in acreage for crops like Cotton, Maize, Rice, etc will be negative for the company.

Growth in the business is primarily dependent on the continuous development of new hybrids and any laxity on that front can impact the market share and sales of the company.

Disclosure: I don’t have any investment in Kaveri Seed and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No