Dear Members,

We have released 25th Jul’21: Cupid Ltd (NSE Code – CUPID) – Alpha/Alpha Plus stock for Jul’21. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 25th Jul’21

CMP – 245.55 (BSE); 245.50 (NSE) Face Value – 10.00

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

Cupid makes male and female condoms at its plant at Nashik, Maharashtra. Besides, it also offers products like water-based lubricant jellies, hand sanitizer, and now also foraying into IVD medical devices.

Cupid is among the only three companies approved by WHO/UNFPA for worldwide bulk procurement of female condoms (FC).

At around CMP of 245, we like the company for the following reasons:

- Female Condom – It’s a small but a growing market with only 3 WHO/UNFPA approved players. Earlier, there were 4, but in 2019, China based PATH lost its approval. Veru Inc, Cupid and HLL are the 3 approved players but HLL has only a minuscule share of the segment.

- As per one of the reports, 85-95% of the FC market is dominated by Church & Dwight, The Female Health Company (now Veru Inc), Cupid Ltd, and PATH and expected to witness a significantly high CAGR of 16% over the next 5-6 years.

- It is important to mention here that the product by Church and Dwight is not specifically a FC and for all practical purposes the FC market is dominated by only 3 players.

- Veru considering selling Female Condom business – Veru, along with Cupid controls 95-98% of the B2G (Business to Government) FC market. Veru is also the only company to have presence in the US Prescription FC market. So, Veru considering selling the FC business could strengthen the Cupid’s dominant position further in the FC market.

- Potential entry into the US market – Cupid has registered the “Cupid Angel” trademark in US. The company has also filed an initial application with the USFDA and the efficacy study to approve the safety of Female Condoms is currently being done in South Africa. The management is hopeful of getting the final decision and approval by the mid of CY 22. The company is also in touch with a couple of marketing companies in the US to make an entry into the US prescription market.

- Product Diversification – Cupid’s sales are largely based on Govt. tenders and procurement by UNFPA and therefore the order flow tends to be lumpy. In order to diversify the revenue base, the company has forayed into IVD medical devices business and spending Rs 10 crore to set up the facility and also tied up with a company for manufacturing and marketing guidance.

- Scope for improvement in margins – FCs command significantly higher margins than MCs; however, despite the lowest contribution of FCs to the sales in FY 21 in the last 6 years, the company could still record EBITDA margins of 25% and net margins of 20%. If the company is able to secure large portions of upcoming orders for FCs from South Africa and Brazil, the margins could improve from the current levels of 25%.

- Healthy Balance Sheet – Cupid is a debt free company with cash and equivalents of Rs 65 crore + at the end of Mar’21.

- Valuations – As mentioned above, Cupid is a debt free company with a current market cap of Rs 327 crore and cash and equivalents of Rs 65 crore +. So, against an enterprise value of Rs 260 crore, the average operating PBT for the last 6 years is Rs 30 crore and the TTM operating PBT is Rs 33 crore.

Company details

Cupid Ltd is a leading manufacturer & supplier of Male condoms (MC), Female Condoms (FC), water based Lubricant Jelly and a few other products.

The company has a modern facility at Nashik with a capacity of over 50 crore pieces for MCs, 5.2 crore pieces of the FCs & 21 crore sachets of Lubricant Jelly per annum. Also, the capacities for condoms are fungible and therefore the peak capacity for FCs (assuming entire MC capacity is used for FCs) can be ~ 20 crore pieces per annum.

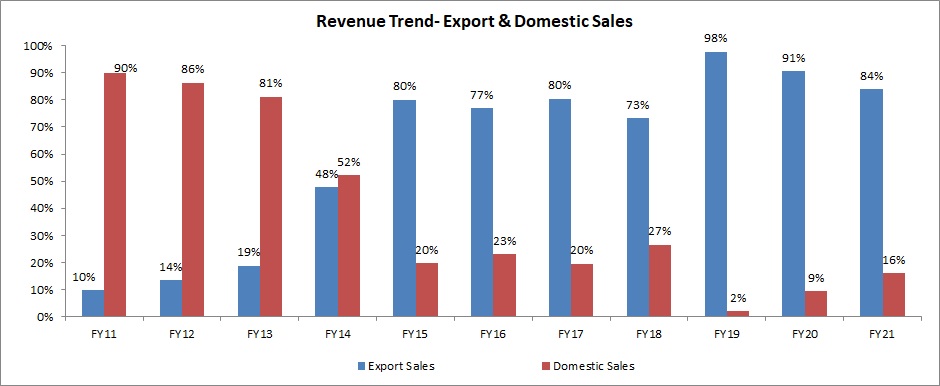

Unlike well-known domestic brands, Cupid is primarily an exporter of male and female condoms with only 10-20% of its sales coming from India. The company exports to 90 + countries with majority of the sales to African and Latin American countries.

Source: CUPID’s Annual Reports

The company generates revenue by selling to the following customers:

- WHO/UNFPA

- orders – Primarily from countries like South Africa, Brazil, Tanzania, India, Zambia, etc

- NGOs

- Private labelling

- Domestic – Online sales and wholesale

Majority of the sales come from fulfilling WHO/UNFPA orders and Govt. orders from various countries. With UNFPA, the company has a long-term supply agreement under which it receives orders from different smaller African countries.

Most of these orders by governments and organizations are towards promoting good sexual health and the importance of consistent condom use to prevent HIV and other STDs.

Especially in the case of FCs, the global market is primarily driven by the rise in public health campaigns and marketing programs by the governments and NGOs. The governments across the world are significantly propelling the use of subsidized condoms through social marketing initiatives.

As per one of the reports, in terms of unit shipments, the institutional condoms segment dominated the global market in 2020 and accounted for over 48% of the revenue.

Why is Cupid not focusing on Domestic Retail sales? As we will find out in the sections below, since Cupid started focusing on the export orders, it has turned highly profitable.

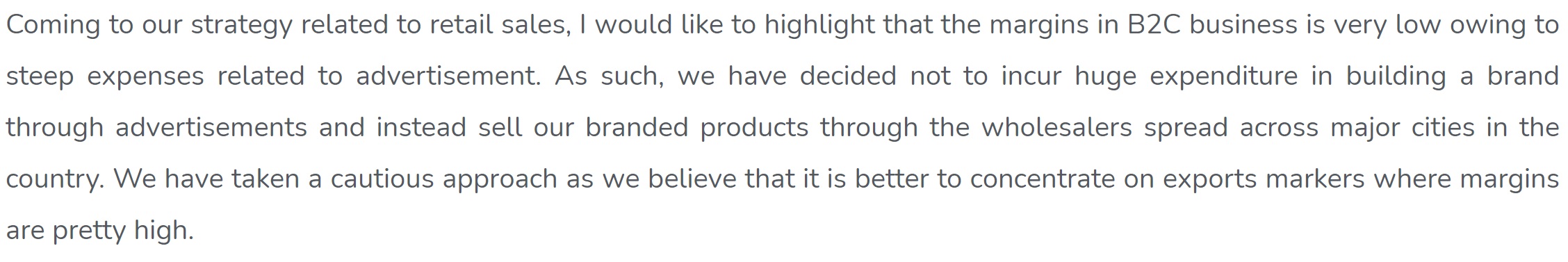

Further, in his speech, the Chairman has clearly stated as to why they are not focusing much on retail sales:

Source: CUPID’s website

Female Condoms

As per one of the reports, in 2020, the male condom segment dominated the market with a share of over 98% and 99% by revenue and unit shipments, respectively. However, female condoms are gaining popularity, and the market is expected to witness a significant CAGR of over 15% +.

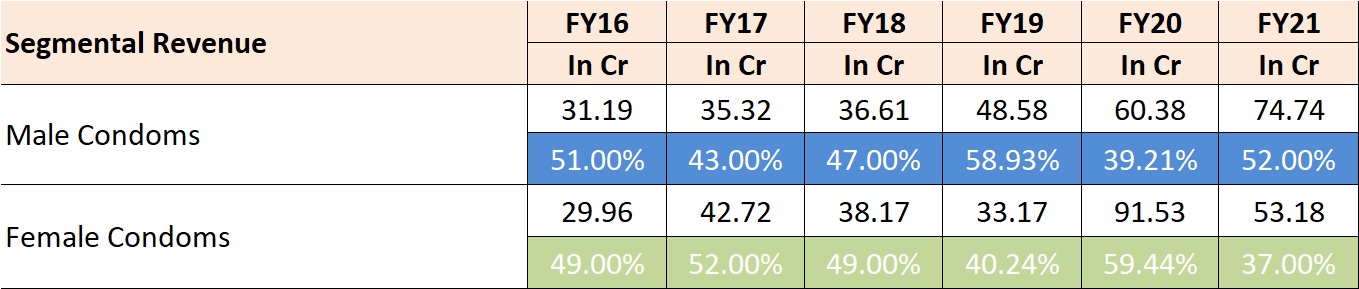

Source: CUPID’s Annual Reports

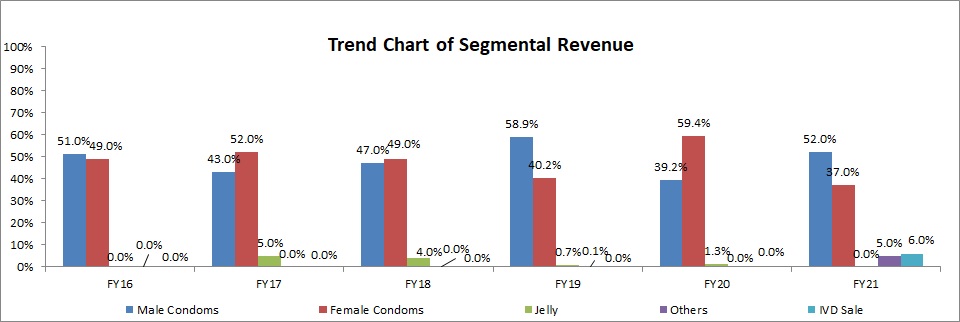

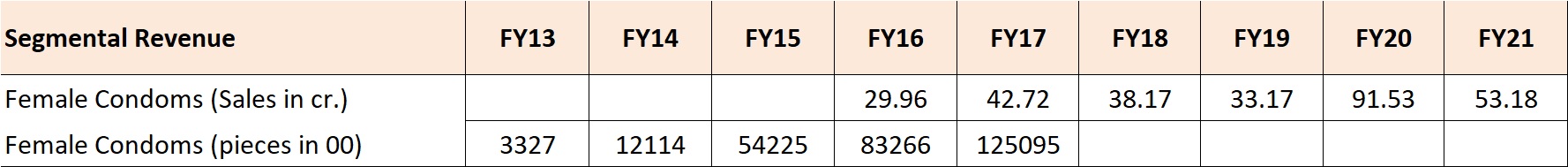

In case of Cupid, unlike other companies, since the last 6 years the company has consistently recorded 35% + sales from female condoms.

In 2007, the company decided to launch an R&D program to start the manufacturing of Female Condoms. After meeting all the regulatory requirements, WHO/UNFPA Pre-Qualified its Female Condoms for worldwide public distribution in July 2012.

As mentioned above, currently, there are only 3 WHO/UNFPA approved players. Earlier there were 4, but in 2019 China based PATH lost its approval. Veru Inc, Cupid and HLL are the 3 approved players but HLL has only a minuscule share of the B2G segment.

As per one of the reports, the female condoms market is almost entirely dominated by The Female Health Company (now Veru Inc), Cupid Ltd, and PATH and expected to witness a significantly high CAGR of 16% over the next 5-6 years.

What is also important to note is that even though the volumes for the female condoms are significantly lower than the male condoms, the realizations are almost 10x the latter. So, in general, the company realizes around Rs 2/- per male condom and around Rs 20-21/- per female condom.

Further, as per the management, the operating margins on female condoms are also significantly higher at 45-55% against 15-20% for male condoms.

The addition of female condoms to the product portfolio and the focus on exports has significantly altered the sales and profits trajectory of the company since FY 15.

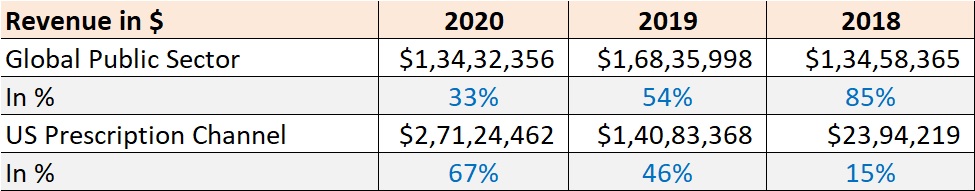

US Prescription opportunity – As mentioned above, Veru is the only qualified supplier to the US at the moment.

Source: Veru’s Annual Reports

In US, the government has covered the cost of Female Condoms under the Medical insurance plan for the users. So, women can go directly to the pharmacy with a prescription from their doctor and get the Female Condoms.

Further, in US the average revenue from the sale of a single Female Condom is about USD 1 per piece which is significantly higher than what the company is realizing at the moment.

As can be noticed above, Veru’s US prescription sales for female condoms have increased by more than 10x in 2 years to USD 27 million (~ Rs 200 crore).

As far as Cupid is concerned, it has registered the “Cupid Angel” trademark in US. The company has also filed an initial application with the USFDA and the efficacy study to approve the safety of Female Condoms is currently being done in South Africa.

The management is hopeful of getting the final decision and the approval by the mid of CY 22. The company is also in touch with a couple of marketing companies in the US to make an entry into the US prescription market.

If Cupid is able to secure the US FDA approval, on account of its low-cost production, it might be able to capture a decent share of the US prescription female condom sales.

USFDA approval will also qualify Cupid for bidding for the USAID tender businesses for distribution of condoms across the world.

IVD medical devices

In Nov’20, the management announced about its decision to foray into the business of manufacturing diagnostic kits for the detection of infectious diseases like COVID-19, HIV, Malaria, Dengue, TB and others.

FY 21 was the first year of sales of IVD for Cupid and was based on outsourcing.

However, the company is setting up a facility at a cost of around Rs 10 crore that will comply with WHO Pre-qualification and USFDA for manufacturing of medical diagnostic tests for India and International markets. The commercial production is expected to start from Jul’21.

The company has also entered into service provider and license agreement with Invex Health Pvt Ltd. Invex will assist in manufacturing, marketing, licensing, etc. of medical devices including various testing kits/diagnostic kits.

The company is working on getting all the paperwork ready for registration into different countries, including the U.S. FDA, Indian Drug Controller, and many other potential customers.

Like the existing condoms business, the IVD business is again going to be largely based on the tenders by the governments across the world. In India as well, there have been tenders from the Central Government and Ministry of Health as well as from the several State Governments as there is a shortage of some of these products in the market.

The management is quite optimistic about the business and has set a target of Rs 50 crore sales in FY 22 with net margins of around 15%. They even believe that the business can cross 100 crore sales in next 2 years.

Male Condoms

An often-overlooked aspect of the Cupid’s business is the male condoms segment.

Source: CUPID’s Annual Reports

However, it still accounts for more than 50% of the sales of the company and has been growing more or less consistently.

Another aspect of the same is that the company has been trying to improve the margins for the segment by negotiating aggressively with the suppliers, improving the productivity of the labour and by operating the machinery more efficiently.

As per the management, on account of the same they have been able to improve the margins for the male condoms segment from 15-20% to 20-25% and even more for some of the sales.

As a result, despite the lowest contribution by female condoms in over 6 years in FY 21, the company could still manage operating margins in excess of 25%.

Promoters/Management

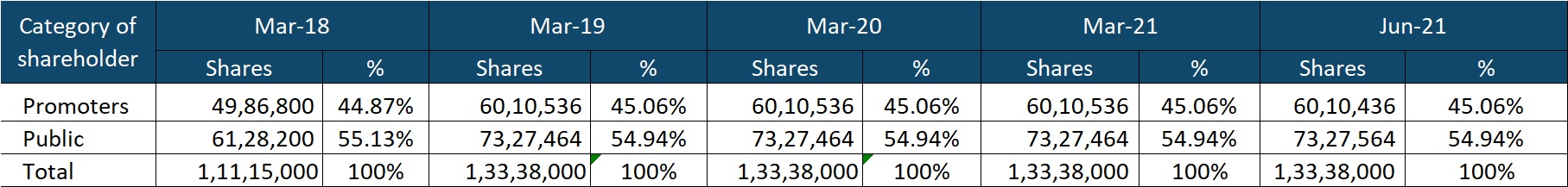

Cupid is an owner operated business with Mr. Om Prakash Garg at the helm of the affairs of the company.

Currently, he is the Chairman and Managing Director of the company, a position he has been holding since 1998. Before joining the condom business, Mr Garg worked for an International Mining company between 1970 and 1987.

In 1987, he decided to be an entrepreneur and started wholesale jewellery distribution business based in Cleveland, Ohio.

He has been associated with Cupid since 1993.

Mr. Garg is 75 years + and his children, if any, are not involved in the operations of the company. Thus, the company has been actively looking for a CEO since more than 3 years now and has not been able to zero in on a suitable candidate.

There’s also a probability that they may promote someone from within the team.

Source: bseindia.com

One can also not rule out the possibility of Mr. Garg deciding to sell off the company to a potential buyer.

Performance Snapshot

Source: Cupid’s Annual Reports

Cupid’s performance started improving FY 15 onwards. Before that, neither there was consistent growth in sales, nor the margins were good.

So, what changed FY 15 onwards? As depicted in one of the charts above, FY 15 onwards the company started focusing on the export orders and reduced focus on the domestic sales.

So, earlier the domestic sales used to be 80-90% of the overall sales of the company and FY 15 onwards the tables turned with exports consistently accounting for 73% + of the sales of the company.

In FY 20 annual report, the management has clearly stated that they wish to continue focusing on the high margin export orders and don’t wish to build a domestic brand as the competition is immense and the brand building expenses are extremely high.

Another factor that has contributed immensely to both the sales growth and significant improvement in margins is the introduction of female condoms.

Cupid’s female condoms got WHO-UNFPA approval in 2012 and by South African Bureau of standard (SABS) in Jul’13 and since then the sales volumes of female condoms have increased tremendously.

Source: Cupid’s Annual Reports

Female condoms also command significantly higher margins of 45-55% against around 20% for male condoms.

As the orders are tender based, growth isn’t uniform; nevertheless, the company has done well to secure a leading position in the female condoms segment.

US FDA approval and an entry into the US market can open up a big opportunity and lend consistency to the sales.

Scope for improvement in margins – Despite the lowest contribution of FCs to the sales in FY 21 in the last 6 years, the company could still record EBITDA margins of 25% and net margins of 20%. If the company is able to secure large portions of upcoming orders for FCs from South Africa and Brazil, the margins could improve from the current levels of 25%.

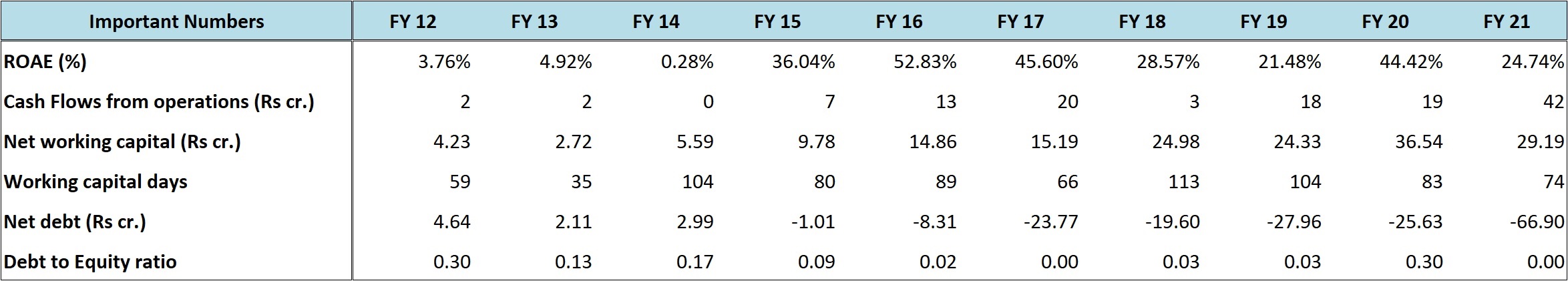

Healthy balance sheet – Another important facet of Cupid’s performance is that it has done well on the important metrics like cash flows, working capital management, leverage, etc.

Source: Cupid’s Annual Reports

The company largely deals in government orders and orders by institutions like WHO/UNFPA. Despite the same, the company has done well to keep the working capital days below 100 for most of the years and the bad debts have been very few and small.

Cupid is also a cash rich company with cash and equivalents of Rs 65 crore + at the end of FY 21.

Way forward – The management is guiding for Rs 170 crore sales in FY 22 with net margins of around 20% and a year on year 10-15% increase in sales and profits thereafter.

We believe the numbers should be achievable considering the foray in the IVD business and the upcoming tenders by Brazil and South Africa for the male and female condoms.

The South African Government has floated a new tender for a total procurement of 100 crore male condoms and 4 crore female condoms each year for the next three years.

The company has submitted its bids and considering its low-cost production and the fact that many manufacturers could not deliver the allocated quantities, it is expecting to secure a decent share of the tender order.

Veru, the major competitor in the female condoms business is considering selling its female condoms business (~ Rs 300 crore sales in FY 20) and that might work further to the advantage of Cupid as buyers may seek certainty regarding the plans of Veru.

Similarly, the Brazilian government is expected to publish the new tender order by the end of the calendar year.

It remains to be seen as to how the IVD business pans out. In the past the management has exuded confidence and predicted sales of 50 crore with net margins of 15% for FY 22 and with further potential of strong growth in the years ahead.

Overall, FY 21, with sales of Rs 144 crore, operating margins of 25% and net margins of 20% is likely to provide a strong base for ~15% CAGR in sales and profits in the years ahead.

Valuations

At around current price of 245, Cupid is available at a market cap of Rs 327 crore. The company is debt free and has surplus cash and equivalents of Rs 65 crore + and therefore the enterprise value is Rs 260 crore.

The company has been performing well since FY 15 and has recorded ~22% CAGR in sales, 19% CAGR in operating profits and 22% CAGR in PAT since then.

As discussed above, the management has embarked on a plan to diversify the revenue base with a foray into IVD business and is also targeting US female condoms market which is growing quite rapidly.

The male condoms market itself is growing steadily and Cupid has an advantage of WHO-UNFPA approval and low production cost. Further, the management has been trying to bring down the costs further and improve the margin profile of the male condoms segment.

Coming back to valuations, against an enterprise value of Rs 260 crore, the average operating PBT for the last 6 years is Rs 30 crore and the TTM operating PBT is Rs 33 crore.

Thus, the stock is available at 10.50 to 11.50 times TTM and 6 years average PAT.

We believe, if the company is able to secure the US FDA approval and capture a decent market share of the FC prescription market, the stock might get re-rated to higher valuations.

Risks/concerns

The very nature of the business is tender based and order driven. Unlike a consumer business, the orders and sales tend to be lumpy and therefore the year-on-year profits and sales can fluctuate a lot.

WHO/UNFPA approval for both the male and female condoms allow the company to participate and secure large government orders. If like PATH, Cupid loses the pre-qualification, the loss in business will be significant.

The company has forayed in the IVD business and is spending Rs 10 crore to set up the manufacturing facility. Since the announcement in 2020, the pricing for the rapid anti-gen kits has dipped significantly and a lot of competition has mushroomed as well.

Last, but not the least, the CMD, Mr. Om Prakash Garg is 75 years + and has been searching for a CEO since more than 3 years with no success.

Disclosure: I don’t have any investment in Cupid and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No