Dear Members,

We have released 29th Sep’21: Dollar Industries Ltd (NSE Code – DOLLAR) – Alpha/Alpha Plus stock for Sep’21. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/

Note: For any queries, mail us at [email protected]

Date: 29th Sep’21

CMP – 363.50 (BSE); 364.60 (NSE) Face Value – 2.00

Rating – Positive – 4% weightage; this is not an investment advice (refer rating interpretation)

Introduction

Dollar Industries is one of the leading companies in the innerwear sector in India dealing primarily in men’s wear. Over the years it has gradually expanded into women’s wear and children’s wear as well.

In the last 10 + years the company has transformed the brand from mass market/economy to a house of brands focusing mainly on mid-market and premium segments.

The company has also expanded the product line up from only innerwear to athleisure and thermal wear as well.

At around CMP of 360-370, we like the company for the following reasons:

- Ambitious target of 2000 crore sales by FY 24 – The company recorded Rs 1,037 crore sales in FY 21 and the management has set an ambitious target of Rs 2,000 sales by 2024. While we don’t expect the company to achieve the stated target, we like the fact that management has started various initiatives to move towards the target

- Margins expansion – Since FY 12 the operating margins of the company have expanded from 7% to 13% in FY 21. Going forward, on the back of economies of scale, capped advertisement expenses and the change in product mix, we believe the margins can further expand to 15% or higher. As per the management, at Rs 2,000 crore of sales, their target will be to achieve 17% EBITDA margins

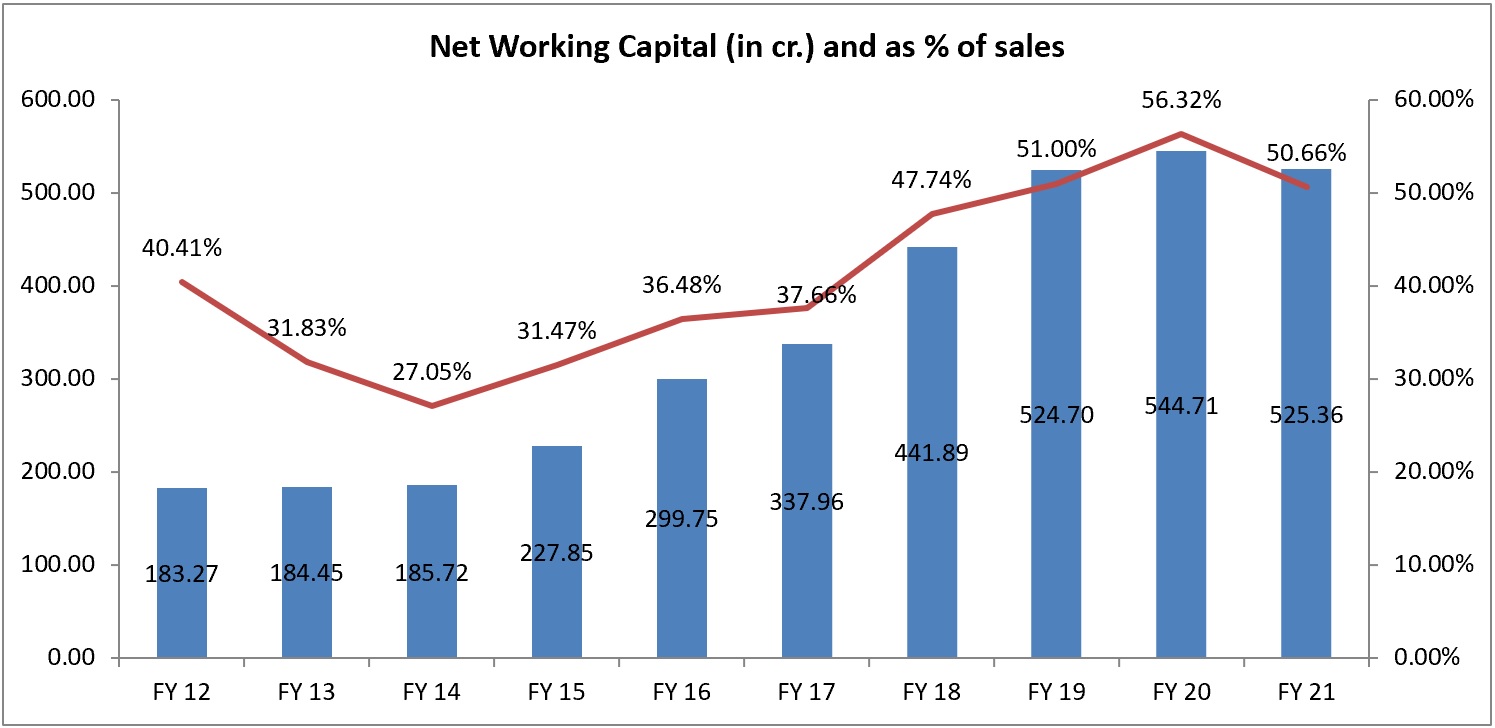

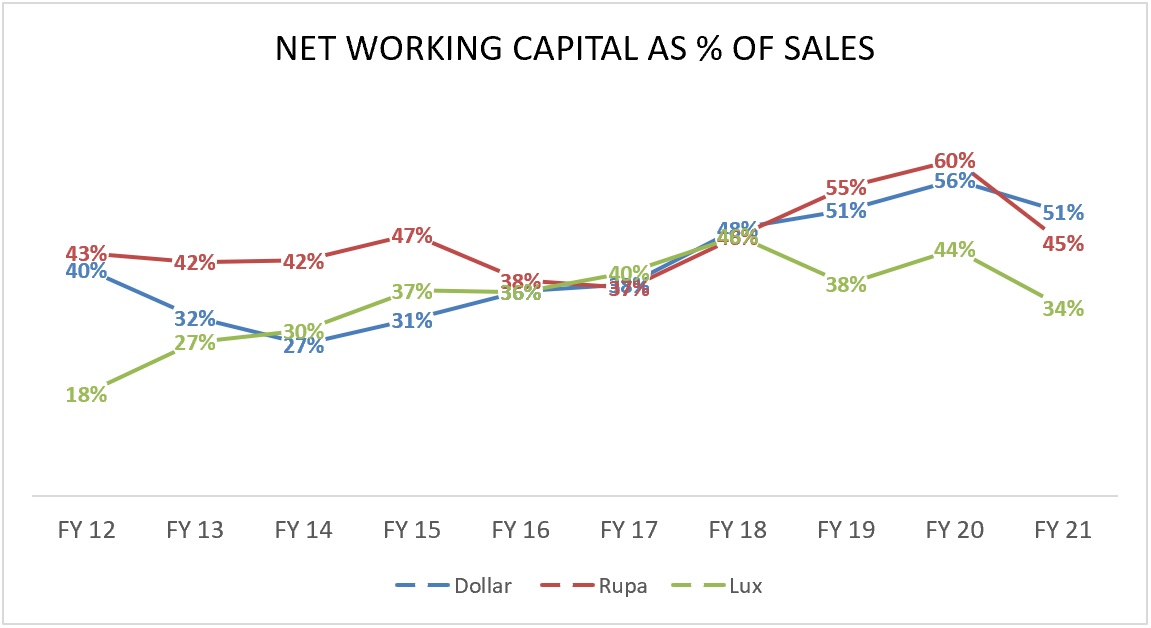

- Working capital rationalization – Working capital as a % of sales is relatively high for Dollar at more than 50%. To avoid inventory clogging and reduce receivable days, the company is implementing Project Lakshya in consultation with Vector Consultants. The objective of the same is to identify the bottlenecks in the system and improve the asset turns of the distributors and the retailers

- Digitization and Automation – Under the Project Lakshya itself, the company is implementing Auto Replenishment Systems (ARS) and Distributor Management System (DMS) at Lakshya Distributors. Further, it is also implementing ARS at production/procurement chain level and after sales service app and tele-calling solutions for the benefit of retailers

- Valuations – Since FY 17 the sales growth of the company has been slow; however, it has made up for slow growth through improvement in margins and reduction in debt. The company has consistently maintained good numbers in terms of returns ratios, leverage and growth in profits. At around 22 times TTM PAT, we believe the valuations are reasonable and there’s scope for rerating in line with the peers if the company is able to improve the growth rate and optimize its working capital.

Company details

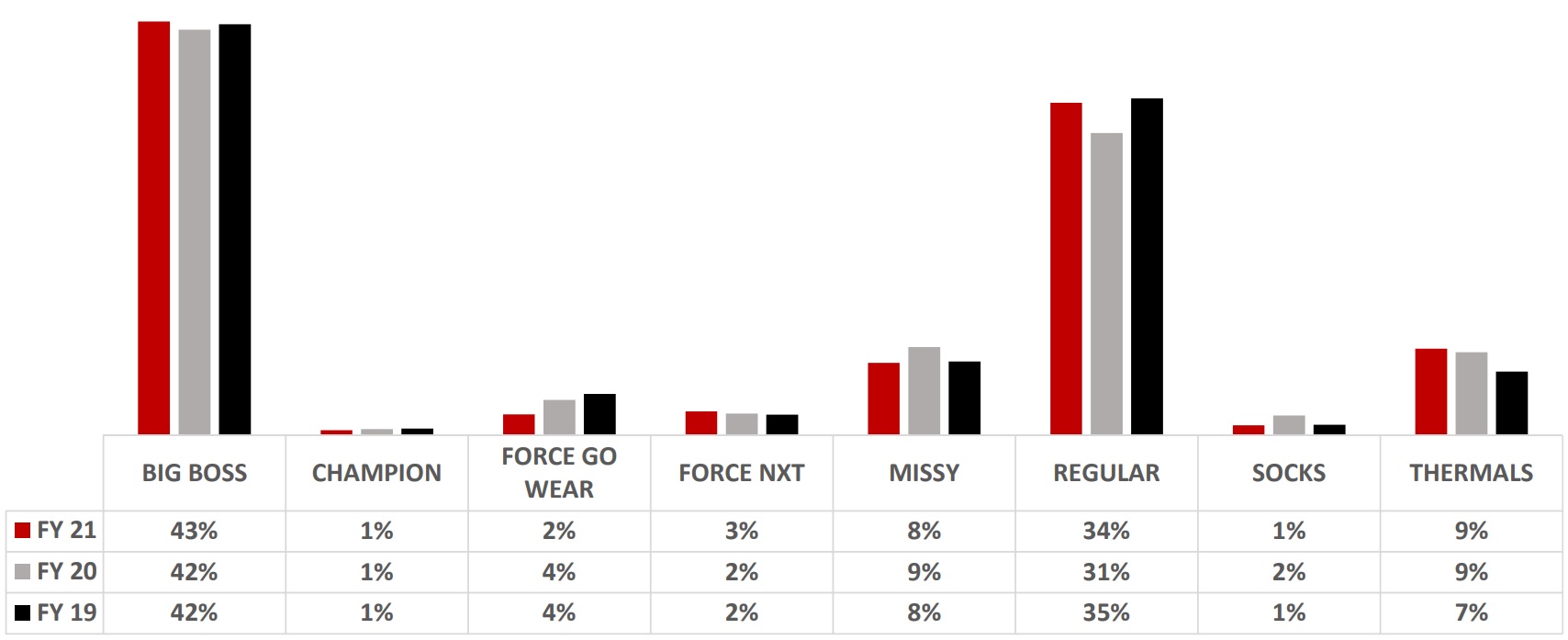

Dollar Industries is one of the leading, branded knitted wear manufacturer in India. It began its journey with its signature brand ‘Dollar’ in men’s vests and briefs but has gradually expanded its portfolio of brands (Bigboss, Missy, Force NXT, Champion, Ultra Thermals, Force Go wear) with presence across varied segments.

Over the years the company has brought about two major transformations:

- Shift from economy to mid-premium and premium segment – In FY 06-07, mass market brands (Club, Lehar) contributed 86% to the sales of the company; however, over the years the contribution from the same have decreased to 34-35% while the contribution from mid-premium (Big Boss) and premium (Missy, thermals, Force NXT, etc) has increased. The company also has a JV with PEPE Jeans Europe B.V for serving the markets with super premium products; however, the JV is still in its infancy.

Source: Dollar’s Q4 FY 21 presentation

- Expansion of product line – Earlier the company was only dealing in men’s inner wear; however, over the years it has introduced several new lines like Missy for women, Champion for children, Thermal wear, athleisure, etc. The same have helped the company serve a wider market and also move up the value chain in terms of the average selling price (ASP).

Source: Dollar’s Q4 FY 21 presentation

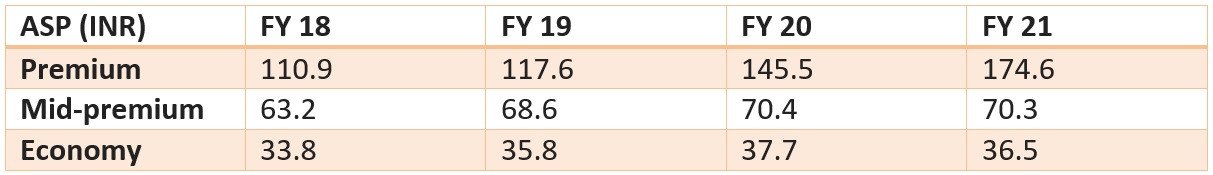

Athleisure – Within each of the categories, i.e., economy, mid-premium and premium, the ASP of the company has been on a rising trend. Some of it can be attributed to inflation and the remaining on account of introduction of higher margin products like Athleisure in the mid-premium and premium segments.

Source: Arihant Capital research

Within each segment, Athleisure products have relatively higher margins than the other innerwear products. For example, in the mid-premium segment, if the innerwear delivers 10-12% EBITDA, athleisure fetches 14-14.5% EBITDA and similarly in the premium segment, if the innerwear delivers 13-14%, athleisure fetches around 16%.

Athleisure is also one of the fastest growing segments for the company. As per the management, athleisure contributed 14% to the sales of the company in FY 21 against only around 5% in Q1 FY 21 and 2-2.5% in Q1 FY 20.

Another high margin segment that the management intends to focus on is Missy. The sales for the same got impacted a bit due to the pandemic; however, with the opening up of the economy, management is expecting stronger growth from the brand. The management is also planning to introduce lingerie in FY 23.

Production capacity – Production of innerwear and other products is mostly an outsourced job with the company primarily focusing on branding and distribution.

However, the company has done backward integration (from yarn production to final packing) for around 25-30% of its total requirement.

Going forward, management has planned a total CAPEX of 140-150 crore over a timeframe of 2 years. The same will be used for the doubling of spinning capacity, socks manufacturing and increasing the production capacity at Kolkata and Tirupur.

Further, the company will set up an integrated warehouse of 3.2 lakh sq. feet which will be fully automated and will help improve the logistics efficiency.

As per the management, they are targeting to achieve sales of Rs 2,000 crore in the next few years and for the same it’s important to secure the supply of yarn. Off-late a lot of yarn is being exported from India and the same has at times created shortage and a sharp increase in prices. Thus, it’s important for the company to increase the spinning capacity so that the production can be increased whenever needed.

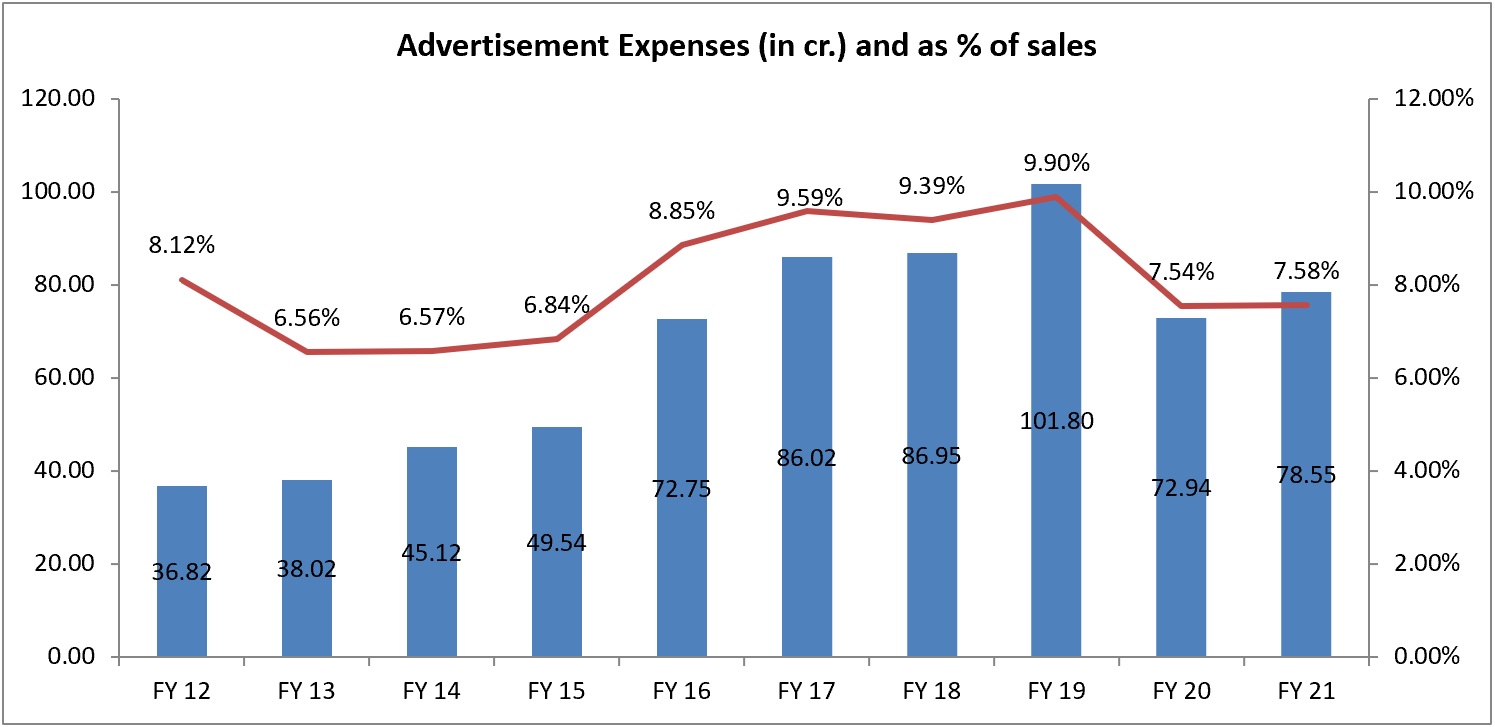

Branding and advertisement – The company has a strong presence in the economy and mid-premium products and there’s not much product differentiation between the 3 major players Dollar, Rupa and Lux.

As a result, in order to create a strong brand recall, all the 3 companies have been big spenders on branding and advertisement.

Dollar too has been investing aggressively behind brand promotion activities at around 8-10% of sales. A significant part of these investments have been allocated towards mid-market brands ‘Bigboss’ endorsed by Akshay Kumar and women’s legging brand ‘Missy’ endorsed by Chitrangada Singh.

Source: Dollar’s ARs

The company recently revamped the brand identity by introducing a new brand logo and architecture.

Going forward, instead of spending on the basis of % of sales, the management has decided to cap the advertisement expenses at Rs 55-60 crore annually while still aiming for higher sales growth.

Distribution network – Company’s sales model is primarily distributor driven who thereafter sell the products to retailers.

Of the entire sales, around 89% is through the distributor model and around 2-2.5% is through e-commerce and modern retail. Exports account for the remaining 8-9%.

The company has around 1,000 distributors who further sell to around 100,000 + retailers.

![]()

Source: Dollar’s ARs

Dollar is working on revamping its distribution network to reduce clogging of inventory, bring down receivable days, expand the retailer network and increase the sales of other brands besides ‘Big Boss’ and economy brands like ‘Club’ and ‘Lehar’.

Project Lakshya

What we like most about Dollar Industries is that the management is aggressively working on optimizing and digitalizing its distribution network.

If executed well, it can bring about a lot of positive changes in the performance of the company in the next 3-4 years.

Basically, the management believes there’s an inefficiency in the supply chain right from the procurement of products to the ultimate distribution to the distributors and the retailers and has started implementing Project Lakshya in consultation with Vector Consultants. The objective is to identify the bottlenecks in the system and improve the asset turns of the distributors and the retailers.

Inefficiency – Dollar deals in economy and mid premium products wherein there’s not much product differentiation. Most of the players operate at similar price points with comparable quality of products.

Brand stickiness is low and retailers play a crucial role in persuading the buyers to buy a certain brand of products.

However, most of the companies haven’t done the mapping of retailers and a lot of small-town retailers aren’t directly serviced by the distributors. Instead, wholesalers bridge the gap by purchasing from distributors and pushing the products to retailers without proper consideration for the actual demand.

As a result, inventory is getting clogged at the company level and the distributors and the dealers.

Source: Dollar’s ARs

Source: Company’s respective ARs

In fact, as can be noticed above, working capital has been on the higher side for all the major companies from the sector.

What is the company doing under Project Lakshya? Basically, the company has set up a sales team on the ground which is helping the distributors in mapping the retail outlets in a particular area.

Earlier, the distributor used to choose the retailers he used to do business with in the area allocated to him. But in the new system, the team on the ground is mapping all the retailers with an objective to serve all the possible retailers in the allocated area.

The sales team maps the retailers, visits them, explains the benefits of the program and puts them on the SFA (sales force automation). Once the retailers enroll, distributors have to start supplying them.

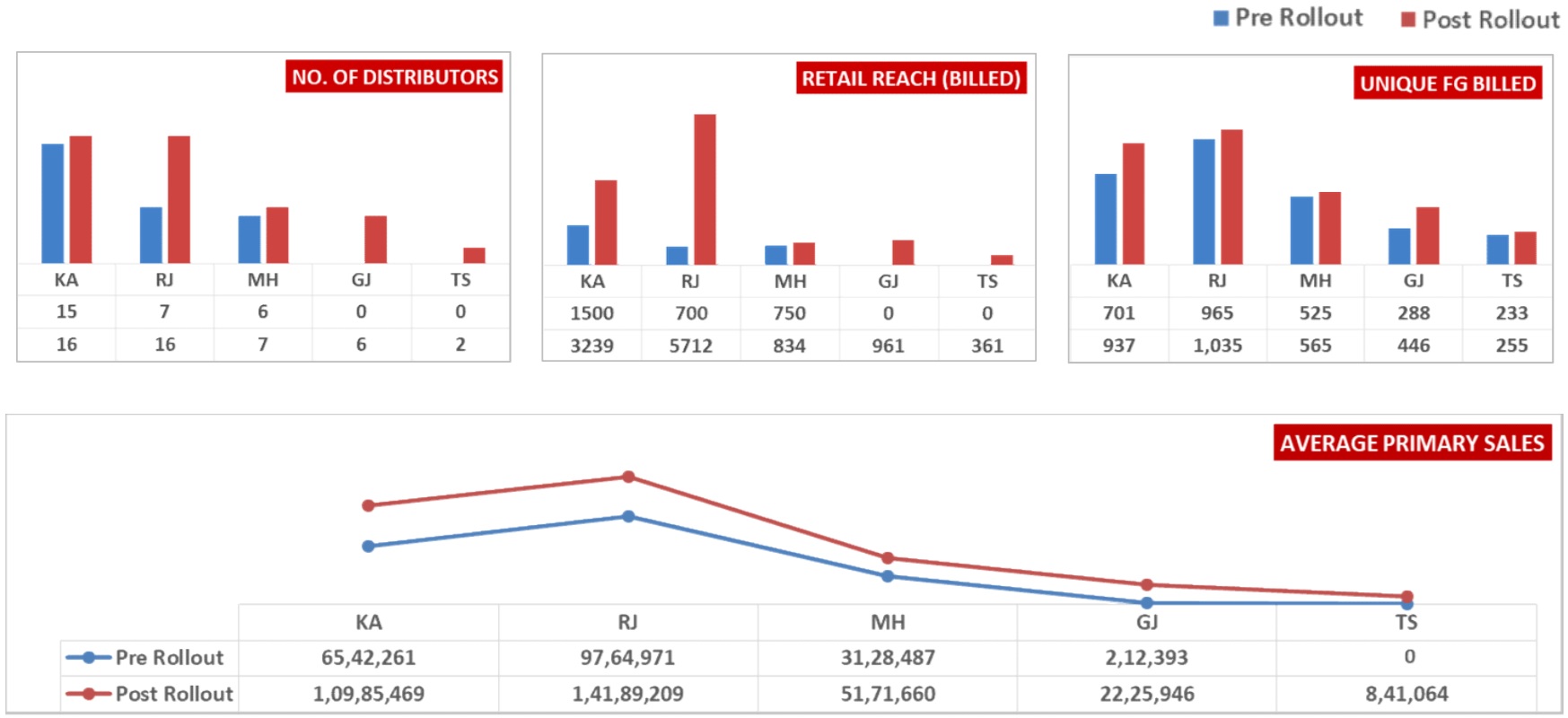

Besides, under the project, the company has started appointing distributors in the area where previously the reach was not through direct channel. For example, the company has started serving retailers through new appointed distributors in Karnataka and Rajasthan where the presence was either zero or negligible.

Also, earlier the company was appointing different set of distributors for different brands; however, the distributors under Project Lakshya have to sell all the products of Dollar Industries. Also, the tele-callers and the field staff of the company are educating the retailers about the broad product range which in effect is giving traction to relatively newer brands like Force NXT and other products.

Earlier, the distributors didn’t keep certain brands which they have started selling now.

As per the management, retailers in general are welcoming the initiative because earlier they were being supplied by small wholesalers but now, they are being served directly by the distributors with the products of their choice.

Benefits of roll out – Due to the pandemic, the roll out of the project has been running a bit behind schedule and will reach a reasonable scale in the next 2-3 years.

The company started the project with Karnataka, then moved to Rajasthan, Gujarat, Maharashtra and Telangana. The work is still pending in the mentioned states but in terms of retail points, the company has mapped around 1.25 lakh retailers and around 30,000 have already been enrolled in the system.

Out of around 1000 distributors, 61 have been brought under the project wherein the DMS has been installed. The company is targeting to bring in 150-200 distributors under the project before the end of FY 22.

Though the roll out has been at a small scale, the initial numbers are encouraging.

Source: Dollar’s Q4 FY 21 presentation

As can be noticed from the above screenshot, the following changes have occurred post the rollout:

- Company is expanding presence in areas where it previously didn’t have a direct reach

- The number of retailers being served by the distributors have more than doubled in general

- Range expansion – FG codes represent a particular product type and do not include the colour and the size combinations. So, the distributors are now keeping and selling a larger variety of products

- Lastly, both the primary and the secondary sales have increased

Digitization and automation – Another aspect of Project Lakshya is the digitization and automation of the various aspects of the supply chain.

The distributors enrolling under Project Lakshya have to compulsorily follow certain digitization methodology. The company implements Auto Replenishment Systems (ARS) and Distributor Management System (DMS) at Lakshya Distributors.

The purpose of the same is to have visibility to the inventories and the sales on a real time basis at the distributor level. Accordingly, the company replenishes or sends the supplies to the distributors without them having to raise the request. The replenishment system is working on weekly basis.

The similar kind of system will be implemented at the production supply chain side. The purpose of the same would be to produce or procure only what is being ordered or what is being demanded in the market.

Lastly the company is implementing an after-sales service app at the retailer level and activity tracker for the sales team.

Promoters/Management

Mr. Dindayal Gupta started Bhawani Textiles in early 70s which has now been renamed as Dollar Industries Ltd.

Dollar Industries is an owner operated business with Mr. Vinod Kumar Gupta and Mr. Binay Kumar Gupta as the MDs of the company and they are further supported by their brothers and the next generation family members including Ankit Gupta, Gaurav Gupta, Aayush Gupta, Pallavi Gupta and Vedika Gupta.

In another good move, the company recently announced the appointment of Mr. Ajay Kumar Patodia as the new Chief Financial Officer (CFO). Prior to joining Dollar Industries, Mr. Patodia was associated with the Lux Industries Ltd as the CFO for the past 18 years.

He is a qualified chartered accountant, cost & management accountant and a certified FI consultant of SAP ERP.

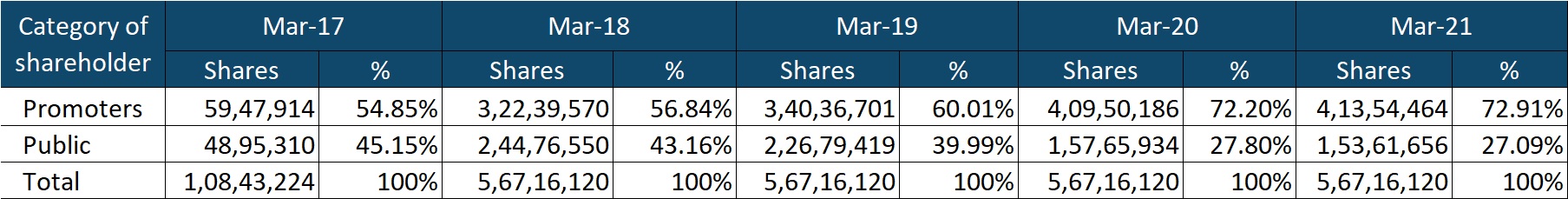

Promoters hold more than 70% stake in the company. In Nov’17, they were allotted 25 lakh shares of the company at 430 per share against the current price of around 365.

Source: bseindia.com

Dollar Industries is a big group in terms of the family members involved and the related entities; however, based on our checking of the related party transactions, the amounts involved are small in the overall scheme of operations.

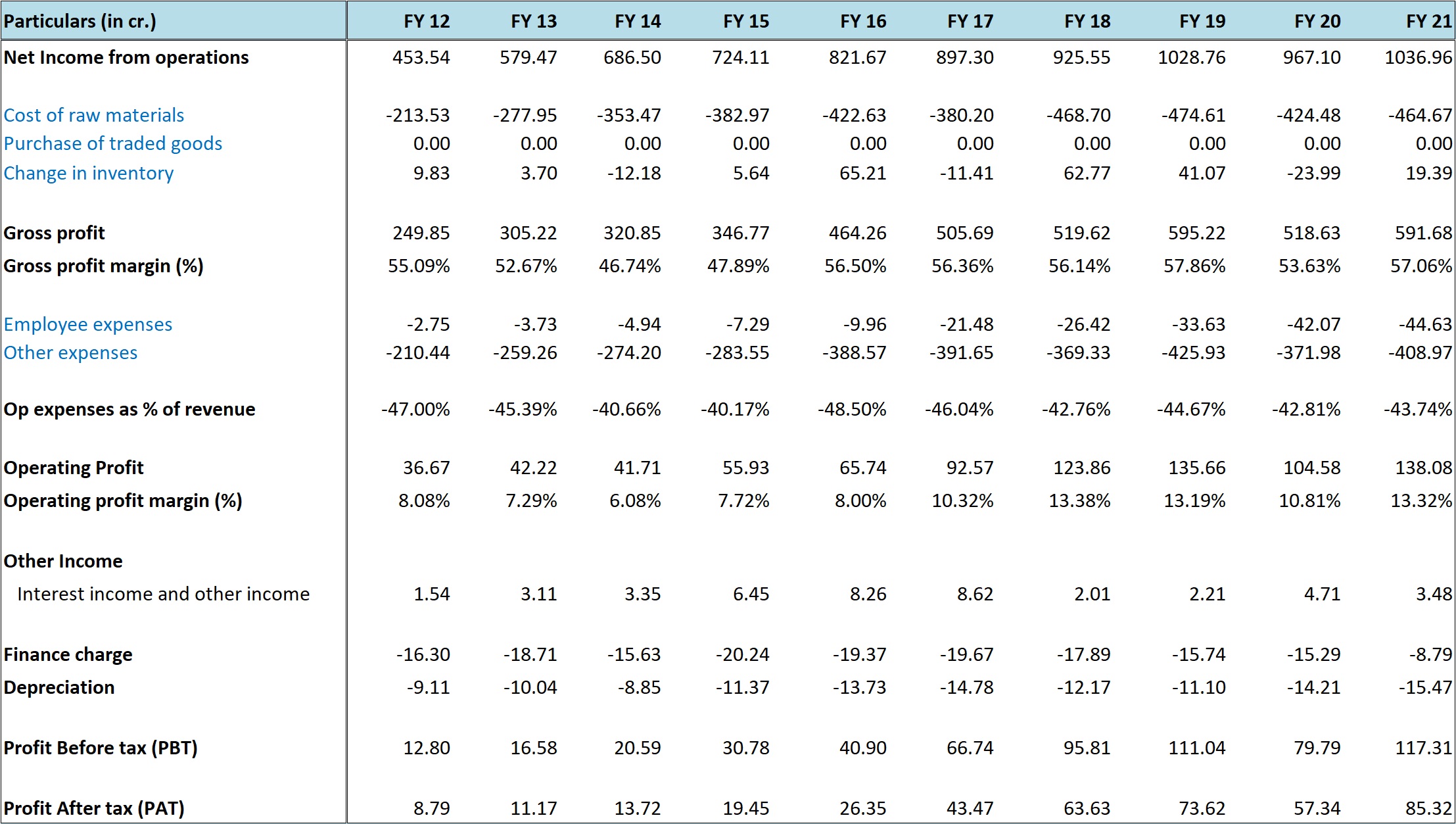

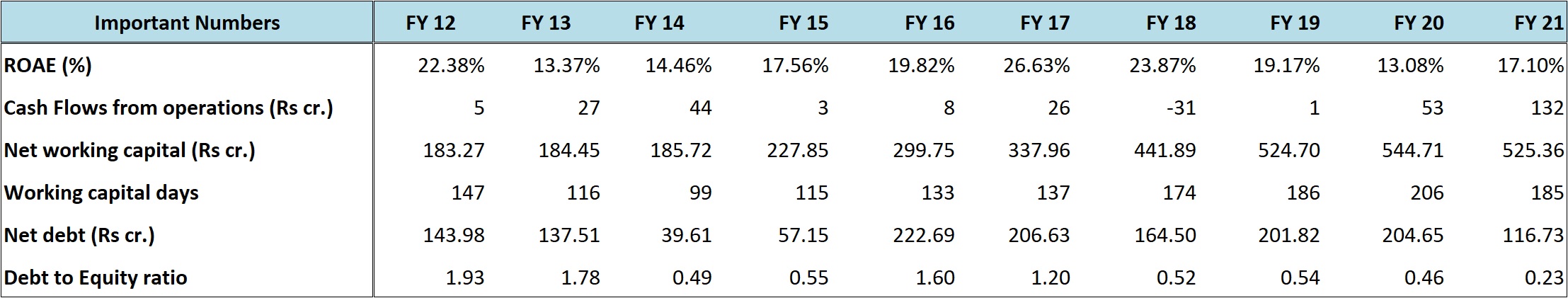

Performance Snapshot

Source: Dollar’s Annual Reports

Dollar Industries has been a relatively consistent performer with regular, though slow growth in sales. However, the company has been able to compensate for slow growth in sales through steady expansion in operating margins enabling it to report faster growth in profits.

The company has also done well on metrics like leverage on the balance sheet and return ratios.

As mentioned in one of the sections above, the company has been a bit inefficient in working capital management with the working capital days increasing from an average of 122 for FY 12-16 to 178 for FY 17-21.

Source: Dollar’s Annual Reports

As a result, the cash flows from operations have been on a bit lower side.

However, the good thing is that the management is already working on resolving the issues through Project Lakshya.

In the near term i.e., FY 22, the management’s aim is to bring down the working capital cycle by 15 days. The company has put down stricter policies around its credit terms which have been accepted by the channel partners.

In the longer run, the Project Lakshya should get completed in 3-4 years and that should help in both reducing the receivable days and unclogging of inventory at the various levels.

Healthy balance sheet – The company continues to have a healthy balance sheet which got improved further with ~ 90 crore reduction in debt in FY 21. Going forward, the management has planned a CAPEX of around 140-150 crore and that should get implemented through internal accruals.

With the expected improvement in the working capital cycle and the expansion in sales and margins, we don’t expect the company to take on significant debt in the years ahead.

Way forward – The management is guiding for 13-15% growth in sales in FY 22 with 14.5-15% EBITDA margins.

On a more medium-term basis the management is targeting 2000 crore sales by March 2024 with EBITDA margins of around 17%.

We believe 2000 crore by Mar’24 is an ambitious target while the more probable is Rs 1,850-2,000 crore by FY 26.

The execution of Project Lakshya will itself take 2-3 years to reach a reasonable scale and looking at the initial numbers of the roll-out, there can surely be good improvement in sales and margins expansion with the expansion of the product range.

Thus, we believe 13-15% CAGR in sales might sustain with further improvement in margins to around 15%. We expect expansion in margins on the back of capped advertisement expenses, economies of scale and improvement in product mix.

Valuations

At around current price of 360-370, Dollar Industries is available at a market cap of Rs 2,070 crore and 22 times trailing twelve months earnings. The company doesn’t have much debt on the books.

The company has been performing well with around 10% CAGR in sales and 28% CAGR in profits since FY 12. The company has also been performing well on metrics like leverage and return ratios.

As discussed above, the management has embarked on a project to transform its entire supply chain starting from procurement to ultimate distribution to the retailers. Under the project the company is also digitizing and automating various parts of the supply chain.

Further, the company has capped its advertisement expenses and working on moving up the value chain in terms of the product mix.

On the back of the above measures, the management has set an ambitious target of Rs 2,000 crores sales by FY 24 with EBITDA margins of around 17%.

For the reasons discussed above, we believe the target won’t be achieved; however, 13-15% CAGR in sales might sustain with improvement in margins to 15%.

Thus, assuming 1,900 crore sales by FY 26 with 15% EBITDA margins, the company should be able to record a PAT of around Rs 190 crore. At an exit multiple of 25, the market capitalization of the company can be Rs 4,750 crore against the current value of Rs 2,070 crore.

The above is just one of the scenarios, while the actual numbers can turn out to be completely different. However, looking at the transformations being carried out, along with the strength of the balance sheet and the brand, we believe the downside over the medium to long term is quite low.

Risks/concerns

In the last few years, the sales growth of the company has been very low at around 4-5%; however, we are assuming 13-15% growth rate over the next few years. If the company isn’t able to sustain the expected growth rate, the returns on the stock might turn out to be lower.

For the company to be able to sustain mid double digit growth rate, faster roll out of Project Lakshya will be crucial. 3rd wave of Covid-19 or any other exogenous factor might derail the same.

Consumers are increasingly buying online and it will be important for the company to mark its presence in the online space to not miss out on the growth opportunities.

Intrafamily friction can derail the pace of progress and transformations being carried out by the company.

Disclosure: I don’t have any investment in Dollar Industries and have not traded in the stock in the last 30 days.

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com/

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Rating Interpretation

Positive – Expected return of ~15% + on annualized basis in medium to long term for investment recommendations and in short term for Special situations

Neutral – Expected Absolute return in the range of +/- 15%

Negative – Expected Absolute return of over -15%

Coverage closure – No further update on the stock

% weightage – allocation in the subject stock with respect to equity investments

Short term – Less than 1 year

Medium term – Greater than 1 year and less than 3 years

Long term – Greater than 3 years

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: No

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision.

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No