Dear Members,

We have released 23rd May’21: L T Foods Ltd (NSE Code – DAAWAT) – Alpha/Alpha Plus stock for May’21. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 23rd May’21

CMP – 87.60 (BSE); 87.50 (NSE) Face Value – 1.00

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

LT Foods is one of the leading rice companies in India and across the world with ground presence in the key markets of the US, Europe and the Middle East.

Company’s flagship brands ‘Daawat’ and ‘Royal’ enjoy market leading positions in India and the US respectively.

At around CMP of 87-88, we like the company for the following reasons:

- Product Diversification – While the company is largely a basmati player, it has diversified into organic and health & convenience foods, which have higher growth and margin potential.

- Expected improvement in margins – With the expected change in product mix, i.e., higher contribution from organic and health & convenience foods and improved economies of scale, the management is targeting 50-100 bps improvement in EBITDA margins per annum.

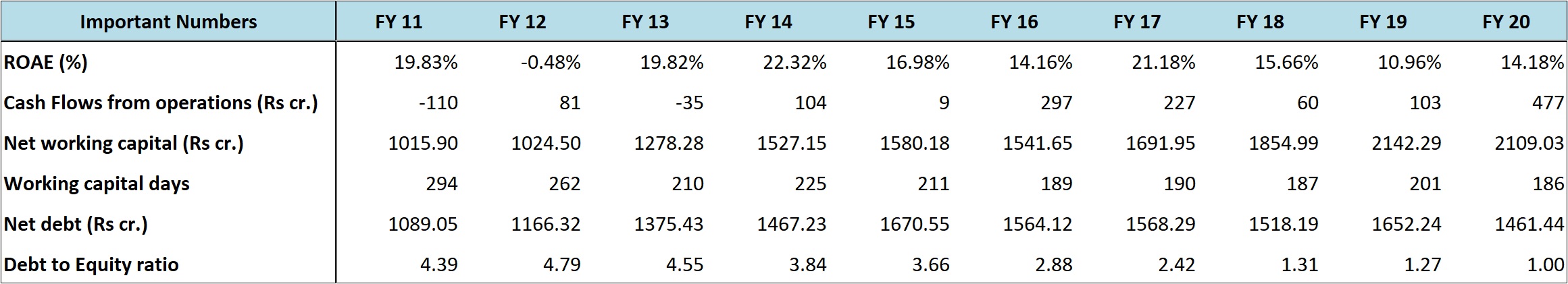

- Improvement in balance sheet – In the last 7-8 years, the balance sheet of the company has improved considerably with debt-to-equity ratio improving from 4.5 in FY 13 to 1 at the end of FY 20. Going forward as well, the management is planning to utilize all the free cash flows in three parts, for dividend, for the growth of the business and reducing the borrowings.

- Increase in Promoter Holding – In the last 3 years promoters have increased their holding in the company by 80 bps. Their last purchase was of 35,000 shares in Sep’20 at Rs 48/- per share.

- Valuations – LT Foods is currently trading around 10 times TTM earnings. Even though the company has shown good consistency in growth and earnings, the stock has gyrated from 4 times to 20 times earnings in the last 5 years. We believe, if the management is able to walk the talk, i.e., diversify the revenue base, increase the margins and profitability, then there’s a good possibility of a re-rating in valuations.

Company details

LT Foods (LTF) is one of the leading rice companies in India with more than seven decades of operations and sales to more than 80 countries.

The company also produces organic Agri-ingredients and supplying them to leading businesses in Europe and the US for the last 20 years.

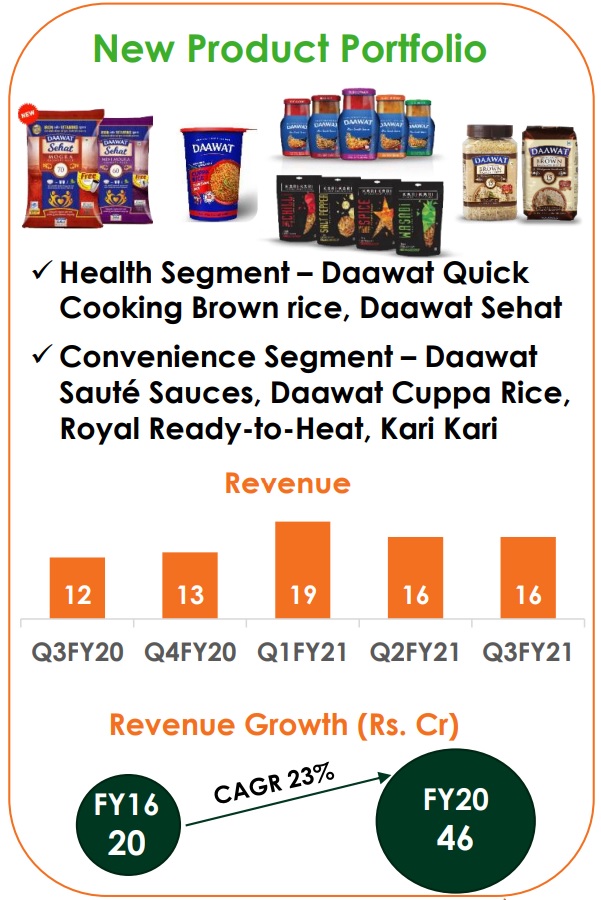

Recently, the company forayed into value added health and convenience products with the launch of ready-to-heat (RTH), Saute Sauces, Daawat Sehat, Cuppa rice and rice-based snack Kari Kari.

The company has the following major brands:

- Rice business – Daawat, Devaaya, Royal, Indus Valley, 817 Elephant, Chef’s Secret, Heritage and Rozana

- Organic Food – Daawat and EcoLife

- Health and Convenience Foods – Kari Kari, Daawat and Royal

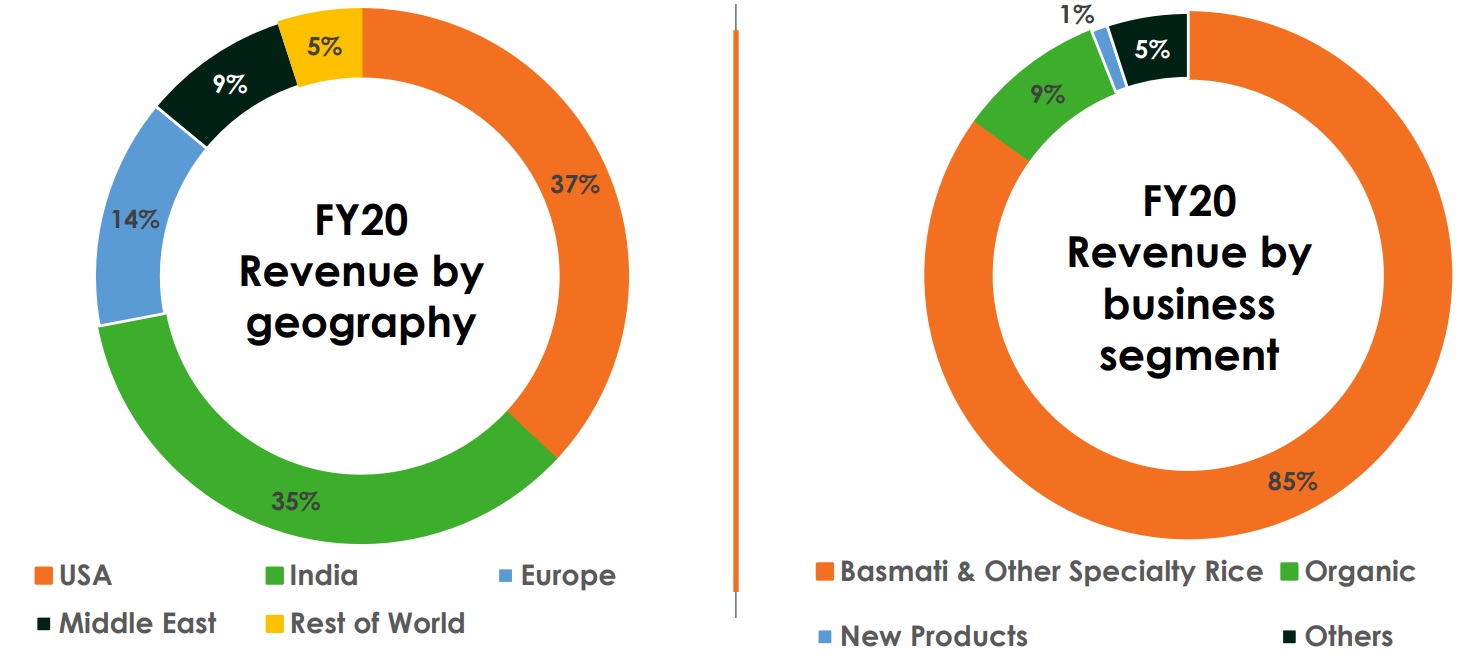

Rice is still the primary business of the company and contributed 85% to the sales in FY 20, followed by 9% from organic business and only 1% from health and convenience foods.

While the product wise diversification is still at a nascent stage, company is well diversified geographically. In fact, as you will see below, US is the largest contributor to the sales of the company.

Source: LTFs Q3 FY 21 Presentation

Rice Business

LTF primarily deals in basmati rice, while off-late it has also introduced some regional varieties like Sona Masoori, Lachkari Wada Kolam, etc.

Basmati rice is a geographical indication (GI) product, grown only in certain parts of India and Pakistan, and is amongst the most expensive varieties globally, due to which it forms only around 2% of the domestic consumption.

India is the largest Basmati rice producer (producing 7 MMT out of the total industry size of 8.5 MMT); however, ~75% of the basmati rice produced in India is exported to Middle East, US, UK, parts of EU and other countries.

Out of India’s market of 2 MMT consumption market size, only 30-40% is branded basmati rice. Nevertheless, with increasing disposable income and higher brand consciousness, the share of branded basmati is likely to increase in the years ahead.

Despite the commodity nature of the rice business, LTF, along with some other companies have transformed it into a branded business. In India and globally, the company has established reputed brands:

- India – DAAWAT, Heritage, Rozana, Chef Secretz

- North America – Royal

- Middle East – Daawat, Gold Seal Indus Valley, Rozana, Elephant

- Europe – Daawat

- Rest of the World (ROW) – Daawat, Heritage

Besides selling through own brands, the company also does private labeling in countries other than India; however, the contribution from branded portfolio has been increasing and stood at 74% in FY 20 against 69% in FY 19.

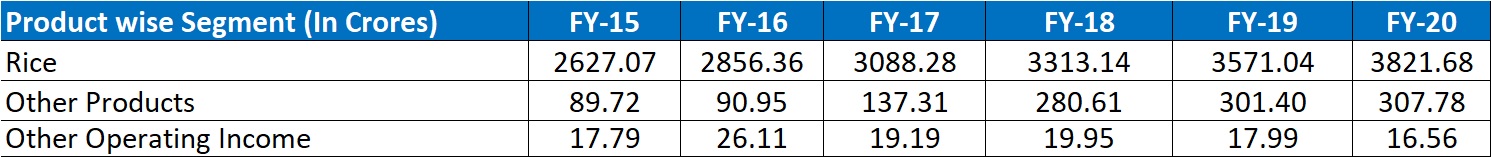

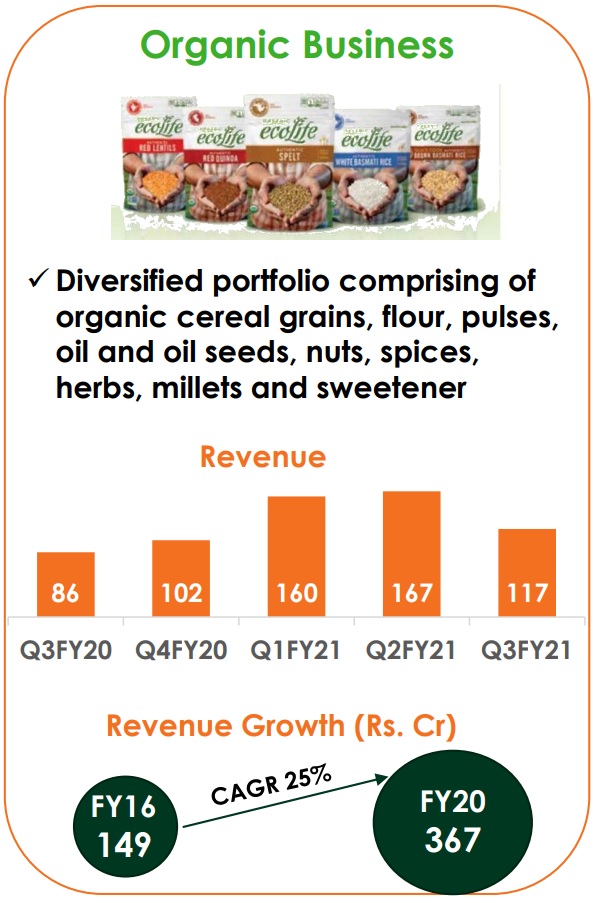

Since FY 15, the sales from the rice business have grown at 8% CAGR from Rs 2,627 crore to Rs 3,822 crore in FY 20.

Source: LT Foods’ Annual Reports

As per the credit rating report, LTFs market share in India has increased from 14% in FY 16 to 27% in 9M FY 21.

Over the years the company has focused extensively on branding and distribution and has engaged in 360-degree marketing initiatives including television campaigns, branding at modern stores and now also on social media platforms. The company has also associated with renowned celebrities like Mr. Amitabh Bachchan and Mr. Sanjeev Kapoor.

Source: LTFs Q3 FY 21 Presentation

What is interesting though is that it is the overseas business which is growing at a much faster pace. Also, as can be noted from the image above, the realizations in the international markets are almost double the realizations recorded in India.

In North America, the company sells in US and Canada and its flagship brand ‘Royal’ holds ~45% market share in the basmati rice segment and is the No. 1 Basmati brand in the US.

The company sells through all the major channels such as – multi-cultural (Ethnic channel), Mainstream, Food Service channel and E-Commerce channel.

Middle East is the largest market for basmati rice at ~ 4 MMT per annum. The company gets around 12% of its sales from Middle East and has good presence across countries such as UAE, Kuwait, Qatar, Oman, Yemen, Saudi Arabia and Bahrain among others.

LTF doesn’t export to Iran.

Recently, SALIC (Saudi Agricultural & Livestock Investment Company) acquired 29.81% stake in Daawat Foods Limited (Subsidiary of LT Foods Ltd) for an amount of USD 17.23 million (~ 127.5 crore).

As per the management, the partnership with SALIC will help to open up and create new opportunities in the Middle East.

Europe is another important market for the company. In fact, in 2017, the company invested USD 15 million and set up its first rice processing plant at Rotterdam, Netherlands with an initial capacity of 60,000 tonnes. The company did so as the import duty on processed goods is higher in Europe as compared to unprocessed goods.

In Dec’20, the company made further investment in expansion of packaging capabilities by commissioning additional packing lines.

As per the management, they have a strong strategic presence in Germany and Scandinavia nations and continuously adding new customers and expanding to new regions such as UK and France.

Organic Business

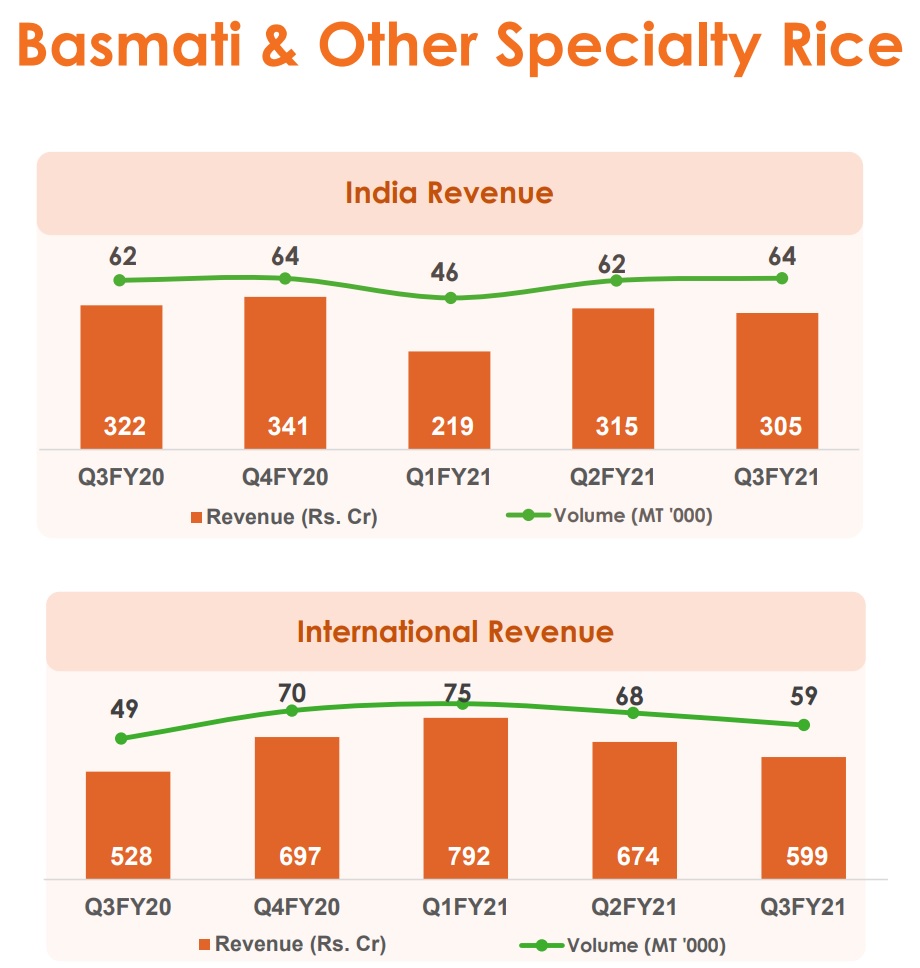

LTF deals in organic products and ingredients and supplies to food companies in the US and Europe. 90% of the business is from ingredient sales to marquee organic ingredient buyers. In 2015-16, the company launched its own brand ‘Ecolife’ in US.

LTF entered the organic food business in 1999, however, it’s only recently the growth seems to have picked up with 25% CAGR since FY 16.

Source: LTFs Q3 FY 21 Presentation

For the organic business, the company is associated with more than 60,000 farming families having a cultivated land of 80,000+ hectares of certified organic land in India.

Unlike Rice business, sales from organic business come largely from US and Europe.

In US, leveraging the back-end strength from India and the distribution channel of ‘Royal’, LTF started selling organic products under the brand ‘EcoLife’. It also sells organic ingredients to major organic food companies.

In Europe as well, the company is leveraging the distribution channel of ‘Daawat’ and is selling organic products under the brand ‘EcoLife’. It is also selling organic ingredients to other major organic food companies.

Recently, in an important development, LTF, through its subsidiary Nature Bio Foods, acquired 30% stake in Leev, Netherlands. Nature Bio Foods has an option to acquire further 21% stake at the end of 5 years.

Leev is a Netherlands based Organic Specialty Food Company with a portfolio comprising breakfast bars, healthy snacks, baking range & gluten free, low sugar products that promote an active & healthy lifestyle. Further, it is expanding its product portfolio and venturing into organic whole grains category such as oats and flax seeds.

Leev has a presence across 2500+ stores in Europe and its products are available in both retail and online stores.

With the acquisition of stake in LEEV, LTF can supply it with its own 100% organic products and ingredients.

In FY 20, organic business accounted for 9% of the total sales of the company; however, as the demand for natural, fresh and locally sourced foods, which are healthier and more wholesome than packaged foods with more shelf life is rising, the management is hopeful of maintaining double digit growth rate going forward.

Health and Convenience Foods

This is a new segment for the company, but is picking up fast on a relatively smaller base.

It includes products such as Daawat Quick Brown rice and Daawat Sehat under the health segment and Daawat Sauté Sauces, Daawat Cuppa Rice, Royal Ready-to-heat and Kari Kari under the convenience segment.

In FY 20, the new products portfolio accounted for 1% of the overall sales of the company; however, on the back of strong growth in 9M FY 21, the contribution has increased to 2%.

Source: LTFs Q3 FY 21 Presentation

Almost 65%-70% of LTFs new products business is made up by the US ready to heat and out of the same around 70% is under its own brand ‘Royal’.

Royal ready-to-heat has been performing well, and the company is leveraging the strong brand equity and distribution network of Royal to market the products in North America.

In fact, in order to tap the US ready-to-heat market aggressively and capture more market share, the company has set up a ready-to-heat facility in US.

Products like Daawat Sehat Rice, Cuppa Rice, Kari-Kari, etc are also getting a very good response in India.

Source: LTFs Q3 FY 21 Presentation

LTFs strategy is to do big research about the relevance of the products and then test market them into a limited geography. This allows them to read the market, to modify and then launch on a bigger scale.

As per the management, their internal target in five years’ time is to have about 15%-20% of sales from new products. These products also come with much superior margin profile.

Promoters/Management

LT Foods is an owner operated business and promoted by Amritsar based Arora family.

Mr. Vijay Arora is the Promoter, Chairman and Managing Director in the company. Along with him, his two brothers, Mr. Surinder Arora and Mr. Ashwani Arora are also at the helm of the affairs of the company.

Besides, the children of the promoters have also started actively participating in the operations of the company.

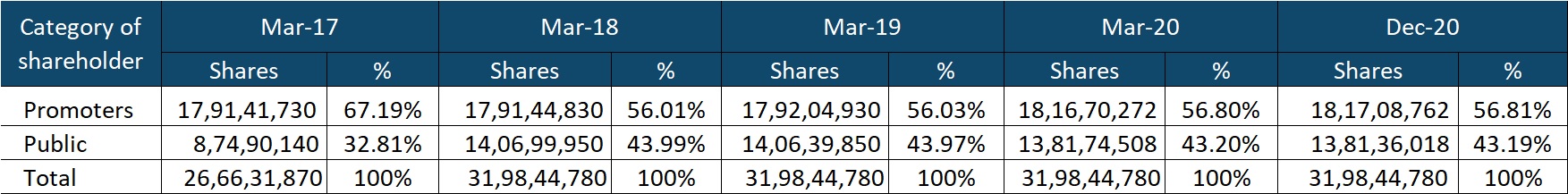

In small cap companies, we believe it’s important as an investor that the promoters hold reasonably high stake and in the case of LT Foods the promoters own more than 56% stake in the company.

Source: bseindia.com

In FY 18, the promoter’s stake got diluted from 67.19% to 56.01% as the company came out with a QIP of 5.31 crore shares at Rs 75.20/- per share in Dec’17. Since then, they have increased their holding by 80 bps through open market purchases.

Their last purchase was of 35,000 shares in Sep’20 at Rs 48/- per share.

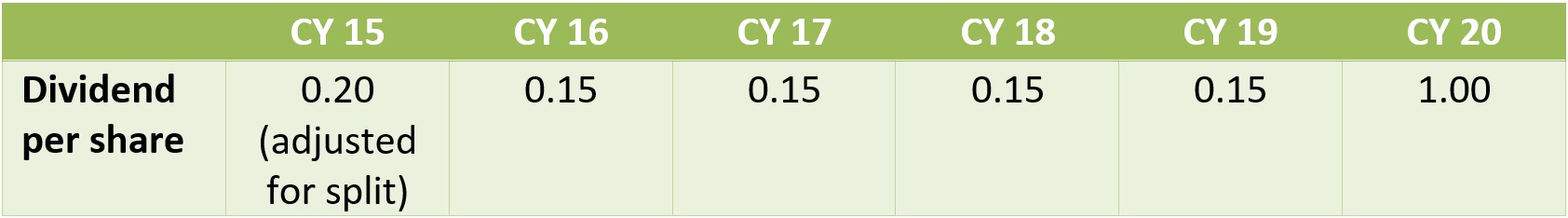

Dividends

In CY 20, the company increased the dividend per share from Rs 0.15/- for the last few years to Rs 1/-

Source: bseindia.com

In its 30th Oct’20 meeting of the Board of Directors, the company revised its dividend distribution policy to a dividend pay-out ratio in the range of 20-30% of the profits of the company. It’s a major increase from the earlier pay-out of 5-7%.

As per the management, they plan to utilize all the free cash flow in three parts: for dividend distribution, for the growth of the business and reducing the borrowings.

Performance Snapshot

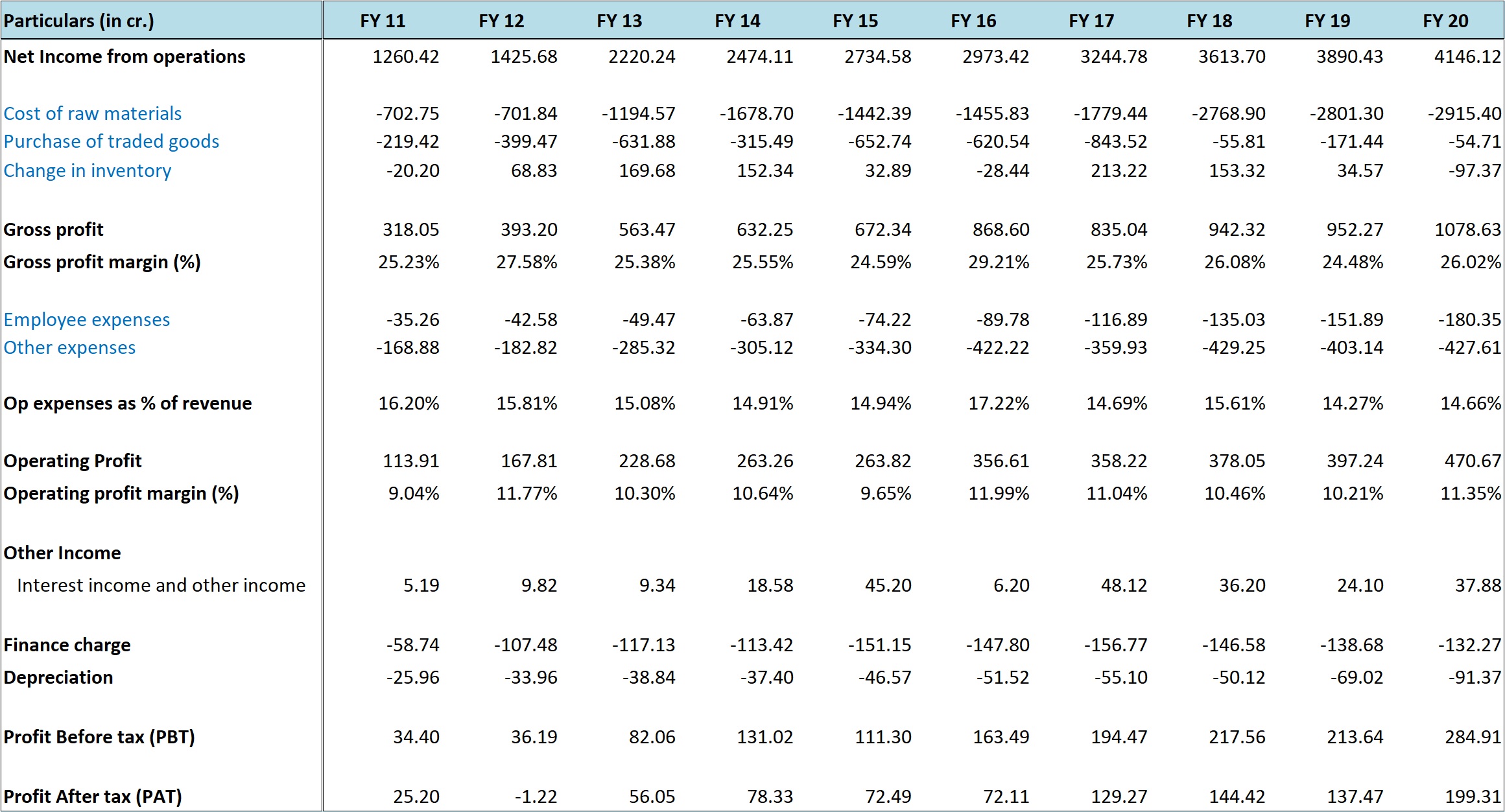

Source: LT Foods’ Annual Reports

LT Foods has been a very steady performer over the years.

Over the last 10 years the company has reported 15% CAGR in sales and 9% CAGR for the last 5 years.

Despite the commodity nature of the business, the company has been able to maintain its gross margins in a very tight range of 24%-27%. Similarly, the EBITDA margins too have been maintained in the range of 10%-12%.

We believe, company’s strong branding gives it the ability to pass on the fluctuations in raw material prices to its customers. As per the credit rating report, the company’s strategy is mostly to offer discounts in times of low raw material prices, which are reduced/withdrawn when prices increase.

However, the private label business (25%-30%) is relatively more price sensitive.

For 9M FY 21, the company has recorded EBITDA margins of 12%. As per the management, with the increasing contribution of higher margin organic products and health & convenience foods, and with economies of scale, their aim is to improve EBITDA margins by 50-100 bps per annum.

In fact, the management has stated the goal of achieving 15% EBITDA margins in the next 2 years.

Source: LT Foods’ Annual Reports

One important aspect of rice business is working capital management.

Basmati Rice is aged up to 24 months to enhance & intensify taste, aroma, and cooking characteristics. This requires company to maintain large inventory of paddy & rice.

The procurement of paddy starts in Q3, resulting in increase in inventory in Q3 and Q4. It starts reducing in subsequent quarters and reaches the lowest level by Q2.

As can be noted from the above illustration, the working capital days of the company have reduced from an average of 241 days for FY 11-FY 15 to 190 days for FY 16-FY 20.

The same has also resulted in good cash flows from operations. Thus, despite more than 200% increase in sales from FY 11, the net debt has increased only by 34%.

Increasing contribution from new product segments, which do not have the same ageing requirement as basmati rice, may further help reduce the working capital requirement of the company.

In the last 10 years, the company has diluted equity only once in FY 18.

As mentioned above, going forward the management plans to utilize the free cash flows for the growth of the business, dividend distribution and reducing the borrowings.

CAPEX also is unlikely to be significant because there’s enough capacity to deliver growth for the next 2-3 years.

We believe, if the management is able to walk the talk and achieve 14%-15% EBITDA margins in 3 years, while maintaining the same level of debt, even with 8%-9% CAGR in sales, the growth in earnings can be 17-20% CAGR.

Valuations

At around current price of 87-88, LT Foods is available at a market cap of Rs 2,800 crore. The company has net debt of around Rs 1,400 crore and therefore the enterprise value is Rs 4,200 crore.

The company has been a very consistent performer, with 9% CAGR in sales for the last 5 years, 10-12% EBITDA margins on consistent basis and the same level of debt at around Rs 1,400-1,600 crore for the last 6-7 years.

As discussed above, the management has embarked on a plan to diversify the revenue base with higher contribution from organic foods and health & convenience foods and as these products have superior margin profile, the target is to achieve 15% EBITDA margins in the next few years.

Another positive is that the company has adopted a revised dividend distribution policy of 20-30% pay-out.

Coming back to valuations, for the trailing twelve months the company has recorded EBITDA of Rs 562 crore and PAT of Rs 272 crore.

Thus, stock is available at 7.47 times EV/EBITDA and 10.30 times earnings.

While the stock has gyrated from 4 times to 20 times earnings in the last 5 years, we believe, if the management is able to walk the talk, i.e., diversify the revenue base, increase the margins and profitability, then there’s a good possibility of a re-rating in valuations.

Risks/concerns

LT Foods derives 65% of its sales from exports. Wide fluctuations in currency can impact the profitability of the company negatively.

European Union has implemented stricter norms on the use of pesticides for the import of various crop varieties and the same has impacted exports of Basmati from India. While LT Foods has a processing facility in Europe and can import from both India and Pakistan, similar norms if adopted by other countries can impact the rice exports negatively.

While LT Foods doesn’t sell to Iran, it could still face heightened competition from other players as they too may start exploring countries outside of Iran.

While LT Foods has a strong brand and has managed price fluctuations quite well, a significant drop in the prices of Basmati rice can still impact the profitability in the short term.

Disclosure: I don’t have any investment in LT Foods and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No