Dear Investor,

We have often talked about the power of compounding and the logic defying results that it is capable of producing. Let us today look at the actual formula for Compound Interest and dissect it.

The Formula: A = P (1 + R/100)^t

A – Final Amount, P – Principal Invested, R – Rate of Return, t – Time

Now, the aim is to increase our A (overall wealth) by increasing P (amount invested), R or t

The most common mistake that most investors make is that they focus way more on improving the Rate of Return or the Principal invested while the most important factor is clearly Time.

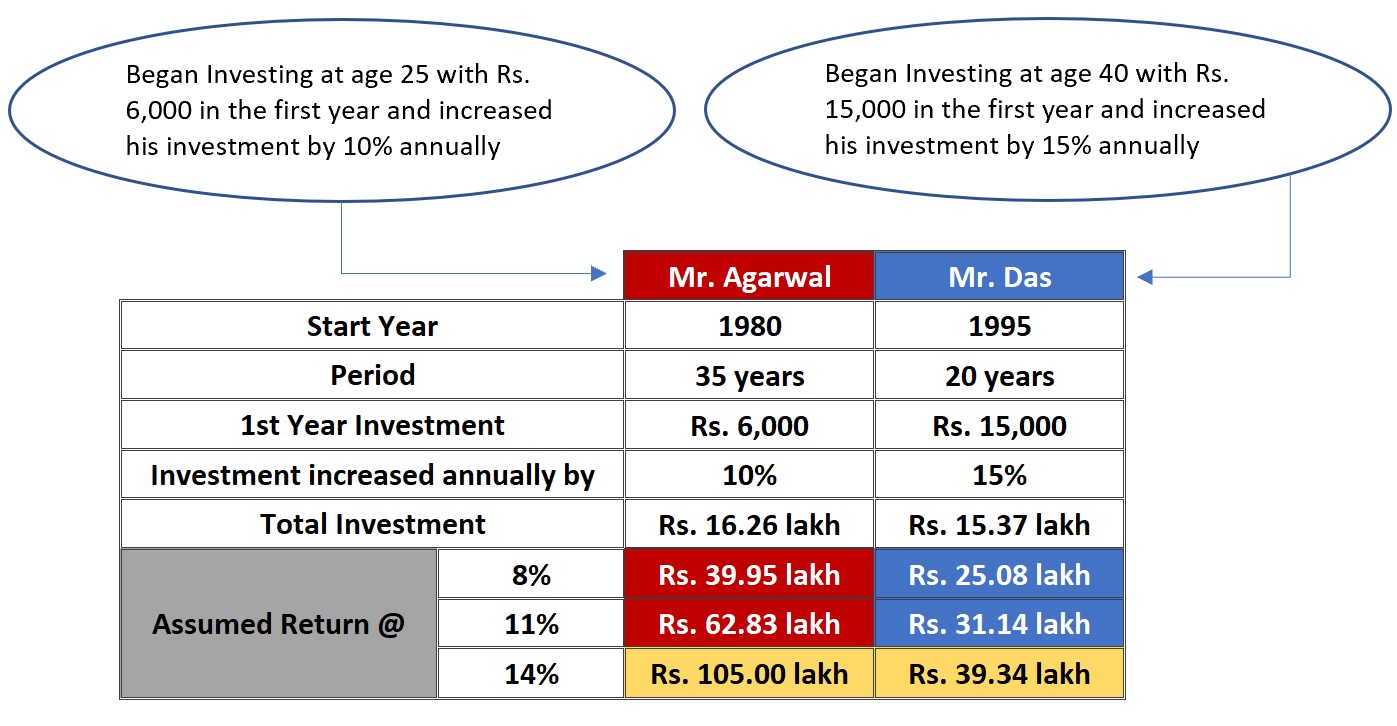

Look at how, even at 14% growth rate, Mr. Das’s overall corpus of Rs 39.34 lakh is still lower than Mr. Agarwal’s corpus of Rs 39.95 lakh at much lower return of 8%.

- An increase in Time can increase the Amount exponentially while an increase in Rate of return or Principal will only have a linear effect.

- It is much simpler to increase Time by starting early than trying to increase Rate of return by taking riskier trades.

- The two are not binary. There is no harm in trying to increase the Rate of return or the Principal; however, you can do it just as well even when you increase Time by starting early.

To conclude, Start Saving as soon as possible. Time is of essence here and the sooner you start your investment journey the more likely you are to achieve your financial goals.

Best Regards,

Archit Mehrotra